Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

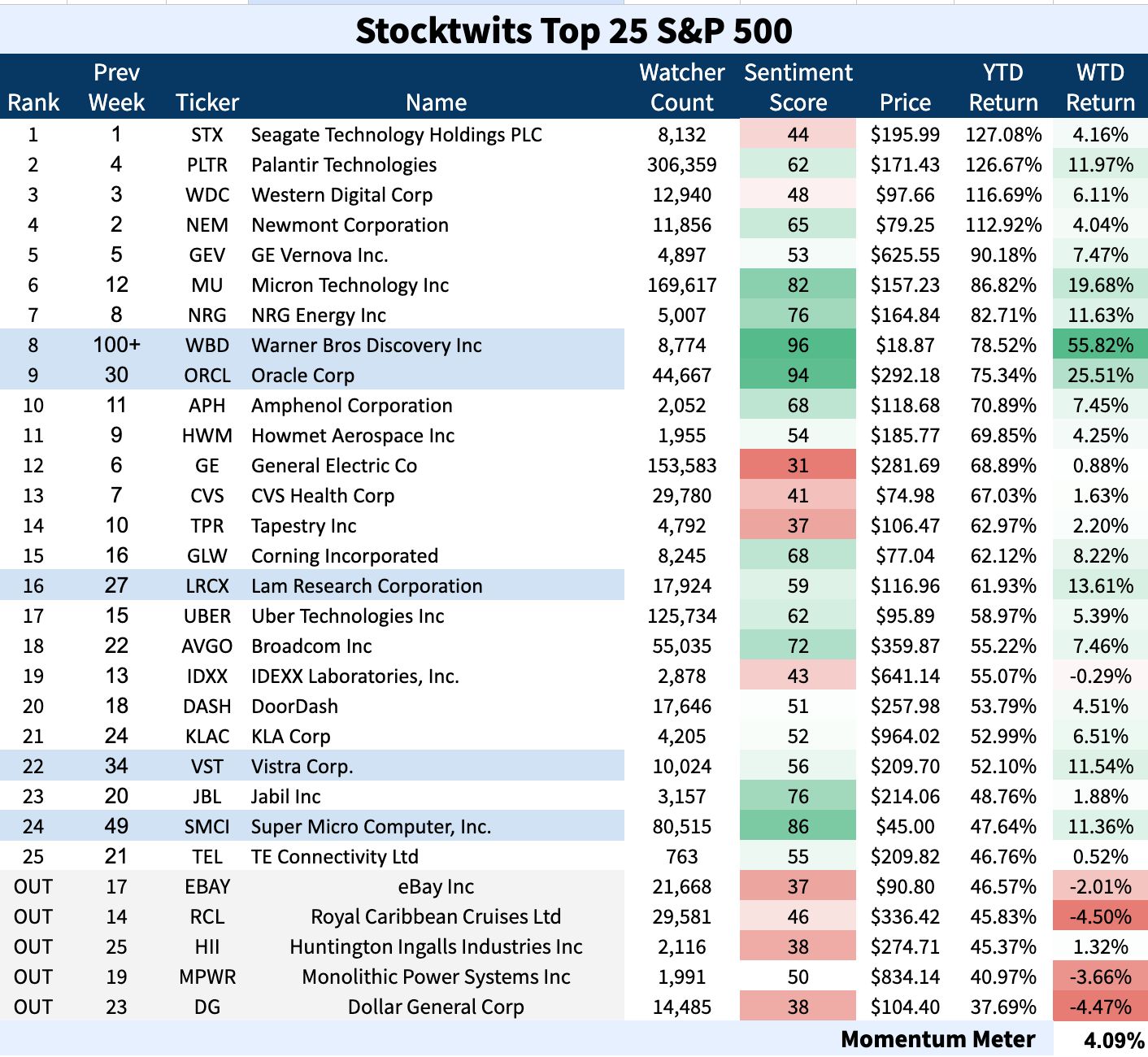

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list (4.09%) outperformed the S&P 500 index (1.59%).

There were five major changes to the list this week.

SPONSORED

Predicting the Unpredictable: ZenaTech's Clear Skies Initiative

At ZenaTech, we’re always looking ahead—developing technologies that don’t just advance industries but also safeguard communities. One area where innovation has never been more critical is in understanding and responding to extreme weather events.

Clear Skies: Precision Weather Insights Extreme weather events are increasingly impacting communities, industries, and infrastructure. Clear Skies represents ZenaTech’s vision to harness AI-powered drones and quantum computing to deliver real-time, high-resolution atmospheric data that can help anticipate and respond to these challenges.

Our drones can collect and analyze complex multi-point weather data, including wind speeds, pressure, and temperature, faster than traditional methods. This provides actionable insights to local areas, supporting better forecasting, operational planning, and emergency preparedness. By leveraging quantum-enhanced algorithms, Clear Skies can empower cities, governments, and other organizations to make smarter, faster decisions in the face of environmental uncertainty.

This initiative demonstrates ZenaTech’s commitment to turning advanced technology into practical solutions, protecting lives, reducing costs, and reshaping how we approach weather-related challenges.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list (4.09%) outperformed the Nasdaq 100 index (1.86%).

There were three major changes to the list this week.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list (6.51%) outperformed the Russell 2000 index (0.25%).

There were two major changes to the list this week.

STOCKTWITS COMMUNITY EVENTS

🌴 Win a Free Trip to Stocktoberfest: Airfare, Hotel, Ticket Covered

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Warner Bros. $WBD ( ▲ 0.14% ) , which rallied 55%. 📈

Paramount Skydance, fresh off the merger that was approved in August, announced plans to buy up Warner Bros Discovery, according to media reports on Thursday. Warner Bros. has yet to receive an offer. WBD Chief David Zaslav said they planned to separate their global TV networks from their streaming business, but WSJ reported Paramount wanted the entire pie, not just a piece. 🥧

The stock is up 78% YTD.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋