The Weekend Rip

Happy Weekend!

Markets swung through a volatile week marked by Nvidia’s earnings, Fed drama, and inflation jitters. Despite record closes midweek and strong macro data, Friday’s PCE spike and the end of the ‘de minimis’ exemption triggered a cautious pullback. With Powell’s rate path still unclear and Lisa Cook’s seat in limbo, September opens with tension and opportunity. Still, August rallies sent all four major indexes higher for the month, muting fears that tariff slowdowns were going to get in the way of economic progress.

Let's recap and prep you for the week ahead. 📝

◀ Markets fell Monday as tech extended its slide and traders digested Powell’s weekend remarks, renewed tariff threats, and the final wave of earnings. Keurig Dr Pepper dropped 11% after announcing a $18B split from its soda business. Despite macro headwinds, S&P 500 earnings so far crushed estimates, with 58% of companies raising guidance and mega-cap tech leading the charge.

🌏 Markets climbed Tuesday as traders braced for Nvidia’s blockbuster earnings and watched the Fed drama unfold. UNH slipped after-hours as DOJ scrutiny intensified, while Trump’s push to remove Fed Governor Lisa Cook sparked legal threats and rate cut speculation. Defense stocks rallied on stake purchase rumors, while Okta and MongoDB beat earnings expectations.

⚡ Markets hit a record close on Wednesday ahead of Nvidia’s earnings, but the stock fell post-report despite posting $46.75B in revenue and $1.05 EPS: solid numbers that felt underwhelming against sky-high expectations. Data center revenue missed some estimates, and Q3 guidance left little margin for error, though China chip sales could add upside. Elsewhere, MongoDB surged 35% on a blowout quarter, Kohl’s jumped 23% on raised guidance, and Snowflake rallied after beating by $600M, while CrowdStrike, NetApp, and Five Below all slipped despite decent results.

🐂 Markets hit fresh records Thursday as traders shrugged off Nvidia’s muted earnings reaction and rotated into broader names. Affirm soared 14% on a revenue beat and bullish guidance, while SentinelOne climbed on strong growth, while Marvell, Dell, and Webull fell on weak outlooks. Macro tailwinds included a 3.3% GDP print, EU tariff rollbacks, and a $5.7B CHIPS Act payout to Intel, while Lisa Cook’s Fed lawsuit and Trump’s digital services tariff threats kept the policy backdrop tense.

😢 Markets closed lower Friday as traders locked in gains ahead of the long weekend, spooked by the highest inflation reading since March and renewed Fed drama. PCE inflation rose 2.6%, with core inflation nearing 3%, while the White House’s move to end the ‘de minimis’ import exemption added uncertainty for retailers and small businesses. Spirit Airlines filed for its second bankruptcy this year, and Fed Governor Lisa Cook’s legal battle to stay on the FOMC board remained unresolved, keeping rate cut speculation alive. An appeals court said most tariffs enacted under emergency justification were illegal, with no news yet as to what that means for importers.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,460 | -0.10% |

Nasdaq | 21,455 | -0.19% |

Russell 2000 | 2,366 | 0.19% |

Dow Jones | 45,544 | -0.19% |

IN PARTNERSHIP WITH MONEYSHOW

Join Stocktwits Editor-in-Chief Tom Bruni At The Orlando MoneyShow October 16-18 🧑🏫

Hey all, Tom Bruni here! I’m joining our friends at the Orlando MoneyShow this October. I’ll cover how to use Stocktwits sentiment to navigate risks and find opportunities in the market. Plus, hear from dozens more experts during this three-day event. Register below and we’ll see you there! 🎫

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

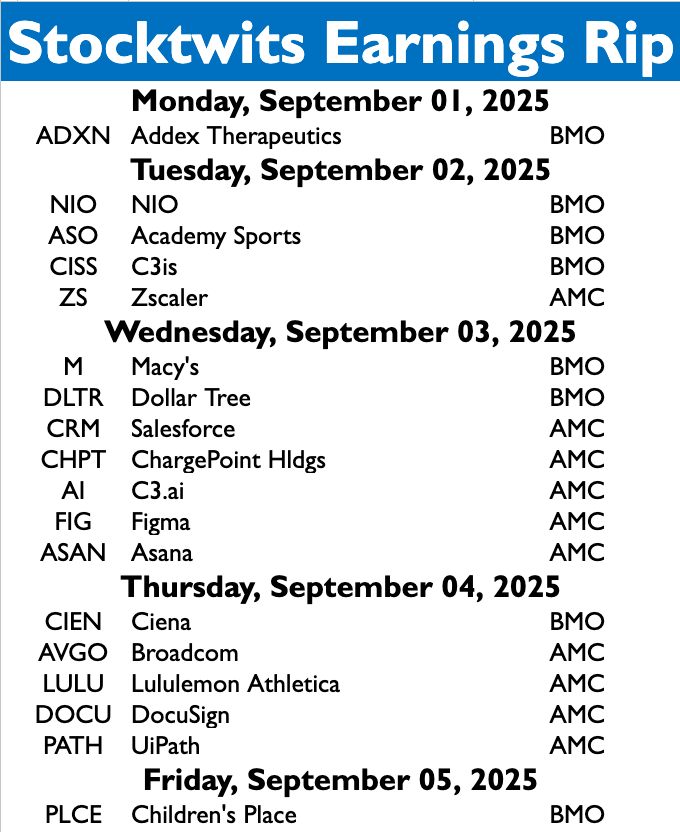

Earnings season is still somehow chugging along, with over 252 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on the job market.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋