Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

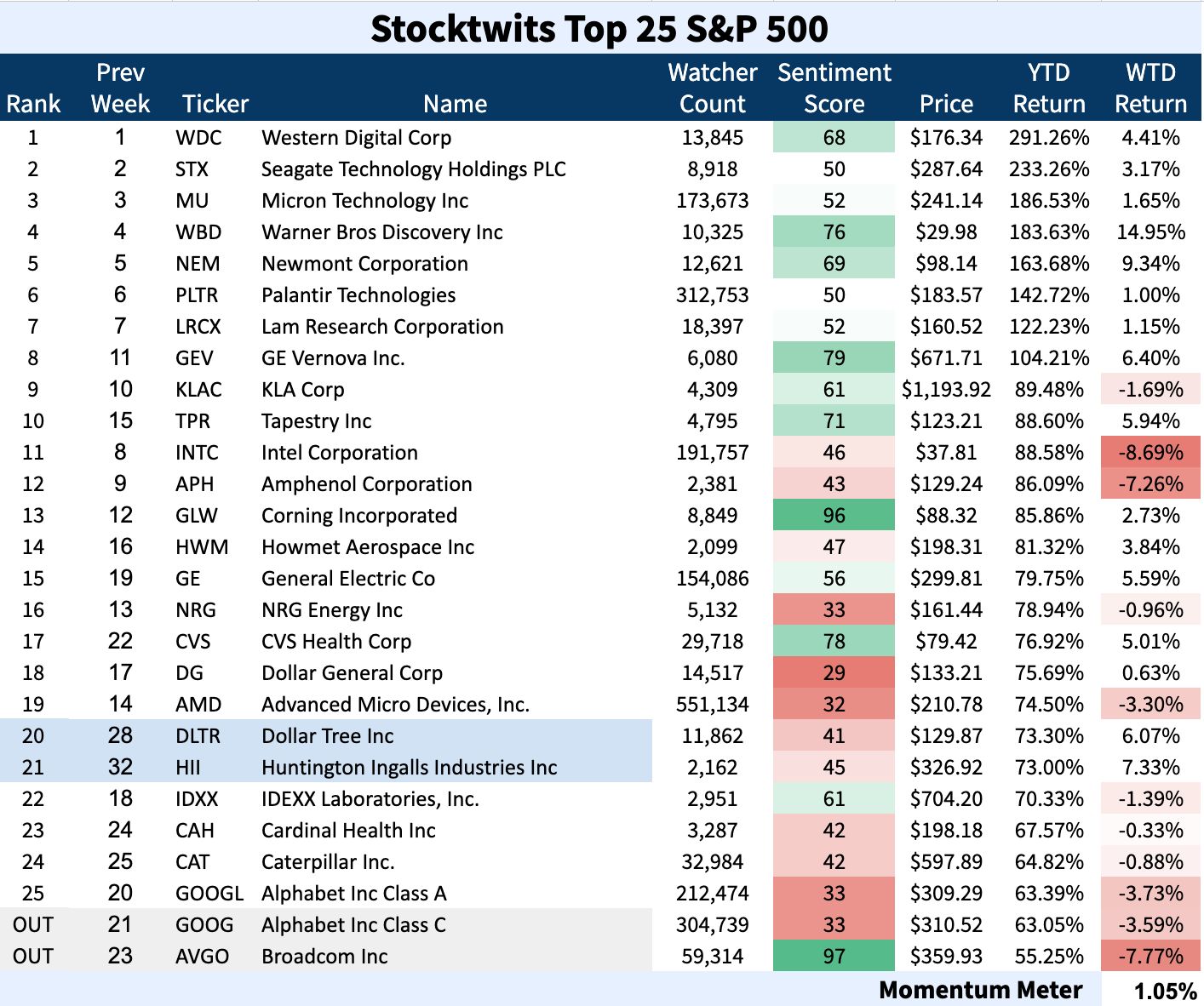

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list 1.05% outperformed the S&P 500 index -0.63%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

SPONSORED

Graphite’s Next Play: NMG Breaks Down Big Deals & Bigger Tech

Missed the interview? Here’s the TL; DR. NMG’s stacking catalysts, trying to speedrun to FID with the kind of momentum most developers dream of: G7-timed offtake with the Government of Canada, updated deals with Panasonic Energy and Traxys, plus the federal stamp as a Major Project of National Interest.

Then NMG casually drops an R&D flex: engineered graphite composites for fuel cells and even stealth-grade materials. Yup, graphite going full “next-gen materials” arc. Margin-rich. Tech-forward. Tomorrow’s manufacturing stuff.

Add it up: near-sold-out future production, geopolitical tailwinds, and a product suite that stretches from batteries to advanced communication systems and aerospace-ish applications. The kind of story traders keep open in a separate tab.

With FID prep well underway, the interview lays out a clear picture of the green graphite power. A deep dive worth your screen time.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list -1.19% outperformed the Nasdaq 100 index -1.93%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list 0.86% compared to the Russell 2000 index 1.19%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Terns Pharmaceuticals flying over 52% after an early week report of a cancer treatment trial. $TERN ( ▲ 1.44% )

The company reported updated positive Phase 1 results for its experimental chronic myeloid leukemia CML drug, TERN-701.

The drug, an allosteric BCR::ABL1 inhibitor, achieved a high Major Molecular Response MMR rate of 64% by 24 weeks across all patients, and 75% in the higher dose groups. This efficacy is considered unprecedented, trending two to three times higher than competitor drugs.

The trial also showed a strong safety profile with no dose-limiting toxicities, supporting the company’s plan to advance TERN-701 directly into Phase 2 development.

Like many startups, TERNs is spending cash on research hand over foot, according to Fiscal.ai

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋