CLOSING BELL

The Weak Holiday Week Continues

Source: Tenor

Everyone is OOO this week, including your normal market sherpa, Kevin Travers, so you’re stuck with me, Tom Bruni, for the next two days. 🧑🏫

In today’s newsletter, we recap 2025’s performance, pay homage to the “Oracle of Omaha,” share a new episode of Stocktwits Retail Edge, and outline the Stocktwits community’s top picks for the new year.

Enjoy the read and have a happy New Year’s celebration. We’ll see you back on Friday for the first trading day of 2026! 🥳

STOCKS

Closing The Books On 2025 Performance 📒

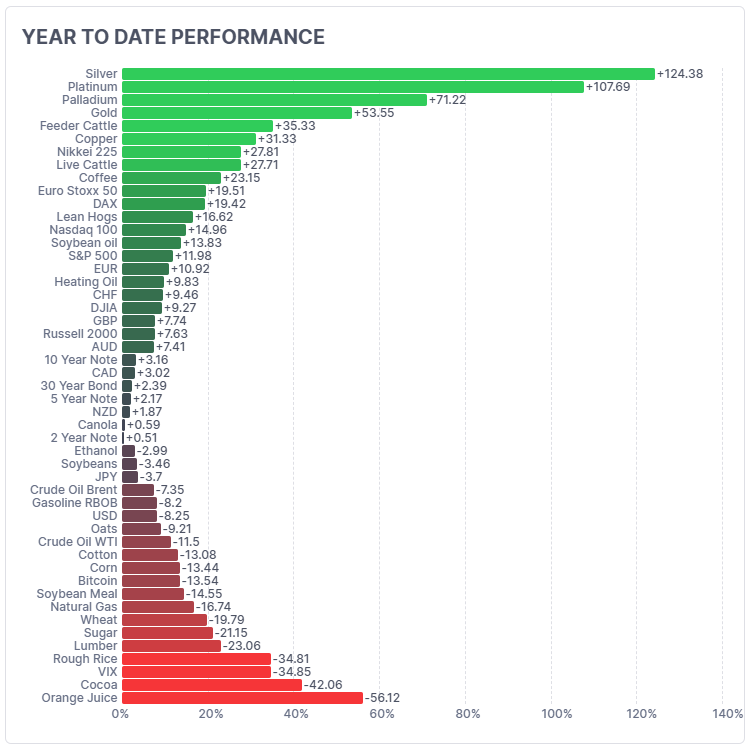

After years of underperformance and frustration, precious metals were the belle of the ball in 2025, with Silver and Platinum both topping 100% gains and Palladium and Gold putting on a show as well. 🏆

Stocks did well too, specifically international markets like Japan’s Nikkei 225, the Euro Stoxx 50, and Germany's DAX, as well as others across the developed and emerging market space. U.S. stocks also performed, led once again by the Nasdaq 100, though small-caps struggled despite their year-end breakout to new all-time highs.

On the downside, several agricultural commodities and energy slipped along with the U.S. Dollar Index, which measures the currency’s performance against the Euro, British Pound, Yen, and four other major world currencies. 💸

Bonds were flat despite several Fed rate cuts, as the market tries to balance risks of a recession via a labor-weakening market and persistent inflation. ⚖

Heading into 2026, strategists across Wall Street are expecting another bullish year, led by the technology and AI trade. What people can’t seem to agree on is crypto, which has been the standout laggard in 2025 and lacks a clear catalyst to move higher. 🐂

Regardless of Wall Street’s views, retail investors are leaning bullish and looking for a fourth year of strength off the 2022 lows. Check out the Stocktwits community’s top picks a few sections down to see what they’re buying and selling in the new year! 📝

SPONSORED BY KNIGHTSCOPE

This Silicon Valley Company Just Launched the Next Phase of Physical AI

Dear Investor,

Across the United States, the cost of keeping people and property secure has spiraled out of control.

That system is breaking under its own weight.

And one American company believes it has the solution.

Knightscope, Inc. (NASDAQ:KSCP) has spent over a decade building and deploying fully autonomous security robots that can patrol, monitor, and detect in real time.

Now the company is entering a new phase with the launch of its most advanced machine yet: the K7 Autonomous Security Robot.

Each unit can perform at an equivalent cost of roughly $15 an hour, a fraction of what businesses pay for traditional guard services.

And that’s why Knightscope (NASDAQ:KSCP) is gaining traction fast.

Download the Corporate Deck Now to see why the K7 could become one of the most important innovations in public safety today.

Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for YOUR further investigation; they are NOT stock recommendations or constitute an offer or sale of the referenced securities.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

RETAIL NEWS

Goodbye To The “Oracle Of Omaha” 🫡

Today is Warren Buffett’s retirement as CEO of Berkshire Hathaway, ending a legendary six-decade run leading the conglomerate. Vice Chairman Greg Abel is taking over operational control, though Buffett will remain Chairman of the board to ensure continuity. 🚢

At 95 years old, Buffett is stepping back from the day-to-day grind of operating, with Berkshire positioned as a net seller of stocks over the last 12 quarters. The roughly $382 billion in cash on its balance sheet has been a “warning cry” of stock market bears, who say valuation has left buying opportunities for prudent investors like Buffett few and far between. ⚠

Still, the company’s portfolio remains heavily invested in blue-chip names like Apple, American Express, Bank of America, Coca-Cola, Chevron, Occidental Petroleum, Moody’s, Chubb, Kraft Heinz, and Alphabet. Now the real question is how Greg Abel and the other managers will adjust this positioning now that they’ve got the reins?

Berkshire Hathaway has lagged the broader market and financial sector since May, when Buffett made his announcement, highlighting investor concern about the transition and whether the stock can perform without Buffett’s touch.

Stocktwits sentiment is in “neutral territory,” signaling the jury is still out among retail investors. Time will tell whether this is a “Be greedy when others are fearful” situation in Berkshire or if the bear’s pessimistic forecast comes true. 🤷

COMMUNITY

The Stocktwits Community’s Top 2026 Picks

We polled the Stocktwits community on its top 2026 picks, and you can view the full thread here. However, we’ve created a summary for your viewing pleasure. 👇

And for those with a more speculative nature, check out the community’s top stocks priced under $10. 🤑

POPS & DROPS

Top Stocktwits News Stories 🗞

Bill Ackman repeats his 2025 top pick for 2026, flagging further upside.

Ned Davis’ Matt Bauer says Silver is in a bubble.

Jim Cramer says Nike exec purchases signal a big year is ahead.

Uber is reportedly looking to acquire parking app SpotHero.

SpaceX’s Chinese competitor LandSpace eyes a $1 billion IPO.

Coupang’s data breach troubles escalate with South Korean regulators.

China earmarks $42 billion for 2026 stimulus projects.

Michael Burry flags Molina Healthcare as the next GEICO.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

STOCKTWITS VIDEO

Your Holiday Watch: A Brand New “Retail Edge” 🍿

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋