Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date (YTD) and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

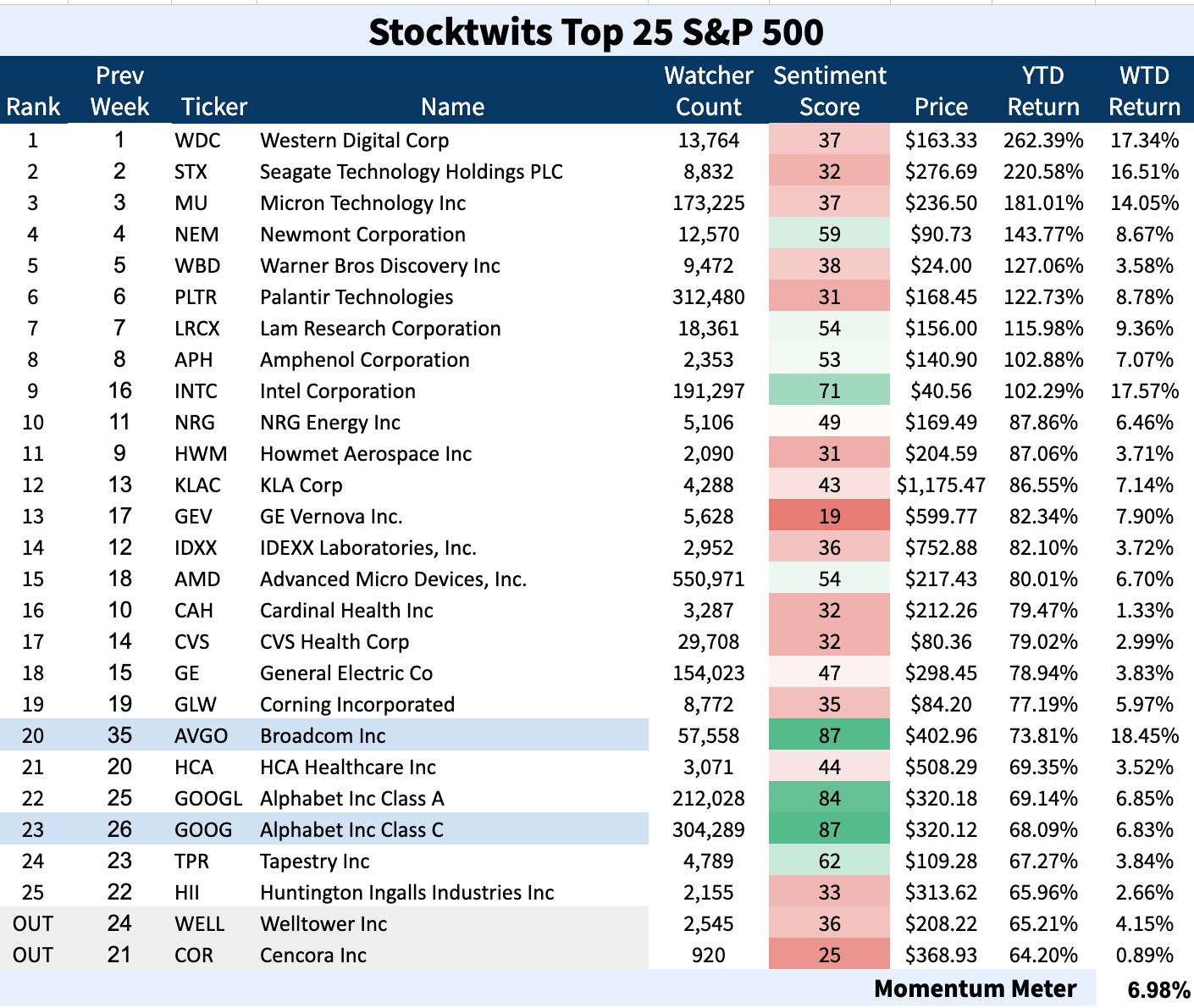

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list 6.98% outperformed the S&P 500 index 3.73%

Newcomers are in blue, and grey names at the bottom were kicked out of last weeks list.

SPONSORED

A message for QQQ shareholders

Have you received emails or calls from our third-party proxy solicitor, Sodali? These are not spam—they're here to help you participate in an important proxy vote for QQQ.

You can help shape the future of Invesco QQQ by voting on a proposed upgrade from its current trust structure to a more flexible, open-ended ETF. This change aims to deliver greater value to you, including:

Lower costs: Expense ratio reduced from 0.20% to 0.18%

Greater transparency: Enhanced reporting and oversight

No tax impact: The change will not trigger any tax consequences

Same investment objective: QQQ will continue to track the Nasdaq-100® Index

Rest assured, QQQ will continue to track the Nasdaq-100® Index and its operations will be managed by the same trusted team.

The deadline to vote is December 4th. Call 800-886-4839 for help.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list 6.27% outperformed the Nasdaq 100 index 4.93%

Newcomers are in blue, and grey names at the bottom were kicked out of last weeks list.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list 8.35% outperformed the Russell 2000 index 5.52%

Newcomers are in blue, and grey names at the bottom were kicked out of last weeks list.

Top Dawg Of The Week 🐶

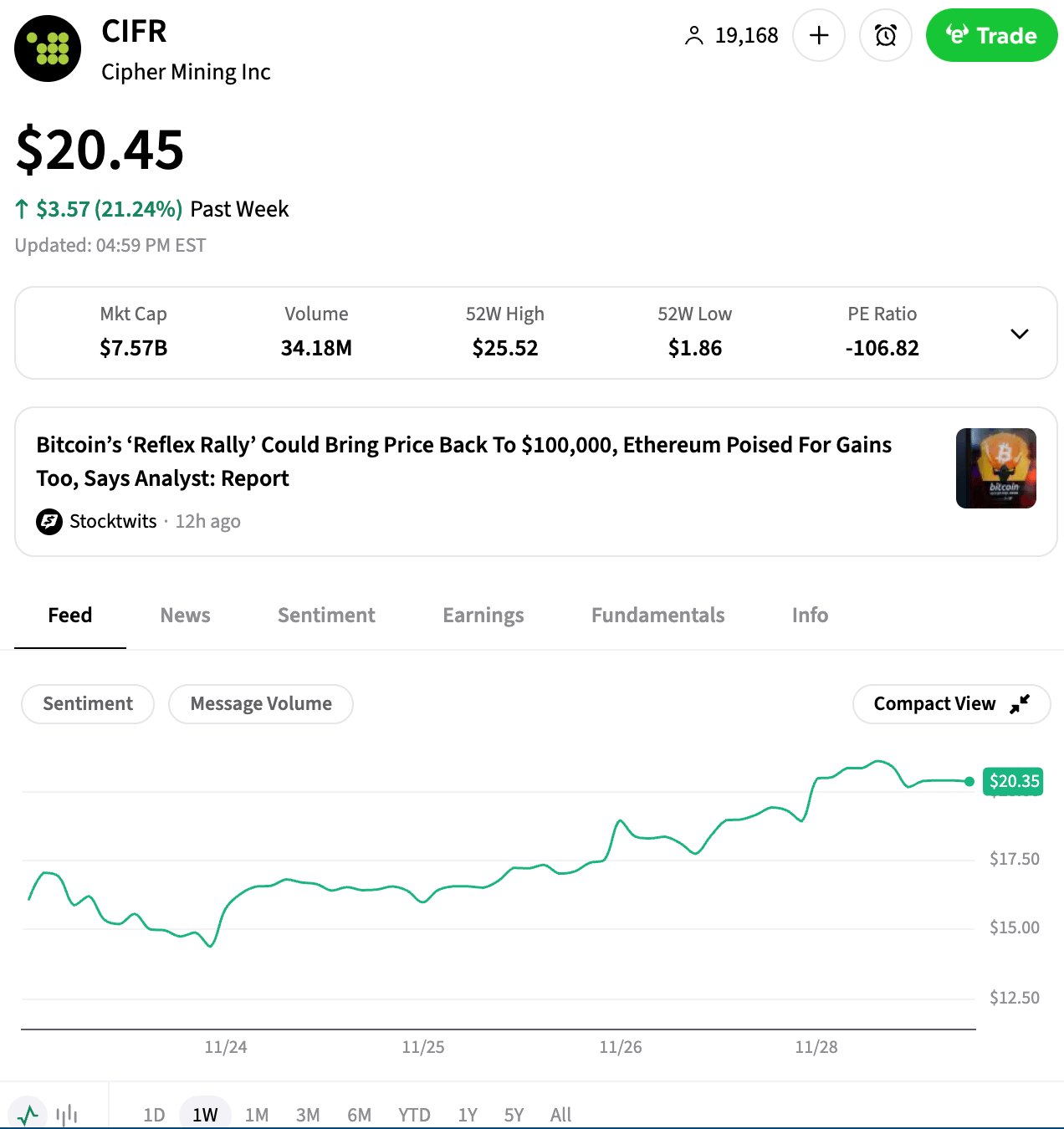

The Top 25 list's Top Dawg was $CIFR ( ▲ 12.48% ) climbing 43%+!

According to Stocktwits news, Bitcoin may be regaining the momentum needed to approach the $100,000-mark again, after a fall to $80k.

It’s all according to a new call from investment banking firm BTIG.

“After a -36% peak-to-trough decline, we think Bitcoin is now poised to continue its reflex rally at least back towards 100k,” BTIG analyst Jonathan Krinsky said, according to a CNBC report.

Crypto Mining Stocks Rebound

BTIG said in a note that Cipher Mining and Terawulf $WULF ( ▲ 11.99% ) are “showing impressive performance during the crypto pullback.”

Cipher Mining’s stock gained more than 7% in morning trade on Friday, while Terawulf’s stock rose more than 5.5%. On Stocktwits, retail sentiment around CIFR remained in ‘bearish’ territory amid ‘low’ levels of chatter over the past day, and retail sentiment around WULF was in the ‘bullish’ zone, with chatter dipping to ‘low’ from ‘normal’ levels.

The analysts noted that their crypto miner index has maintained support and could rise another 15% before hitting stronger resistance.

This week, Cipher broke some news

The company announced it delivered a notice of redemption for all outstanding warrants to purchase shares of common stock on Wednesday. The news helped send the stock higher, according to Benzinga, alongside the rebound enjoyed as Bitcoin climbed past $90k again.

CIFR revenue in the past five quarters, according to Fiscal.ai

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋