CLOSING BELL

Powell's 'Maybe' Defibulator

The market closed higher after a whiff of interest rate cuts came out of FOMC head Jerome Powell’s Jackson Hole monetary policy speech.

The VIX volatility index hit a year low after Powell admitted to a crowd of reporters that trade and immigration changes have added to rising downside risks to employment, which “may warrant adjusting our policy stance.” Stocks flew, especially after five days of sell-off. AI bubble AI Smubble, rates might come down!

This late into 2025, ‘may’ might as well mean, ‘we’re going to cut rates like a ribbon ceremony’ to a stalling market dying for any hint of change. 👀

Today's issue covers Powell’s promise to maybe do something eventually, Uncle Sam is buying Intel bags, and more. 📰

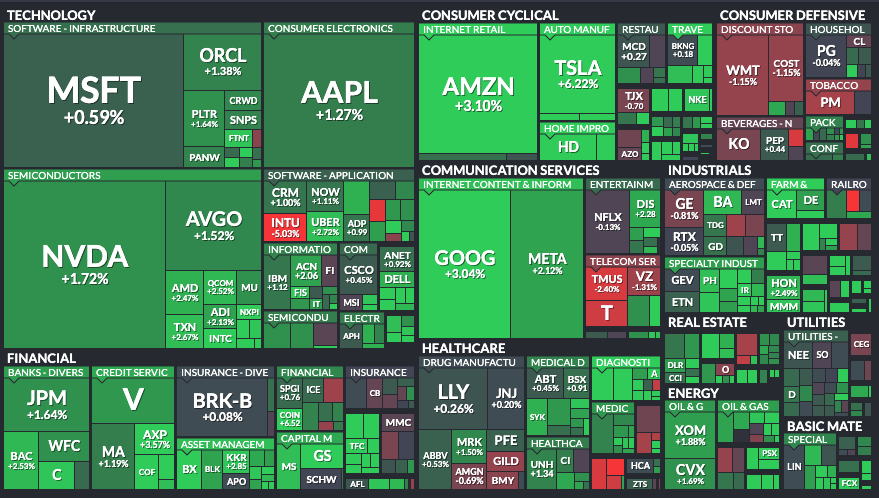

10 sectors closed green, with discretionary $XLY ( ▲ 0.3% ) leading and staples $XLP ( ▼ 0.81% ) unchanged.

MACRO

Powell Said the Fed May Budge, But That’s Of Course Dependent On Labor And Inflation Data💰

Jerome Powell said in his Jackson Hole speech that current U.S. economic conditions may warrant monetary policy changes, nearly a year after embarking on what became a 1% cut to the target Federal Funds rate.

Powell made sure to make clear that the FOMC is looking at the data, and not listening to the increasingly loud calls from the White House to cut rates.

Luckily for the White House, the data has not been great. Powell pointed to job growth numbers from July, which showed 73k additions and 258,000 cuts to the previous two months. Without healthcare job gains, the July number would have come in negative, and if that’s not a slowdown, what is?

Last year, when the FOMC started its cutting campaign, they blamed the 4.2% unemployment rate as a reason. Now that the figure is right back to 4.2%, they might do the same come September, according to Yahoo Finance

Powell made sure to promise not to be slow to react again, or as Trump has said, ‘Too-late Powell.’ In 2021, a one-time increase in the price level turned into the worst inflation in a lifetime. Going in the reverse direction (hopefully) Powell has vowed to keep the economy from falling into a stagflation environment.

TLDR: Powell said the Fed might move in September, but PCE and GDP inflation data next week might turn that promise upside down, if prices are still climbing. Still, after a pullback from all-time highs, enjoy the positive price action on a sunny Friday afternoon. ☀

SPONSORED

ZenaDrone: Green & Blue UAS In Process to sell to US Defense Agencies

ZenaTech delivers American-made drone solutions, including the ZenaDrone 1000, IQ Nano, and IQ Square.

The company is currently pursuing Green and Blue UAS certification pathways, an important step toward aligning with DoD and federal procurement standards. Under the July 10, 2025, directive, these are now Group 1-2 expendable assets. This enables field commanders to purchase directly for rapid deployment in training and missions, bypassing traditional certification.

ZenaTech drones have undergone paid trials with US Air Force and the Navy, including critical cargo delivery. Partnering with Eagle Point Funding and business development partners for military program relationships and securing grants. ZenaTech streamlines defense procurement and pursues vital R&D grants. ZenaDrone offers autonomous, AI-powered, multi-mission utility for ISR, logistics, and secure inventory management.

Interested in ZenaTech's innovative drone solutions?

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Uncle Sam Is, In Fact, Buying Your Bags 💾

Intel $INTC ( ▲ 1.65% ) climbed on the news that President Trump did offer to pick up 10% of the chip-making giant using funds from the 2022 Chips Act, and Intel accepted. Speaking in the Oval Office on Friday, Trump said Intel Chief Lip-Bu Tan made such a good impression on him that he said, “‘You know what? I think the United States should be given 10% of Intel.’”

According to the Wall Street Journal, the company has about $8B in grants from the Chips Act, convertible to nearly a 10% stake. The company loses about $1B a month, so it’s not like the grants are saving much time, anyway. 🙄

The firm confirmed that the stake would come from a combination of $5.7B in previous grants and an extra $3.2B ‘enclave program.’

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Dan Ives dismissed AI bubble concerns on CNBC, urging investors to stay focused through tech corrections and naming long-term winners like Microsoft, Nvidia, and Amazon.

Apple is reportedly exploring a partnership with Alphabet’s Gemini AI to power a next-gen version of Siri, signaling increased openness to external AI integrations.

Waymo received a permit to deploy a limited number of robotaxis in Manhattan and Downtown Brooklyn under New York City’s autonomous vehicle safety rules.

Zoom surged 9% after beating Q2 estimates and raising full-year guidance, with analysts citing strong fundamentals, AI momentum, and improved enterprise traction.

Netskope filed to go public on the Nasdaq under the symbol “NTSK,” marking a major step for the Santa Clara-based cybersecurity firm founded in 2012.

Canada announced it will drop 25% retaliatory tariffs on many U.S. goods starting September 1, though levies on automobiles, steel, and aluminum will remain in place.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋