CLOSING BELL

The Fallout Has Begun

The market pulled back Thursday, but stock market twitter ramped up. Tesla fell 14% after Musk went wild with his anti-Trump tweets, with enough bikering to help send his EV firm below $1T market cap. At the end of the day, no one was talking about Trump’s phone call with Xi to restart trade talks! Today’s issue covers: Broadcom beat earnings barely, the Musk-Trump feud, and Circle flew after its public listing. 👀

With the final numbers for indexes and the ETFs that track them, 1 of 11 sectors closed green, with communications $XLC ( ▲ 0.21% ) leading and discretionary $XLY ( ▲ 0.22% ) lagging.

S&P 500 $SPY ( ▲ 0.83% ) 5,887

Nasdaq 100 $QQQ ( ▲ 1.36% ) 21,198

Russell 2000 $IWM ( ▲ 0.56% ) 2,102

Dow Jones $DIA ( ▲ 0.58% ) 42,140

EARNINGS

Broadcom Beat But Only Just Barely 🥶

$AVGO ( ▲ 2.54% ) reported Q2 results on Thursday after the market closed. The firm beat estimates, but the stock turned negative after the beat was small.

Broadcom is a major semiconductor player on the Magnificent Seven top stock list shortlist with a market cap of over $1.2T. The firm reported adjusted EPS of $1.58 and revenue of $15B.

Analysts expected earnings of $1.57B /share on revenue of $14.96B according to FactSet.

The firm expects a Q3 of growth, with revenue at $15.8B, but it was not much higher than analyst expectations. Analysts were looking for $1.67/share for the next quarter with revenue at $15.77B. For the full year, analysts were looking for earnings of $6.64, and revenue at $62.44B.

Stocktwits users’ Sentiment climbed on AVGO leading up to earnings

Lululemon $LULU ( ▲ 2.1% ) meanwhile fell 20% after cutting its full-year profit outlook. The firm sees full-year earnings ranging from $14.58 to $14.78, down from its old $14.95 to $15.15 range. Analysts wanted at least $14.86 according to Barron’s.

SPONSORED

Cycurion, Inc. $CYCU Achieves Full Year Profitability & More

Cycurion, Inc. $CYCU could emerge as a cybersecurity force with two major new wins: a $33M state-level higher ed contract and a $6M award from a top municipal transportation agency. CYCU just posted $17.8M in 2024 revenue, up +58.9% YoY, with $2.3M in adjusted EBITDA and $1.2M in net income— marking its first full year of profitability. EPS improved to $0.07 basic and $0.01 fully diluted.

With growing federal, state, and municipal trust, CYCU is scaling fast in the high-demand cybersecurity sector. Government-grade protection, real profits. 🔐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

STOCKS NEWS

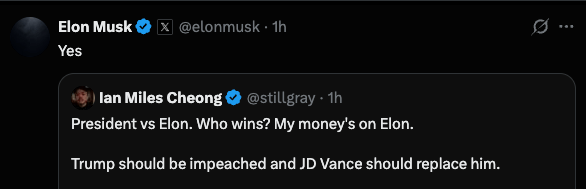

Tesla Is Between A Rock (Musk) And A Hard Place (Trump) 🪨 🏦

A week after receiving a key to the White House, Elon Musk called out President Trump and the GOP spending bill, claiming the president would not have won the election without his help. $TSLA ( ▲ 1.53% ) was falling after the fallout and bickering.

Musk took to the social media site he bought to fire shots across Trump’s bow, claiming the Epstein files mention Trump. He told user Autism Capital that without him, the GOP would have lost the House, lost the presidency, and control just a slim majority of the Senate.

Musk was really going at it Thursday

The tweetstorm came after Musk tried to start a ‘Kill the Bill’ campaign Wednesday, and Trump responded that he was disappointed and claimed he kicked Musk out.

What Is He Talking About?

Musk is worried about the size of the spending bill, cited by the Congressional Budget Office to raise the deficit $2.4T, while cutting subsidies and medicare spending. It also cuts overtime taxes, raises deduction amounts, raises the debt ceiling, and brings the military budget to above $1T.

The bill also removes the EV/solar incentive that helped consumers finance purchases in green energy tech, like Tesla cars. Leading up to the bill, analysts had cited the Project 2025 goal to cut EV credits as beneficial, because… Tesla was already established, and the tax write-offs mostly help start-up firms.

Of course, cutting the subsidy also raises the price of Teslas by $7,500 a pop, and Tesla sales have started to decline even with cheaper car prices. In May, the firm reported its worst quarter for deliveries since 2022, with nearly 337k cars shipped, missing estimates for 390k.

It’s as if Musk finally asked himself, ‘Are people going to buy more Teslas when they’re more expensive?’

Trump took to the tweeting site he owns and said that he and Musk were no longer on good terms, and that Musk knew about the EV cut for months.

Trump’s Truth Social

In response to the public blowup feud between the leader of the free world and the man who paid him $300M for an office in the White House, Tesla was falling like a rock.

POPS & DROPS

Top Stories From The Stocktwits Newsdesk 🗞

U.S. trade deficit narrowed in April as Trump’s tariffs took effect, slashing imports by 16% and cutting the trade gap by over 55%. Read more

Howard Lutnick called for stricter enforcement of export restrictions on China, warning that Beijing is accelerating efforts to replicate U.S. technology. Read more

Fed Governor Adriana Kugler signaled support for steady interest rates, citing upside risks to inflation from tariffs and potential downside risks to employment. Read more

Uber Eats expanded its retail delivery service by partnering with Five Below, allowing customers to order from over 1,500 stores nationwide. Read more

GameStop surged after revealing its first-ever Bitcoin purchase, but analysts flagged its valuation as excessive compared to MicroStrategy’s holdings. Read more

Boeing reached a $1.1 billion settlement with the DOJ to avoid prosecution over the 737 Max crashes, agreeing to invest in compliance and safety programs while compensating victims' families. Read more

Brown-Forman plunged over 16% after warning of a tough fiscal 2026, citing macroeconomic volatility, tariffs, and soft consumer demand. Read more

Yum Brands was upgraded to "Buy" at Goldman Sachs, citing strong unit growth, a resilient franchise model, and accelerated digital integration. Read more

Five Below raised its full-year forecast after a strong Q1, citing robust sales growth and an expanding store footprint. Read more

STOCKTWITS CREATORS

Daily Rip Live’s Shay Boloor Announces New Venture “Futurum Equities Research” 🤩

You already know Shay Boloor as host of Stocktwits’ “Daily Rip Live” morning show, where he delivers expert takes on the latest market trends. Now, he’s joining Futurum Group to launch and head Futurum Equities Research as Chief Market Strategist.

The Futurum Equities philosophy, ‘A.I.R’ (Access, Insights, Research), aims to level the playing field and provide retail with the edge that institutions have long held. Stocktwits will be a key partner, with Shay building on his existing collaboration with Stocktwits to host and distribute exclusive video content and shows. 🤝

Be sure to follow @Shayboloor on Stocktwits and subscribe to the Stocktwits YouTube channel to stay on top of this exclusive content. 🚨

Check out today’s Daily Rip Live where Shay discusses the partnership details. Plus, he debates Apple and MongoDB with Michael Parekh, and checks in with IonQ’s CEO Niccolo De Masi on the latest quantum computing trends. 🤯

IPO NEWS

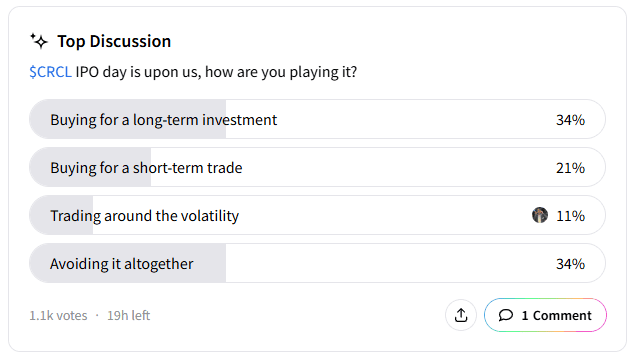

Crypto Market Sees Major IPO For Stablecoin Giant ⭕

$CRCL ( ▲ 33.93% ) flew 168% Thursday after the stable coin issuer went public on the New York Stock Exchange at $69/share, before closing at $83.

The firm issues USD Coin, the second-largest stablecoin in the world, with a market cap at around $61B. Stablecoins claim to hold backings in real-world assets like Treasury Bills to maintain a price near enough to a U.S. Dollar, at least if you squint.

The launch comes at a positive time for crypto, under the Trump administration, with the presidential family recently announcing its very own cryptocurrency app.

It’s also a flush time for IPO’s, even during tariff market craziness: eToro climbed 29% on its first trading day, and Hinge Health climbed above its listing price.

According to the Wall Street Journal, the firm raised more than $1B during its listing. WSJ reported that companies that went public are trading up 15% from listing prices so far this year.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Nonfarm Payrolls (Apr) (08:30), Unemployment Rate (Apr) (08:30). 📊

Pre-Market Earnings: Exxon Mobil ($XOM), FuboTV ($FUBO), Chevron ($CVX), Shell ($SHEL), Butterfly Network ($BFLY), Wendy's ($WEN), Cinemark Holdings ($CNK),Cigna Group ($CI), Brookfield Renewable ($BEP), Apollo Global Management ($APO), T. Rowe Price Group ($TROW). 🛏️

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋

…