Presented by

The Weekend Rip

Happy Weekend!

The market endured a hiring recession and suspiciously "noisy" inflation data while Ford torched $20 billion to escape the EV business and iRobot sucked its last bit of dirt in bankruptcy court. Micron earnings sent AI related names flying on Ram demand. Tesla hit record highs on driverless footage despite California legal threats, and DJT Media pivoted to nuclear fusion because social media and Bitcoin apparently weren't speculative enough. Oracle ended the week as TikTok’s new American landlord, providing just enough distraction to cover Nike’s 10% tariff-induced collapse and the DOJ finally dumping the Epstein files.

Let's recap and prep you for the week ahead. 📝

Monday 📉: The S&P 500 and Nasdaq both slumped into a red Monday as the AI bubble started looking a lot like a wet holiday napkin. Ford is lighting $20 billion on fire to pivot away from EVs, while iRobot officially sucked its last bit of dirt into bankruptcy court. To top it off, the Nasdaq-100 is kicking Lululemon to the curb just in time for everyone to realize they can't afford $100 yoga pants in this economy.

Tuesday 📉 : The market fell as unemployment hit a four-year high, signaling a hiring recession while investors waited for inflation data. Tesla reached a record high after footage showed a Model Y driving without a human, while homebuilder Lennar dropped 4% as margins and prices fell. Warner Bros. Discovery rejected a buyout bid from Paramount and Skydance, choosing to stick with its existing plan to sell to Netflix instead.

Wednesday 🐏 : The market slumped again as Oracle’s $10 billion data center dream hit a funding wall and California threatened to ban Tesla sales over its self-driving ads. Micron saved the post-market with a massive earnings beat, signaling that gamers and AI firms will keep overpaying for memory well into 2026. Meanwhile, Congress finally decided to mention healthcare before millions of plans expire, and the nation braced for a prime-time address from the White House.

Thursday ⚛️ : The market bounced back as investors decided to ignore a suspiciously low inflation report that the Labor Department admitted was mostly "noise" from the recent government shutdown. Trump used a prime-time address to rebrand a congressional housing subsidy as a $1,776 "warrior dividend," while his media company DJT pivoted to nuclear fusion in a $6 billion deal that sent shares up 30%. Nike, however, ruined the mood after hours by tanking 10% after tariffs and a 30% collapse in Converse sales proved that even "America First" can't fix a shoe business.

Friday 🎅: Tech stocks led a pre-holiday charge as the market ignored a missing PCE data report to focus on the news that Oracle finally became TikTok’s official American landlord, securing a 15% stake in the newly spun-off U.S. entity. While Nike investors were left nursing an earnings hangover the rest of the world was distracted by the Bank of Japan hitting 30-year high interest rates and the Justice Department finally dumping thousands of long-awaited Epstein case files.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

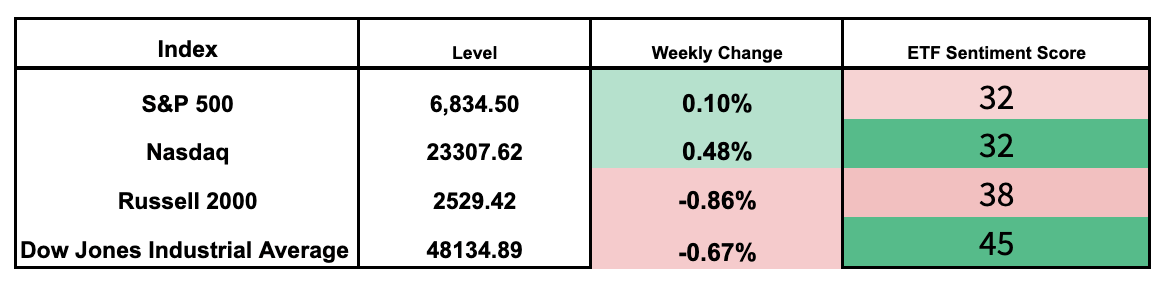

Here are the closing prices:

SPONSORED

ZenaTech’s “Drone as a Service” Roll-Up Strategy Goes Global

ZenaTech is building a global Drone as a Service (DaaS) platform that delivers efficient, flexible drone-based solutions to commercial and government customers—without the capital or operational burdens of drone ownership.

The company is executing a focused roll-up acquisition strategy, acquiring profitable legacy and low-tech service businesses, and upgrading them with drone innovation. These services span a growing list including land surveying, power line and renewable energy inspections, infrastructure maintenance, and power washing.

With 14 acquisitions to date, ZenaTech is scaling a multi-service DaaS network anchored by existing customers and recurring revenue. The company’s integration model is designed to drive operational efficiency and expand service margins.

As drone demand continues to expand, ZenaTech’s unique DaaS vision and execution differentiates the company.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋