OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list -4.45% underperformed the S&P 500 index -1.95%

Newcomers are in blue, and grey names at the bottom were kicked out of last week’s list.

PRESENTED BY

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list -3.51% underperformed the Nasdaq 100 index -3.07%

Newcomers are in blue, and grey names at the bottom were kicked out of last weeks list.

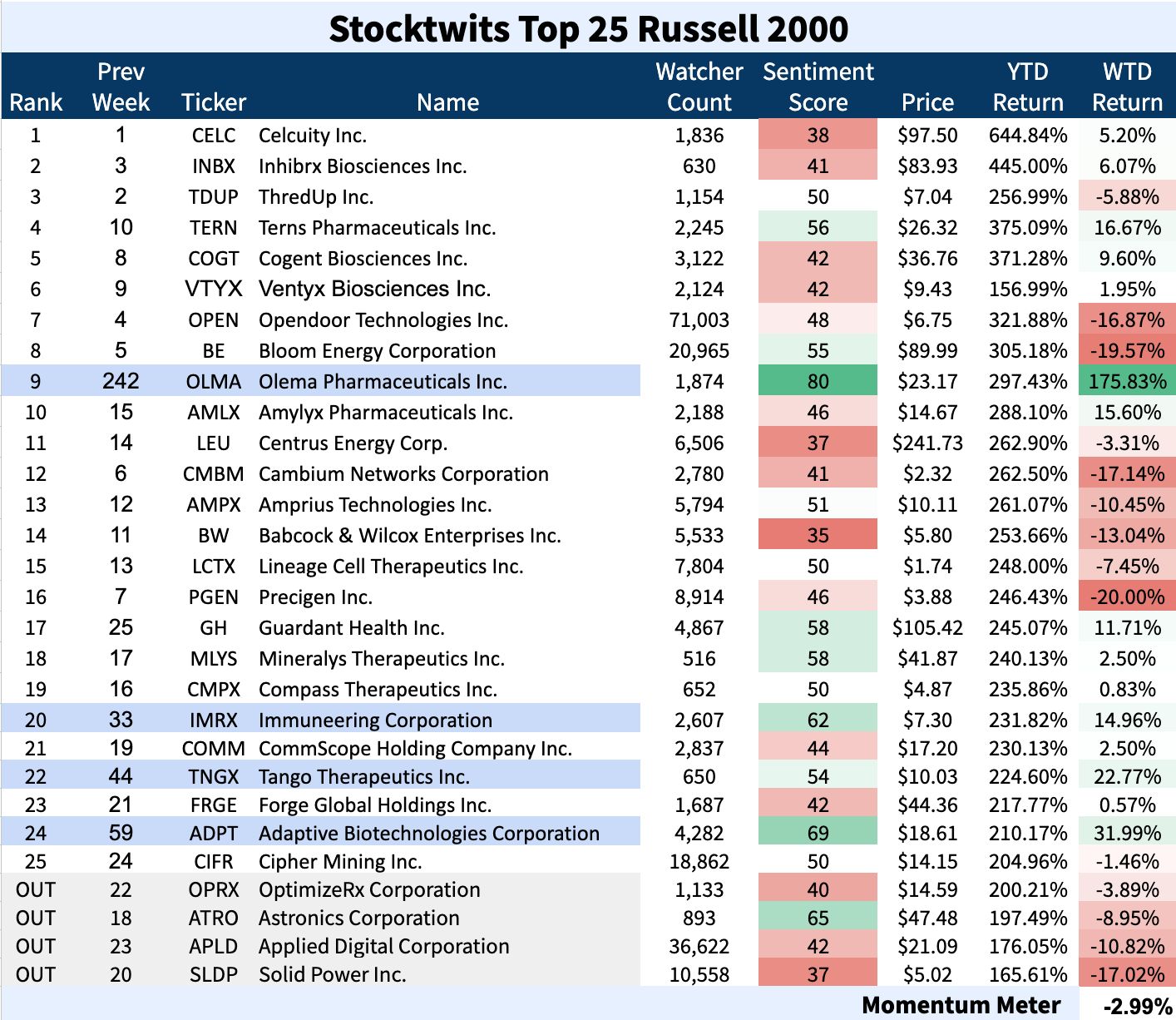

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list -2.99% underperformed the Russell 2000 index -0.78%

Newcomers are in blue, and grey names at the bottom were kicked out of last weeks list.

Top Dawg Of The Week 🐶

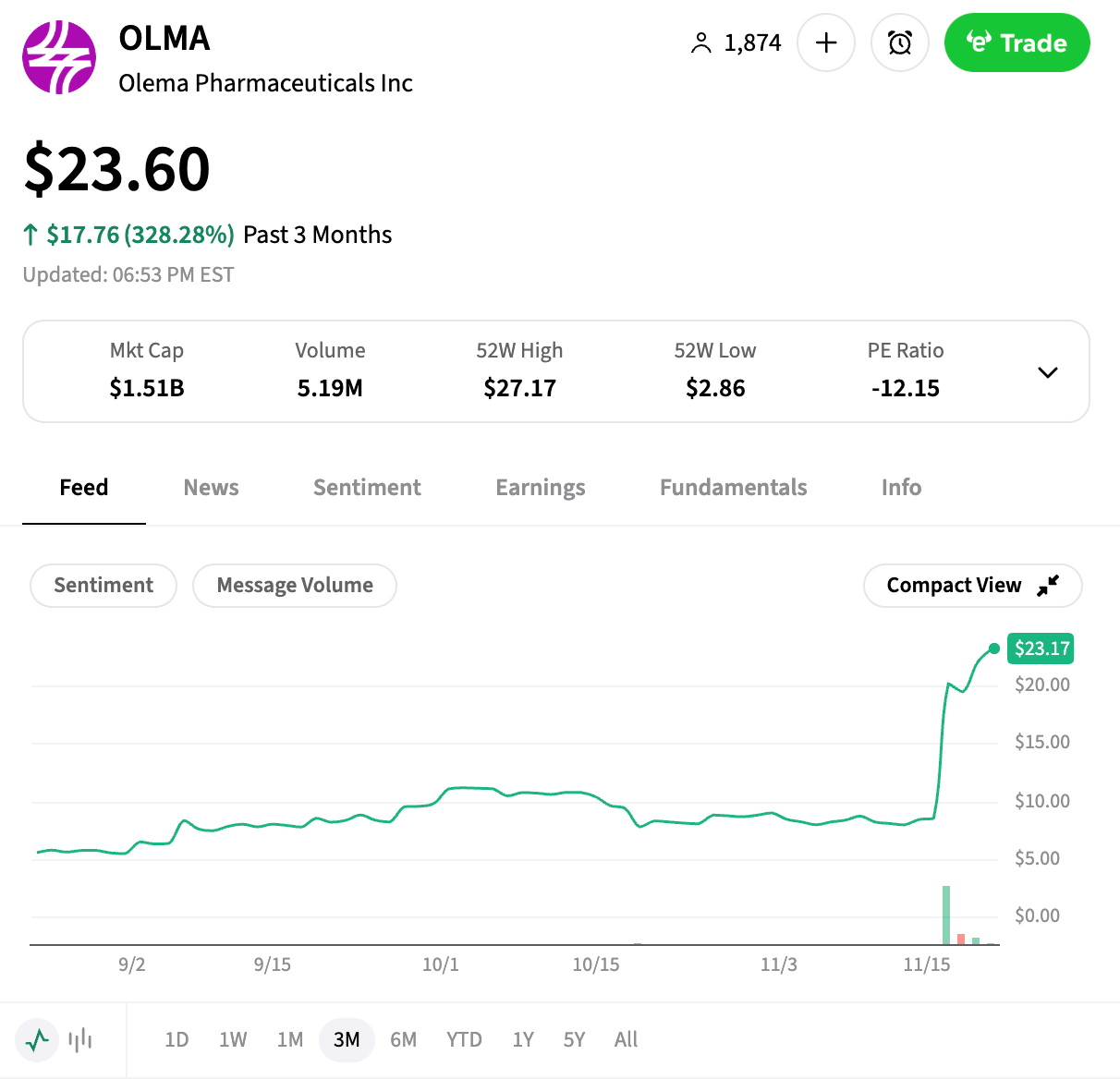

The Top 25 list's Top Dawg was $OLMA ( ▲ 1.36% ) Flying 175.83%!!

Olema Pharmaceuticals surges on Roche validation::

Olema Pharmaceuticals’ shares jumped after $RHHBY ( ▲ 1.02% ) announced positive Phase 3 results for its oral SERD, giredestrant. The trial showed a statistically significant improvement in invasive disease‑free survival versus standard endocrine therapy in ER‑positive, HER2‑negative, early‑stage breast cancer. This marks the first oral SERD to demonstrate benefit in the adjuvant setting, a multi‑billion‑dollar market. 📈

Investor impact: Roche’s success is seen as external validation for the SERD drug class. Olema’s lead candidate, palazestrant (OP‑1250), is both a complete estrogen receptor antagonist (CERAN) and SERD. Because it works via the same mechanism, investors view Roche’s data as reducing scientific risk for Olema’s program.

Big picture: Palazestrant is in pivotal Phase 3 trials for metastatic breast cancer. Roche’s breakthrough strengthens confidence in Olema’s pipeline and positions the company as a potential next mover in a validated, high‑value therapeutic space. 🌍

Like all biotech companies, Olema spends all of its money on R&D, according to Fiscal.ai

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋