CLOSING BELL

Santa Rally's Commin' To Town

The first day of the Santa Rally is here, and Wednesday’s half day of trade saw prices climb to fresh highs.

If the rest of the year goes this well, 2026 will start off with a pretty average kickoff: the Santa rally was first observed by Yale Hirsch in Stock Trader’s Almanac 1972, a once a year tendency for stocks to climb in the last five days of the trading year, and first two days of the new one. The rally tends to see a 1.3% climb in those seven trading days since the 1950s, according to CNBC.

Ari Wald, an analyst at Oppenheimer, found in 2018 that the market climbed 77 out of 97 years since 1928, with an average return of 1.6% during the Santa Rally. The common lore has it that December is a tax-loss sell-off month, and after traders make peace with their year, they buy into weaker stocks, and a perfect storm of low volume and a light dusting of upwards selling pressure brings a healthy green to the new year.

There is the reverse warning though that proves the rule, a Financial District saying, “If Santa Claus should fail to call, bears may come to Broad and Wall.” ❄

Wald told CNBC the S&P 500 lost 1% in the first quarter on average if Santa failed to ‘call’ in with a rally when he was supposed to, compared to an average 2.6% gain following a normal Santa Rally. The last two years saw no Santa Rallies, and subsequent -3% and -4% drops in the market. 😟

Merry Christmas and happy holidays from the Stocktwits newsletter team.

🎅 🎄🕯

TRENDING STOCKS

Here’s What Santa Is Bringing to Town

It was a short, boring day on Wall Street; the average daily trading volume for the S&P 500 tends to be close to 5.37 billion shares, according to Yahoo Finance. Today saw only 1.03B in volume. On half days like Wednesday, you wonder why they even open the market at all. But here were the standout stories:

Vaccine maker Dynavax $DVAX ( 0.0% ) skyrocketed on news that Sanofi $SNY ( ▲ 0.19% ) is planning a $2.2B buyout to bolster its vax portfolio. The deal offers Dynavax shareholders $15.50/share, compared to Tuesday’s $11 closing price, Sanofi getting its hands on the HEPLISAV-B hepatitis B vaccine, and a promising shingles candidate treatment to Sanofi’s pipeline.

Agios Pharmaceuticals $AGIO ( ▲ 0.63% ) jumped after the FDA approved AQVESME, making it the first oral treatment for anemia in adults with thalassemia. Analysts expect the approval to significantly de-risk the company's metabolic platform as it prepares for a full commercial launch in early 2026. 🧬

Intel's Hiccup: $INTC ( ▲ 5.71% ) shares faced pressure following reports that Nvidia paused its evaluation of Intel's production process to make advanced chips. Check out the Stocktwits story here.

Snowflake's $1B Buy: $SNOW ( ▲ 2.2% ) is reportedly in advanced talks to acquire observability startup Observe for $1B. The move is seen as a strategic play to integrate deeper data monitoring and AI-driven troubleshooting into the Snowflake platform. ❄️

UiPath $PATH ( ▼ 0.69% ) jumped 8% on its inclusion in the S&P 400.

Omeros $OMER ( ▲ 0.96% ) flew on the FDA approval of YARTEMLEA, the first therapy for rare post-transplant complications.

AST SpaceMobile Launch: $ASTS ( ▲ 2.29% ) successfully deployed its BlueBird 6 satellite via an ISRO launch in India. The array is the largest commercial communications system in low Earth orbit, marking a massive win for the firm's global cellular broadband mission. 🛰️

AST Spacemobile PR

SPONSORED

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Sectors See Year End Totals Soon 📊

As we head into the final week of 2025, we finally have a chance to look at a massive year for the S&P 500, fueled by the accelerating AI infrastructure build-out and a resilient consumer in the face of tariffs, taxes, and trade headwinds.

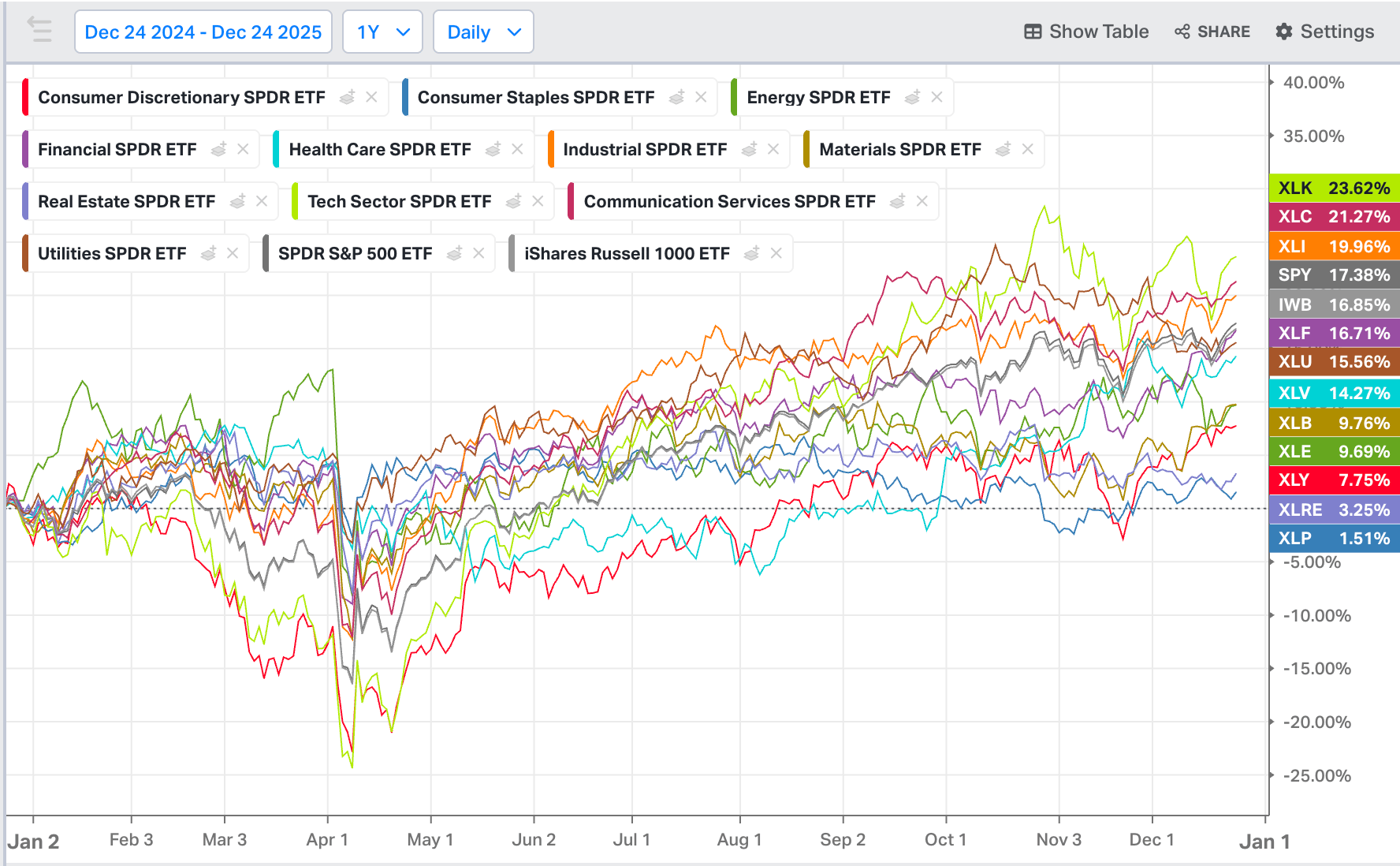

Looking at how each of the 11 sectors of the S&P 500 performed, we can parse out the tale of ’25: a wide dispersion between technology and defensive sectors like staples, healthcare, and utilities that shows an investor base starving for growth. 📈

TLDR:

AI Dominance: Technology and Communication Services continue to pull the broader index higher, with the "Magnificent Seven" accounting for nearly 60% of the S&P 500's total gains this year. 💻

The Value Lag: Defensive sectors like Utilities and Real Estate have struggled as interest rates remained elevated throughout 2025, dampening the appeal of high-dividend stocks. 🏠

Resource Rebound: The Materials and Energy sectors saw a late-year surge as silver prices broke past $70 and supply-side constraints kept the physical commodity markets tight. 🥈

Information Technology $XLK ( ▲ 1.3% ) : This sector led the market with a 38.4% gain as the AI infrastructure build-out moved from speculation to massive capital expenditure. Semiconductor giants and cloud providers drove the bulk of these returns as enterprises raced to integrate generative AI.

Communication Services $XLC ( ▲ 0.69% ) : Strong digital ad spending and the recovery of social media giants pushed this sector up 31.2% this year. Improved margins and aggressive share buybacks from mega-cap internet names made it a favorite for growth-oriented investors.

Financials $XLF ( ▲ 0.49% ) : Higher-for-longer interest rates boosted net interest income for major banks, resulting in an 18.5% YTD return. The sector also benefited from a late-year pickup in M&A activity and initial public offerings.

Energy $XLE ( ▼ 0.09% ) : Driven by geopolitical supply risks and tight physical markets, Energy climbed 14.2%. Crude oil stability and high free cash flow allowed companies to reward shareholders with record dividends.

Industrials $XLI ( ▲ 1.23% ) : A focus on domestic manufacturing and increased defense spending led to a 12.8% gain for the year. Aerospace and infrastructure companies saw strong backlogs as global tensions and government subsidies fueled demand.

Consumer Discretionary $XLY ( ▲ 1.52% ) : Despite high inflation, the sector gained 9.6% as travel and cruise lines experienced a record-breaking year. However, high mortgage rates acted as a persistent drag on homebuilders and high-ticket retail.

Materials $XLB ( ▲ 0.76% ) : This sector rose 6.4% as silver and copper prices reached historic highs in late 2025. Silver is up 140%, Gold 120%, and even Copper climbed 45% this year. Industrial demand for green energy metals helped offset the impact of a slowing global construction market.

Consumer Staples $XLP ( ▲ 0.87% ) : Defensive positioning and strong pricing power allowed the sector to eke out a 2.1% gain. While shoppers traded down from bougie to store brand, dominant packaged food brands maintained stable earnings.

Health Care $XLV ( ▼ 0.42% ) : The sector fell 1.5% as drug pricing reform and the GLP-1 wars created high volatility. Major pharmaceutical firms faced significant headwinds from upcoming patent expirations and federal cost-cutting measures and tariff changes.

Real Estate $XLRE ( ▲ 0.28% ) : High financing costs and low office occupancy rates led to a 4.2% decline in 2025. While data centers were a bright spot, the broader commercial sector struggled to refinance debt at higher rates.

Utilities $XLU ( ▲ 1.11% ) : As the worst performer of the year, Utilities dropped 5.8%. It’s hard to beat high bond yields offering better risk-adjusted returns. The sector's status as a bond proxy made it unattractive in a high-interest-rate environment. 📊

POPS & DROPS

Top Stocktwits News Stories 🗞

Micron hit record highs as AI margins drove market repricing.

Netflix rejected TRC Capital's below-market mini-tender offer.

Psychedelic stocks rallied as RFK Jr. signaled a regulatory reset.

U.S. markets resume regular trading hours on Friday, December 26.

Omeros jumped after FDA approval of its rare complication drug.

Tim Cook showed early insight into Nike's potential before Wall Street.

STOCKTWITS VIDEO

Retail Edge Episode 1: Trump Pump, Bearish Bets & Biotech Lotto

Welcome to the inaugural episode of Stocktwits Retail Edge with Michele Steele and Tom Bruni tracking where retail attention is moving, and what it could mean for markets.

Links That Don’t Suck 🌐

😨 Consumer spending powers the US economy. A K-shaped economy will further test this dynamic in 2026.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋