Presented by

CLOSING BELL

Robinhood, APP Get The Nod

The market fell Friday after a weaker-than-expected jobs report. Labor Day seemed a harbinger of bad labor market news. The unemployment rate rose on schedule, but the jobs added were way lower, and June’s additions were revised to negative. It’s the first monthly job cut since 2020. Economists went full rate cut frenzy, with a completely priced-in September 17th cut. Barclays now predicts three cuts this year, in Oct and Dec. Chicago Fed Prez Goolsbee said it’s easier to focus on bad labor as a reason to cut, but also warned inflation was rising too.

Still, gold and bitcoin prices flew, and 30-year mortgage rates saw the biggest one-day drop in a year. Tech fell after warnings from the president that semiconductor tariffs were coming, but Broadcom’s healthy earnings held up the Nasdaq 100. 👀

Today’s story: New additions to the S&P 500 climb, banks and brokers fall on jobs data, and more. 📰

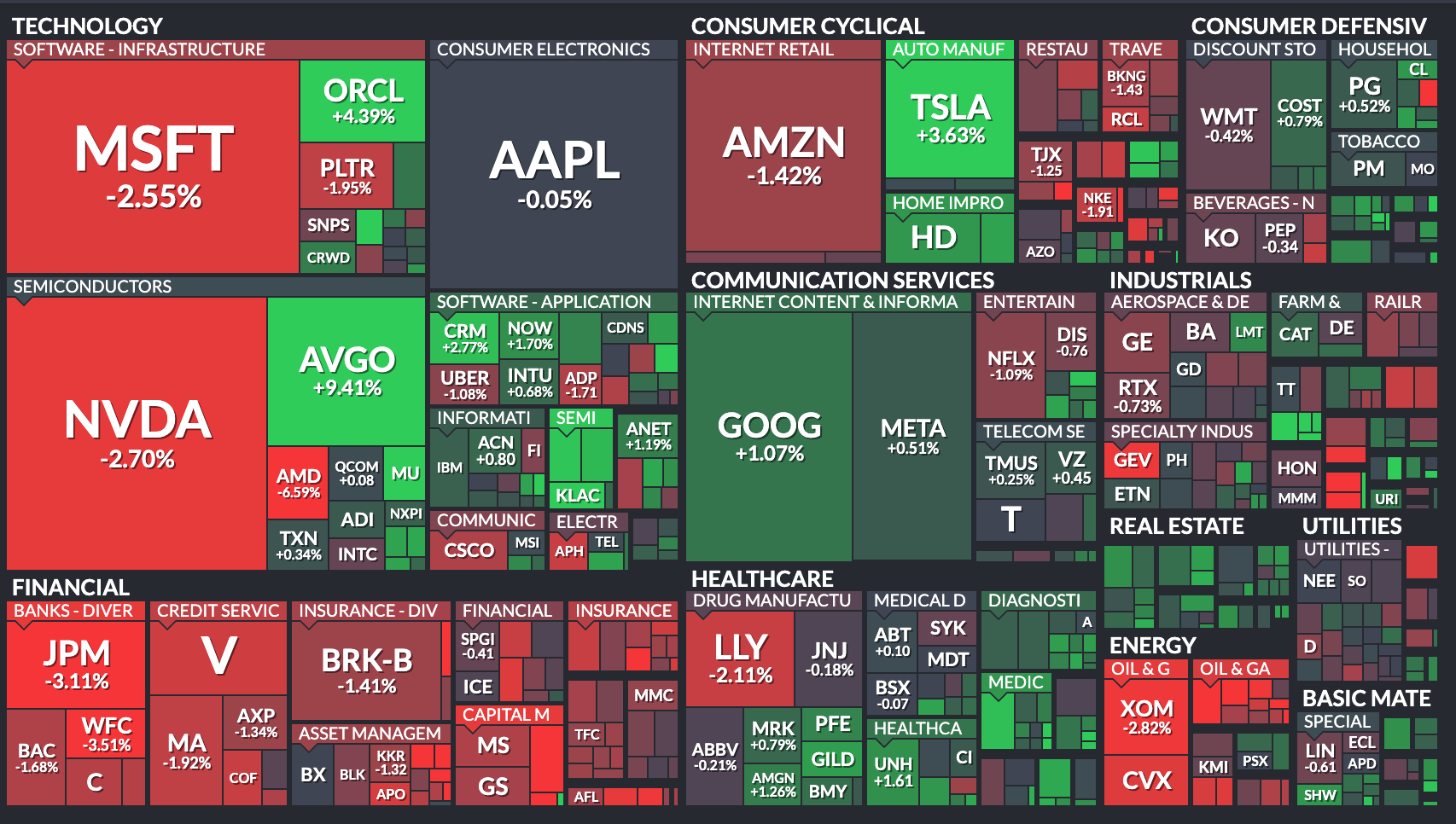

5 of 11 sectors closed green, with real estate $XLRE ( ▼ 0.66% ) leading and energy $XLE ( ▼ 0.42% ) lagging.

MACRO NEWS

Robinhood And AppLovin Get The Nod

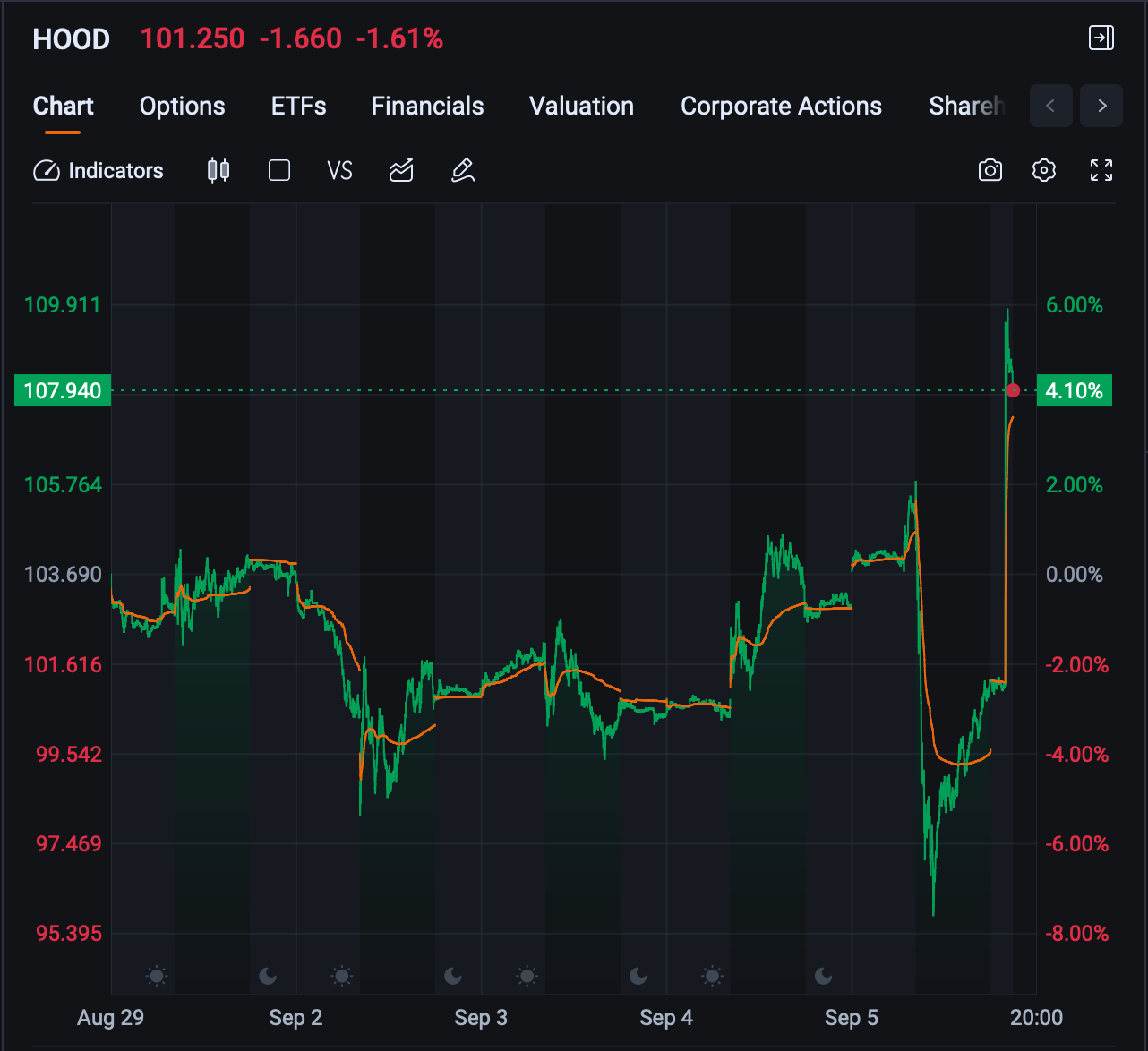

The big news after the bell on Friday was the who's who of stocks joining the S&P 500, in a quarterly rebalancing.

$HOOD ( ▲ 5.64% ) Robinhood, $APP ( ▲ 7.23% ) AppLovin, and $EMKR ( ▲ 0.81% ) were on the list, replacing low market cap stocks MarketAxes, Enphase, and Ceaser’s Entertainment. It has been a long time coming for Robinhood and AppLovin; investors have felt spurned in multiple rebalancing events this year. According to MarketWatch, the index includes the largest companies in the U.S., over $22.7B in market cap, and a float of $10.25B.

HOOD has met those requirements, as do fresher stocks like $RDDT ( ▲ 5.34% ) Reddit, but the index also selects for "financial viability." Companies have to show non-adjusted profitability for four quarters.

All three stocks were climbing on the news, as the market awaits fund managers to buy up shares to reflect the additions to the list.

SPONSORED

Former Zillow Exec Opens Door to $1.3T Market

Austin Allison sold his first company for $120M. He later served as an executive for Zillow. But both companies reached massive valuations before regular people could invest.

“I always wished everyday investors could have shared in their early success,” Allison later said. So he built Pacaso differently.

Pacaso brings co-ownership to the $1.3T vacation home market, earning $110M+ in gross profit to date. No wonder the same VCs that backed Uber, Venmo, and eBay already invested in Pacaso.

Now, after adding 10 new international destinations, Pacaso is hitting their stride. They even reserved the Nasdaq ticker PCSO.

And unlike his previous stops, you can invest in Pacaso as a private company. But you’ll have to hurry. Invest in Pacaso before 9/18.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

LABOR

Slowing Jobs Market Means

One segment of the S&P 500 really hated the bad jobs numbers: banks and brokers. When the market is at all-time highs, what falls can define it.

Besides $LULU ( ▲ 1.71% ) falling on its Thursday guidance cut, $KVUE ( ▼ 1.26% ) dropping on a rumor Kennedy was going to cite Tylenol as a prenatal Autism risk, and $AMD ( ▼ 1.39% ) sagging on semi tariffs, $IBKR ( ▲ 2.41% ) Interactive Brokers and Charles Schwab were leading the downtrend.

Real estate was happy, but fear over an actual recession does not tend to make stocks climb. Economists were hoping for 75k additions, not 22k, and not expecting the first negative month since Covid.

Wealth management stocks and investment banks like $MS ( ▲ 2.93% ) were falling, and consumer banks like $WFC ( ▲ 2.59% ) were down. The fear is a softer economy and lower interest rates could hurt banks. Barron’s reported a dip in the demand for loans, and higher defaults would hurt the bottom line. Giants like Schwab have performed great during tariff-caused stock volatility this year, but their valuations come down to bringing new money in the door.

Finra reported that Q2 margin debt exceeded $1 trillion as traders worldwide flocked to the stock market to trade.

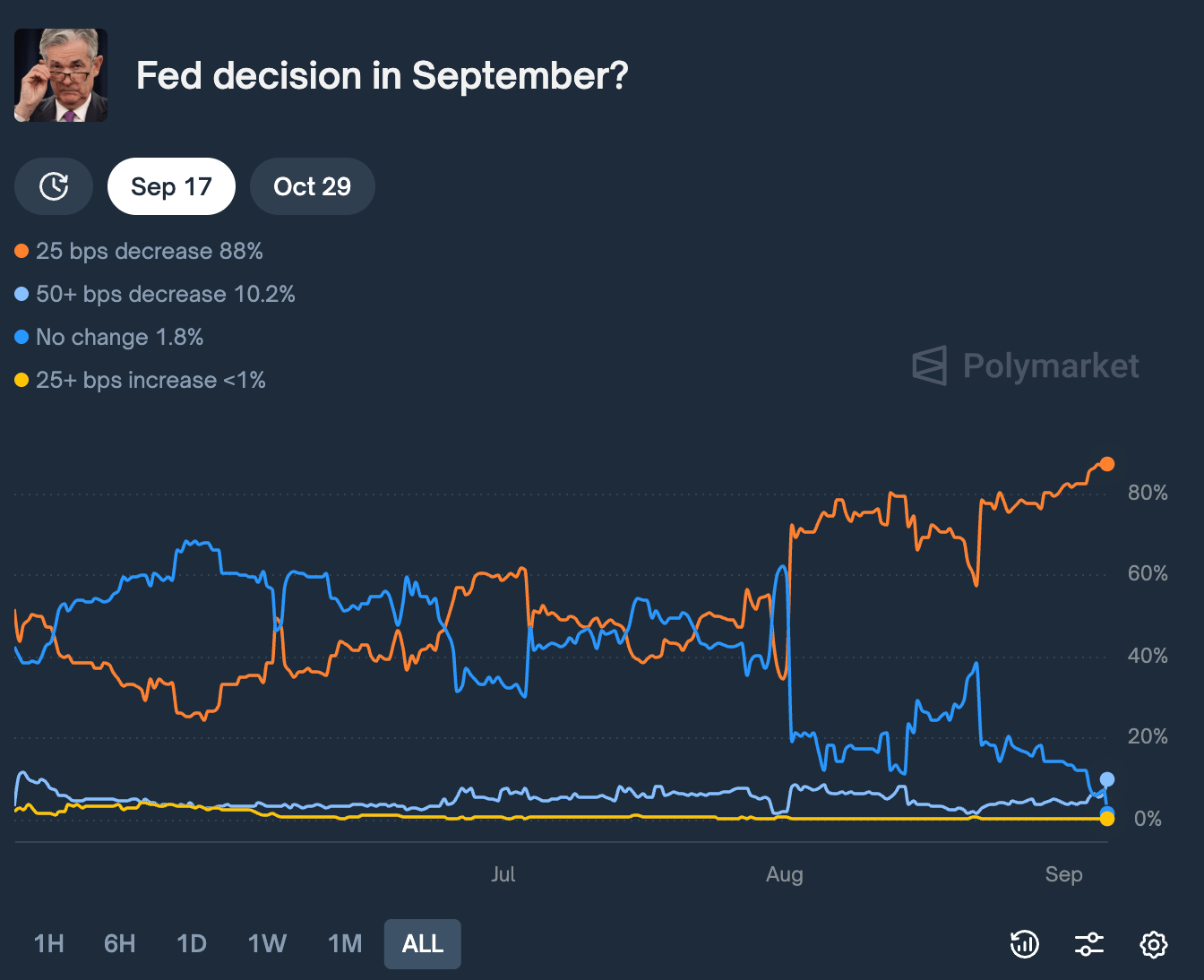

White House Advisor Howard Lutnick said BLS data will improve after Trump fired its chief, about an hour before the data came in worse than when the last BLS head was still in the seat. Kevin Hassett called the August jobs data disappointing and expects better updates in the future. President Trump played his part, calling out 'too late’ Fed Chair Jerome Powell to cut rates. Friday’s CME FedWatch puts the chances of a September cut at 100%.

Polymarket ods for a rate cut show nearly a 100% cut

IN PARTNERSHIP WITH THE CMT ASSOCIATION

Join Market Leaders In Dubai Sep 30th-Oct 2nd 🤝

Over 250 Investors, portfolio managers, regulators, fintech leaders, and more are gathering at the Global Investment Summit 2025 in Dubai. Don’t miss your chance to learn directly from experts shaping today’s markets through high-impact discussions, skill workshops, exclusive networking, and more!

It’s all happening at Dubai’s iconic Museum of the Future from September 30 to October 2. The CMT Association is offering a special discounted rate exclusively for the Stocktwits community. Register below—and we’ll see you there! 🎟

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Kenvue sank 9% after HHS autism-Tylenol report leak.

Roblox launched short-form “Moments” for gameplay clips.

ConocoPhillips CEO blamed M&A the reason for 25% job cuts.

Mortgage rates plunged to 6.29% after weak jobs data.

Qualcomm CEO said Intel’s chips aren’t efficient enough yet.

Bessent warned Fed policy threatens its independence.

Bitcoin rose above $113K after weak jobs data.

Tesla board proposed a $1T Musk pay deal, backed by Dan Ives.

US Jobs Report showed just 22,000 payroll gains in August.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋