Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list -1.75% underperformed the S&P 500 index -1.63%.

There were 3 major changes to the list this week.

SPONSORED

Graphite Heats Up: A G7-Backed Mine is Nearly Sold Out Before It’s Built

Halloween may be over, but the G7 just pulled a monster shift that’s sticking around. The jump from “Critical Minerals Resilience” to a full-blown G7 Critical Minerals Alliance puts graphite front in the West’s supply-chain playbook. It turns energy security into a long-term feature, not seasonal decor.

Enter NMG. No tricks, just treats: during the G7, $NMG signed a binding offtake with the Government of Canada, securing nearly 100% of Phase-2 mine volumes alongside Panasonic Energy, Traxys, and advanced talks underway with a top global anode maker. Key permits? Done. Engineering? 80% advanced. Site prep? Key infrastructure completed. ESG? Greenlighted. Add sovereign backing, bankable volumes, and a Western integrated value chain, NMG is ready to move toward financing.

Not a ghost story, a geopolitical pivot with real tonnes behind it. Investors, keep this one on your radar.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list -3.34% underperformed the Nasdaq 100 index -3.09%

There were 4 major changes to the list this week.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list -10.92% underperformed the Russell 2000 index -1.88%.

There were 6 major changes to the list this week.

Top Dawg Of The Week 🐶

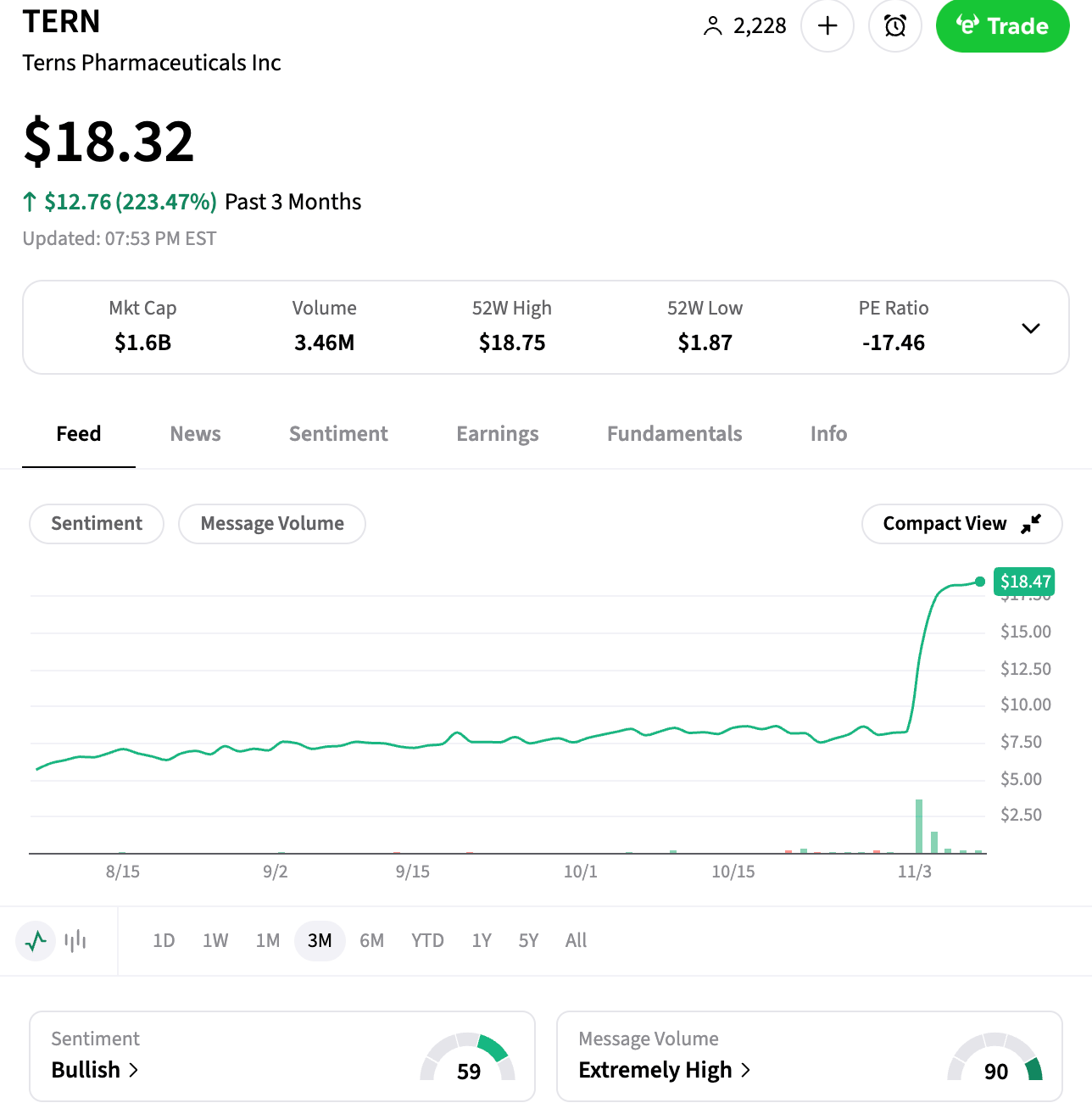

The Top 25 list's Top Dawg was Terns Pharmaceuticals, which rallied 123%. 📈

$TERN ( ▲ 1.44% ) is a clinical-stage biopharmaceutical company, developing drugs to treat non-alcoholic steatohepatitis, or NASH, and other chronic liver diseases. This week they posted positive data for TERN-701 to help people with a blood sickness called CML. After 24 weeks, more than half of patients recovered with few side affects. The company will present the findings in greater detail on its investor update call. December 8

“We are pleased that data from our CARDINAL trial have been selected for oral presentation at ASH. These data further validate the potential of TERN-701 to be a new, game-changing therapy for CML. The 24 weeks MMR achievement rate with TERN-701 is unprecedented, trending at least two times higher than the rates reported in other Phase 1 studies of CML therapies that are approved or in development,” said Amy Burroughs, chief executive officer of Terns.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍