NEWS

Sell In May, Or Will Bessent Take The Tariffs Away

The market fell for a second day. Talking about tariffs continued, while actual tariff talks are just starting. AMD's earnings were good, but they warned that policy would hurt their margins in the coming quarters. The Treasury Department announced right after 6 PM that Secretary Scott Bessent would head to Switcherland this week to meet with representatives from the People’s Republic of China. 👀

Today's issue covers AMD beats with strong datacenters, the good bad and ugly tariff talks, and what the FOMC dot plot looks like. 📰

Here’s the S&P 500 heatmap. 2 of 11 sectors closed green, with utilities (1.22%) leading and health care (-2.76%) lagging.

S&P 500 Map - finviz

And here are the closing prices:

S&P 500 | 5,607 | -0.77% |

Nasdaq | 17,690 | -0.87% |

Russell 2000 | 1,983 | -1.05% |

Dow Jones | 40,0829 | -0.95% |

STOCKS

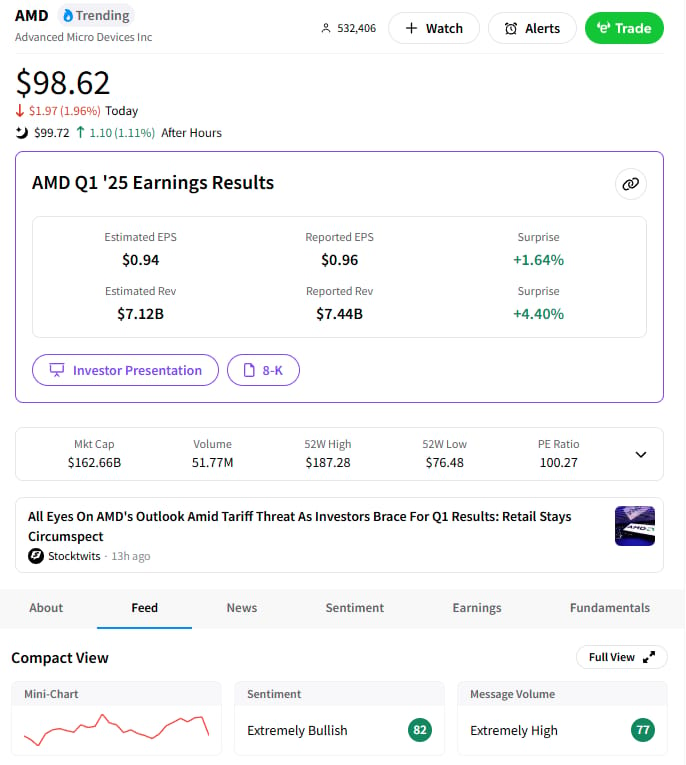

AMD Beats, Says Gamers Are Not Buying Custom Cards

AMD reported Q1 EPS Adj. $0.96 on revenue of $7.438B. Analysts expected earnings of $0.94/share on revenue of $7.12B, according to Benzinga.

“We delivered an outstanding start to 2025 as year-over-year growth accelerated for the fourth consecutive quarter, driven by strength in our core businesses and expanding data center and AI momentum,” Dr. Lisa Su, AMD chair and CEO said in the firm’s release.

For Q2 2025, AMD anticipates revenue between $7.1 billion and $7.7 billion. The firm projects its non-GAAP gross margin at 43%, which includes roughly $800 million in inventory-related charges due to new export controls, as disclosed in AMD’s Current Report on Form 8-K filed on April 16, 2025. Without this charge, the non-GAAP gross margin would be about 54%.

“Despite the dynamic macro and regulatory environment, our first quarter results and second quarter outlook highlight the strength of our differentiated product portfolio and consistent execution, positioning us well for strong growth in 2025,” Su said.

AMD boasted strong Q1 growth across its segments. Data center revenue reached $3.7 billion, up 57% year-over-year, driven by high demand for AMD EPYC CPUs and Instinct GPUs, the firm said.

The firm’s client and gaming revenue totaled $2.9 billion, rising 28% year-over-year. Client revenue surged 68%, fueled by Zen 5 Ryzen processors, while gaming revenue actually fell 30% due to lower custom sales. Embedded revenue came in at $823 million, down 3%, reflecting mixed demand across key markets.

SMCI also posted results, showing a miss in both adjusted EPS and sales revenue vs. FactSet expectations. For the current quarter, the data shelf maker said it would expect net sales between $5.6 and $6.4B, while Wall Street wanted a $6.81B on average.

Advanced Micro Devices Inc - Stocktwits users are ‘extremely bullish’

SPONSORED

StartEngine: One Check, Exposure to Dozens of Pre-IPO Companies

StartEngine is the platform allowing accredited investors to gain exposure to some of the world’s most coveted private companies— without paying millions.¹

But it’s not just access: StartEngine is also a smart diversification play. Why?

StartEngine has a 20% carried interest in some of its Private pre-IPO offerings. That means their success (and potentially yours, too) is tied to the success of these companies.²

So your upside can grow with some of StartEngine’s best offerings— like Series for OpenAI, Perplexity, and Databricks.¹

So, how do you get involved? By becoming a shareholder in StartEngine. The window is open (but closing soon) for you to join over 45,000+ who have invested $84+ million in StartEngine to date. Get in on the action before this round closes in June.

1. The underlying companies held by StartEngine Private Funds LLC, and StartEngine Private LLC (together, “StartEngine Private”) are not participating or involved in the offering. The availability of company information does not indicate that the company has endorsed, supports or otherwise participates with StartEngine Private or any of its affiliates. StartEngine Crowdfunding LLC purchases shares from current and former employees, early investors, and advisors of the companies and sells the shares to StartEngine Private for each offering. When you make an investment in a company on StartEngine Private, you are purchasing an interest in a series of StartEngine Private Funds LLC or StartEngine Private LLC, each a Delaware limited liability company (together the “Series LLCs”), which were created to hold shares of privately held companies. An investor will not directly own or hold shares of the private company but instead will own member interests in a series of the Series LLCs, which either directly or indirectly, will hold shares in the company. There may not be a one-to-one economic parity on the value of the Series LLCs interests and the underlying shares. This is offered only to accredited investors per regulation D rules.

2. StartEngine receives a small percentage of equity in fees from many of our crowdfunding offerings, and 20% carried interest in some of our Private pre-IPO offerings. Fees are subject to change. There is no guarantee that the 20% carried interest or equity received as compensation will have value, that they will generate income for StartEngine, or that StartEngine will be profitable. To understand the impact on margins, see financials.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TARIFF TALK

The Good The Bad, and The Ugly 👹

Trade tensions are in the air- even the hint of Hollywood tariffs became everyone’s most feared summer slasher flick Monday. Today, there were updates, and depending on who you ask (or who you quote) the situation could be good, bad, or freaky.

The US trade deficit surged to a record $140.5B in March as companies rushed to import goods ahead of Trump’s tariffs. Imports jumped 4.4%, while exports rose just 0.2%. Pharmaceutical imports led the increase, climbing 71% to $50.4B.

Meanwhile, the EU threatened $100 billion+ in tariffs on US goods if negotiations fail. Bloomberg reported that proposed measures would add to existing levies on steel and aluminum. Not to fear, as Treasury Secretary Besset said today that 17 countries have sent the U.S. first drafts, and the U.S. is sizing them up. The Treasury said Bessent was headed to Switcherland to talk taxes this week.

Speaking of sizing up, freshly crowned Canadian Prime Minister Mark Carney met with Trump at the White House, pushing back against tariffs and reaffirming Canada’s sovereignty. Trump said “never say never,” hinting to his plan to turn our neighbor to the north into someone who lives above our garage. 🏘

There was executive commentary on all things macro and commodity, as well. None of it was very pretty.

Paul Tudor Jones warns that stocks will hit new lows even if Trump cuts China tariffs to 50%. He said the real issue is rates, that the Fed must step in with aggressive cuts. Mattel CEO Ynon Kreiz said toy manufacturing won’t shift to the US despite tariffs. Instead, prices will rise as the company diversifies its supply chain away from China.

Diamondback Energy CEO Travis Stice said US shale production has peaked and will likely decline due to low oil prices and rising drilling costs, according to CNBC. He emphasized that the current oil price environment “doesn’t work” for sustaining growth. Oil rebounded today, but futures hit a four-year low price in April, and nearly broke lower Monday. 🛢

IN PARTNERSHIP WITH MONEYSHOW

The Rise of Cryptocurrencies

The dramatic volatility in cryptocurrencies gives you the opportunity to increase your trading profits!

Learn new ways to look at charts and indicators that will ensure you can capitalize on evolving markets – at the 2025 MoneyShow Masters Symposium Miami!

Meet veteran traders and market experts.

Enjoy longer, more in-depth classes and keynotes that will take your investing and trading to the next level.

Join us at the Miami Riverwalk VIP reception on our opening night to take pictures and meet your favorite experts – and mingle with like-minded traders and investors!

Click on the link to join us May 15-17, at the Hyatt Regency Miami…

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Other Noteworthy Pops & Drops 📋

Palantir ($PLTR -12%) fell despite beating Q1 revenue estimates. Analysts flagged valuation concerns, with Mizuho maintaining an underperform rating and RBC questioning long-term growth potential. The company raised full-year guidance but remains under pressure as investors weigh its premium valuation.

Celsius ($CELH +5%) reported Q1 revenue of $320.3M, missing estimates of $342.31M. EPS came in at $0.18, below the expected $0.19. North American revenue declined 10% to $306.5M, while international revenue surged 41% to $22.8M. CEO remains optimistic about Q2 growth.

Take-Two ($TTWO +3%): gained after Rockstar released a second GTA VI trailer, despite confirming the game’s launch was delayed to May 2026. The trailer introduced more narrative details, including GTA’s first female protagonist, Lucia. Analysts expect Electronic Arts ($EA) to benefit from the extended release window.

Ferrari ($RACE +2%) reported Q1 net profit of €412M ($466M), up 17% year over year, driven by strong demand for personalized vehicles. The company warned that Trump’s tariffs on EU car imports could reduce profitability by 50 basis points. Ferrari raised prices by 10% on certain models to offset costs, with some cars increasing by as much as $50,000. Revenue guidance for 2025 stands at €7B ($7.93B).

DoorDash ($DASH -7%) missed Q1 revenue estimates, reporting $3.03B vs. $3.09B expected. EPS of $0.44 beat forecasts. The company announced $5B in acquisitions, buying SevenRooms for $1.2B and Deliveroo for $3.85B.

EVgo ($EVGO +32%) surged after reporting Q1 revenue of $75.3M, beating estimates of $71.37M. The company reaffirmed full-year guidance and expects minimal impact from Trump tariffs. Retail sentiment jumped to extremely bullish.

Tesla ($TSLA -2%) saw new car sales in the UK and Germany drop to over two-year lows in April. UK sales fell 62% year-over-year to 512 units, while Germany sales declined 46% to 885 vehicles. Despite rising EV demand in Europe, Tesla’s market share in the UK shrank to 9.3% from 12.5% a year ago. In Germany, sales have fallen for four consecutive months, down 60% year-to-date.

PRESENTED BY STOCKTWITS

From Startup to Legend: Vlad Tenev & Howard Lindzon Recount Robinhood’s Rise

The year was 2013.

Vlad Tenev and Baiju Bhatt had a wild idea: commission-free trading. @HowardLindzon backed them early.

12 years later, they sit down to reflect on how that bet changed markets — and earned Vlad the first-ever Cashtag Legend Award. 🏆

🎥 Watch the full conversation premiere now. Over 100,000 Stocktwits members voted — don’t miss this.

MACROECONOMICS

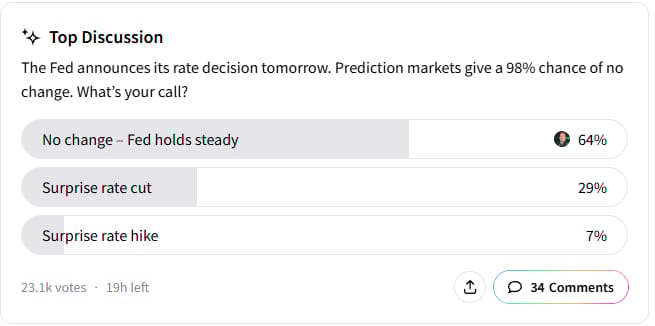

FOMC On The Way, With No Cut But New Dot Plot

The Federal Reserve is expected to hold interest rates steady in the climax of their two-day meeting, tomorrow at 2 pm ET. Monetary policymakers have faced mixed signals, with declining inflation numbers, low unemployment, but possibly negative growth, and Trump tariffs that are sending mixed economic signals, according to CNBC.

Futures markets indicate almost no chance of a rate cut this week, with a 1-in-3 probability of a cut at the June session. Though, futures markets are rarely 100% accurate on the direction of monetary policy.

The Fed might not deliver Trumps sought-after cuts, but they will trot out the famous dot plot, which maps policymakers’ rate expectations. The most recent graph predicted two cuts this year, down from earlier projections of four. Think of the plot as a big dartboard that FOMC members throw their predictions onto and the financial media world trys to make sense of. 🎯

Septembers Dot Plot (left) and March Dot Plot, Fed Reserve

In September, they saw four cuts this year, and rates near 3% by Christmas, but in March, they huddled closer to the 4% line. They may show even less movement this time around, after Chair Powell has said the Fed will wait and see what happens first. 23,000 Stocktwits voted to predict the meeting, and 64% said no change is coming.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Crude Oil Inventories (10:30 am), Fed Interest Rate Decision (2:00 pm), FOMC Press Conference (2:30 pm). 📊

Pre-Market Earnings: Uber Technologies ($UBER), Walt Disney ($DIS), Unity Software ($U), Amarin Corp ($AMRN), Barrick Gold ($GOLD), Teva Pharmaceutical Industries ($TEVA), First Majestic Silver ($AG), Novo Nordisk ($NVO), 🛏️

After-Hour Earnings: ARM Holdings ($ARM),AppLovin ($APP), Goodyear Tire & Rubber ($GT), AMC Entertainment Holdings ($AMC), Carvana ($CVNA), Sunrun ($RUN), MercadoLibre ($MELI), Joby Aviation ($JOBY), Zillow Group ($Z), 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋