The Weekend Rip

Happy Weekend!

Markets whipsawed through a week of record-high tariffs, cautious earnings reactions, and geopolitical curveballs, but tech and retail sentiment kept the rally alive. From Palantir’s billion-dollar breakout to Apple’s tariff-dodging $100B pledge and Freddie/Fannie’s IPO moonshot, investors rode a wave of volatility with surprising optimism. 📉

Let's recap and prep you for the week ahead. 📝

◀ Markets rallied Monday as the EU paused its tariff retaliation and Switzerland signaled openness to renegotiation, lifting the S&P 500 and Nasdaq to their best day since May. Palantir surged after reporting its first-ever billion-dollar quarter, beating estimates with 48% YoY revenue growth and raising full-year guidance to $4.15B. U.S. government contracts held steady, while commercial revenue nearly doubled. Meanwhile, Berkshire Hathaway disappointed with a drop in operating income, currency losses, and a write-down of its Kraft Heinz stake. Buffett’s looming retirement and a cautious cash-heavy posture added to investor unease, though Stocktwits sentiment turned bullish on the dip.

🌏 Markets pulled back Tuesday as trade uncertainty loomed, with anti-Russian oil tariffs and pharma levies weighing on sentiment. AMD posted in-line earnings but fell 4% as investors punished anything short of a beat. Despite 32% YoY revenue growth and strong free cash flow, its China chip ban and cautious outlook dragged peers like SMCI, SNAP, and Rivian down after hours. SMCI missed across the board, yet retail sentiment turned bullish on Stocktwits. SNAP blamed ad platform missteps and trade war fallout for its $262M loss. Meanwhile, OPEN, LCID, and HNGE all reported mixed results, with meme stock OPEN failing to turn a profit despite beating revenue estimates. Only Pfizer and BP stood out with beats and bullish sentiment.

⚡ Markets climbed Wednesday as Apple dodged new tariffs by pledging $100B to U.S. manufacturing, lifting tech stocks despite the Trump administration’s push for 100% tariffs on chips. Apple’s deal includes building iPhone glass in Kentucky and expanding data centers, bringing its total U.S. investment to $600B. Earnings reactions were mixed: Airbnb beat but guided cautiously, falling 6% after hours; Lyft dropped 5% as it lagged Uber; DoorDash, DraftKings, and Duolingo all rallied on strong beats. Arista Networks and Shopify led pre-market gains with 17% and 21% jumps, respectively. Meanwhile, investors punished misses harshly as valuations remain stretched.

🐂 Markets tried to climb Thursday despite record-high average tariffs of 18%, as exemptions and strategic pledges softened the blow. Apple’s $100B domestic investment set the tone, and other firms are racing to secure similar Oval Office exemptions. The Trade Desk tanked 39% post-earnings despite beating estimates and raising guidance, with investors spooked by a CFO transition. OpenAI launched GPT-5, touting expert-level intelligence and integration into Microsoft products. Duolingo soared 30% on AI-driven monetization gains, while AppLovin and Firefly Aerospace rallied on strong earnings and IPO momentum. Retail sentiment surged across Stocktwits, even as macro uncertainty lingered.

😢 Markets ended the week on a high note despite tariff volatility and shifting sentiment. The S&P 500 and Nasdaq closed at barely record highs, with tech leading sector gains. Freddie Mac and Fannie Mae surged 20% and 18% respectively after the Fed proposed spinning out up to 15% of their equity, potentially creating the largest IPO in history at $500B valuation. Gold futures spiked to intraday highs of $4,490/oz before settling near $3,491, driven by confusion over new tariffs on bullion bars. Meanwhile, retail sentiment on Stocktwits turned increasingly bullish, buoyed by IPO momentum, ceasefire talks with Russia, and strong consumer stock chatter.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,389 | 2.43% |

Nasdaq | 21,450 | 3.87% |

Russell 2000 | 2,218 | 2.38% |

Dow Jones | 44,175 | 1.35% |

SPONSORED

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

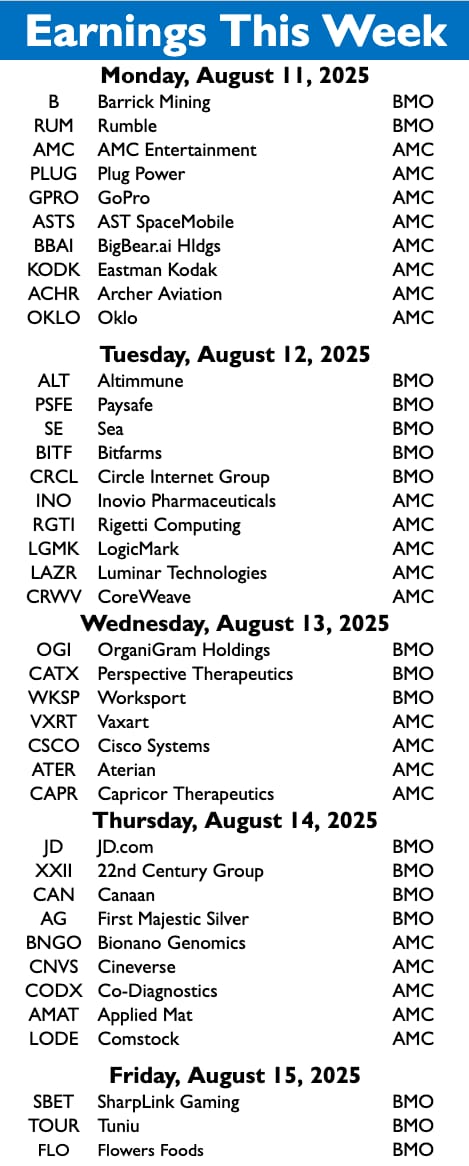

Earnings This Week

Earnings season is underway, with over 607 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on CPI inflation and PPI numbers.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋