Presented by

CLOSING BELL

Stocks Surge As Government Shutdown (Nearly) Shutters 📕

Source: Tenor.com

It was a risk-on day, with investors and traders celebrating what they believe to be the beginning of the end for the longest government shutdown in history.

Today’s RIP: The government’s reopening vote, Michael Burry’s AI hyperscaler warnings, the precious metals market pumping, and more. 📰

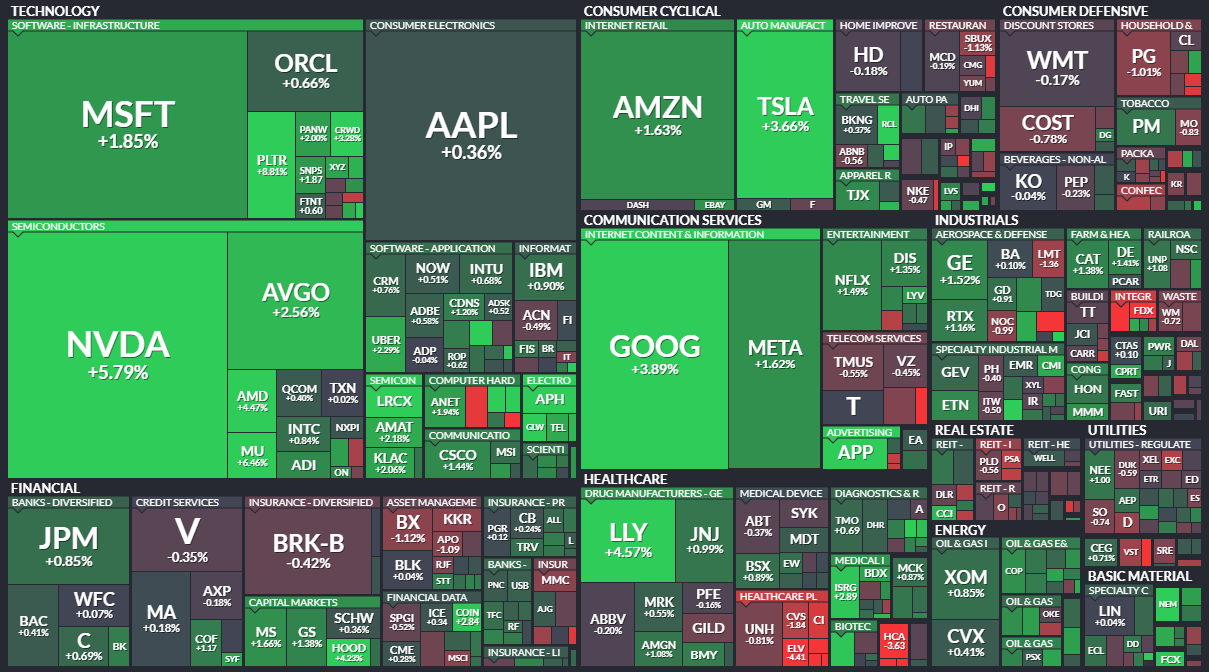

8 of 11 sectors closed green. Technology $XLK ( ▲ 1.3% ) lead and staples $XLP ( ▲ 0.87% ) lagged.

Source: Finviz

POLICY

Government Set To Reopen After Senate Vote 🗳

After roughly 40 days, the longest-ever government shutdown is nearing a close (or shall we say, open?). With the vote sitting at 53-47, negotiations allowed Republicans to attract eight votes from the other side of the aisle, losing only Rand Paul in the process due to the proposed increase in national debt. 🤝

The deal includes an agreement for a vote in December on extending healthcare subsidies that are due to expire this year, a key issue Democrats had been holding out for concessions on. Still, the Senate’s Democratic leader, Chuck Schumer, said this bill does nothing to address the healthcare crisis. However, others felt it necessary to get a bill across and kick the can down the road until January 30th.

With many losing access to critical government services over the last six weeks, it appears the Federal Aviation Administration’s (FAA) impact on travel this weekend was the final catalyst to help get things done. Thousands of flights have been impacted, and the outlook looks bleak ahead of the upcoming holiday traveling season, prompting outrage across the nation. Additionally, the recent election outcomes may have spurred certain government leaders to reconsider whether the shutdown was serving them (or their constituents) politically. 😬

Now, it moves to the House of Representatives, where it may face some challenges, but is expected to progress. Meanwhile, Fed Governor Stephen Miran continues to advocate for a 50 bp rate cut this December, playing his tune from the prior two Fed meetings. He’s focused on the deteriorating labor market and trying to position policy for 12 to 18 months away, when it will show up in the economy.

While the Fed board remains mixed on their forecast and policy suggestions, the market continues to bet on at least a 25 bp cut in December and more in 2026. ✂

SPONSORED

Laser Tech Isn’t the Future. It’s Here. Still Under $5.

LASE tech speeds up complex manufacturing and maintenance processes, cutting cycle times, material loss, consumables, and manual effort.

A fast-growing provider of laser processing solutions - now with CMS Laser and Beamer Laser Marking Systems as part of Laser Photonics. Booked 4x revenue in Q2 2025, with strong momentum for long-term growth.

Industrial marking, cutting, welding, and surface prep transformed with automated and handheld laser systems engineered in USA. Serving the medical device, pharma, micromachining, aerospace, auto, energy, and government sectors.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS

Are Hyperscalers Burry-ing The Lede? 🤔

After making headlines last week for his bets against Palantir and Nvidia, ‘Big Short’ investor Michael Burry made another accusation against AI hyperscalers. 🤯

He claims that companies are understating depreciation in order to boost earnings, calling it “one of the more common frauds of the modern era.” By artificially extending the useful lives of their compute equipment, they’re able to reduce their deprectiation expense and the short-term earnings impact of their capex spending.

He specifically called out Oracle, Meta, Microsoft, and others as he teased further details to be released on November 25th. Needless to say, this caused a lot of debate among those in the Fintwit community. 🙃

Source; Michael Burry on X

But Burry isn’t the only one raising red flags about the AI market. Jim Cramer warned that investors are seeing potential “cracks” in the data center market, citing concerns that OpenAI may be spending beyond its means. ⚠

And Bank of America is also cautious, issuing a warning that the AI boom may be hitting a “cash crunch.” Its research team noted massive borrowing for AI data centers during September and October, with $75 billion in bond/loan issuance nearly doubling the average from the last decade. It says capex is approaching limits on what cash flows alone can support. This echoes comments from Morgan Stanley Wealth Management CIO Lisa Shalett in late October.

Still, the stocks continue to rise, with prospects of lower interest rates and the government shutdown ending providing the bulls with fuel to push the market higher. Whether or not Burry, Bank of America, and AI skeptics are right remains to be seen, but this will undoubtedly be a heavily debated topic until November 25th.

COMMODITIES

Precious Metals Resume Their Pump 🪙

After a few weeks of downside, weak economic data and inflationary concerns put gold, silver, and other metals back on investors’ menu. However, it appears that retail is not necessarily on board with the rebound just yet. 😐

Sentiment for one of the most popular gold miner ETFs ($GDX) is sitting at its lowest level year-to-date, suggesting the sharp pullback in late October shook a lot of the latecomers and trend chasers out.

The broader macro factors driving metals have not changed, but sentiment became too bullish in the short term, helping to usher in a pullback in prices. Now, after a several-week correction and traders shifting their focus elsewhere, some technicians believe today was the start of a move back to all-time highs. 📈

Time will tell if they’re right. But if you’re looking for a contrarian indicator that some of the “greed” has washed out of gold, silver, and related stocks, Stocktwits sentiment data suggests that it has. 👍

POPS & DROPS

Top Stocktwits News Stories 🗞

Priority Technology jumps on CEO-led $520 million buyout proposal.

Coinbase launches a new platform prior to them listing on the exchange.

Papa John’s is reportedly going private for $65/share, but retail is skeptical.

Sonder initiates bankruptcy after Marriott cancels licensing agreement.

TreeHouse Foods is going private in a $2.9 billion deal.

Grab is investing $60M in remote-driving tech provider Vay Technology.

Tower Semiconductor soars 17% after posting strong Q3 results.

Warren Buffett is “going quiet,” reaffirms his belief in CEO Greg Abel.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Stimulate Your Feed By Following Us On X 💸

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Fed Vice Chair for Supervision Barr Speaks (10:25 PM). 📊

Pre-Market Earnings: Workhorse Gr ($WKHS), Nebius Gr ($NBIS), Sea ($SE). 🛏️

After-Market Earnings: Beyond Meat ($BYND), Microvision ($MVIS), Oklo ($OKLO), Spruce Power ($SPRU), LightPath Technologies ($LPTH), Spectral AI ($MDAI). 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍