Presented by

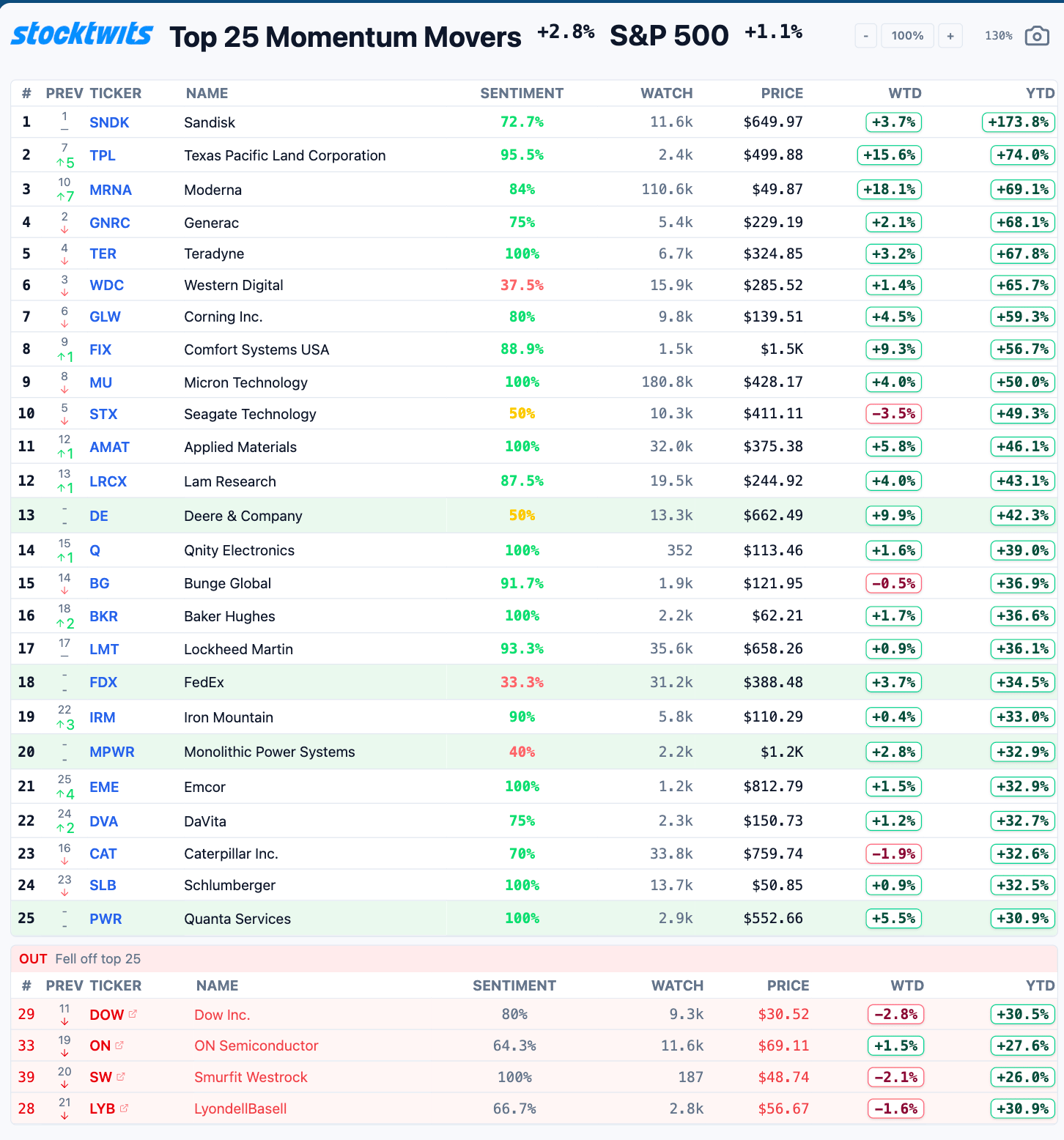

OVERVIEW

Happy Saturday

Welcome to the Stocktwits Top 25 Newsletter this week!

The Stocktwits Top 25 reports the 25 best-performing stocks in the S&P 500, Nasdaq 100, and Russell 2000 year to date and tracks their performances over time. To help you understand this data further, check out our FAQ page, and feel free to reach out if you have questions!

Here are the Stocktwits Top 25 Lists for this week:

SPONSORED BY ZENATECH

ZenaTech Initiates Green UAS for ZenaDrone1000 for US Defense

ZenaTech recently announces that its ZenaDrone subsidiary has formally initiated the Green UAS (Uncrewed Aircraft System) certification application process for its ZenaDrone 1000 (ZD1000). The ZenaDrone Flagship product is a heavy-lift multifunction AI drone platform intended for potential inclusion on approved procurement pathways for the U.S. Department of War (DoW) and government buyers upon successful certification.

The ZenaDrone 1000 is engineered as an advanced AI-powered VTOL heavy-lift platform optimized for defense use, offering ISR capabilities including real-time surveillance, tactical reconnaissance, and secure data collection, alongside cargo transport and mission-critical payload delivery. Its modular design allows rapid configuration for multi-mission operations in high-risk environments, from infrastructure monitoring to operational logistics support.

ST VIDEO

EXCLUSIVE: Opendoor CEO Kaz Announces Mortgage Beta, Talks Earnings With Michele Steele

Opendoor CEO Kaz Nejatian joins Stocktv to talk Opendoor’s monster Q4, and answer retail questions. He announced a brand-new Opendoor mortgage beta running internally at the firm, with a launch date TBD. 👀

Nejatian breaks down what actually changed inside the business, why Q1 revenue can drop even as the company gets structurally healthier, and the single metric he says investors should model: contribution margin per cohort.

Kaz explains Opendoor’s cohort-based business model (buy homes, renovate, resell), why most Q4 sales came from inventory acquired before he arrived, and how a massive acceleration in acquisitions takes time to flow into revenue.

He also shares surprising details on how AI is transforming execution speed at the company — including a mind-blowing stat on how much code was produced in eight weeks — plus commentary on profitability targets.

Top Dawg Of The Week 🐶

The Top 25 list's Top Dawg was Immunity Bio Inc. $IBRX ( ▲ 1.05% ).

$IBRX shares skyrocketed over 40% this week, closing near $8.70 as investors reacted to a rapid-fire sequence of global approvals. While the company is expected to report a quarterly loss of $0.08 per share in its upcoming results, preliminary FY25 product revenue reached $113 million, representing a massive 700% year-over-year surge fueled by Anktiva’s domestic and international launch momentum.

Strategic partnerships with Biopharma and Cigalah serve as the primary catalyst, facilitating the distribution of Anktiva for bladder and lung cancer indications across Saudi Arabia. This expansion follows a major regulatory breakthrough earlier this week when the European Commission granted conditional marketing authorization, effectively opening the door to 33 countries and significantly de-risking the company’s commercial roadmap.

The outlook remains aggressive as ImmunityBio establishes a dedicated Saudi unit to support regional commercialization and prepares for long-term safety data submissions to the EMA. Wall Street remains overwhelmingly bullish with a Strong Buy consensus and an average price target of $11.80, implying approximately 37% additional upside as the company transitions from a clinical-stage biotech to a global commercial powerhouse.

Get In Touch 📬

How Was The Daily Rip Today?

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋