Presented by

CLOSING BELL

Rally Takes A Breather

The market fell Tuesday as equities took a breather. Trading started higher but trended lower following speeches from Fed’s Powell covering monetary policy, and from President Trump addressing the UN General Assembly.

Powell said that the Fed will be cautious because stock prices are high but still called rates ‘modestly restrictive.’ Trump did his best to encourage the world to take a hard line on Russian aggression. Of course, Trump did not specifically state any new sanctions, but said Europe had to help, or what’s the point? He also said the gathered leaders were doing nothing while their countries were “going to hell.” 😵

The TikTok deal is moving along, with reports that American butts would fill the majority of the new board seats, and that Oracle would license and edit the Chinese TikTok algorithm. In light of the Paramount Skydance deal and Murdoch succession, there is speculation that the TikTok deal brings modern scrolling media into the old world media buyout space and might emerge as a new avenue for old-school distribution. 👀

Today’s rip: Micron earnings beat, Uncle Sam is buying Lithium companies, Fed speak, UN speak, and more. 📰

6 of 11 sectors closed green, with energy $XLE ( ▼ 0.09% ) leading and discretionary $XLY ( ▲ 1.52% ) lagging.

EARNINGS STOCKS

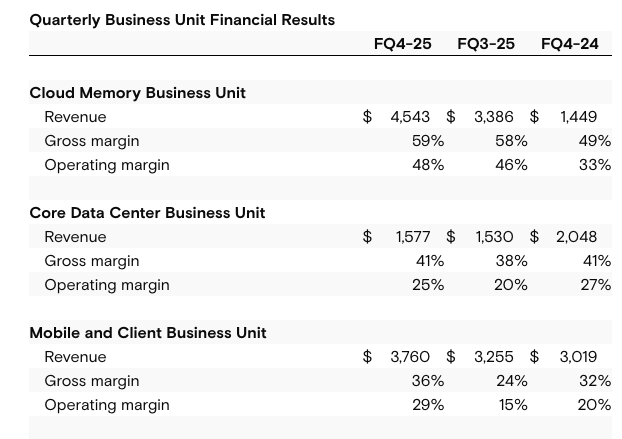

Micron Climbs As One More Datacenter Stock Posts Record Report 🥇

Micron climbed after the market closed, $MU ( ▼ 0.7% ) after the semiconductor company posted a revenue outlook above street estimates. MU expects Q1 2026 adjusted revenue in the $12.5B range after closing out its final quarter of its fiscal 2025, breaking records, according to CEO Sanjay Mehrotra.

“In fiscal 2025, we achieved all-time highs across our data center business and are entering fiscal 2026 with strong momentum and our most competitive portfolio to date. As the only U.S.-based memory manufacturer, Micron is uniquely positioned to capitalize on the AI opportunity ahead.”

The firm’s margins grew to 44.7%, led by the strength of the Cloud Memory Business unit.

STOCKS

Trending And Climbing

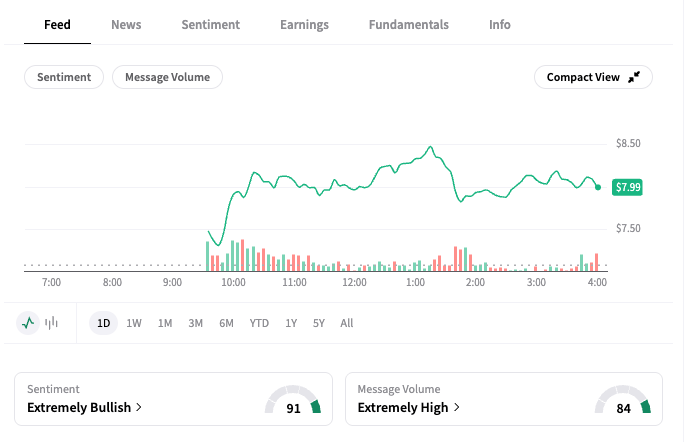

BigBear.ai was up 12% $BBAI ( ▲ 5.12% ) Tuesday after the AI tech company said it won a slot as a tech provider for a Navy partnership. Stocktwits retail traders were calling the stock the next $PLTR ( ▼ 1.35% ), trading at just $8 a share and operating at a loss.

BBAI watchers were ‘extremely bullish’ on Stocktwits

Better Home & Finance Holding $BETR ( ▲ 4.95% ) continued to climb Tuesday after Eric Jackson's stock pick post on Twitter Monday sent the price flying, and retail traders into a frenzy.

Lithium Americas $LAC ( ▲ 10.28% ) was absolutely flying upwards of 84% after a Reuters report Tuesday night that Uncle Sam was aiming to buy up a 10% in the Canadian mining company, like the stake it sought in Intel $INTC ( ▲ 5.71% ).

LAC is currently building a Nevada lithium mine called Thacker Pass, with help from General Motors $GM ( ▲ 2.05% ) and a $2.26B loan from the Energy Department. The build is not going well, Reuters reported, but instead of shutting down, the U.S. is asking for a stake.

Uncle Sam needs the mine to work. Right now, the U.S. produces less than 5,000 metric tons of Lithium annually, all stemming from an Albermarle $ABL ( ▲ 1.51% ) facility in Nevada. When complete, Thacker Pass mine is supposed to produce 40,000 metric tons a year. But, a White House official told Reuters that if LAC needs more money to keep the project going, the money won’t come free.

Stocktwits retail was ‘extremely bullish’ on LAC

SPONSORED

ZenaTech Expands Drone-as-a-Service to Florida

ZenaTech, a leader in AI drones and technology solutions, is expanding its reach with its tenth acquisition, A&J Land Surveyor Inc. This strategic move establishes a strong presence in Florida's key aviation, utility, and infrastructure markets.

The company is integrating A&J's extensive surveying expertise with its innovative Drone as a Service (DaaS) platform. This combination provides a powerful, AI-driven solution for inspections and surveys, delivering unmatched speed and accuracy.

ZenaTech's DaaS model allows clients to access on-demand drone services without the significant capital costs of equipment and training. This makes advanced drone technology accessible and efficient for a wide range of applications.

With plans to grow to 25 DaaS locations by mid-2026, ZenaTech is building a scalable network to meet the increasing demand for aerial services nationwide. The company is advancing the industry by delivering a new era of efficiency and precision.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Fed Speak After Fed Cut Shows Divided Votes

The FOMC restarted a rate cut cycle last week after no movement in Monetary Policy so far this year. In the aftermath, investors and economists are scrutinizing FOMC members’ public appearances for any indication of when the next rate cut will occur.

And you know what? Federal Reserve officials are sounding increasingly cautious and divided as labor market conditions deteriorate and inflation remains stubbornly elevated.

Governor Michelle Bowman warned on Tuesday that the U.S. may already be “behind the curve.” Demand in goods is weakening, which, Bowman said, raises the risk of layoffs if conditions don’t improve. While she expressed optimism following last week’s 25 bps rate cut, Bowman emphasized that further, faster cuts may be necessary if businesses begin shedding workers.

Chair Jerome Powell echoed the concern, but spoke of caution, calling the Fed’s balancing act “a challenging situation” with inflation risks tilted upward and employment risks downward. Powell said rates were still restrictive, giving some hope for more cuts soon, but he defended the recent rate cut as a “risk management” move, not a no-brainer.

Meanwhile, Chicago Fed President Austan Goolsbee added that rates could eventually fall to 3% if inflation cools, but warned against premature easing given persistent stagflationary pressures. Goolsbee seemed comfortable with higher rates as long as inflation was at 2%.

CONFLICT NEWS

Haliburton, Oil Climb After Trump And Nato Talk War With Russia 🪖

Halliburton $HAL ( ▲ 1.56% ) climbed after the Trump UN visit, and NATO threats for more decisive actions against Russia after a breach of unknown drones into Dutch Airspace that caused flight delays. Trump told NATO powers to shoot down Russian planes after NATO forces shot down unmanned drones over Poland last week. Tensions are rising in Eastern Europe, as Russia seems to have become very lax with where it sends its drones, with incursions in Estonia and Romania marking a surprising change from past years of airspace respect.

Alexander Stubb, president of Finland, a Russian neighbor that has lost land to the warmonger in the past, said these airspace incursions are ‘tests’ from Russia, and reminded a Bloomberg reporter that Russia is testing NATO in more than one way. Russia is testing with undersea cable sabotage, with cybersecurity attacks, and now with drones and fighter jets.

The president called out European importers of Russian oil and threatened tariffs on China and India for financing the war effort by participating in trade. After the speech, Trump also said there was a future where Ukraine could take back all of its land, a major change of direction from past Ukrainian peace talks. Trump has been literally rolling out the red carpet for Russia’s Putin, and has indicated Ukraine would have to make land concessions to stop the fighting. Today, he might have finally changed his tune. 🌮

PRESENTED BY STOCKTWITS

🚨 Enhanced Stream Filtering Is Live! ⚡

Your stream just got smarter. With Enhanced Stream Filtering, you can now:

Hide GIFs that clutter the feed

Filter out posts with multiple cashtags to keep discussions focused

Use the Link Filter to cut spam and keep conversations clean

How to Access It:

Go to any symbol page

Switch to the Latest feed

Scroll down to the feed

Tap the ⚙ settings gear

Set your stream filters

Your feed, your rules.

POPS & DROPS

Top Stocktwits News Stories 🗞

Elon Musk defended $1T pay package based on robot safety.

Exxon rose 2% intraday after Rosneft write-down deal.

Microsoft unveils chip cooling breakthrough.

Eli Lilly announced $6.5B Texas plant for small-molecule drugs.

Morgan Stanley hit a record high after E*Trade crypto rollout.

TSMC rose 3.2% after Nvidia-OpenAI chip supply deal.

Fold Holdings fell 15.9% Tuesday despite Stripe-Visa Bitcoin card launch.

Kenvue rose 4.1% after Citi downplayed Tylenol legal risk.

Dan Ives called Nvidia-OpenAI deal a 1996-style tech moment.

IonQ climbed 4% Tuesday after quantum milestone.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

🟢 LIVE - JAM SESSION WITH BEN, EMIL & CEM KARSAN: BUBBLEHEMIAN RHAPSODY

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: New Home Sales (10:00 AM), Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM), 5-Year Note Auction (1:00 PM), FOMC Member Daly Speaks (4:10 PM) 📊

Pre-Market Earnings: Uranium Energy ($UEC) and Thor Industries ($THO). 🛏️

After-Market Earnings: Stitch Fix ($SFIX) and KB Home ($KBH).🌕

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋