OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list (-1.07%) underformed the S&P 500 index (-0.10%).

There were two major changes to the list this week.

PRESENTED BY

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list (-0.93% ) underperformed the Nasdaq 100 index (-0.50% ).

There were three major changes to the list this week.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list (-1.04%) outperformed the Russell 2000 index (-0.59%).

There were two major changes to the list this week.

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Intel, which rallied 20%. 📈

Intel Corp. (INTC) stock closed at a new 52-week high on Thursday as traders bid up the stock on hopes that it would receive more bailout money as the chipmaker plots its turnaround.

Following SoftBank’s $2 billion bet in Intel, the U.S. government and Nvidia invested in the chipmaker. Earlier this week, a Bloomberg report stated that Intel was in discussions with Apple and several other companies regarding potential investments.

A Wall Street Journal report identified one of the parties Intel approached as TSMC. Intel CEO Lip-Bu Tan has reportedly spoken to Apple’s Tim Cook and TSMC’s C.C. Wei regarding a partnership or joint venture.

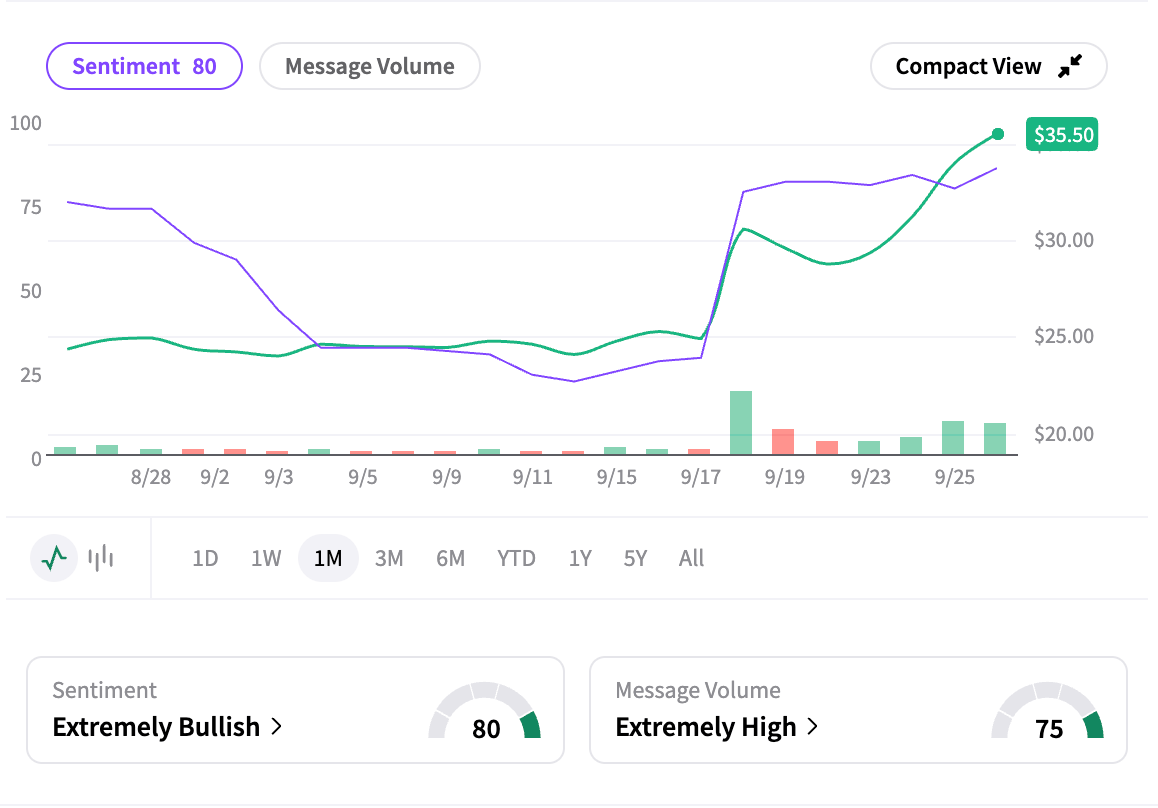

Intel sentiment is ‘extremely bullish’

In a note published Thursday, tech venture capitalist Gene Munster said he sees the logic of Apple investing in Intel as weak.

“Apple’s most advanced chips are currently manufactured at scale by TSMC, whose process technology is two to three years ahead of Intel,” he said, adding that “From a product and manufacturing standpoint, Intel does not move Apple’s roadmap forward.”

$INTC ( ▼ 5.03% ) is up 77% YTD.

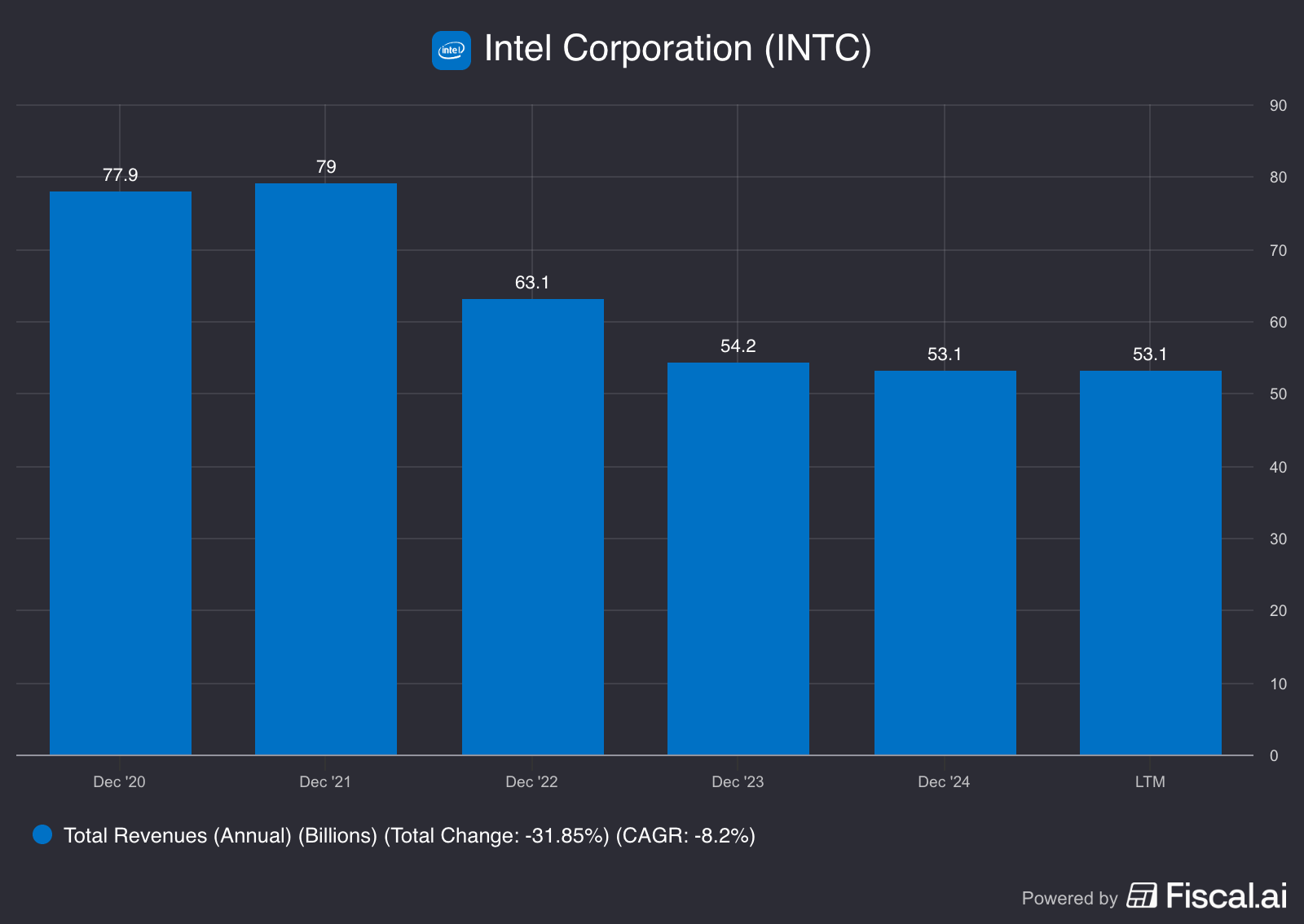

Intel Revenue has declined for years, according to Fiscal.ai data

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋