CLOSING BELL

The Great Coffee/Soda Breakup

The market fell Monday, selling off after a post-Powell policy speech bump over the weekend. Now that the earnings season is coming to an end, the record-high market is watching for what a few key trend setters say about what comes next: Fed Chair Jerome Powell, trade trend setter President Trump, and Chief Jensen Huang from Nvidia.

The majority of the S&P 500 fell, with the green concentrated in the energy and communications sectors. Tech kept on falling, dark red and ‘angry’ according to Bloomberg TV. The Trump administration was busy discussing deals, commenting on the Intel Chips Act turned stake purchase that might inspire more, and threatening high tariffs on China if they don’t secure favorable rights to rare materials.

After the bell, the admin announced they had reached a trade deal with South Korea, unchanged at 15% tariffs, and expected shipbuilding investments after a meeting with President Lee Jae Myung. 👀

Today’s issue covers: Dr. Pepper and Keurig are breaking up, earnings season is ending with a bang, and more. 📰

2 of 11 sectors closed green, with energy $XLE ( ▼ 0.42% ) leading and staples $XLP ( ▼ 0.81% ) lagging.

COMPANY NEWS

Big Food Braces For Another Big Breakup🩸

In the second big food breakup news this summer, $KDP ( ▼ 2.84% ) fell after a report the Keurig Dr Pepper brand struck a deal to buy Amsterdam-based coffee company JDE Peets for $18B, according to WSJ.

The idea is to unwind a 2018 merger that combined Keurig coffee and soda giant Dr. Pepper within the same corporate family. KDP will pay JDE shareholders $37/share in cash, to serve as a new entity to separate Keurig from the soda brand as a standalone coffee beverage company.

The new company would have about $16B in annual revenue, and the new Dr. Pepper would pull in about $11B. Chief Executive Tim Cofer said the move was to boost earnings under two separate stocks. Keurig’s coffee business has stagnated in the past couple of years, and Cofer said tariffs only make it worse.

JAB Holding bought JDE Peet’s public in 2020, though the stock price is below the IPO price even after a 16% jump on Monday. JAB Holding owns 70% of JDE and owns 4% of KDP.

The news follows a report that Warren Buffett’s Berkshire was finally writing down its purchase and merger of Kraft and Heinz in 2015, a deal that went bad in just four years. Since the ketchup and cheese merger, the stock is down 60%. The breakup is one for the ages: even if products go hand in hand at a July 4th barbecue, they might not do well on Wall Street. 🍔

MACRO NEWS

Earnings Season Ends With a Bang 💣

The second quarter earnings season has nearly come to an end, with just a handful of stocks left to report. Nvidia is set to report its industry-leading semiconductor sales later this week on Wednesday after the closing bell. The company, on a winning streak as a high-flying sales bombshell that helped push the entire market into the AI tech frenzy, is receiving bullish analyst projections for Q2 earnings.

Analysts at shops like JPMorgan are pointing to CapEx spending jumps at other tech giants, driving even more business for Nvidia. According to analyst views compiled by Fiscal AI data, the Street expects Q2 revenue to be $46 billion and earnings per share EPS to hit $1.

How Did The Earnings Season Go Overall?

David Kostin, chief strategist at Goldman Sachs, wrote to his followers today that with 2Q 2025 earnings nearly wrapped, the market did pretty well rebounding from spring's tariff shock.

Companies on the S&P 500 posted an 11% earnings per share gain from last year. The lofty growth raked in by some of the world’s largest companies was nearly triple the 4% Street estimate. Turns out, slashing estimates in spring set the bar so low, 60% of companies pole-vaulted over it by more than a standard deviation. 🏅

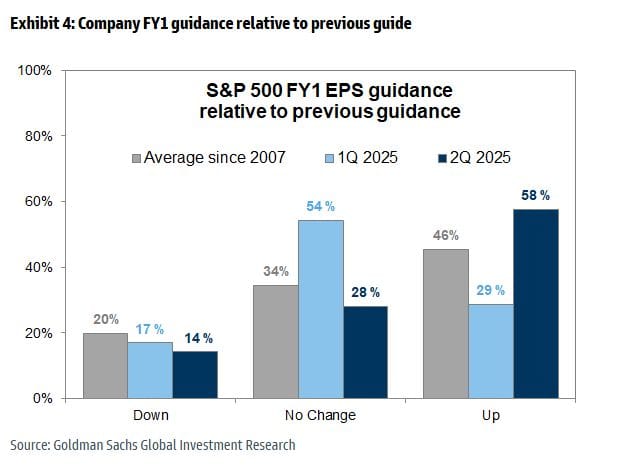

Guidance Goes Vertical 📡

58% of firms raised full-year guidance, double the rate from 1Q. Analysts followed suit, hiking 2H 2025 and 2026 EPS forecasts across most sectors. But don’t get too comfy: growth is still expected to slow from 11% in 2Q to 7% in 2H.

Margins vs. Tariffs: Who Wins? 🥊

Despite tariff headwinds, S&P 500 margins held firm in 2Q and are expected to stay flat through year-end. But 2026 consensus forecasts show margin expansion that feels... ambitious. Analysts may be overestimating how much pricing power companies really have.

Dollar Drops, Sales Pop 💸

A weaker greenback gave large caps a boost in nominal sales growth. But constant-currency real growth actually slowed for the S&P 500 and shrank for mid- and small-caps. Analysts expect nominal sales to hold steady in 2H, but FX tailwinds may fade.

Mega-Cap Tech: Still Magnificent 🤖

The Magnificent 7 crushed it again. EPS for the big boys was up 26% YoY in 2Q, beating consensus by 12%. NVDA hasn’t reported yet, but the Mag 7’s 2026 EPS estimates are up 1% YTD, while the rest of the S&P 500 got cut by 4%. Capex for the crew? Raised 29% to a jaw-dropping $461B.

SPONSORED

7 Mistakes People Make When Choosing a Financial Advisor

Working with a financial advisor can be a crucial part of any healthy retirement plan.

In fact, SmartAsset’s latest proprietary model reveals that working with a financial advisor could potentially add from 36% to 212% more dollar value to investors' portfolios over a lifetime, depending on multiple unique, individual factors.¹

But choosing the wrong one could wreak havoc. Avoiding these 7 mistakes people make when hiring an advisor could potentially help save you years of stress. See the list.

Interested in finding a financial advisor? SmartAsset's no-cost tool can help you find and compare vetted fiduciary advisors serving your area. All advisors on the platform have been rigorously screened through a proprietary due diligence process and are legally bound to work in your best interest.

This is a hypothetical example and is not representative of any specific security. Actual results when working with a financial advisor will vary. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

POPS & DROPS

Top Stocktwits News Stories 🗞

Roblox was called the “most compelling growth opportunity” in gaming by Wedbush, which cited strong platform momentum, decisive child safety actions, and a $165 price target.

Intel warned shareholders of delays, legal risks, and geopolitical fallout tied to the U.S. government's equity stake conversion. Kevin Hassett said the stake was more like a “sovereign wealth fund,” while Trump said the U.S. paid “zero” for the $11B equity deal.

Ed Yardeni warned the Fed against a September rate cut, arguing it would undermine inflation-fighting credibility as tariffs keep inflation stuck near 3%.

Opendoor surged 13% and topped Stocktwits trends, then fell 9% as Powell’s Jackson Hole speech boosted housing sector optimism and rate cut hopes.

Aehr Test Systems jumped 35% after securing a major AI customer order for six ultra-high-power burn-in systems.

Netflix shocked the box office by topping charts with its re-release of KPop Demon Hunters, outperforming A24’s Weapons despite limited theater participation.

Tilray rallied 20% after Jefferies hiked its price target, citing Trump’s push to reschedule marijuana and expand U.S. access.

Keurig Dr Pepper dropped 11% following its $18 billion acquisition announcement of Dutch coffee giant JDE Peet’s.

PDD jumped 11% pre-market after beating Q2 earnings expectations, with adjusted EPS of RMB 22.07 and strong retail sentiment driven by Temu’s global traction. The stock swung during regular trade, and fell back to a less than +1% climb.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

Powell’s Last Jackson Hole, Stagflation Fears, and Nvidia Earnings Ahead

Welcome back to Daily Rip Live with Katie Perry as she’s joined by Bloomberg Quant Researcher Steve Hou and Carson Group Chief Market Strategist Ryan Detrick for a jam-packed market session. From Powell’s last Jackson Hole speech to stagflation fears, inflation strategies, and Nvidia’s upcoming earnings, today’s conversation covers everything investors are watching heading into Labor Day.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Trade Balance (8:30 AM), S&P Global PMI (9:45 AM), ISM Non-Manufacturing PMI (10:00 AM), 3-Year Note Auction (1:00 PM), Atlanta Fed GDPNow (Q3) (1:00 PM), API Weekly Crude Oil Stock (4:30 PM). 📊

Pre-Market Earnings: EHang Holdings ($EH), Gaotu Techedu ($GOTU), Daqo New Energy ($DQ), Bank of Montreal ($BMO), Bank of Nova Scotia ($BNS). 🛏️

Post-Market Earnings: Okta ($OKTA), Applied DNA Sciences ($APDN), MongoDB ($MDB), Box ($BOX) 🌕

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to see some change? Email me, Kevin Travers, your feedback; follow me on Stocktwits. What did I miss? What do you want to see? I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋