OVERVIEW

Stocktwits Top 25

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time.

Here are the Stocktwits Top 25 Lists for this week:

P.S. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

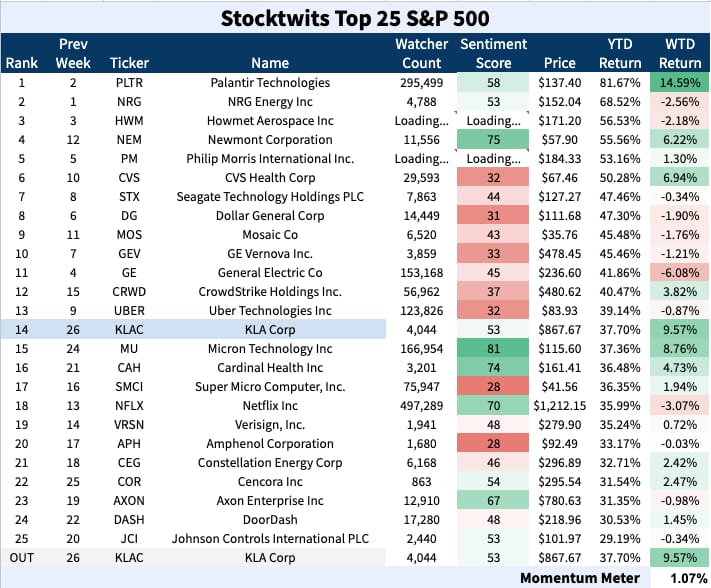

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list (+1.07%) outperformed the S&P 500 index (-0.39%).

There was 1 major change to the list this week.

Check out how the momentum meter has performed vs. the S&P 500 index.

PRESENTED BY U.S. Gold Corp.

$USAU: Russell Inclusion + 118% YTD = Big Gold Breakout Setup

$USAU is up +118% YTD with forecasted +84.6% more upside. Analysts see price targets $24, while the stock trades under $14. The CK Gold Project holds 1.44M oz gold equivalent (~$4.5B), is fully permitted, and backed by $7M in new capital. A Q3 feasibility study adds near-term catalysts.

On June 30, $USAU will be added to the Russell 2000® and 3000® Indexes, but funds must buy in before market close on June 27 - meaning passive flows and institutional demand are imminent. With only 9.6M shares in float and a sub-$200M market cap, this is a rare, de-risked U.S. gold play. $10.6T in benchmarked assets track Russell indexes.

Add $USAU now - this is as close as it gets to free money.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list (+0.75%) underperformed the Nasdaq 100 index (-0.60%).

There were 3 major changes to the list this week.

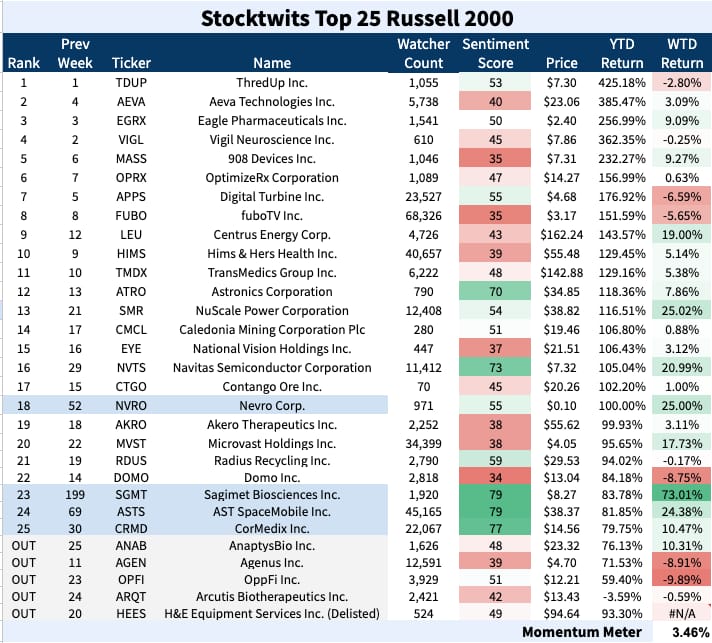

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list (+3.46%) outperformed the Russell 2000 index (-1.49%).

There were 5 major changes to the list this week.

PRESENTED BY STOCKTWITS

WEEKEND RIP WITH BEN & EMIL: A WET HOT AMERICAN MELT UP

The melt-up is molten and the boys are barely holding it together. Inflation came in cooler than your ex’s new girlfriend, markets won’t go down even with missiles flying, and Apple just gave us "Liquid Glass" — aka Liquid A$$. Tesla’s driving itself, Bitcoin’s still above 100K, and somehow Fartcoin launched on Coinbase. Meanwhile, Powell’s ghosting the rate cut group chat and the VIX aged out of the teens.

🔹 Markets Melt Up, Ben Melts Down: The S&P and Nasdaq log one of their strongest runs in decades. Ben didn’t capitalize, but Emil did, with some VT Sacks. Ben lowercase-d on it.

🔹 Tesla Unmanned & FartCoin Dumps: Elon’s driverless Teslas spotted in Austin. Ben's calls are aging like milk. He’s out of FartCoin, still has ButtCoin, and deeply regrets his trading lineage.

👉 Will Jesus return before a rate cut? Is liquid glass just liquidass? And are the robots already planning our demise? Find out on this week’s episode of the Weekend Rip.

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Sagiment Biosciences Inc., which rallied 73%. 📈

The clinical-stage biopharm firm is attempting to create an oral one-a-day weight-loss adjacent pill to treat nonalcoholic steatohepatitis.

The California-based firm recently elected new executives and changed the compensation agreement for CEO David Happel.

$SGMT ( ▲ 12.12% ) is up 83% YTD.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Kevin Travers) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋