Presented by

OVERVIEW

Happy Valentine’s Day!

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

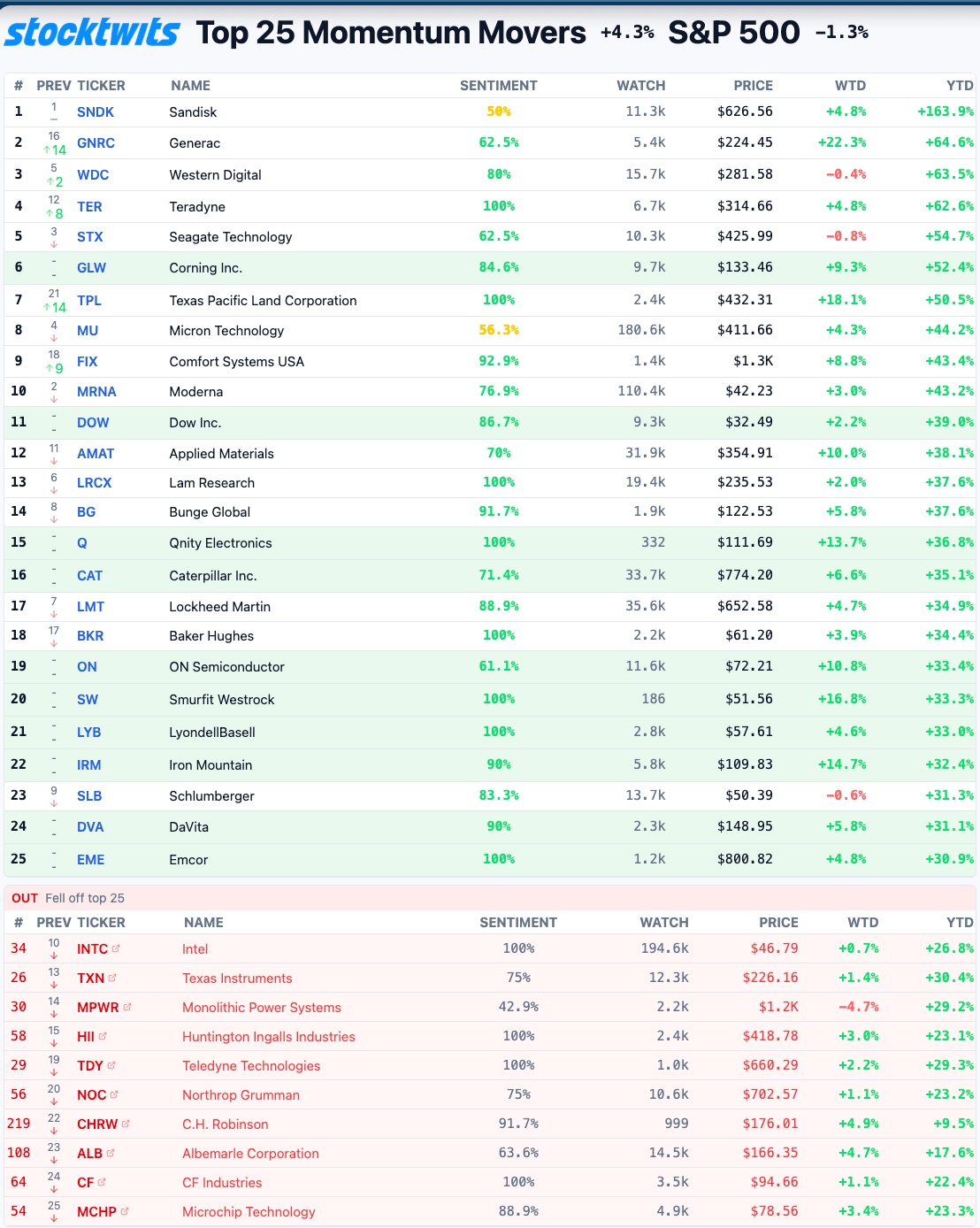

S&P 500

ST Top 25 S&P 500 💪

The S&P 500 Top 25 list compared to the weekly S&P 500 index. Let me know if this template floats your boat!

IN PARTNERSHIP WITH POLYMARKET

🚨New Earnings Markets Just Dropped on Polymarket

Ever been RIGHT about earnings... but still lost money?

Traditional markets force you to trade 10+ variables when you only need to have conviction on one to profit.

Now, there's a better way to trade your conviction.

On Polymarket, you can trade the ONE outcome you actually have an opinion on:

Will NVIDIA beat Q4 earnings?

What will Nebius say on their earnings call?

Will AMZN close above $200 in February?

No Greeks. No IV crush. No "priced in" excuses ❌

Being right on earnings = profit.💰

Upcoming earnings ide NVIDIA, DASH, CVNA, SNOW, and more... 👀

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

RUSSELL 2000

The Growth-Centric Russell 2000 🦐

The Russell 2000 Top 25 list compared to the weekly Russell 2000 index

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Fastly $FSLY ( ▼ 1.47% ) climbing a wild 113%

Fastly shares delivered their strongest single-day performance in company history Thursday following a dominant fourth-quarter earnings beat and a massive guidance raise. The company is successfully pivoting toward high-margin AI traffic, leading to its largest revenue beat since 2019 and a significant re-rating from Wall Street analysts.

The quarterly results were a "clean sweep" as $FSLY posted revenue of $172.6 million against the $161.36 million expected, while adjusted EPS of $0.12 doubled the analyst consensus of $0.06. This outperformance was mirrored in the company’s internal metrics, marking the fourth consecutive quarter of accelerating growth across all business segments and a notable expansion in large-customer commitments.

The massive surge of 72% was catalyzed by Fastly’s emergence as a key infrastructure play for "agentic AI" traffic, which CEO Kip Compton noted is driving new workloads and security demands on the platform. Analysts from William Blair and RBC Capital highlighted that the company is successfully gaining market share in network delivery and compute, transforming from a traditional CDN into an underappreciated beneficiary of the LLM boom.

The forward outlook remains exceptionally bullish, with management guiding 2026 revenue to a range of $700 million to $720 million, well above the $667.79 million consensus. With a projected 2026 gross margin of approximately 63% and free cash flow reaching up to $50 million, the market is now pricing in a sustainable shift toward long-term profitability and structural growth.

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋