CLOSING BELL

PLTR's Time Has Come

Happy Thursday, the market fell after the morning macro data showed that the U.S. trade deficit rose instead of shrinking. Almost a year of record tariffs diddn't effect imports, and the U.S. shipped in just $2B less than the year before, but at a much higher cost.

In terms of AI taking over everything and replacing all stocks, the fears are subsiding, as recent reports from names like Figma show there is plenty of revenue out there for companies that help people use AI tools to use software. Perma-tech bull Dan Ives said in a note that prices on stocks like Crowdstrike, Palo Alto Networks, and Zscaler, were looking great for buying opportunities after the rout.

In oil news, the U.S. gave the Iranians 10 days to respond to nuclear deals, or else. Speaking at the inaugural Board of Peace meeting, Trump said things will get ugly. It’s the largest U.S. buildup of military forces since the 2003 invasion of Iraq to the Gulf and more are on the way. The buildup follows Israeli strikes on Iranian leaders in response to violent Houthi rebels, and a U.S. strike that effectively ended talks. The potential for war sent oil prices higher, fanned by recent anti-regime protests in Iran that were brutally put down.

The warning comes just one day after the arrest of Prince Andrew, 66, for his connection and appearance in the Epstein files. He is the first royal to face arrest since King Charles I at the end of the English Civil War 400 years ago.

After the bell, Applovin was up after an unconfirmed rumor that it may work with OpenAI on monotizing Chatgpt.

AFTER THE BELL

Door is Closing on Stocks With No AI Play 🏘

The iBuying pioneer Opendoor continues to battle a sluggish residential real estate market as high-interest rates stifle transaction volumes. **$OPEN ( ▲ 7.53% ) reported a fourth-quarter loss of $1.26 per share on revenue of $736B, way above the $595 million consensus** and the meme stock shot up 13%. ** CORRECTION

The Opendoor 2.0 strategy is focused on reducing operational burn through AI-driven pricing. Management expects a path to breakeven by the end of 2026, though macro data shows pending home sales inthe U.S. are at a record low, dating back to 2001. Despite the current headwinds, the firm’s $1.1 billion in unrestricted cash provides a buffer.

OPEN climbing after its report

GRAIL Inc. Early Detection Scale-Up Beats Estimates 🧬: The multi-cancer early detection leader reported a narrower-than-expected loss as it continues to commercialize its Galleri blood test. $GRAL posted a loss of $2.44 per share, significantly better than the $3.18 loss projected by analysts, on revenue of $43.6 million. The stock tanked 45%+ the lowest sinking stinker in the post market.

GRAIL after hours

STOCKS

Michael Burry Attacks Palantir "Accounting Optics" in 10-K Audit 💿

Michael Burry finally did it: he launched a ‘forensic audit’ of Palantir's latest 10-K filing, alleging aggressive revenue recognition and "channel stuffing" as the stock sits 32% below its November peak.

The "Big Short" investor wrote in his newsletter Cassandra Unchained in the wee hours of the morning, arguing that the firm is a consulting company wearing the disguise of a software company. In today’s economy, software is a mean word, but it’s what kept PLTR trading at a 1000X forward revenue multiple at its peak just a couple of months ago.

Burry alleges the firm’s accounts receivable outgrowing revenue for nine of the last 12 quarters signals a company booking sales faster than it collects cash. SaaS firms usually have steady, predictable income from subscriptions, but Burry said Palantir's looks uneven, with big ups in some quarters and downs in others – suggesting that the company is likely billing for custom work, not software.

"Software Charade" accounting: Burry claims labor costs for "forward-deployed engineers" are miscategorized to protect vaunted gross margins.

"Billionaire-to-Sales": he also mocks the $17.2 million in jet reimbursements paid to CEO Alex Karp.

Burry remains committed to his short position, with a "landing area" as low as $50–$60. PLTR’s valuation remains extreme at 99.6 times next 12-month earnings, roughly five times the S&P 500 average. While Palantir reported high adjusted operating margins of 57% in the fourth quarter, Burry argues these figures would collapse if the company utilized the same accounting standards as IT consultants like Accenture.

Burry first disclosed a short position in Palantir in November 2025. According to disclosures from his hedge fund, Scion Asset Management, he held approximately 50,000 put contracts on Palantir (along with 10,000 on Nvidia) as of the end of the third quarter of 2025.

As for CEO Alex Karp, he is still going viral, this time not for playing with a sword, but for celebrating his firm’s military operation support during its Feb 2nd earnings call.

PLTR helps institutions, “When it’s necessary to scare enemies and, on occasion, kill them,” Karp said.

MACRO NEWS

Tariffs Didn’t Really Affect Trade… Yet ⛴

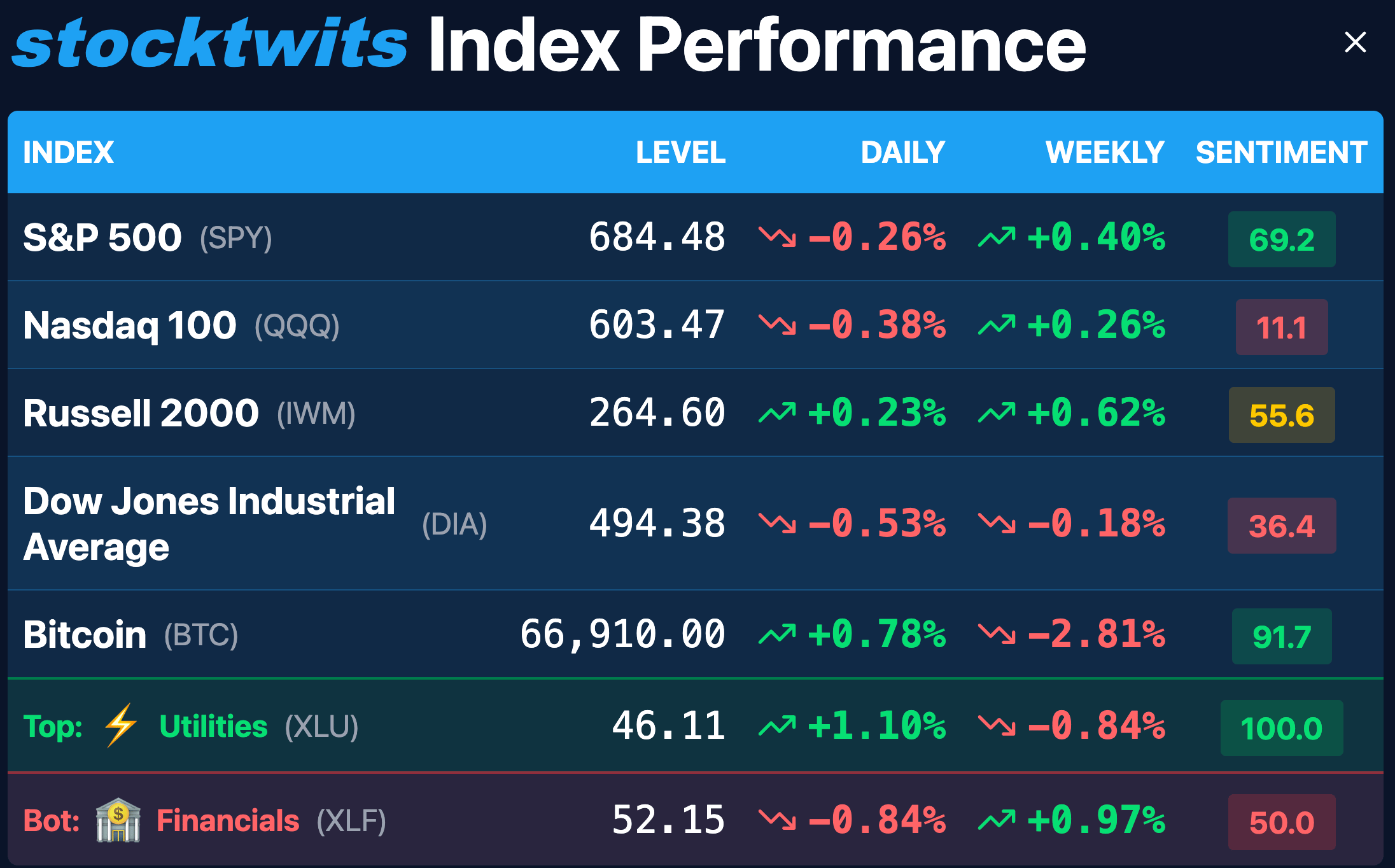

Investing.com graph of U.S. Trade Balance is still very negative.

The U.S. trade deficit just got BIGGER instead of smaller, almost a year of tariffs diddn't effect how much we import at all. It was one of the largest full-year deficits since 1960, according to the Commerce Department.

December’s 32.6% deficit expansion defied economist forecasts of a contraction and climbed to -$70B, as imports jumped 3.6% to $357.6 billion. While the full-year deficit of $901.5 billion was technically a 0.2% decrease from 2024, the underlying goods gap widened 2.1% to an all-time high.

On top of that a bombshell report from the Federal Reserve Bank of New York found this week that American businesses and consumers paid nearly 90% of the costs from the 2025 tariff wave. Despite administration claims that foreign exporters would "eat" the costs, researchers found that international suppliers barely lowered their prices. U.S. footed the $264 billion bill in total tariff revenue.

White House National Economic Council Director Kevin Hassett slammed the paper as "partisan" and "embarrassing," even suggesting the researchers should be disciplined. Neel Kashkari, Minneapolis Fed President, said threatening Fed workers for crunching the numbers correctly was just another attempt to cut back on Fed independence.

The real outlook on tariffs hinges on SCOTUS, which is expected to rule as early as tomorrow on the legality of the IEEPA-based "reciprocal" tariffs that pushed average effective rates to 13.5%. Of course, with the prospect of taking away Trump’s most prized executive action in the past year, then having to sit in the House next week and get a full blast of Trump speak, some Fintwit nerds have said there is no way SCOTUS is deciding tariffs before the Feb 24th State of the Union.

INDUSTRY NEWS

Walmart no Longer the Big Dog in Town 🐶

$WMT ( ▼ 1.51% ) earnings were a big story, but it’s not the biggest retailer anymore.

The stock climbed after delivering a powerhouse Q4. Revenue exceeded $190 billion with a 24% explosion in global eCommerce sales, but it was not enough to keep the crown for most retail sales revenue. 👑

TRENDING STOCKS

Market Movers

$OMC ( ▲ 2.87% ) Omnicom Group Inc.: Surged after announcing a massive $5 billion share repurchase program. The advertising leader also reported record Q4 revenue of $5.53 billion following its merger with Interpublic Group.

$DE ( ▲ 0.15% ) Deere & Company: Climbed after posting Q1 EPS of $2.42, crushing analyst estimates of $2.02. Strong demand in the Construction & Forestry segment helped offset rising production costs.

$TPL ( ▲ 2.74% ) Texas Pacific Land Corp: Gained as the company demonstrated high margin resilience despite a year-over-year decline in oil prices, supported by strong royalty production.

$SMCI ( ▲ 0.81% ) Super Micro Computer, Inc.: Shares rose as the company continues to see heavy trading volume driven by sustained demand for AI-optimized server infrastructure.

$OXY ( ▲ 0.6% ) Occidental Petroleum Corp.: Rose following the commencement of a $700 million cash tender offer for senior notes, a move aimed at deleveraging the balance sheet and reducing interest expenses.

$KLAR ( ▼ 5.56% ) Klarna Group plc: Plunged as the company faces a critical deadline for a federal securities class action lawsuit. Investors are reacting to allegations involving previous financial disclosures and market valuation adjustments.

$CVNA ( ▲ 1.15% ) Carvana Co.: Fell as the stock faced selling pressure amid broader concerns over used vehicle pricing trends and consumer credit tightening.

$UAL ( ▲ 2.71% ) United Airlines Holdings, Inc.: Retreated as rising operating expenses, which grew 6.2% to $14 billion, offset record passenger volumes and positive 2026 EPS outlooks. The report sent airlines lower.

ST MEDIA

Top Stocktwits Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Macro: S&P Global Manufacturing PMI, S&P Global Services PMI, 30-Year Bond Auction, Michigan Consumer Sentiment. 📊

Pre-Market Earnings: $AU, $WU, $PPL. ☀️

After-Market Earnings: $WBD. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

Get In Touch 📬

2026 Forecast

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋