Presented by

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list came up 1.84% compared to the weekly S&P 500 index 1.40%.

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

SPONSORED

Gain exposure to Chainlink, with GLNK.

Chainlink is a versatile blockchain network that delivers essential infrastructure for connecting on-chain and off-chain data, serving as the bridge across blockchain ecosystems. For investors looking to participate in the expanding world of digital finance, Chainlink underpins many core applications in the industry, such as tokenization. Now, investors can gain exposure to Chainlink with the newly launched Grayscale Chainlink Trust ETF (GLNK). Just search for the ticker GLNK in your brokerage account.

Grayscale Chainlink Trust ETF (“GLNK” or the “Fund”), an exchange traded product, is not registered under the Investment Company Act of 1940, as amended (“40 Act”), and therefore is not subject to the same regulations and protections as 40 Act registered ETFs and mutual funds. GLNK is subject to significant risk and heightened volatility. GLNK is not suitable for an investor who cannot afford to the loss of the entire investment. An investment in GLNK is not a direct investment in Chainlink.

Please read the prospectus carefully before investing in the Fund. Tokenization refers to the process of representing real-world assets on the blockchain using cryptocurrency tokens. Foreside Fund Services, LLC is the Marketing Agent for the Fund.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

NASDAQ 100

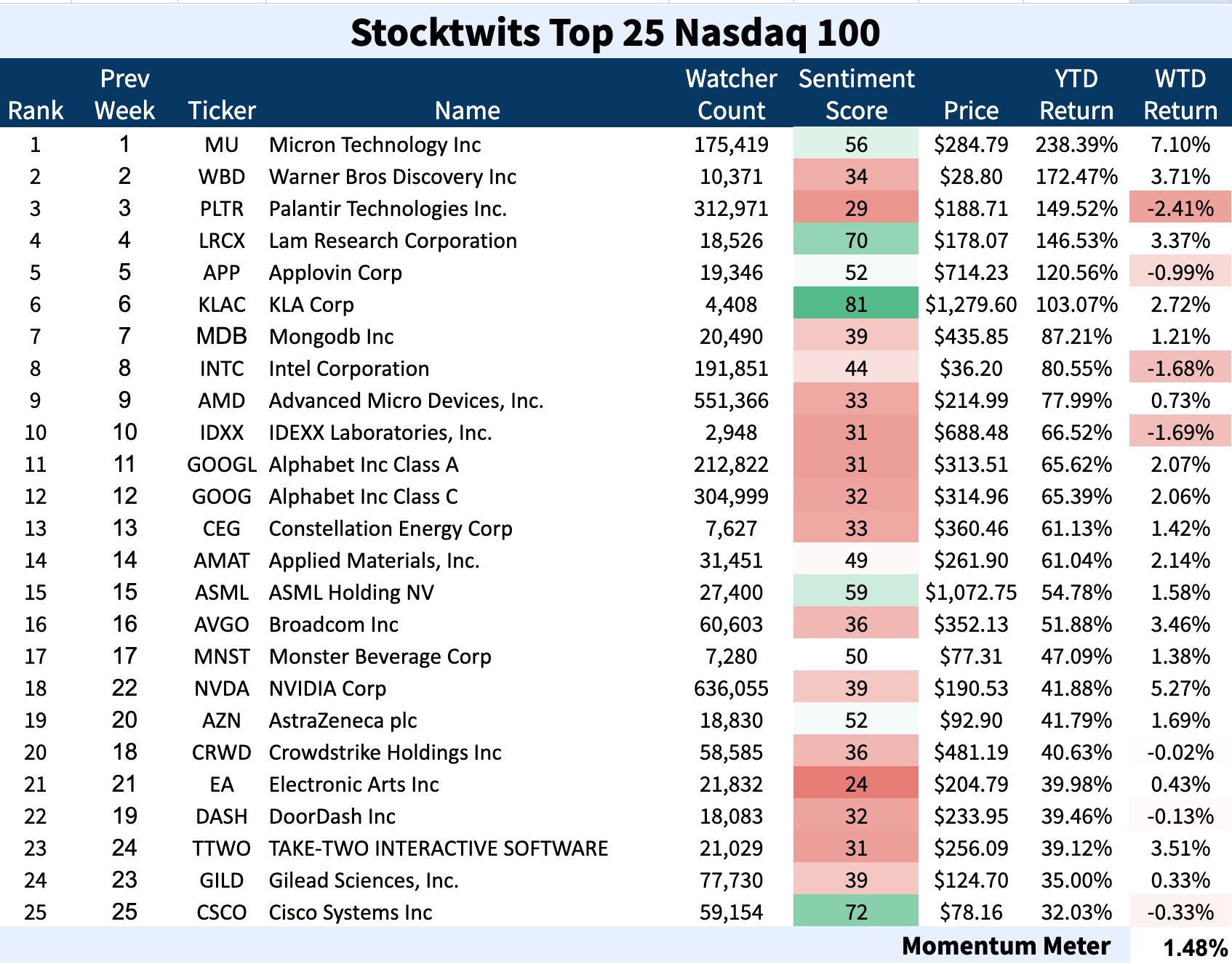

The Large-Cap Nasdaq 100 🤖

The Nasdaq 100 Top 25 list performed 1.48% compared to the weekly Nasdaq 100 index 1.18%.

The list was exactly the same this week as last week, just one or two names changed positions!

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list was -1.57% compared to the weekly Russell 2000 index 0.19%

Newcomers are in blue. Grey names at the bottom were kicked out of last week’s list.

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋