CLOSING BELL

Tech Climbs While Market Prices In Trade

The market did its best to handle new tariffs in stride. The effective rate on average for all imported goods now sits at roughly 18%, the highest in nearly a century, according to the WSJ.

It could be because of exemptions. Apple’s Tim Cook showed off gifts to the administration in the White House, and boasted a domestic manufacturing plan that helped his firm avoid the newest war-focused sanctions on trading partners with Russia. Others are joining the push to land an exemption promise stamped from the Oval Office, including commodity-specific allowances like Brazilian orange juice and Chilean copper.

The American Chamber of Commerce in Brazil found 43% of Brazil’s $42.3B exports to the U.S. are included in some tariff-dodging deal. Maybe it won’t be so bad after all. 🌮

Today's issue covers The Trade Desk tanked after beating estimates, OpenAI launches next step in artificial intelligence, and more. 📰

With the final numbers for indexes and the ETFs that track them, 5 of 11 sectors closed green, with utilities $XLU ( ▲ 1.11% ) leading and health care $XLV ( ▼ 0.42% ) lagging.

S&P 500 $SPY ( ▲ 0.73% ) 6,340

Nasdaq 100 $QQQ ( ▲ 1.07% ) 23,389

Russell 2000 $IWM ( ▲ 1.09% ) 2,214

Dow Jones $DIA ( ▲ 0.78% ) 43,968

STOCKS

Speaking Of Earnings Reactions, The Trade Desk Tanks After A Beat 🐻

Reporting after the bell, $TTD ( ▲ 3.19% ) fell like a rock tied to an anchor despite an all-around beat. In-line adjusted EPS met expectations, a revenue of nearly $700M beat Wall Street by more than a couple of million, and a Q3 guidance that was well above what traders were looking for.

Still, the stock was down nearly 30% right after the results. In a week of volatile opens and report reactions, this one stands out. ❤🩹

Can someone explain this price action?

The company also announced an executive board refresh. CFO Laura Schenkein will transition away from her position, replaced by Alex Kayyal by August 21.

Kayyal is a current board member, replacing Schenkein and her decade of leadership positions at TTD. Kyyal has decades of experience in fintech, with time at Salesforce and Lightspeed Ventures, and even trad-fi experience from way back when at investment bank Merrill Lynch.

That is to say, if Schenkein’s removal is the reason the stock is tanking, it’s not a very compelling one.

One Stocktwits user pointed out the options implied move after the report was just 12%.

Speaking of, $XYZ ( ▲ 0.49% ) was actually climbing 12% after Blocks post-market report showed a boosted year guidance and profit beat. At least some stocks were making cents.

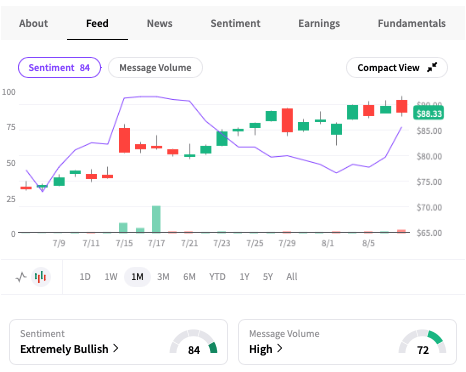

Not to be caught lacking in optimism, Stocktwits users went ‘extremely bullish’ on the sudden price cut.

SPONSORED

How Regular Investors got an 89,900% Return

Institutional investors back startups to unlock outsized returns. Meanwhile, regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? That’s worth $1+ million, an 89,900% return on investment.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors that backed Uber, Venmo, and eBay also backed Pacaso. Now, you can join them and share in Pacaso’s upside for just $2.90/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Comparisons to other companies are for informational purposes only and should not imply similar success.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

AI NEWS

Imagine A Really Really Smart Chat Bot 🤓

OpenAI announced the launch of ChatGPT-5, calling it a “major upgrade” with faster thinking, fewer hallucinations, and expert-level responses across all tiers. Chief Sam Altman said if GPT 3 was like a high schooler, GPT 4 was a college graduate, and GPT 5 was an expert, doctor, or PhD-level agent.

“We think you will love using GPT-5 much more than any previous AI." Altman said in a video. "With GPT-5, now it is like talking to an expert. A legitimate PhD-level expert in any area you need, on demand, that can help you with whatever your goals are."

Altman said it was a major step closer to artificial general intelligence or AGI, and Microsoft said GPT-5 is coming to its products as early as Thursday.

Not to be left out of the news, XAI owner Elon Musk replied to Microsoft’s Satya Nadella that OpenAI is going to eat his firm alive. He also said a new version of Grok will come later this year. Read more

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → Grab Yours Now

POPS & DROPS

Top Stocktwits News 🗞

Duolingo soared 30% intraday after a beat-and-raise Q2 report, with retail chatter spiking 1,407% and analysts hiking price targets on AI momentum and monetization gains. Read more

Apollo increased its loan to SoftBank’s Vision Fund 2 by $900M to $5.4B, marking a record NAV deal amid booming demand for private capital debt. Read more

Crocs’ CFO warned of wholesale headwinds and forecast a mid-single-digit decline for the core brand in Q3, offset by international growth. Read more

AppLovin jumped 13% intraday after Wall Street raised price targets on strong Q2 earnings and optimism around its new e-commerce product. Read more

GM will source batteries from China’s CATL for its next-gen Bolt EVs despite Trump’s 80% tariff, calling the move temporary until U.S. production ramps up. Read more

Warner Bros. Discovery CFO said the company took a short-term hit for long-term gains from its content strategy, citing over $1B in intercompany profit and momentum ahead of its 2026 corporate split. Read more

Ralph Lauren tumbled nearly 8% intraday after its CFO flagged tariff risks and issued cautious guidance for the second half of 2025 despite strong Q1 earnings. Read more

Firefly Aerospace jumped 56% intraday on its Nasdaq debut, raising $868M at a $6.3B valuation as retail sentiment surged despite mixed trading intentions. Read more

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: U.S. Baker Hughes Oil Rig Count (1:00 PM), U.S. Baker Hughes Total Rig Count (1:00 PM). 📊

Pre-Market Earnings: Canopy Growth ($CGC), FuboTV ($FUBO), Under Armour ($UAA), Tempus AI ($TEM), TeraWulf ($WULF), Under Armour ($UA), Wendy’s ($WEN), and AMC Networks ($AMCX). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋