Presented by

CLOSING BELL

Silver And Gold, Silver And Gold

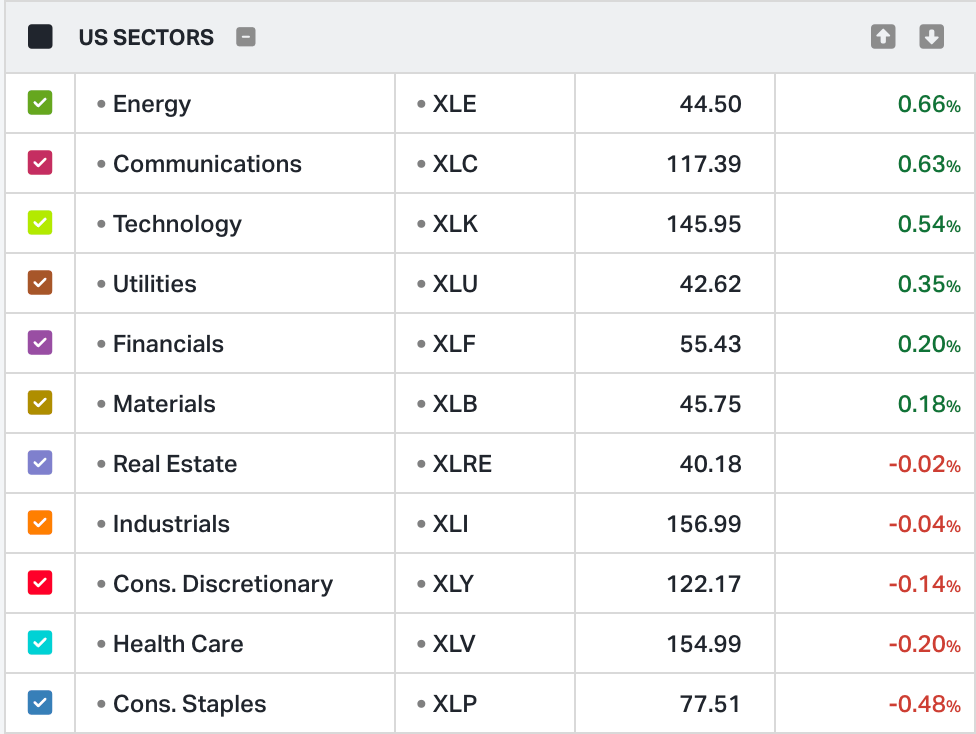

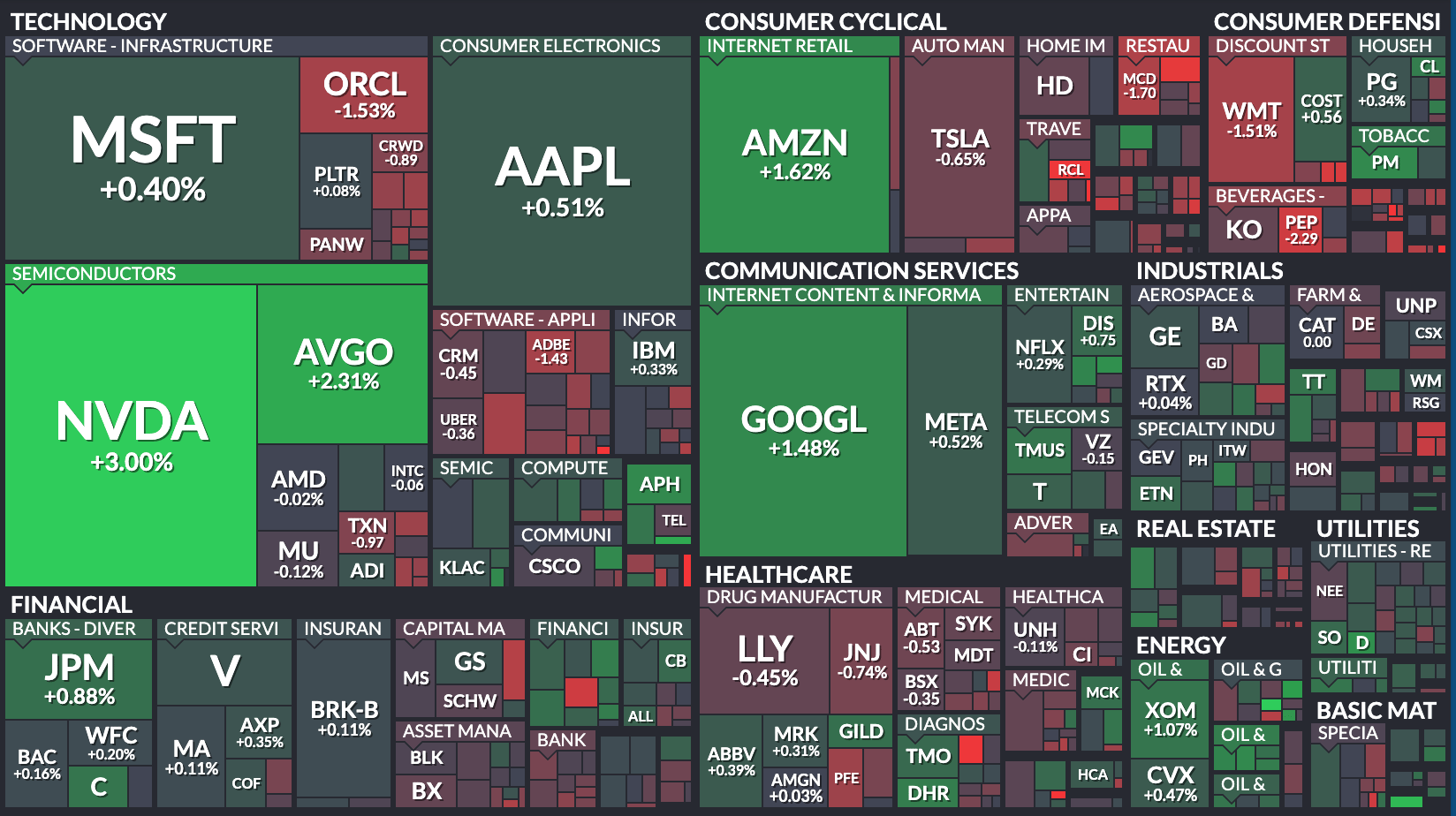

The Santa Claus Rally technically starts tomorrow, but the market climbed Tuesday as investors digested dramatically higher GDP growth in the third quarter.

It was a little delayed since the shutdown, but the 4.3% growth rate in Q3 looks great over a 3.3% expectation. Macro data makes it look like Santa is coming to town during flush times: the VIX volatility index is at a year low, and consumer spending is coming in at the highest rate for a year, alongside the strongest growth rate in two years.

Some were worried about the data, as the Confidence Board showed consumer sentiment fell for the fifth straight month. Economists warned that economic growth was concentrated in a K-shaped way: the largest firms CapEx held up GDP, while the waelthiest spendiers held up consumer appetites. Another critique from WSJ is that GDP is calculated as all domestic spending, minus imports, and plus exports. If exports climb and imports fall, say, when tariff import taxes are at a century high, GDP will climb. 👀

Further GDP estimates for the third quarter will continue coming out in a delayed fashion, likely next month, the BEA said.

Either way, CME Fed Watch odds on a rate cut any time soon fell toward the ‘yeah right’ zone, while gold, silver, and even copper prices hit records Tuesday, as the S&P 500 closed at a record. 🥇 🥈 🥉

STOCKS

NOW That’s What I Call Security ⛓

ServiceNow $NOW ( ▲ 1.68% ) said it spent $7.75B cash on a deal to acquire cybersecurity firm Armis. The move aims to transform ServiceNow into an "AI Control Tower" for global enterprise security.

The deal is expected to close in H2 2026, as NOW hopes it will lead to a 3x increase in its security and risk market share. The company already leads the IT service manamgnet verticle, and now it wants security too.

What the Heck is Armis?

According to The Wall Street Journal, Armis provides "agentless" tracking of security assets that traditional software cannot reach. The idea is to combine that security know-how with NOW’s IT software to offer easy-to-sell products to current customers.

Despite the strategic growth, ServiceNow stock has struggled, down 27% year-to-date. Investors are weighing the massive price tag against the company’s aggressive 2025 M&A spree, which includes earlier deals for Moveworks and Veza. With global security spending hitting $240 billion, ServiceNow is betting that "intelligent trust" will be the cornerstone of the ongoing AI era.

HEALTHCARE

Novo Nordisk eyes 2026 recovery with landmark weight-loss pill approval

Novo Nordisk $NVO ( ▼ 2.62% ) is closing out its worst year since 1984, with shares down over 40% as the company faced slowing growth and Trump administration pricing pressures.

Tuesday, the tune changed slightly, after the FDA approved the first oral version of its blockbuster drug semaglutide, sold in a 25mg pill under the brand name Wegovy. The stock climbed nearly 8%, signaling a potential bottom for the stock is now behind investors. 📉

The approval allows Novo to beat rival Eli Lilly LLY to the pharmacy shelf for chronic weight management. 💊

Analysts predict oral treatments could account for 20 percent of the obesity market by 2030, appealing to patients who prefer daily tablets over weekly injections. That number seems low: Based on hearsay and personal preference, I would way rather take a fat pill than a fat shot, imo.

The Novo Reset: New Pillars of Growth

Direct-to-Consumer Pricing: Novo agreed to offer starter doses of its new weight-loss pill for $149 per month via the White House TrumpRx site, aiming to capture the millions of cash-paying customers previously priced out. 🏛️

Lead Over Lilly: While Lilly leads in injectable market share, its own oral candidate is still awaiting regulatory clearance, giving Novo a critical first-mover advantage for the new year. 🏃

Manufacturing Push: The company is aggressively scaling production to ensure the January launch of the 1.5mg starter dose avoids the supply shortages that plagued its injectable line. 🏗️

The move has flipped retail sentiment on Stocktwits to extremely bullish, as investors bet that easier administration and lower price points will reaccelerate earnings in 2026.

SPONSORED BY TRENDSPIDER

Generic AI Will Hallucinate Your Account to Zero

Most AI chatbots weren’t built for trading. Ask them about last week’s earnings or a key level on AAPL and you can get five different answers. That might be fine for trivia—not for your P&L.

Sidekick is different. It’s specialized AI for active investors, powered only by TrendSpider’s vetted institutional grade data. It sees the same charts, scans, and watchlists you do, so every answer is grounded in one consistent, repeatable dataset instead of a random crawl of the public internet.

Talk to your charts: Spot key levels, patterns, and indicator signals in plain English.

Dig into fundamentals: Summarize filings, earnings, and insider/government trades for you.

Scan on command: Prompt "find stocks gapping up today" and have Sidekick build and run the scan.

Build better strategies: Review your strategies tabular metrics to refine entries, exits, and risk rules.

AI won’t replace your judgment, but with clean, consistent data it can radically upgrade your workflow.

Sign up today to lock in up to 65% off TrendSpider and get 1 month of Sidekick Plus and 1 year of SignalStack Basic free—that’s $399 in upgrades included.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MACRO NEWS

Silver and Gold, Silver and Gold 🎼 Prices Smash Through Historic Rally 🤘

Spot silver prices surged past the $70 per ounce mark for the first time on Tuesday, extending a massive rally that has seen the metal gain over 140% in 2025. It wasn’t just silcer- copper spot prices climbed too, jumping over $12,000 a ton. Gold was jumping to a record high above $4,480/oz.

The surge reflects a perfect storm of structural supply deficits and explosive industrial material demand from the solar, electric vehicle, and artificial intelligence sectors.

“Historically during precious metal bull markets, silver lags gold and will then experience huge lifts, as we’re seeing [Monday],” said Steven Orrell, VP at Orrell Capital Management, told Yahoo Finance. “Over the last five years, silver has lagged gold performance up until this past month, where it has shot up dramatically. Its tie to gold as a precious metal is certainly a driver, considering gold has had a historic performance year.”

The record-breaking move in the metal pushed silver miners to multi-decade highs\. Hecla Mining $HL ( ▼ 1.46% ) briefly hit its highest levels in over 38 years, up 300%+ this year.

Analysts at Yardeni Research and Bank of America have recently raised their long-term price targets, citing persistent fiscal deficits and the critical role of silver in the global energy transition as permanent drivers for the new bull market. 🥈

POPS & DROPS

Top Stocktwits News Stories 🗞

Salesforce and Palantir are analyzed as possible AI winners.

Reddit was named Needham's top pick for 2026.

Reviva Pharmaceuticals fell 50% intraday after a failed a Phase 3 study.

Frontier Jet dropped 54% intraday following a massive post-IPO rally.

Michael Saylor urged Bank of America to rethink its stance on Bitcoin.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Continuing Jobless Claims (8:30 AM), Initial Jobless Claims (8:30 AM), Crude Oil Inventories (10:30 AM), Cushing Crude Oil Inventories (10:30 AM). 📊

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Christmas Day Slate & The Gift Tracker Market | True Odds Podcast

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋