Presented by

CLOSING BELL

Tesla Looking Red

The market fell Wednesday as tech sold off, following weaker-than-expected reports from Netflix. After the bell, Tesla disappointed with its Q3 report despite the first revenue growth in nine months, and IBM beat estimates but its stock sold off after a 30%+ gain this year.

The gov shutdown is now the second-largest in history, with no end in sight. Meme stocks flew, Beyond Meat flew at open, up nearly 100% and almost hitting $8/share, before falling back for the day. Bitcoin fell below $110k again, while gold tried to recover.

It’s the second day of Stockoberfest in Coranado, CA, Check in wherever you catch vertical video for our top speakers. 👀

Today’s Rip: Tesla falls following 40% profit dip, Beyond bumps 100%+ before falling back, and more. 📰

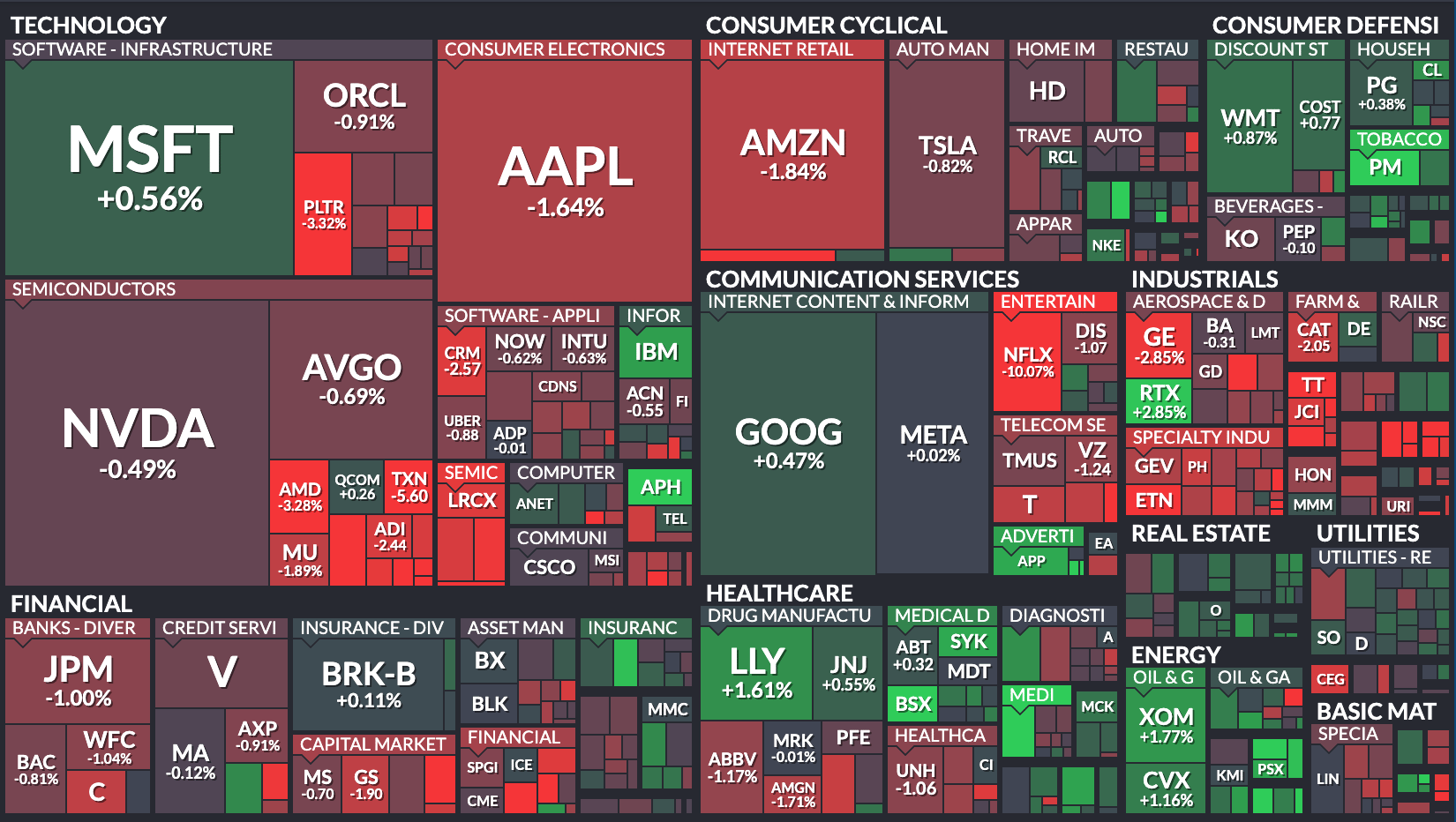

4 of 11 sectors closed green. Energy $XLE ( ▼ 0.09% ) lead and industrials $XLI ( ▲ 1.23% ) lagged.

EARNINGS

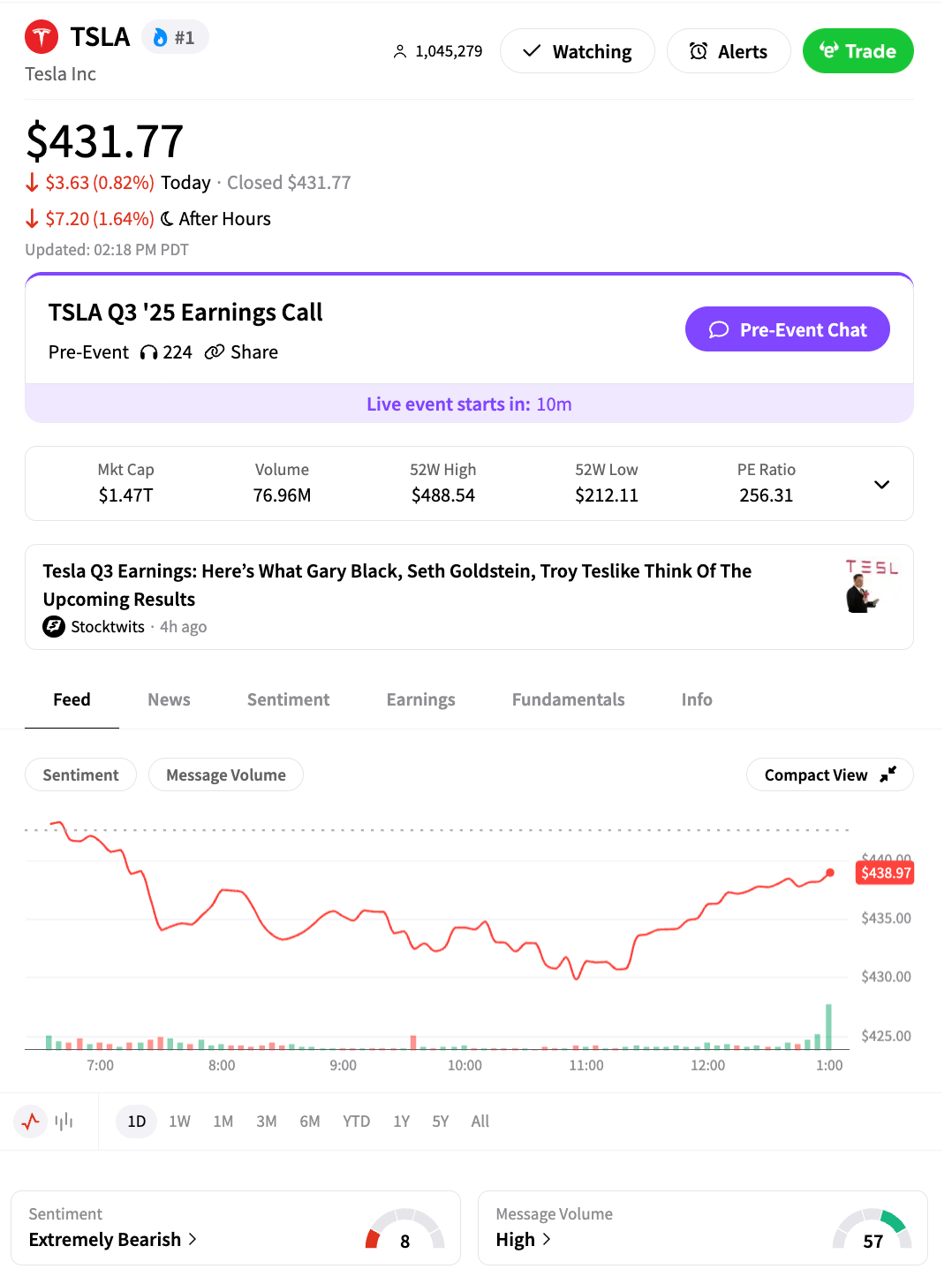

Tesla Falls After Record Deliveries Meet Record Expenses 🚘

Tesla was falling $TSLA ( ▲ 2.39% ) after the bell. The EV giant pulled in $28B in revenue for the quarter, a 12% climb after some flat growth this year, but adjusted earnings were down 31% to just 50C/share, below estimates that expected a 24% drop. The initial release held little promise for the future, for a stock that is highly dependent on forward-looking ideas.

Operating profit fell a whopping 40% in the quarter. The company said the “difficult-to-measure impact” of trade and changes to its carbon emission credit sales hurt the bottom line. Carbon credit sales fell 44% to $417M. The profit decline came as automotive sales grew to nearly 500k, a record high number of deliveries.

“While we continue to execute on innovations to reduce the cost of manufacturing and operations, over time, we expect our hardware-related profits to be accompanied by an acceleration of AI, software, and fleet-based profits,” the company said in its shareholder presentation.

Tesla’s energy business grew 44% to $1.1B in gross profit. By revenue, energy and carbon sales together bring in nearly $4B, compared to $21B in automotive revenue for the quarter. The company bills itself as a tech firm, pushing its self-driving goals and new robotaxi service, but ‘services and other revenue’ only pulls in $3.5B.

Tesla praised the expansion of its robotaxi services in Austin and San Francisco Bay, but made no mention to any revenue the services pull in.

Musk said on the earnings call that Tesla is the leader in real-world implementation in AI, and said people are not appreciating the shockwave that will hit when software updates turn Teslas into full self-driving. He did not say when that would be. Musk did say he hopes to have robotaxi operations in eight metro areas by the end of the year. As he concluded his opening, saying FSD helps him “imagine a world with no poverty,” the stock fell further. 🙄

The release is just two weeks away from Chief Elon Musk’s big annual meeting, where shareholders will vote on his $1T pay package.

SPONSORED

Elon Musk: “Robots Will…Do Everything Better”

And it’s already happening.

Just look at fast food. Miso Robotics is already delivering an AI-powered fry-cooking robot named Flippy that can cook perfectly 24/7.

With the restaurant industry grappling with 144% employee turnover rates and rising minimum wages, it’s no surprise that major brands like White Castle are turning to Miso.

Now, after selling out the initial run of its first fully commercial robot in one week, Miso is scaling production to 100,000+ U.S. fast food locations in need. That’s accelerated by a brand-new manufacturing partnership, joining established partners like NVIDIA, Amazon, and Uber AI.

And you can become an early-stage investor today. Just don’t wait. Invest in Miso before tomorrow, the final day to invest this year.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

MORE EARNINGS NEWS

IBM Beats Estimates, But Stock Sells Off

IBM beat estimates and raised guidance for the coming quarter, but the stock fell after hours $IBM ( ▲ 2.67% ).

The American computer maker said Q3 revenue was $16.33B, and adjusted earnings were $2.65/share. Revenue was up 9% from last year, with software sales leading growth. The company grew its cash pile by $3.1B, ending the quarter with a whopping $15B in cash,

"Clients globally continue to leverage our technology and domain expertise to drive productivity in their operations and deliver real business value with AI. Our AI book of business now stands at more than $9.5 billion," said Arvind Krishna, chairman, president, and CEO of IBM.

Winnebego $WGO ( ▼ 0.11% ) shares flew after the RV caravan company swung to a fourth-quarter profit, sales climbing 7.8% to $777.3M. It was a record day for the stock, the most it has gained in one day for 45 years. The company said its typically older customer base shifted younger in the past quarter.

Intuitive Surgical climbe $ISRG ( ▲ 0.39% ) after the robot surgery company posted Q3 earnings that topped estimates. It expects its da Vinvi system to grow a total 17.5% this year, upping its past forecast for 15%.

TRENDING

Meat Alternative Looks More Like Alternative Asset Than Stock 🍔

Beyond Meat flew Wednesday, up more than 1010% at one point, following what can only be described as a retail investor feeding frenzy. Sure, there was some news to pin the move to: Beyond Meat announced Walmart would soon sell six packs of the firm’s fake meat. The stock was also added to the $MEME ( ▲ 1.47% ) stock ticker, but the real news was about a potential short squeeze.

Tracked on stocktwits, retail trader sentiment for BYND had shifted to ‘extremely bullish’, climbing a few notches higher since the start of the week. The 24-hour message volume for the ticker rose 180%.

It was the talk of the town at Stocktoberfest, with resident retail traders describing the jump as a clear sign that the powers that be are looking to create high volume to get out of the stock, while retail is jumping on the fun and sending prices flying.

The stock felt more volume today than the Nasdaq 100, and Dow Jones Industrial Average combined. 🤯

POPS & DROPS

Top Stocktwits News Stories 🗞

Beyond Meat climbed, then fell 22% after ETF inclusion triggered meme stock frenzy.

AT&T reported strongest broadband growth in 8 years, boosting retail sentiment.

Intuitive Surgical rose 14% after earnings beat and analyst upgrades.

U.S. Government considers new export curbs on software to China.

Standard Chartered warned Bitcoin will fall below $100K before rebounding.

Coinbase fell 6% after confirming plans to list Binance Coin.

General Motors received multiple price target hikes after Q3 beat.

Google claims Willow chip runs ‘Echoes algorithm' 13,000× faster than supercomputer.’

Nebius fell 6% despite Avride securing $375M from Uber.

Meta cut 600 AI jobs to streamline operations.

Krispy Kreme rose 5% after breaking above 200-DMA for first time since Nov 2024.

1-800-Flowers fell 15% despite surging retail interest.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Stocktoberfest Day One Snitzle Real

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Jobless Claims (8:30 AM), Existing Home Sales (10:00 AM), 5-Year TIPS Auction (1:00 PM), Fed’s Balance Sheet (4:30 PM). 📊

Pre-Market Earnings: American Airlines Group ($AAL), Nokia ($NOK), Blackstone ($BX), Mobileye Global ($MBLY), and Valero Energy ($VLO). 🛏️

After-Market Earnings: Intel ($INTC), Ford Motor ($F), and Alaska Air Gr ($ALK). 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋