Presented by

CLOSING BELL

Robinhood's Crypto Rev Left the Building

Happy Tuesday, the market fell overall, and sectors started to show a divergeance after a two-session rebound ran out of steam.

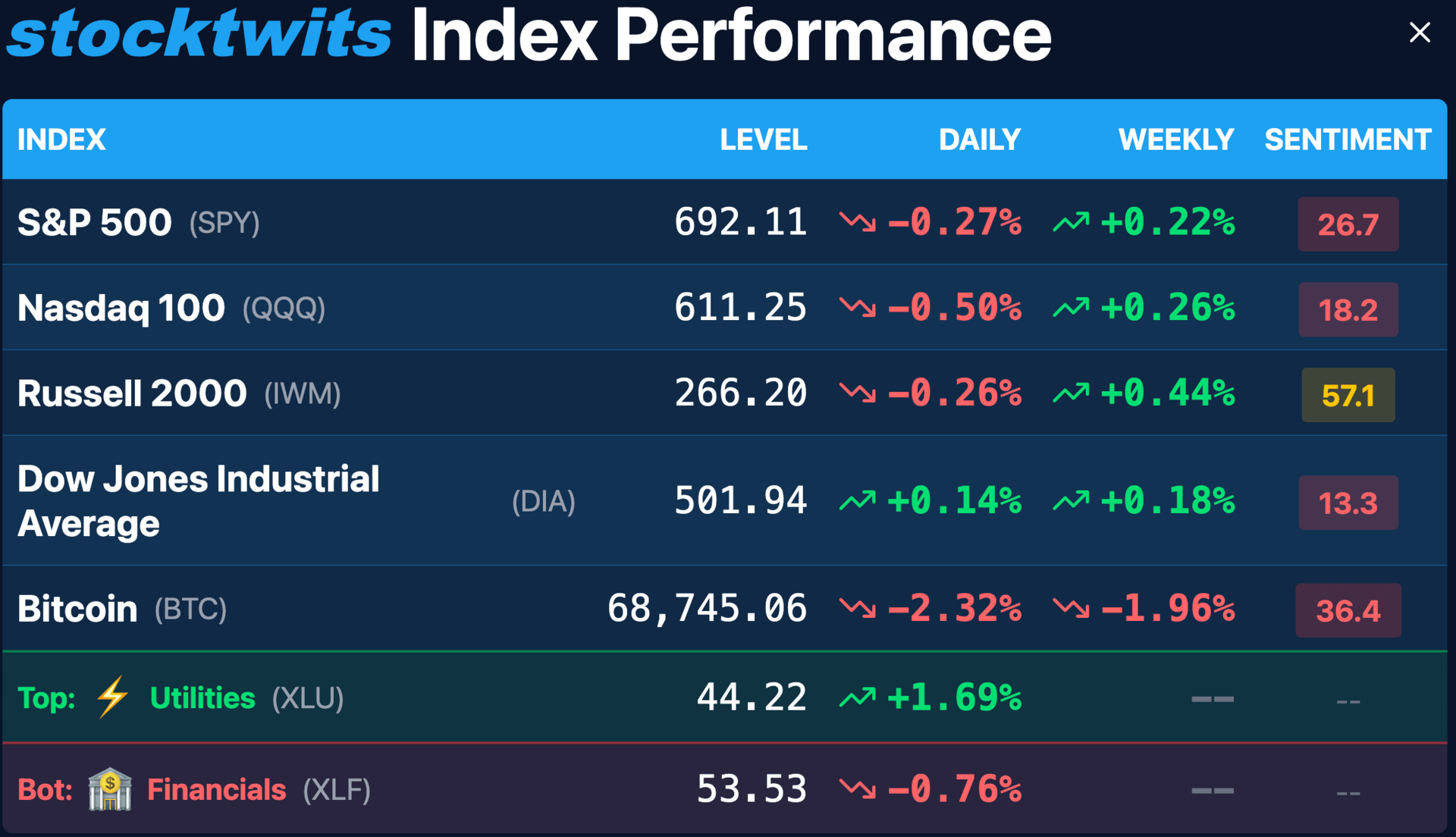

The S&P 500 was falling, but still treads water about 1.5% up for the year, while tech names on the Nasdaq 100 were down 0.5% for the year. The Dow hit a record high before pulling back some. All this talk of AI century bonds makes it easy to forget the Russell 2000 is outshining the rest, up nearly 8%.

Macro talk could be why, two voting members of the Fed said they could see rates holding where they are, according to Cleveland Fed’s Beth Hammick and Dallas Fed’s Lorie Logan. Retail sales numbers from December also showed a disheartening stall. Labor and unemployment numbers will drop tomorrow, and the White House is already hedging expectations.

Bitcoin continues to struggle, looking cold enough for a "crypto winter," trading near 52-week lows and breaking lower through 70k again.

Google’s century of AI bonds sold well Monday, pulling in $32B in debt in sterling and Swiss francs.

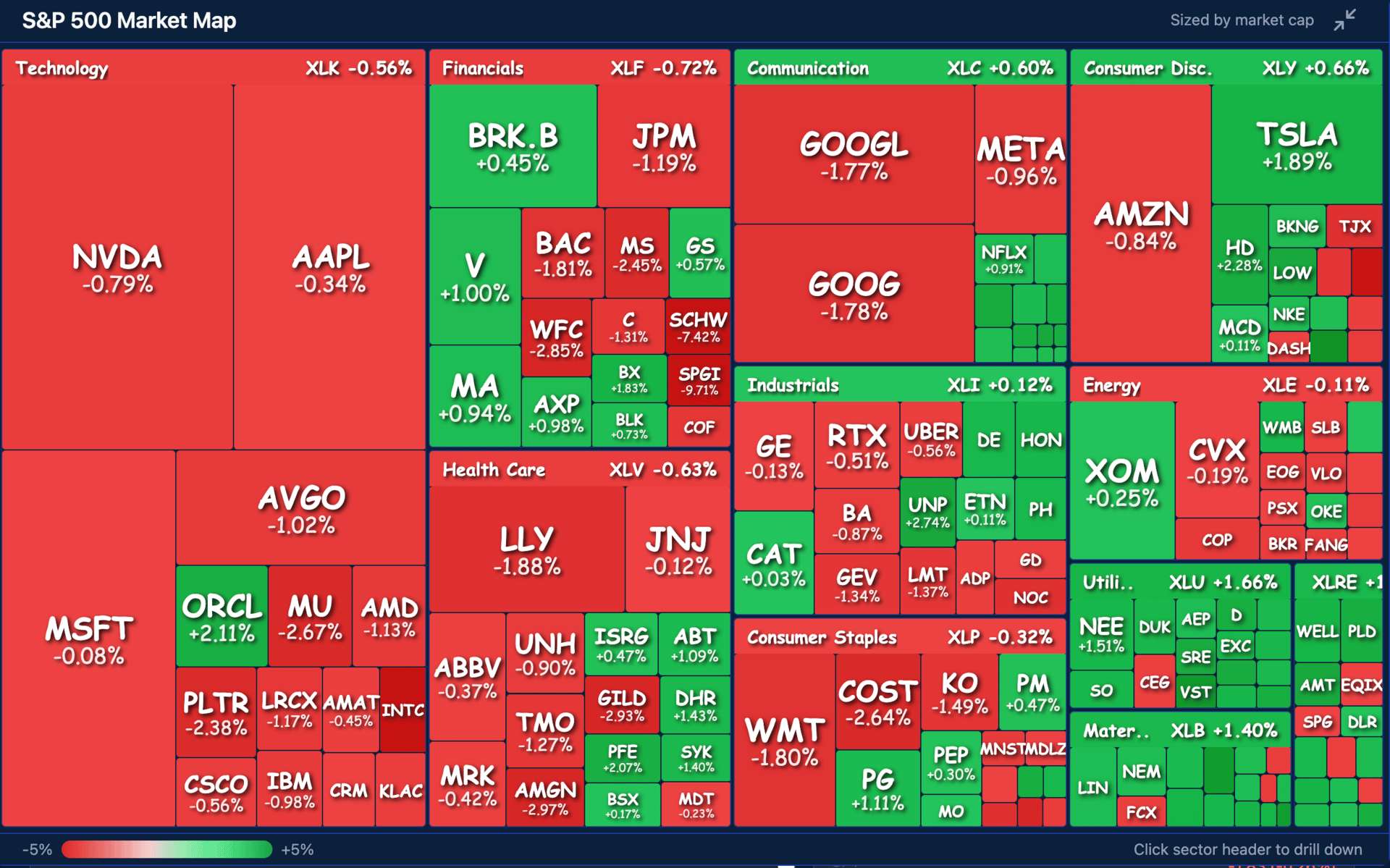

Morning earnings showed strength in software and consumer discretionary, and utilities did great, but a bad report from S&P Global, and worries over AI tax and financial tools helped rip down financials. Moody’s and Charles Schwab fell.

Shopify was last seen climbing, as investors await its earnigns rpeort tomorrow, hoping e-commerce tailwinds continue to drive merchant platform subscription growth.

AFTER THE BELL

Robinhood, Ford, Lyft Fall After Post-Market Reports

💘 Robinhood delivered a decisive beat-and-raise quarter, powered by a massive surge in premium Gold subscribers and a rebound in retail trading volatility. The stock enjoyed its S&P 500 inclusion, but a major 38% decline in crypto revenue and a fall in net income YoY sent the stock falling 6% in the post market.

$0.65 EPS vs. $0.62 analyst consensus. $1.35 billion revenue vs. $1.32 billion expected. 2.8 million Gold subscribers, an all-time high, and prediction transactions reached $147M in December alone, according to Fiscal.ai

The "AI infrastructure ramp" in retail trading tools and a 20% surge in transaction-based revenues fueled the top-line beat. A record $16 billion in net deposits was driven by aggressive promotions and the expansion of the Gold Credit Card.

The firm raised its 2026 expense efficiency targets, projecting total operating expenses between $2.0 billion and $2.1 billion, and a $1.5 billion buyback program.

🛻 Ford posted a significant bottom-line miss as massive warranty charges and ongoing electric vehicle losses overshadowed resilient truck sales. The automaker faced an $8.2 billion net loss for the full year, primarily tied to a pivot in its EV strategy and legacy quality issues.

$0.02 EPS vs. $0.06 analyst consensus. $41.8 billion revenue vs. $41.78 billion expected.$8.2 billion full-year net loss.

Results clouded by $900 million in losses from tariff pressures and persistent "warranty friction" that has plagued the gasoline segment. Management issued 2026 adjusted EBIT guidance of $8 billion to $10 billion, falling short of more aggressive analyst targets.

🌸 Lyft achieved its first full year of GAAP profitability, reporting after hours a definitive end to its period of "cash burn" and market share erosion. The rideshare challenger saw record rides and significant margin expansion, but forward profit was not enough to impress hungry investors.

$0.48 EPS vs. $0.42 analyst consensus. $1.65 billion revenue vs. $1.6 billion expected. $5.13 billion in Gross Bookings, topping the high end of guidance.

Growth was catalyzed by 15% year-over-year ride volume increases and a strategic shift toward "autonomous vehicle partnerships." Management expects 2026 free cash flow to exceed $1 billion, supported by a conversion rate of 150-175% from adjusted EBITDA. The narrative has shifted from "survival" to "profitable scale" but macro headwinds and self driving gains are not making success this year a done deal.

STEAK 🥩

Beta Technologies Amazon Boosts Stake in Electric Flight Pioneer ⚡

Amazon.com revealed a significant stake in the aerospace startup $BETA ( ▼ 1.36% ) , sparking a massive rally in extended trading. The e-commerce giant's updated filing underscores its continued commitment to sustainable logistics and next-generation aviation technology.

The stake disclosure triggered an immediate 25.5% surge in after-hours trading to $20, a sharp reversal for a stock that was down 41% year to date. The SEC filing confirmed Amazon holds approximately 11.8 million shares, representing a 5% ownership position in the electric aircraft manufacturer.

SPONSORED BY JAMES CRESS FLORIST & EVENTS

Don’t Paper-Hand Valentine’s Day 💎🙌 | 25% Off Sitewide!

Save 25% Sitewide on Flowers - BIGGEST Deal Yet!

Use Code STOCKTWITS at checkout or click here for nationwide local flower delivery.

Valentine’s Day is February 14th, and the best delivery slots go fast. Don’t wait to panic buy! Make the smart move now and let flowers do the talking.

Use code STOCKTWITS at checkout online for 25% off orders $85+.

James Cress Florist, trusted since 1903, serves over 350,000 customers. We hand-deliver nationwide through local shops, backed by our 100% Satisfaction Guarantee.

Impress them beyond words this Valentine's Day with the #1 trusted florist.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

PREMARKET REPORTS

Spotify, Data Dog Rally Big on Profitability 🎼 🐶

Spotify ignited a massive pre-market rally after crushing earnings expectations, signaling a definitive transition into a high-margin "sustained profitability" phase. The music-streaming giant $SPOT ( ▲ 1.78% ) led a broader surge in growth-oriented equities as record user engagement and disciplined cost management drove a historic bottom-line beat.

The Why: The "efficiency-first" narrative was the primary catalyst, as Spotify's gross margins expanded to record levels following successful price hikes and a pivot toward high-margin audio content. This sentiment mirrored the performance of Datadog $DDOG ( ▲ 1.28% ) , which surged on an "AI infrastructure ramp.” Hasbro $HAS ( ▼ 1.46% ), the toy company also rose as lean inventory management and holiday demand salvaged the bottom line.

The Outlook : Management teams across these leaders issued upbeat 2026 outlooks, none more important than hotel behemoth Marriott $MAR ( ▲ 0.18% ) as global travel demand remains "remarkably resilient" despite macroeconomic jitters. The collective guidance suggests a "cyclical bottom" could be in the rearview, like Christmas carols.

TRENDING STOCKS

Winners and Losers

$MAS ( ▼ 2.08% ) : Masco Corporation jumped following a strong earnings report and positive forward guidance for the home improvement sector.

$DGX ( ▼ 1.0% ) : Quest Diagnostics Incorporated surged following news of expanded diagnostic testing partnerships and solid quarterly performance.

$TPL ( ▼ 2.02% ) : Texas Pacific Land Corporation gained as land and resource management remains a high-demand inflation hedge for institutional portfolios.

$HIMS ( ▼ 4.13% ) : Hims & Hers Health, Inc. plummeted following a massive regulatory pivot; the company announced it would stop offering its copycat version of Novo Nordisk's weight-loss drug, Wegovy, amid intense FDA scrutiny and a new patent infringement lawsuit.

$WDC ( ▼ 5.54% ) : Western Digital Corporation retreated as the storage and memory sector faces inventory concerns and a downward revision in hardware spending. Sandisk, Segate also pulled back about the same amount.

$INTC ( ▼ 5.03% ) : Intel Corporation stumbled as the legacy chipmaker continues to struggle with manufacturing delays and market share loss to more agile competitors.

IN PARTNERSHIP WITH POLYMARKET

Ever been RIGHT about earnings... but still lost money?

You knew NVDA would crush earnings. They did. Stock tanked anyway.

You nailed HOOD's quarter. Bought calls. Theta decay ate your gains.

There's finally a better way.

On Polymarket, you can trade the ONE outcome you actually have an opinion on:

Will HOOD beat earnings today?

What will COIN say on their earnings call?

Will NVDA hit $150 in February?

No Greeks. No IV crush. No "priced in" excuses. Being right = being in profit.

Traditional markets force you to trade 10+ variables when you only need to have conviction on one to profit.

This week: Earnings on HOOD, APP, AIRBNB, and more... 👀

Earnings season is here. Trade it on Polymarket ⚡

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ST MEDIA

Top Stocktwits Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Macro: CPI Inflation, Unemployment Rate, 5-Year Note Auction, 7-Year Note Auction, Crude Oil Inventories. 📊

💀 Investors and policymakers are bracing for a potentially stagnant employment reading. The delayed January data, set for release Wednesday, is expected to confirm a sharp cooling. Dow Jones expects 55,000 new jobs, a stark decline from nearly 300k last year, with the unemployment rate projected to hold steady at 4.4% despite the slowing momentum.

Pre-Market Earnings: $SHOP, $MCD, $TMUS, $KHC, $VRT, $NTES, $RPRX, $HUM, $GNRC, $HLT, $SN, $THC, $GFS. ☀️

After-Market Earnings: $CSCO, $CVS, $MGM, $APP, $GRAB, $ALB, $NE, $HUBS, $NBR, $AR, $EQIX, $HBI, $QDEL, $NBIX, $MSI. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋