CLOSING BELL

Tariffs? Best We’ve Got Is TACO

tenor

The market whiplashed a bit Thursday as investors watched conflicting reports from the courts on Trump’s tariffs, likely to head to the Supreme Court soon as lesser judiciaries attempt to block aspects of the president’s executive power flexes. Big if true, but some have coined the term TACO, for Trump Always Chickens Out, to describe the rocky road to small changes.

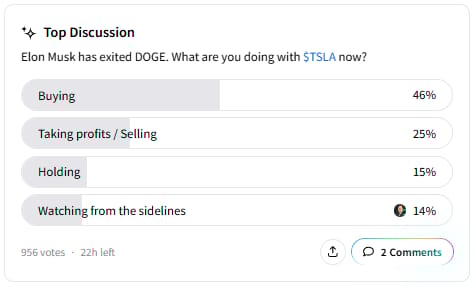

In tech, Nvidia was positive despite warning about China chip bans on Wednesday, and Tesla was green after Chief Musk said farewell to his short stint in government, for now. His firm hopes to launch self-driving cars in Austin in a week or two. 👀

Today's issue covers Tesla's Chief Headed Back To Work, After-Hours Earnings Were Less Optimistic, Trump’s Tariffs Face Judicial Reckoning. 📰

With the final numbers for indexes and the ETFs that track them, 10 of 11 sectors closed green, with health care $XLV ( ▼ 0.02% ) leading and communications $XLC ( ▲ 0.21% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 5,912

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,363

Russell 2000 $IWM ( ▲ 0.56% ) 2,074

Dow Jones $DIA ( ▲ 0.58% ) 42,215

NEWS

Tesla's Chief Headed Back To Work 🚗

Uber fell Thursday, and financial media saw Tesla’s upcoming Austin self-driving event as a catalyst: if cars drive themselves, who’s calling an Uber?

It wasn’t just that driving news in the car world, it was the return of the car-making giant’s prodigal son. Elon Musk said his sad goodbyes on X, at the end of his 130-day government stint, and headed back to work (hopefully) full time.

It could not have come at a better time. On Wednesday, a group of pension fund Tesla investors wrote a letter to the board, demanding Musk spend at least 40 hours a week at the EV firm. Seems like a reasonable demand for the man who has led firings for government employees for shirking work. 👀

SPONSORED

He’s already IPO’d once – this time’s different

Spencer Rascoff co-founded Zillow, scaling it into a $16B real estate giant. But everyday investors couldn’t invest until after the IPO, missing early gains.

"I wish we had done a round accessible to retail investors prior to Zillow's IPO," Spencer later said.

Now he’s doing just that. Spencer teamed up with fellow Zillow exec Austin Allison to launch Pacaso. Pacaso’s co-ownership marketplace is disrupting the $1.3T vacation home market. They’ve already surpassed $110M in gross profit and $1B in transactions.

They also recently reserved their Nasdaq ticker PCSO. But unlike Zillow, you can invest in Pacaso as a private company.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY EARNINGS

Nvidia And Elf Led Gains, But After Hours Was Less Optimistic 🙃

$NVDA ( ▲ 2.25% ) climbed Thursday, a classic beat and raise, and despite a warning they would lose $8B to China chip curbs. Wall Street analysts raised price targets, but It was not the only firm climbing on earnings news. e.l.f. Beauty flew after the firm beat expectations Wednesday, and said it was acquiring Hailey Bieber’s Gen Z favorite Rhode brand for $1 billion, marking its biggest acquisition to date.

After the bell on Thursday, Costco beat sales estimates with $63.2B, and growing 8% YoY despite shaky consumer confidence.

On the flip side, $GAP ( ▲ 0.46% ) sank like a rock after it reported following the closing bell, beating estimates and holding its sales guidance for a gain of 1-2%. Still, the firm warned its brands, Old Navy, Athleta, and Banana Republic, were not set to predict the impact of ever-changing tariff impacts. It was not a great day to report retail import sales, as the courts argued tit for tat wit the White House. More on that below, but first, a new Stocktwits feature that you can read more about down below. 😍

PRESENTED BY STOCKTWITS

🟢 Introducing the Stocktwits Sentiment Index

Wall Street watches the $VIX for expected volatility.

Stocktwits traders have the Stocktwits Sentiment Index, which measures retail investor emotion and updates daily after close.

Today’s Takeaway:

📈 Retail caution is rising, as the latest Stocktwits Sentiment Index reading signals heightened fear.

Remember:

The $VIX is based on the options market’s near-term volatility expectations.

The Stocktwits Sentiment Index is based on what retail traders are feeling and signaling right now.

Combining both gives traders a smarter, earlier read on market shifts.

P.S. The Stocktwits Sentiment Index is currently only available on Desktop, on the Stocktwits homepage.

…EXCEPT DEATH AND TACOS

Trump’s Tariffs Face Judicial Reckoning. Will It Be Strong Arms Or Tacos Next 🌮

So the Court of International Trade ruled Wednesday that Trump overstepped his authority imposing new tariffs, and said the executive branch had to pause a share of Trump's tariffs pending review.

The market opened higher (a little) on that news, but waited for the inevitable rebuttal. The ruling only affected general tariffs on nations, not levies on specific goods like steel. 🏗

The Trump Admin had its response, and went to tell mom and dad, or in this case, the Supreme Court, to ask to halt the ruling Friday that halted their rule. They also petitioned lower courts for help, and late Thursday, a federal appeals court ruled tariffs are fine for now, and the administration can collect tariffs while the lawyers push it through the appeal process.

So, who wins? Lawyers, as always.

In any case, there are plenty of levers to pull in the White House, some hundreds of years old, to put taxes on trade. Goldman Sachs analysts said the Trump administration has multiple tools to offset the recent court ruling. The court blocked the use of a 1977 emergency act, but Trump Trade Advisor Peter “Dow Falls” Navarro said the admin could use 1974’s Section 122 tariffs for up to 15% tariffs for 150 days. 🎱

The White House also considered Section 301 tariffs that enable the Trade Representative to act against foreign powers for unreasonable trade practices.

In other macroeconomic theatre news, Federal Reserve Chair Jerome Powell met with President Trump at the White House, emphasizing that monetary policy decisions will be based on objective, non-political analysis. Powell wants to wait for economic data, and Trump reportedly said Powell was making a mistake.

Treasury yields fell after revised Q1 GDP data showed an economic contraction in Q1, though less than feared, but the first contraction since 2022. The economy shrank 0.2%, beating expectations of a 0.4% decline, and weekly jobless claims rose to 240,000 from 226,000. Investors are now watching April PCE inflation data for any uptick in current prices. 🛍

SPONSORED

Your Portfolio’s Boring. This Company Isn’t. It's Early + Up 1600%.

RAD Intel raised $41M+, grew 1600%, and brought in 7,000+ investors. The firm is up 20% in Q1, and has a NASDAQ ticker $RADI coming in Q2.

Adobe and Fidelity are backing RAD, so are insiders from Google, Meta, Amazon, and Youtube.

The window to get in early is closing fast. Shares are $0.60 until May 29. After that, the price moves.

*Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A offering and involves risk, including the possible loss of principal. The valuation is set by the Company. Please read the offering circular and related risks at invest.radintel.ai. 3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Noteworthy Stories From Stocktwits News 🗞

$CRM ( ▲ 3.42% ) reported Q1 revenue of $9.83 billion, up 8% year-over-year, with adjusted EPS of $2.58, beating estimates of $2.55. The stock fell, though analysts noted strong execution and momentum in its Agentforce strategy. Retail sentiment on Stocktwits remained bullish.

Li Auto reported Q1 revenue of $3.6 billion, beating estimates, with vehicle deliveries rising 15.5% year-over-year to 92,864 units. However, Q2 guidance disappointed investors, with projected revenue growth of 2.5%–6.7% and deliveries expected to increase 13.3%–17.9%, falling short of analyst forecasts.

$AI ( ▲ 3.31% ) shares surged after reporting Q4 revenue of $108.7 million, up 26% year-over-year, with a non-GAAP net loss of $0.16 per share, beating estimates of a $0.20 loss. The company also secured a $450 million contract expansion with the U.S. Air Force and renewed its Baker Hughes partnership through 2028, reinforcing investor confidence.

Best Buy fell 7% after the firm reported Q1 revenue of $8.77 billion, missing estimates of $8.81 billion, while adjusted EPS of $1.15 topped forecasts of $1.09. The company cut its full-year sales and profit guidance due to tariff-related cost pressures, lowering its revenue outlook to $41.1 billion–$41.9 billion from $41.4 billion–$42.2 billion.

$KSS ( ▼ 2.46% ) reported a Q1 net loss of $0.13 per share, narrower than the expected $0.37 loss, with revenue of $3.23 billion beating estimates despite a 3.9% decline in comparable sales. The company reaffirmed its full-year guidance, expecting net sales to decline between 5% and 7%. The stock jumped at open before dropping into a decline.

HP shares fell 7% after reporting Q2 adjusted EPS of $0.71, missing estimates of $0.80, while revenue rose 3% year-over-year to $13.22 billion. Analysts cut price targets, citing tariff-related cost pressures and weaker-than-expected guidance, with HP lowering its full-year EPS outlook to $3.00–$3.30 from $3.45–$3.75.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Core PCE Price Index (8:30am), Goods Trade Balance (8:30am), Chicago PMI (9:45am), Michigan Consumer Sentiment (10:00am), Fed Bostic Speech (12:20pm), Fed Goolsbee Speech (7:30pm). 📊

Pre-Market Earnings: Canopy Growth Corporation ($CGC).🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋