Presented by

CLOSING BELL

Semi Cousin Stocks Soar

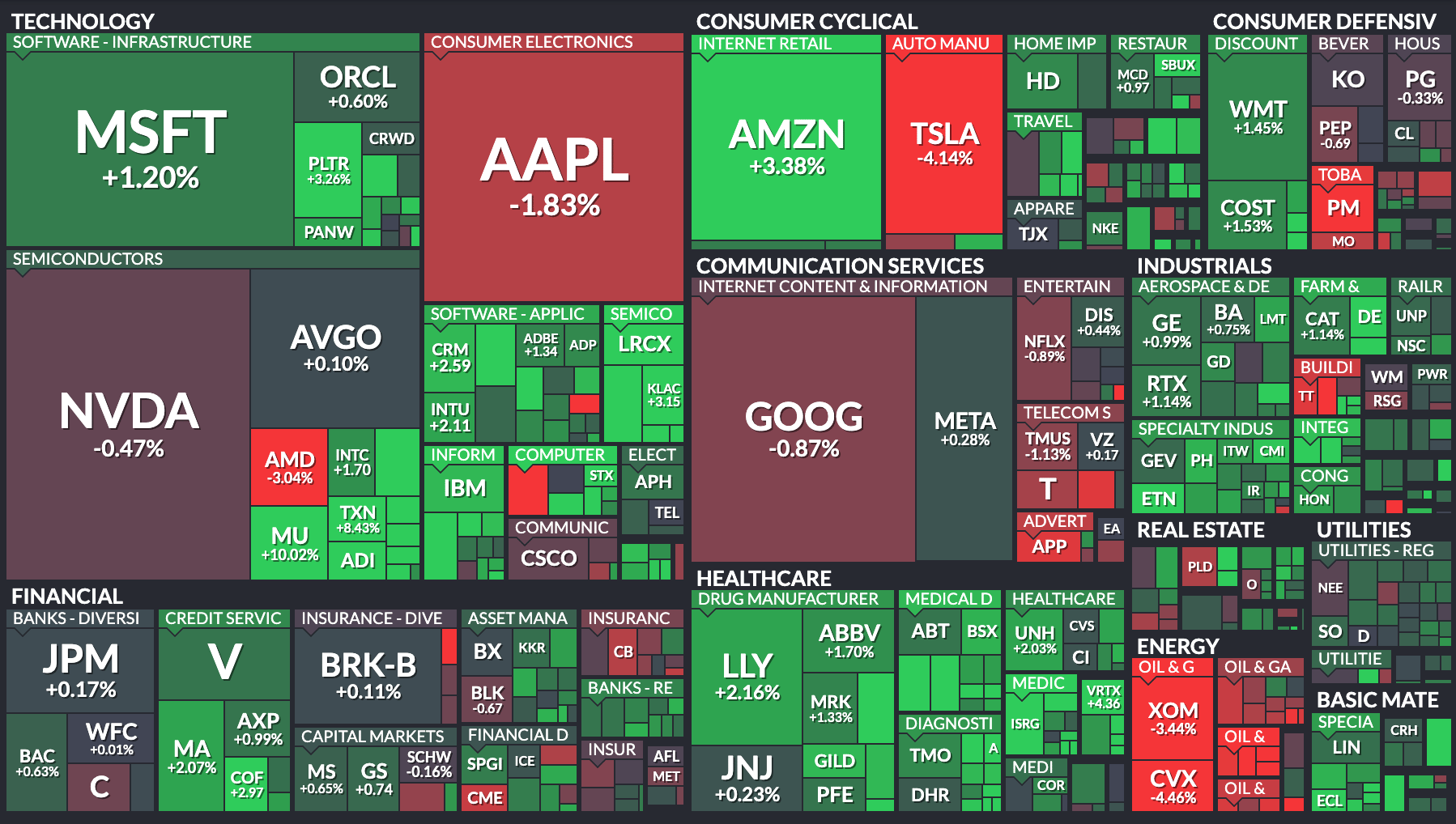

The market climbed Tuesday to fresh all time closing records for the S&P 500 and Dow Jones Industrial Average. Who said Donroe Doctrine threats would hurt equities?

It may have been a wash of analyst upgrades hitting AI Semi and computer RAM stocks this week, sending names like Sandisk and Western Digital climbing. The CES conference also helped punctuate the need for memory and data center service providers, sending AI related stocks climbing.

It wasn’t all good news hitting stocks - MSCI, a major issuer of ETF products, officially said they are not including bitcoin and crypto treasuries in their indexes, setting some pretty bleak implications for stocks like $MSTR ( ▲ 0.73% ) and Bitmine. Crypto treasury firms spread like a rash this year, but many hit their hype peak, and all-time high, back in October. While the Santa rally did not arrive, it did come through for Bitcoin prices, our Cryptotwits writer informed us today, though Bitcoin saw its first-ever negative post-halving year in 2025.

In politics, Trump made remarks at a Republican party retreat Tuesday, putting winning midterms as a top priority, or else he said he would be impeached. He also said aquiring Greenalnd was a priority, sending Critical Materials $CRML ( ▲ 4.07% ) flying, a miner that owns rare earth projects there.

The U.S. Services PMI from December showed the weakest climb for eight months, adding to rate cut hopes.

STOCKS

CES and the Storage Supercycle

It’s day two of CES 2026 in Las Vegas, as Stocktwits reporters tread the hallowed casino halls, retail traders react to a massive reshuffling across the AI infrastructure stack.

SanDisk $SNDK ( ▼ 4.2% ) shares were leading the pack, ip bigtime today, bringing its six month climb past 750% after Nvidia CEO Jensen Huang called memory storage an "unserved market" for AI. Investors are pivoting to storage names like Western Digital $WDC ( ▼ 3.51% ) as memory bandwidth becomes the primary bottleneck for data center build-outs in the new year. 💾

Texas Instruments $TXN ( ▼ 2.96% ) joined the rally, as investor optimism for a 2026 analog chip recovery grew. AMD CEO also appeared in a keynote at CES, and despite a brand-new Helios computing system demo, the stock fell Tuesday in competition with Nvidia’s wireless data center shelf from earlier in the day.

Other stocks that might compete with the new tech were falling. Cooling giants like Modine $MOD ( ▲ 6.38% ) and Johnson Controls $JCI ( ▲ 1.32% ) plummeted after Jensen Huang showed his Rubin chips can be liquid-cooled without traditional water chillers. $SMCI ( ▲ 1.37% ), a data center shelf maker, did not enjoy the same brutal price action. ❄️

While the show went on, chip names were still catching stray updates form anlytsts.

Microchip Technology $MCHP ( ▼ 0.88% ) shares surged 11% after the company announced fiscal third-quarter revenue will significantly exceed previous forecasts due to strong bookings. It got a price upgrade from JPM.

It wasn’t just passing comments and analyst upgrades that moved stocks Tuesday.

Though not a publicly traded firm, Elon Musk’s xAI closed a massive $20B Series E round with strategic backing from Nvidia and Cisco, comfortably exceeding its original $15B target. The fresh capital will fund the expansion of the "Colossus" supercomputer to over one million Nvidia H100 equivalents to accelerate the training of the upcoming Grok 5 model.

Mobileye $MBLY ( ▲ 1.38% ) climbed after the firm announced a $900M acquisition of Israeli startup Mentee Robotics at CES, to merge automotive AI with general-purpose humanoid robots. CEO Amnon Shashua described the deal as the start of a "Physical AI" era where context-aware reasoning will power robots designed for factories and homes. 🤖

Intel $INTC ( ▲ 5.71% ) shares were up following the official debut of its "Core Ultra Series 3" processors built on the advanced 18A process. Industry watchers say the launch is a critical attempt to reclaim market share from ARM-based rivals, hoping to win some mobile computing hardware sales. $QCOM ( ▲ 3.11% ) also dropped a new PC chip, the Snapdragon X2 for Androids. 💻

SPONSORED BY THE MOTLEY FOOL

The Same Signal That Came Before Netflix’s 59,000% Run

Something big just happened here at The Motley Fool. You see, market beating stock ideas aren’t new to our co-founder Tom Gardner. Tom Gardner’s investing service, Stock Advisor, has been recommending stocks since 2002. And the average return of a recommendation from Stock Advisor is 1,002%.

But every so often, Tom and his team issue a rare ‘Double Down’ recommendation: a chance for investors who missed the boat on a great stock to get in again…and a chance for investors who did buy to add to their gains.

After all, previous ‘Double Down’ picks include:

— Netflix, up +57,588% since we doubled down on 12/17/2004

— Nvidia, up +47,246% since we doubled down on 12/18/2009

— Apple, up +5,149% since we doubled down on 6/20/2008

And today, you can access a special report that includes Tom's favorite Double Down stock, plus two more Double Down bonus picks.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

TRENDING TICKERS

Biotech, Nuclear Power, and Space Race Stocks Trend 🚀 💉

Another reason the market was hitting records was a healthy bunch of trending stocks hit Tuesday’s trade in an avalanche. It feels like the December holiday doldrums are finally in the rearview, heres what went down:

Epilepsy Breakthrough: Bright Minds Biosciences $DRUG ( ▲ 2.99% ) announced positive Phase 2 data for BMB-101, showing a 73% reduction in absence seizures with a strong safety profile.

TYK2 Success: Alumis $ALMS ( ▲ 1.56% ) reported Phase 3 success for its oral psoriasis drug envudeucitinib, which demonstrated superior skin clearance compared to placebo and apremilast.

Bio Collapse: $TIL ( ▲ 1.36% ) shares plummeted over 40% after discontinuing its lead clinical program and terminating a major collaboration with ImmuneOnco.

Molten Salt Pilot: Terrestrial Energy $IMSR ( ▲ 7.53% ) signed a pivotal DOE agreement for "Project TETRA" to build a pilot molten salt reactor by July 2026.

Plutonium Power: Oklo Energy $OKLO ( ▲ 3.12% ) investors are awaiting a DOE announcement on surplus plutonium fuel, which the company successfully tested as a commercial bridge fuel with Los Alamos. It joins Centrus Energy $LEU ( ▲ 3.08% ) climbing 10% Monday after late day news from Bloomberg it was selected by the Department of Energy for a $900M deal to expand a Uranium Enrichment oplant in Ohio.

Lunar Infrastructure: Momentus $MNTS ( ▼ 2.03% ) and Ondas $ONDS are trending as small-cap space plays following the White House's renewed push for lunar industrialization.

POPS & DROPS

Top Stocktwits News Stories 🗞

Tesla is falling behind in AI according to Ross Gerber following Nvidia’s Alpamayo launch.

Viking Therapeutics suffered its worst day in months as executives sold shares amid rising competition from Novo Nordisk.

MicroStrategy faces its greatest risk from a potential narrowing of its "NAV premium" rather than BTC price or delisting.

SoFi topped a retail poll for S&P 500 inclusion, with its next earnings report seen as the deciding factor.

Sellas Life Sciences shares breached the $5 level for the first time in over three years.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

“AI Is in Action Now” — SoundHound CEO on Amelia 7, Voice Commerce & 2026 Break-Even

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: ADP Nonfarm Employment Change (8:15 AM), Factory Orders MoM (10:00 AM), ISM Non-Manufacturing PMI (10:00 AM), JOLTS Job Openings (10:00 AM), Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM). 📊

Pre-Market Earnings: Albertsons Companies ($ACI) and Cal-Maine Foods ($CALM). 🛏️

After-Market Earnings: Applied Digital ($APLD), Constellation Brands ($STZ), ALT5 Sigma ($ALTS), and Jefferies Financial Group ($JEF). 🌕

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋