Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list (1.69%) outperformed the S&P 500 index (0.71%).

There were two major changes to the list this week.

SPONSORED

Meet the ChatGPT of Marketing – Still Just $0.81

RAD Intel is tackling a timeless, trillion-dollar problem — helping companies find and influence the right customers. Their AI platform reads real-time culture across TikTok, Reddit, and other hard-to-see corners of the open web, surfacing precise audience segments and the creative angles that drive up to 3.5X ROI.

The tech is fast, battle-tested with F-1000 brands, and backed by Adobe, Fidelity Ventures, and insiders from Meta, Google, YouTube, and Amazon.

A who’s-who roster of Fortune 1000 clients and agency partners leveraging our award-winning AI. Recurring seven figure contracts in place and a Nasdaq ticker, $RADI reserved.

Momentum is clear — valuation is up 4,900% in four years, and shares are available privately at $0.81 in the Reg A+ round.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list (2.78%) outperformed the Nasdaq 100 index (1.97% ).

There was one major change to the list this week.

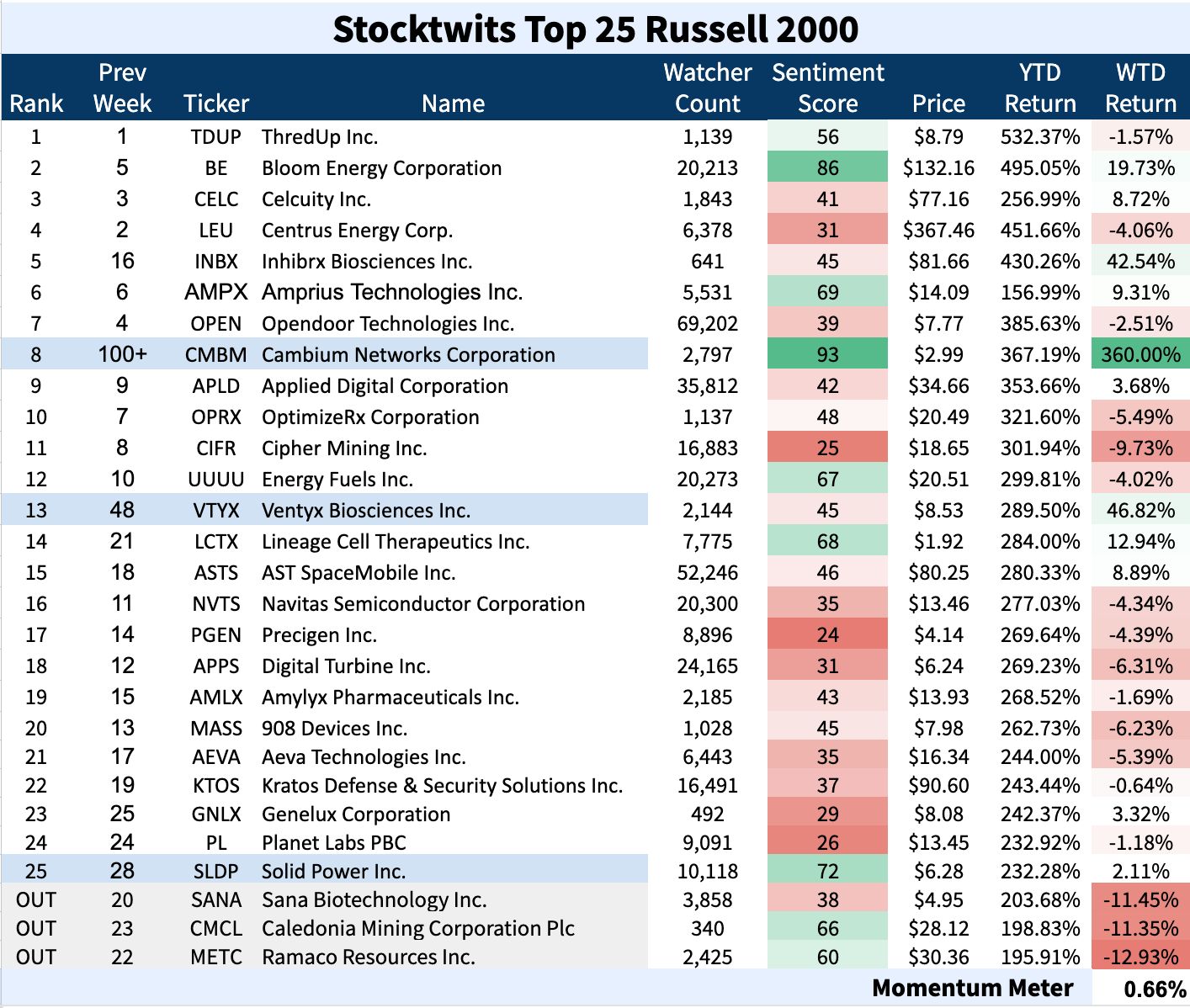

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list (0.66%) outperformed the Russell 2000 index (-1.36%).

There were three major changes to the list this week.

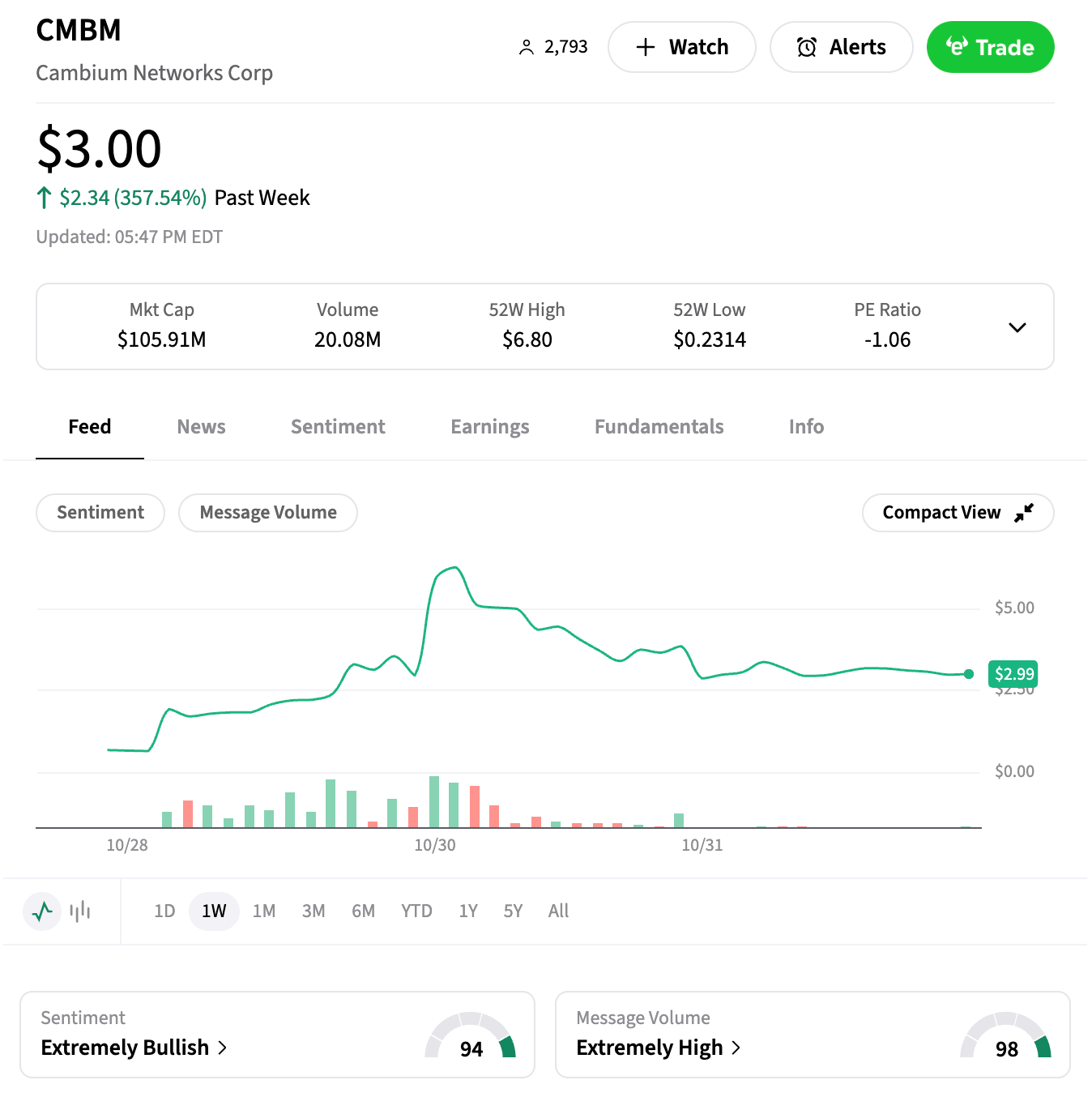

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Cambium Networks Corporation, which rallied 360%. 📈

🚀 Cambium Networks Stock Skyrockets on Starlink Deal

$CMBM ( ▲ 2.48% ) surged over 300% this week after announcing a strategic integration with Elon Musk’s Starlink. The company’s ONE Network platform will now support Starlink’s satellite internet delivery, enabling enterprise-grade connectivity and centralized management.

The news triggered a frenzy in retail and institutional circles, with shares jumping from $0.62 to $2.95 in two days. Despite weak fundamentals, the Starlink partnership injected fresh optimism into Cambium’s long-term prospects.

Key Stats:

📈 +377% in 48 hours

🛰️ Starlink integration confirmed Oct 29

🧠 Centralized network management via cnMaestro

💰 Free cash flow: $6.77M | Net income: -$73.6M

Wall Street remains cautious, but retail traders are betting this is Cambium’s moonshot moment.

CMBM gorss profit margins have only been imporving, according to Fiscal.ai

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋