Presented by

CLOSING BELL

Rip Tariffs, Claude Killed Cybersecurity

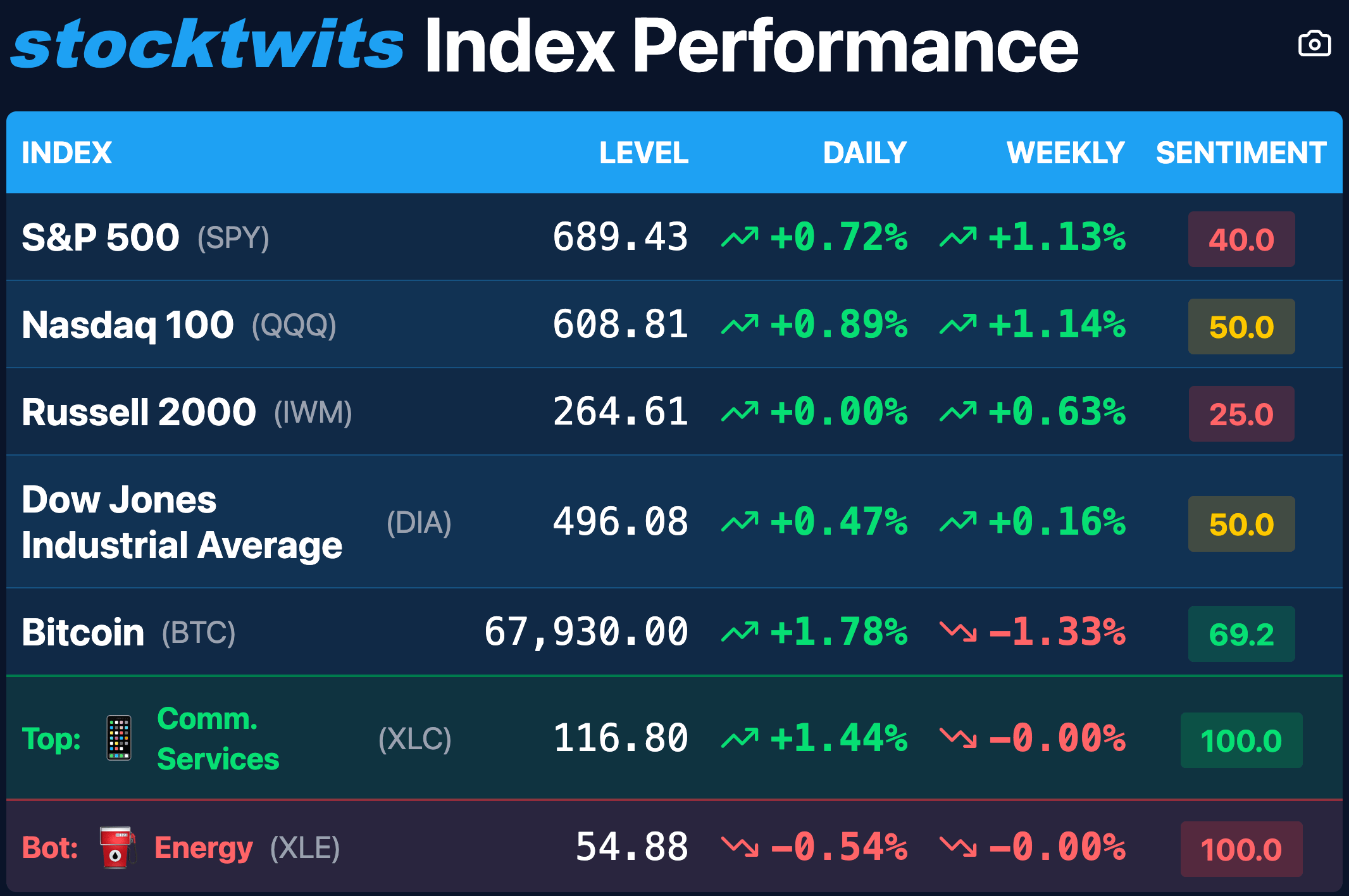

The market climbed Friday, ending a short week with a deluge of news that may shake the entire world.

The Supreme Court decided the Trump Admin could not raise one cent using IEEPA tariffs, and the Fed may have to refund hundreds of billions of what has sort of turned out to be consumption taxes on the U.S.

Have no fear hardliners, the President said the SCOTUS may be compromised by foreign powers, and said he would sign in new tariffs using new, razor-thin avanues availible in executive branch legal precedent. Woah boy.

The decision is headed to Uncle Sam, but no word on how or when the tariffs may be refunded.

On top of that, the GDP data showed a rapid fall in economic growth in the fourth quarter last year, from a rapid 4.4% in Q3, to just 1.4%. The data from Q3 is actually still delayed because of the shutdown.

AND the PCE showed a remarkable climb to 2.9%. For all the talk of inflation is low and cutting rates, the metric was the highest in three years, and since May of 2025 has been steadily climbing. Weird.

Outside that mess, Anthropic dropped fresh updates to Claude Code, that sent AI security Crowdstrike falling with the AI fear.

In the Stocktwits verse, Michele Steele welcomed Opendoor CEO Kaz Nejatian, who talked about earnings and tariffs and secret new products— check it out below.

MACRO THE BELL

SCOTUS Strikes Down Trump Tariffs, Trump Announces More 🤪

The U.S. Suprme court struck down tariffs. Consumer discretionary stocks, like LULU lemon and Nike shot upwards, and the market followed right after the highest court in the land voted 6-3 that the way the Trump admin was issuing tariffs is unconstitutional.

Right after 10 am EST, the Chief Justice wrote the President cannot impose tariffs under IEEPA, the International Emergency Powers Act signed into law under Carter.

The Trump admin had imposed record tariffs under the law, every single country in the world was looking at at least 10% tariffs on their goods under the concept of emergency, according to the Tax Policy Center.

The decision to halt them puts anywhere from $100B-$175B in already collected tariffs, according to Penn-Wharton Budget Economists. Importers are going to scramble for refunds. The gov pulled in $500M daily under this act. Treasury Secretary Scott Bessent said the Treasury can easily make this back, well duh they print money.

Well the court said it was illegal, but they did not say how Uncle Sam will refund the money- that goes to the Treasury and Trade departments, and it all might come back to the SCOTUS.

The news follows reports this week that the U.S. trade deficit grew in 2025, despite the massive tariffs. It was one of the largest full-year deficits since 1960, according to the Commerce Department.

On top of that a bombshell report from the Federal Reserve Bank of New York found this week that American businesses and consumers paid nearly 90% of the costs from the 2025 tariff wave. The U.S. footed the $264 billion bill in total tariff revenue.

Now fast forward to Friday. Chief Justice Roberts wrote that they can’t use the IEEPA language to keep doing this.

"Based on two words separated by 16 others in ... IEEPA," Roberts writes, " 'regulate' and 'importation'--the President asserts the independent power to impose tariffs on imports from any country, of any product, at any rate, for any amount of time. Those words cannot bear such weight."

President Trump immdeiently called the decision a disgrace, and took to the press room to announce brand new tariffs on the entire world. He said the justices were compromised by foreign interests, including the justices that he appointed.

Have no fear, there are other options to implement tariffs, but they are limited. Trump said today he was signing a new order to use is Section 122, which gives 150 days of tariffs up to 15% on the legal justification that there are ‘large and serious’ issues with the U.S. dollar.

If that does not work, or he requires congressional approval, there are other options. The White House could use Section 232, section 301, which are national security tariff restrictions that have been used in the past on commodities like steel. These are the preferred tariff options now, but they take longer to impose, possibly up to 12 months.

This changes the political midterm landscape which is more like nine months away, but more importantly the international trade situation and importers in the US.

IN PARTNERSHIP WITH POLYMARKET

🚨New Earnings Markets Just Dropped on Polymarket

Ever been RIGHT about earnings... but still lost money?

Traditional markets force you to trade 10+ variables when you only need to have conviction on one to profit.

Now, there's a better way to trade your conviction.

On Polymarket, you can trade the ONE outcome you actually have an opinion on:

Will NVIDIA beat Q4 earnings?

What will Nebius say on their earnings call?

Will AMZN close above $200 in February?

No Greeks. No IV crush. No "priced in" excuses ❌

Being right on earnings = profit.💰

Upcoming earnings ide NVIDIA, DASH, CVNA, SNOW, and more... 👀

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ST MEDIA

EXCLUSIVE: Opendoor CEO Kaz Announces Mortgage Beta, Talks Earnings With Michele Steele

Opendoor CEO Kaz Nejatian joins Stocktv to talk Opendoor’s monster Q4, and answer retail questions. He announced a brand-new Opendoor mortgage beta running internally at the firm, with a launch date TBD. 👀

Nejatian breaks down what actually changed inside the business, why Q1 revenue can drop even as the company gets structurally healthier, and the single metric he says investors should model: contribution margin per cohort.

Kaz explains Opendoor’s cohort-based business model (buy homes, renovate, resell), why most Q4 sales came from inventory acquired before he arrived, and how a massive acceleration in acquisitions takes time to flow into revenue.

He also shares surprising details on how AI is transforming execution speed at the company — including a mind-blowing stat on how much code was produced in eight weeks — plus commentary on profitability targets.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

INDUSTRY NEWS

Cybersecurity Sector Anthropic Disruption Triggers Software Sell-Off 🛡️

The cybersecurity sector experienced a sharp "mini-flash crash" Friday after Anthropic unveiled a new Claude AI tool capable of scanning and patching code vulnerabilities. Investors fled legacy security names on fears that AI-native automation will make old software obsolete.

Panic selling swept through the industry as Crowdstrike $CRWD tumbled 7.9%, Cloudflare $NET slumped over 8%, and Okta $OKTA declined as much as 9.6%. The Global X Cybersecurity ETF $BUG extended its year-to-date losses to 15.6%, reflecting a broader rotation out of specialized software as the iShares Expanded Tech-Software Sector ETF $IGV tracks toward its worst quarter since 2008.

The catalyst is Anthropic’s new limited research preview tool, which automates the identification of security flaws and suggests targeted software patches for human review. This "vibe coding" evolution allows users to essentially generate their own security fixes, leading to institutional anxiety that AI providers like Alphabet and OpenAI will increasingly compete for incremental cyber budget dollars previously reserved for pure-play vendors.

The outlook remains clouded by "headline headwinds" as the market labels legacy software as potential AI losers during this transition. While analysts suggest cybersecurity could eventually be a net winner as AI infrastructure requires protection, today it looks like the old names lost.

TRENDING STOCKS

Market Movers

$RXT ( ▲ 37.14% ) Rackspace Technology, Inc.: High retail engagement persists ahead of the Feb 26 earnings report, with the stock currently trading in a volatile range near $0.44 and a market cap of $834.3M.

$FIX ( ▲ 6.46% ) Comfort Systems USA, Inc.: Surged after reporting Q4 2025 EPS of $9.37, more than doubling year-over-year. The company’s project backlog nearly doubled to $11.94B, signaling massive future demand in HVAC and electrical contracting.

$GLW ( ▲ 7.32% ) Corning Incorporated: Gained as analysts highlight an "AI Boom" in infrastructure; eleven research firms now carry a "Buy" rating with a consensus target price of $114.25.

$GRAL ( ▼ 50.55% ) GRAIL, Inc.: Shares plummeted after the landmark NHS-Galleri trial missed its primary combined Stage III-IV endpoint, despite demonstrating a four-fold improvement in cancer detection rates and a 20% reduction in Stage IV cases.

$ORCL ( ▼ 5.4% ) Oracle Corporation: Fell as capital markets expressed concern over the financing required for its massive OpenAI infrastructure deal, despite news of potential fresh funding for its partner.

$ARES ( ▼ 5.15% ) Ares Management Corporation: Slipped after Q4 results showed a profit drop despite a revenue beat. Investors are weighing a 20% dividend increase against rising costs and margin compression in private credit.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

2026 Forecast

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋