NEWS

The Great $4 Trillion Day: Are We Back?

Source: Tenor

Holy guacamoly, now that’s a rebound. The market printed green seconds after President Trump tweeted that he was pausing tariffs on nearly every country with a tariff rate over 10%.

It wasn’t all good. China tariffs were raised to 125%, placing tech import firms like Apple in a losing trade position. Our largest trading partners, Canada, Mexico, and most likely the EU, still face higher tariffs, but on Green Wednesday, the market did not seem to care. 👀

Today's issue covers Trump’s insider hint we all missed, pharma pill pinching, and the end of this season’s forward guidance. 📰

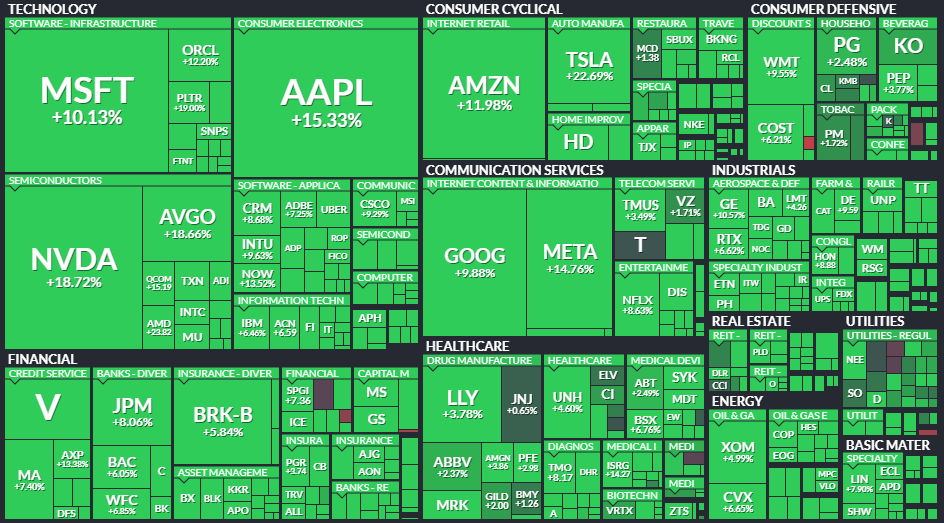

Here’s the S&P 500 heatmap. All sectors closed green, with technology (+24%) leading and real estate (+2%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,457 | +9.52% |

Nasdaq | 17,125 | +12.16% |

Russell 2000 | 1,913 | +8.66% |

Dow Jones | 40,608 | +7.87% |

STOCKS

We’re Gonna Insider Trade So Much We’ll Get Tired Of It 🐻

The day started like most others: fear and loathing, slow index gains while we awaited a rain of tweets that would likely shake things up. China responded overnight with 84% more tariffs, and Jamie Dimon said on Fox Business that, yeah, he is pretty sure we are trending toward a Recession. ⚠

Well, it turns out the president might have heard Dimon, and shortly after gave what could be the largest insider (outsider?) trading tip in history:

It seemed like just another Trumpism, signed with his initials or maybe his stock ticker, DJT. Even on Stocktwits, less than half of the readers believed it was real. 😵💫

Shortly after, the 10-year Treasury Bond sale went surprisingly steady. Bond markets, something Trump has always clashed with, were selling off this week in a way that could signal a longer-term bear market. The U.S. 30-year yield rose 0.50 in three days, marking its fastest sell-off since 1982. 😨

Then came the turn. ⏪

Right after 1 pm ET, the president posted that China and countries that had fought back would be hit, but countries that called him were free from large tariffs for now. As Trump clarified in front of the White House, he had watched as the stock and bond market got scared and “yippy.” Then, every sector of the market went green.

Chip stocks hit their best day ever: Apple had its best day since 1998, and the Philadelphia Semiconductor Index saw its best day in history. Speaking of personal bests, the Dow saw its biggest one-day point gain in history.

The Nasdaq hit its best day since 2001 and its second-best day of all time, though still 14% lower than recent highs. The S&P 500 added $4.3T on its 9% climb, according to Bloomberg.

There are still reasons for pause. Ten percent tariffs on everyone are still five times more than we have seen in decades, and Canada, Mexico, the EU, and China still face high charges. Semiconductors and tech made overseas were already down 30%+ from recent highs. 📊

Based on last year’s import numbers, trade tariffs with China will result in ~$550 billion in extra taxes this year. While Goldman Sachs analysts cut their recession likelihood, there is still a risk: the world has 90 days to negotiate with Trump, or the levies will come back.

P.S. We are collecting the craziest charts from today’s historic day on Wall Street. Drop it in this thread for a chance to win a ticket to the Cashtag Awards. 🤩

SPONSORED

Today’s Fastest Growing Company Might Surprise You

🚨 No, it's not the publicly traded tech giant you might expect… Meet $MODE, the disruptor turning phones into potential income generators.

Mode saw 32,481% revenue growth, ranking them the #1 software company on Deloitte’s 2023 fastest-growing companies list.

📲 They’re pioneering "Privatized Universal Basic Income" powered by technology — not government, and their EarnPhone has already helped consumers earn over $325M!

Invest in their pre-IPO offering before their share price changes on May 1st.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

EARNINGS

This Might Be A Tough Pill To Swallow🙃

Before the afternoon market defibrillation, the pharmaceutical industry topped the largest decliners in the S&P 500 after Trump's comments last night that pharmaceutical levies were on the way.

Firms like $BMY Bristol-Myers fell this morning but ended the day marginally higher. Still, it begs the question: Will pharma firms face industry-specific taxes like auto, steel, and energy? If so, what will the economic impacts be? 🤔

Source: CNBC

Here’s what he said:

“We’re going to be announcing very shortly a major tariff on pharmaceuticals,” he said a the National Republican Congressional Committee dinner. “They will leave other places because they have to sell — most of their product is sold here and they’re going to be opening up their plants all over the place.”

It wasn’t the first time the president spoke about them. Last week, Trump said pharma tariffs were coming at a level “you haven’t really seen before,” according to CNBC.

Speaking Friday, Eli Lilly Chief David Ricks warned that big pharma would have to immediately cut costs, cutting R&D first. Tom Kraus, VP of Government Relations for the American Society of Health-System Pharmacists, said increasing costs in pharma from tariffs would hurt the lowest income bracket hardest. ⚠

CNN Health noted that 90% of medicines prescribed in the U.S. are generics, and Kraus said it would become impossible to sell these pennies-per-dose drugs profitably.

In addition to industry-specific tariffs, reciprocal levies with the EU might affect the $97 billion pharmaceutical product exports to the U.S. from firms like Ozempics from maker Novo Nordisk. 💊

Plus, while we’re chatting about pharma stocks, here are other noteworthy pops and drops from the sector. 👇

Bristol Myers ($BMY +1%): The pharmaceutical company won the dismissal of a proposed class action accusing it of fraudulently obtaining patents.

Immunic, Inc. ($IMUX +9%): The biotech announced it is looking to raise about $5.1 million through a registered direct offering led by Aberdeen Investments.

Theratechnologies ($THTX -9%): The biotech’s first-quarter earnings fell below Wall Street estimates, reporting revenue of just 17% YoY.

PacBio ($PACB +18%): The biotech is executing a plan, including job cuts, to reduce the annualized operating expense run rate by $45 to $50 million by year-end.

Phio Pharmaceuticals ($PHIO +54%): The pharmaceutical company announced that a Safety Monitoring Committee (SMC) recommended escalating the dose in the clinical trial for its lead product candidate, PH-762.

PRESENTED BY STOCKTWITS

Stocktwits Users Navigate The Selloff 🧭

Stocktwits users @Gpaisa, @JFDI, and @Holdingbags walk through how they’re approaching this volatile market. Topics include:

The Nasdaq 100’s current pattern and its top components

Sloping moving averages and the “mental capital” grind

Risk management, trailing stops, and building back from drawdowns

When to buy, when to wait, and why “seat time” still wins

EARNINGS

There Goes All Forward Guidance 🙃

Earnings season kicks off on Friday with the big banks, but today, we got a taste of how almost every company will handle the current environment.

Delta Airlines’ first-quarter earnings topped Wall Street estimates. Still, CEO Ed Bastian disclosed that the company is reducing planning capacity growth in the second quarter, citing economic uncertainty around global trade. 🔻

He added, “In this slower-growth environment, we are protecting margins and cash flow by focusing on what we can control. This includes reducing planned capacity growth in the second half of the year to flat over last year while actively managing costs and capital expenditures.”

Delta also decided NOT to update its full-year outlook because, given the overall uncertainty, how could it possibly do that? 😐

North America’s largest retailer and employer, Walmart, also had trouble predicting its future. The company reiterated its first-quarter sales guidance, but said that the range of outcomes for its Q1 operating income growth has widened.

This is “due to less favorable category mix, higher casualty claims expense and the desire to maintain flexibility to invest in price as tariffs are implemented,” Walmart said.

Retailers like Walmart will have a tough time in this environment. They need to decide whether they will eat the rising costs of goods, or attempt to pass it along to price-sensitive consumers who have already been pulling back on spending.

Good luck to all the CFOs navigating this and to investors who are trying to determine their companies' future earnings. 😵

For now, sentiment is pretty rough when it comes to the economy. Roughly 72% of the 4,300 respondents on Stocktwits see the U.S. falling into a recession during 2025. 🚨

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Consumer Price Index (8:30 am), Initial/Continuing Jobless Claims (8:30 am), Fed Logan Speech (9:30 am), Fed Goolsbee Speech (12 pm), Monthly Budget Statement (2 pm). 📊

Pre-Market Earnings: CarMax ($KMX), Lovesac ($LOVE), Byrna Technologies ($BYRN). 🛏️

After-Hour Earnings: N/A — enjoy your evening. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🧑🏫 Join IBD’s experts for a comprehensive workshop where you’ll learn the secrets of short selling*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋