CLOSING BELL

Santa Did Not Rally, But Oil Did

The market came back to the new year roaring green Monday, after a tumultuous 48 hours following a U.S. incursion into Venezuela.

Oil futures climbed, alongside tech and the regular AI-related names, after everyone returned from a long holiday and new years to a fresh round of Delta Force diplomacy.

Trump and his team captured dictator President Maduro in Venezuela, killing 40 people, sending the despot to N.Y.C. for a Monday hearing with a judge on crimes of narco-terrorism. The talk of the town is that the Monroe Doctrine is back, forcing the question, who is next, and what does this mean for the price of oil? Based on futures Monday, it looks like markets are happy at the prospect of U.S. oil giants reaching their leviathan tendrils toward what some call the largest supply of oil in the world, and others call rust neglected infrastructure that worked better before Hugo Chavez took power.

In less scary news, the Santa Rally did in fact not happen, according to Monday’s closing prices, showing a seven day -0.03% or so on the S&P 500, a harbinger of a falling first quarter if the rest of the holiday rhyme follows suit. While that jingle isn’t jolly, CES just started in Las Vegas, where Nvidia Chief Jensen Huang said their language models will make cars think like people. Who would’ve thought? 🚘

ENERGY NEWS

As Maduro Appears in Court, Who Will Appear to Claim Venezuela?

Daniel Patrick Moynihan United States Courthouse Wikimedia Commons

Venezuela is now forced to cooperate with the Americans, but who is in charge of Venezuela now that Maduro is out? The White House said that the U.S. is, and Trump is hopeful that oil interests waiting in the wings to invest in outdated extraction infrastructure will bring enough cash to convince a country with a terrible human rights record that all is well.

While the people of Caracas and Venezuela celebrated this weekend, happy a brutal man was finally gone, the government wasted no time, inaugurating Vice President and Oil Minister Delcy Rodriguez, while Maduro pled not guilty in N.Y.C.

According to Bloomberg reporting on the ground, Monday was not as celebratory, as armed gangs and military troops were out on the streets maintaining the illusion of control, alongside throngs of protestors and government supporters — a mix of humans caught in what may be just the beginning of a major conflict in the Western Hemisphere. If the new government doesn’t want to play ball, the U.S. is out of options but escalation. Or, the news cycle rolls on, the White House looks elsewhere for approval rating boosts, much like it did after the Iranian missile strike, and the grip on the Venezualan poeple stays tight.

It may seem unlikely, but consider the ‘new’ government is made up of everyone from the old government besides the man at the top, including other internationally wanted narco-terrorists with tens of millions of bounties on their heads. The plan went off without a hitch Friday, but now it’s Monday, Venezuelans are heading to work and school, and someone has to reclaim the seat of power.

Internationally, our friends and enemies are unhappy with the rash kidnapping, no matter the victory for those who see the operation as a beheading of a twenty-year dictatorship. China and BRICS nations are pissed; their ambassadors reportedly watched from nearby as bombs dropped Friday night. Speaking of Iran, anti-government protests there are getting violent, so say what you will about late-night airstrike missions.

Arepa Frita

Venezuela sits on top of 17 percent of global oil reserves, or about 300 billion barrels, according to Al Jazeera, but its one-time world-leading production has been cut into thirds after decades of neglect. Turns out South American socialists don’t really care for international oil trade, who knew?

For these oil fields to ever come back online, analysts estimate it would take a years-long endeavor with an astronomical cost of anywhere from $10-$100B, or $1T depending what twitter expert you doomscroll past. Francisco Monaldi, director of Latin American Energy Policy told Bloomberg it would cost $10B per year for ten years, compared to $27B in CapEx planned by Exxon Mobil for 2026, the largest oil company in the U.S.

In the Stargate world of AI spending, that doesn’t admittedly sound like all that much for the creation of an oil empire that would see North and Central-ish America hold 40% of global oil production, according to napkin math by opinion columnist Javier Blas.

The problem is, if the political situation stays volatile, and for that matter oil prices stay low per barrel, who in their right mind would invest billions to drill Venezulan Oil?

Still, if the situation goes great, the government turns happily neo-liberal capitalist and democratic (or remains authoritarian but this time welcomes U.S. corporate interests); watch for any stock that builds services for the oil industry.

Watch the oil services stocks like Halliburton $HAL ( ▲ 1.56% ) , Schlumberger $SLB ( ▲ 1.19% ) , and Baker Hughes $BKR ( ▲ 1.65% ). In the meantime, Chevron $CVX ( ▲ 0.23% ) was trending Monday, as it is the only major oil service provider that has direct ‘boots on the ground’ access to Venezuela. Pun semi-intended. 🛢

SPONSORED

See every move your competitors make.

Get unlimited access to the world’s top-performing Facebook ads — and the data behind them. Gethookd gives you a library of 38+ million winning ads so you can reverse-engineer what’s working right now. Instantly see your competitors’ best creatives, hooks, and offers in one place.

Spend less time guessing and more time scaling.

Start your 14-day free trial and start creating ads that actually convert.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

AI NEWS

CES Asks: Will Investors Put All Their Chips on AI, Again? 🃏

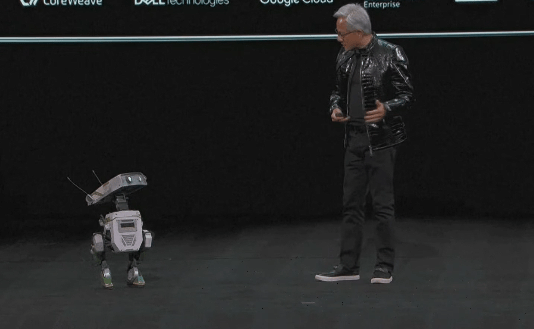

Nvidia’s CEO Jensen Huang talking to a robot at CES

In tech, the CES conference gauntlet starts today with keynotes from Nvidia $NVDA ( ▲ 0.68% ) and Intel $INTC ( ▲ 5.71% ) . $TSM ( ▲ 4.25% ) Shares were climbing after a price raise from Goldman Sachs, on the eve of the coveted tech conference.

Nvidia’s CEO Jensen Huang took to the keynote stage at 4 pm ET, flanked by Star Wars copycat robots and product updates to excite an audience of investors that have recently tired of AI stock climbs.

Huang said Nvidia was leading the way in what he calls the first physical AI market: automated cars. Nvidia unveiled Alpamayo, an open-source autonomus vehivle model. Huang also announced the Vera Rubin computing system is in full production, designed to make up for the insane computing demand problem.

Named after Dr. Rubin, the scientist who discovered dark matter, the system includes two distinct chips together on one big compute board, that each goes on a data center shelf, stacked with enough shelves to make up a two-ton giant system.

The Vera Rubin computing system

The chip system for the Rubin CPU is 5X the compute of Blackwell, Nvidia’s previous industry-leading chip, but Huang said the new Rubin CPU has just 1.6X the transistors. A whole rack of these massive computers will simulate enough to train robots and cars how to navigate our world before the first screw is turned on a factory line, Huang said. The new node has zero cables, and takes five minutes to install compared to two hours and 46 cables in the last top-of-the-line supercomputer Nvidia offered.

Each shelf of two massive chips can process 200TB/sec, two times the speed of the GLOBAL internet usage of 100TB/sec, Huang said.

The tech whiz spiel sounds as remarkable and futuristic as ever, but the market is asking itself, is it going to sell? Does the world have enough Cap-Ex to spend on light-year leaps in AI every year? In the post-market, Nvidia was up just 2 cents, as Huang presented.

POPS & DROPS

Top Stocktwits News Stories 🗞

Nio neared one million deliveries and 2026 expansion plans, despite its Hong Kong shares dipping.

Oil giants are positioned for a $100 billion windfall following the extraction of Nicolás Maduro.

MicroStrategy faces its biggest risk from a potential narrowing of its "NAV premium."

Palantir popped as retail interest surged following Trump's Venezuela operations.

Michael Burry warned markets haven't priced in Nicolás Maduro's arrest.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS FEATURES

New on Stocktwits: Stream Topics

When a ticker heats up, there’s never just one conversation. Valuation debates. Earnings reactions. Macro pressure. Technical levels.

Stream Topics break active streams into clear discussion themes - so you can jump straight to the part of the conversation you care about.

Instead of scrolling through everything, you can now:

See what traders are debating at a glance

Tap a topic

Read only the posts focused on that discussion

Stream Topics are now live on Trending and Most Active tickers.

STOCKTWITS VIDEO

Nvidia CEO Jensen Huang Talks AI Robotics in Vegas

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: S&P Global PMI (9:45 AM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: Angiodynamic ($ANGO). 🛏️

After-Market Earnings: AAR ($AIR) 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋