CLOSING BELL

Operation Big Bucks is a Go

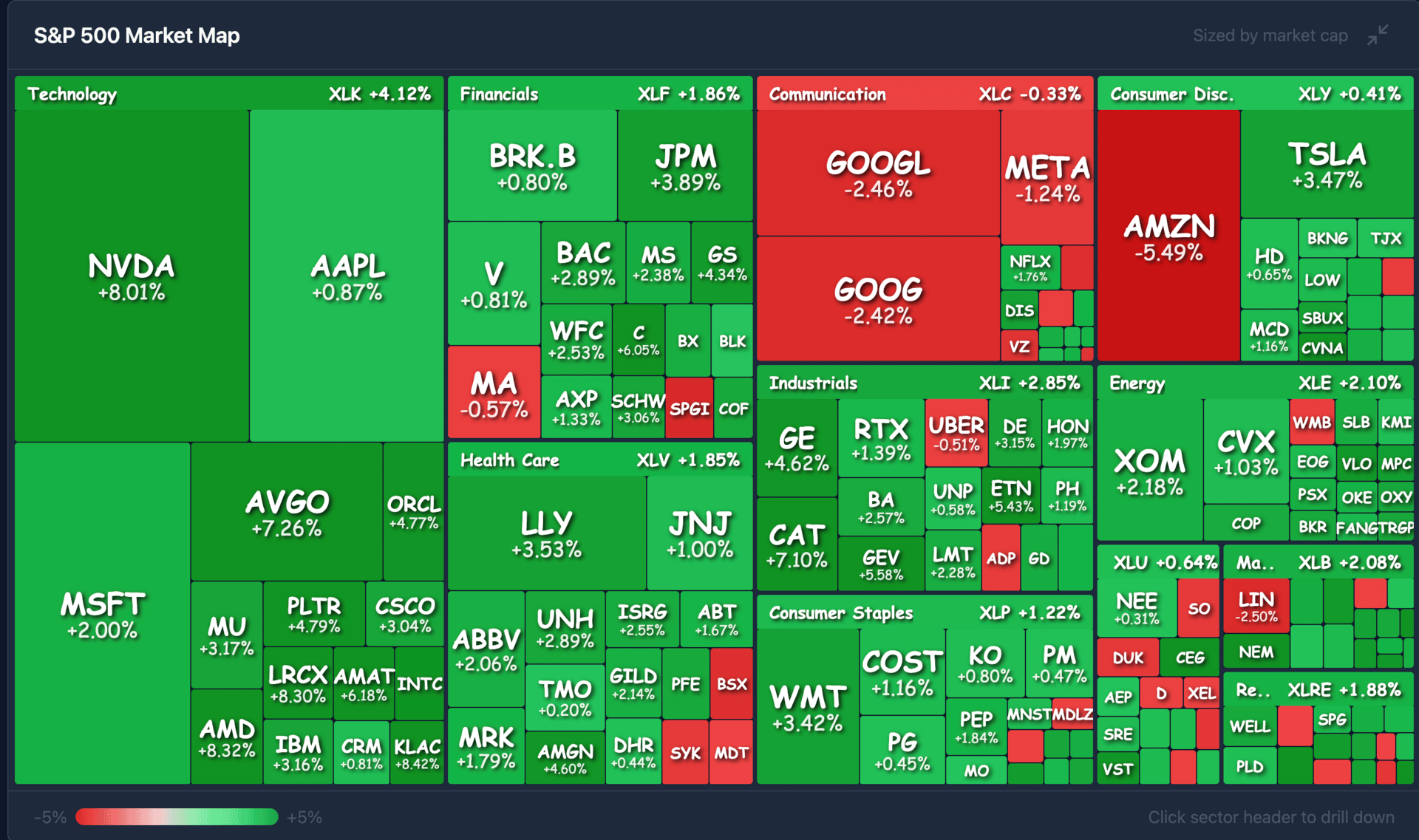

Happy dip-buying Friday! CAPEX spending is out of control but the markets came roaring back anyway, tech jumping a whopping 4% as a sector. After Bitcoin hit bottom at $60k, everyone started buying back, and not just on metals and crypto, but tech, and even giant boomer stocks on the Dow Jones Industrial Average.

The Dow hit a new record past 50,000 points, and it was the best session for the S&P 500 in nearly a year. Nvidia and chips were climbing, CEOs waving their hands at insane capex and worries that AI will replace software, which had its first green day in eight sessions.

The jobs report was pushed off to Wednesday next week, keeping pesky macroeconomic data that might have echoed this week’s dire labor numbers, after the micro shutdown over ICE funding stopped the BLS from doing anything productive. What we don’t know, can’t hurt us.

Analyst shops seem to be rewarding big tech for its massive spending, in a truly damned if you do, damned if you don't situation for the biggest stocks around.

AFTER THE BELL

Amazon Massive CAPEX Guidance Sparks Investor Exit, But Tech Roared Back

$AMZN ( ▲ 1.0% ) shares cratered after revealing a staggering capital expenditure plan for 2026, signaling a brutal and costly escalation in the generative AI arms race. While the retail giant reported record fourth-quarter revenue of $213.4 billion, the prospect of a 50% surge in spending has shifted market sentiment from growth optimism to capital efficiency anxiety.

$200 billion in 2026 spending is a lot of money, a massive pile of cash aimed at doubling data center capacity and scaling custom silicon like Trainium to meet "insatiable" demand.

Amazon wasn’t alone in its climb, as chip stocks caught up. Big Tech is set to spend a whopping $650B on AI this year, not even counting all the smaller firms that will pay out to implement elctrical infastructure, data center furnishings, and supply chain componants.

As the market rotates back into chip leaders, $NVDA ( ▼ 4.17% ) and $AMD ( ▼ 1.7% ) also climbed, buoyed by the realization that Amazon's spending "shock" represents direct revenue for the silicon providers.

Company | 2026 Est. CAPEX | Post-Earnings Price Move | Context |

Amazon (AMZN) | $200B | -9.0% | Market hated the $200B + lower operating income. |

Microsoft (MSFT) | $117.5B | -10.0% | Steepest drop in years. Azure growth is slowing. |

Google (GOOGL) | $180B | -2.5% | Investors wary of the "spending spiral." |

Meta (META) | $125B | +10.0% | The outlier, Rewarded |

Tesla (TSLA) | $20B+ | +1.2% | Highly volatile. Trading on Robotaxi Hype |

Apple (AAPL) | $14B | +2.0% | "safe haven." Record iPhone sales |

SPONSORED

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Bitcoin & Crypto Sentiment Explodes as Markets Rebound 🚀

Digital assets and related equities staged a massive recovery after a volatile overnight session saw the premier cryptocurrency test multi-year psychological floors. While $BTC ( ▼ 2.72% ) briefly touched the $60,000 mark during a period of peak anxiety, cooling liquidations and a stabilization in risk appetite triggered a double-digit percentage surge across major trading platforms and miners.

Bitcoin recovered to $70k, up roughly 13%. This rebound catalyzed significant rallies in the equity markets, with $MSTR ( ▼ 2.92% ) surging 25.79% to $134.43, while $HOOD ( ▼ 4.53% ) and $COIN ( ▼ 2.88% ) jumped 14% and 11% respectively, as retail participants aggressively bought the dip.

The Why: The move followed a brutal deleveraging event where nearly $5.4 billion in leveraged long positions were liquidated over a 72-hour window. This "inventory digestion" was exacerbated by record outflows from spot ETFs and a "seller’s virus" that hit a cyclical bottom.

The Outlook: Analysts view the sharp reversal as a potential "capitulation" signal typical of historical recovery zones, suggesting that the "Bitcoin Boomer Adoption" trade may be shifting toward a value-driven narrative. Markets are now looking for $BTC to reclaim the $75,000 level to confirm a trend shift, while $MSTR management continues its aggressive $41 billion capital-raising plan to expand its treasury amid stabilized volatility.

TRENDING STOCKS

Winners and Losers

$HOOD ( ▼ 4.53% ) Robinhood – Rebounded sharply alongside the crypto market after an eight-day losing streak that had wiped out $31 billion in market cap.

$SMCI ( ▲ 0.34% ) Super Micro Computer – Recovered after recent earnings volatility as analysts maintain long-term price targets suggesting the stock could nearly double from current levels.

$UAL ( ▼ 8.7% ) United Airlines – Led the airline sector higher on falling fuel costs and strong travel demand indicators heading into the first quarter.

$MOH ( ▲ 5.25% ) Molina Healthcare – Plummeted to a 12-month low after reporting a Q4 adjusted loss of $2.75 per share, missing the $0.43 EPS estimate significantly due to surging medical costs.

$VRSN ( ▲ 1.18% ) Verisign – Underperformed as narrowing profit margins (down to 49.9% from 55.7%) raised concerns about the company's ability to maintain historical efficiency levels.

$FSLR ( ▼ 1.45% ) First Solar – Retreated as the renewable energy sector faced headwinds from shifting interest rate expectations and regulatory uncertainty.

STOCKTWITS BOARDROOM EXCLUSIVE: SPONSORED BY VIRTUIX ($VTIX)

Virtuix's Competitive Advantage Explained by CEO Jan Goetgeluk (Virtuix IPO)

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ST MEDIA

Top Stocktwits Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋