Presented by

CLOSING BELL

Ram Buyers Be Like

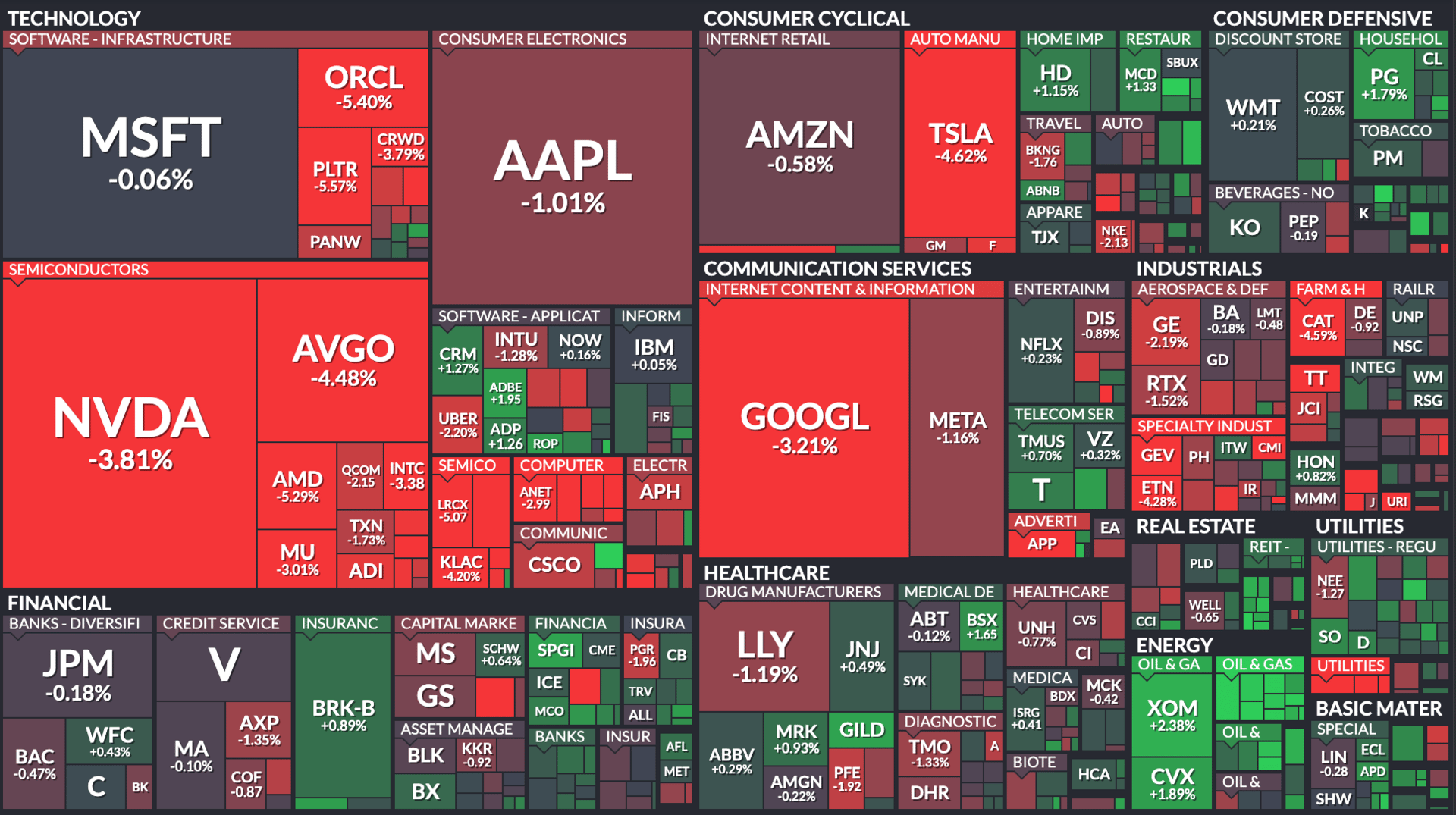

The market pulled back again Wednesday, and even overnight enthusiasm for Tesla was not enough to keep tech stocks from hitting the red.

It all started with a nasty report from Financial Times that Oracle’s favorite money bag supplier Blue Owl Capital, was not going to back its most recent project. It’s an upset for a $10B Michigan-based data center project, but in the grand scheme it’s just one of two dozen the tech giant needs to build to keep up with the tech giant Joneses.

After the bell, Micron posted some great forward looking guidance, painting a ‘memory super cycle’ of rising prices of computer memory. It looks like flush times for RAM makers, a classic supply and demand hurricane hitting AI accelerators and any poor sap that’s tried to build a gaming computer this holiday season.

Oh, and Tesla: the EV maker is suspended from selling cars in California if it does not follow a juges’s orders and fix its allegedly falsely advertised self driving.

The news wasn’t all bad, Fed’s Waller, fresh off a supposed interview with Trump, said he could see up to 100 basis points of cuts over the course of a steady pace in the coming year toward his ideal neutral interest rate. CPI data from during the shutdown drops tomorrow; even if it’s weird shutdown data, the S&P 500 has moved ±1% in the past 12 reports.

In the House, Congress moved to actually talk about health care after four Republicans broke with the Speaker of the House to join Democrats and force a vote on the House floor to send the problem to the Senate to figure out. It was either that or let millions of healthcare plans expire in two weeks. 🤷

Trump will address the nation tonight on TV, from the White House at 9 pm ET.

AFTER THE BELL

Micron Breaks the Piggy Bank After Hours 🐷

The market is undercutting AI earnings this quarter, as we all head into the new year. But after the bell Wednesday, Micron $MU ( ▼ 0.7% ) delivered a great quarter. Demand for its memory in the new year was sending the stock flying, proving that its plan to pivot away from consumer memory toward high-margin AI infrastructure is paying off.

Q1 Fiscal 2026 Results Snapshot

Adjusted EPS: $4.78 vs. $3.95 estimated (+167% YoY)

Adjusted Revenue: $13.64 Billion vs. $12.95B estimated (+56% YoY)

Operating Cash Flow: $8.41 Billion vs. $5.94B estimated

Adjusted Operating Income: $6.42 Billion vs. $5.37B estimated

While the Q1 beat was impressive, the Q2 guidance is what sent shockwaves through the market. Micron is projecting growth and profitability that Wall Street didn't think was possible until 2027.

Q2 Revenue Guidance: $18.3B – $19.1B (Wall Street was only looking for $14.38B)

Q2 EPS Guidance: $8.22 – $8.62 (Nearly double the $4.71 consensus)

Q2 Gross Margin: 67% – 69% (Completely blowing away the 55.7% estimate)

💡 Why the Numbers are Exploding

1. HBM3E Dominance: Micron’s High Bandwidth Memory is essential for AI accelerators like NVIDIA’s Blackwell chips. CEO Sanjay Mehrotra said that Micron’s HBM capacity for all of 2025 and most of 2026 is already sold out, pushing any other sales to the premium side.

2. The Data Center Shift: Data center revenue hit a new record as hyperscalers like Microsoft, Google, Meta aggressively build out AI clusters. This segment now carries much higher margins than the volatile PC and smartphone markets Micron used to rely on.

3. Strategic Exit from “Crucial”: The company’s recent decision to exit its consumer-facing Crucial business is flexing its forward guidance. By shifting that manufacturing capacity to high-margin AI server chips, Micron is capturing significantly more profit per wafer. Theoretically.

Investor Takeaway: Micron is pitching itself as a commodity stock no longer. Instead, it’s a high-margin AI play. With free cash flow reaching record levels and guidance coming in 80% above consensus, the “AI bear” case for semiconductors is getting harder to defend. At least tonight it is.

In other after hours moves, Insmed stock plunged 20% after its sinus drug failed mid-stage trial. 💊

SPONSORED

The Newsletter Wall Street Hopes You Never Find

Wall Street has built an empire on investor ignorance. They sell “diversification” while feeding you old, recycled strategies.

With the H.E.A.T. Formula we show you what they won’t say out loud:

That most portfolios are sitting ducks — and your advisor probably doesn’t know it.

You’re not just reading a newsletter. You’re joining the side that sees the game for what it is — and knows how to play it.

The H.E.A.T. Formula is a radically different way to look at investing your portfolio.

👉 Click here to get the one newsletter Wall Street prays you never find.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

SECTOR NEWS

Oracle AI Expansion Hits Snag as Key Investor Pulls Back: Report ⚠️

Oracle shares are falling $ORC ( 0.0% ) after its largest finance partner, Blue Owl, will not back a $10B deal for yet another data center. $IREN ( ▲ 7.3% ) $CRWV ( ▲ 9.31% ) and $NBIS ( ▲ 1.96% ) were also falling, three smaller diversifying names in AI that offer computing and electrical power alternatives, getting battered by the less optimistic capital expenditures market.

Oracle is facing a critical bottleneck in its ambitious Project Stargate AI expansion after its primary funding partner, Blue Owl Capital, reportedly pulled out of a $10 billion data center deal in Saline Township, Michigan.

The withdrawal marks a significant shift in market sentiment as lenders grow wary of Oracle’s rapid, debt-fueled spending. Blue Owl had previously financed major projects in Texas and New Mexico, but negotiations for the Michigan based facility that was planned to power OpenAI thinking reportedly stalled over lease terms and Oracle's mounting leverage.

The debt dilemma: Oracle’s balance sheet is under intense scrutiny as it attempts to build hyperscaler infrastructure without a hyperscaler balance sheet. It’s been around the block, but it ain’t Google.

Debt Load: Total debt has surged to approximately $105 billion, up from $78 billion just a year ago.

Lease Commitments: Regulatory filings reveal that debt load is only going to increase. Long-term data center lease obligations have ballooned to $248 billion.

The Ratio: Oracle’s debt-to-equity ratio sits at a staggering 4.3, meaning the company carries $4 of debt for every $1 of equity. Compare that with swimming in cash trillionaires like Microsoft or Google.

The funding snag coincides with operational hurdles that are pushing back timelines for Sam Altman’s OpenAI vision. Completion dates for several OpenAI-linked data centers have been pushed from 2027 to 2028, citing labor and material shortages.

Oracle, for its part, disputed the report, claiming Blue Owl was simply “not selected” and that they are moving forward with a different equity partner to keep the project on schedule.

POPS & DROPS

Top Stocktwits News Stories 🗞

Gorilla Technology fell 8% as a major contract moved to phased rollout.

Archer Aviation fell 4% as short-seller concerns clash with air taxi deployment.

Medline upsized its IPO and set a $29 price for debut.

Eric Jackson launched a crypto treasury firm despite the dull market.

Christopher Waller saw Fed Chair odds surge following dovish comments.

Bitcoin and Ethereum ETFs saw over $500 million in combined outflows.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

NFL Worried About Prediction Markets?! Rams–Seahawks Pick, Nike Earnings & Jake Paul–AJ

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: CPI (Inflation): Economists forecast November CPI at 3.1% year-over-year, slightly higher than the 3.0% previous reading and confirming that inflation remains stubbornly sticky.

Jobless Claims: Initial claims near 212K, signaling a labor market that remains resilient rather than "cooling" as the Fed intended.

Fed’s Balance Sheet: Markets are waiting for the 4:30 PM release to see how the Fed is managing liquidity after today’s mixed inflation and labor data.

Pre-Market Earnings: Accenture ACN, Darden Restaurants DRI

Post Market:

Nike $NKE ( ▲ 1.59% ) Investors are bracing for a double-digit revenue decline as the market waits to see if the new CEO can spark a holiday turnaround.

FedEx $FDX ( ▲ 0.74% ) As a global bellwether, all eyes are on whether FedEx can maintain its profit guidance amid shifting global shipping volumes.

KB Home $KBH ( ▲ 0.76% ) : After Lennar's rough start to the week, the focus is on whether KB Home is also sacrificing margins to keep its delivery numbers alive.

Links That Don’t Suck 🌐

🏠 Tricolor executives charged with ‘systematic fraud’ after subprime auto lender roiled banking sector

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋