The Weekend Rip

Happy Weekend!

The market spent the first week of December in a bizarre state where bad macro news became good stock news. Trades hope for rate cuts in the coming next week pushed stocks higher despite massive layoffs, and delayed Sept. inflation that was flat at 2.8%. In tech drama, Meta's Metaverse died, OpenAI went "Code Red" to fight its rivals, and Netflix won a $72B bid for Warner Bros. in a deal that might be held hostage by a rival bidder's rich dad.

Let's recap and prep you for the week ahead. 📝

Monday 💀 : The December slump arrived right after the Thanksgiving feast, dragging the market down. Adding to the hangover, Nvidia made another questionable "circular" investment in a partner company, and OpenAI proved that the best way to spend money is to buy a stake in your own venture capitalist's firm.

Tuesday 🍎 : The market bounced back, shrugging off December blues to flirt with a Santa Rally, while both Apple and metals minted fresh records. In the AI arms race, OpenAI reportedly went "Code Red" after competitors launched superior models. Rumor has it Intel and Amazon jumped in and started making their own chips to keep up with the increasingly expensive Nvidia arms race.

Wednesday 🤑: The market cheerfully soared to a green close despite ADP reporting the worst private payroll job cuts in three years, proving once again that bad news for the labor market is apparently great news for Fed rate cut. Meanwhile, the AI software sector had a massive after-hours party, with Salesforce and UiPath beating big, prompting one analyst to declare that the AI arms race party is still raging at 10:30 PM and won't stop until 4 AM.

Thursday 🚪 : The market struggled to climb higher, buoyed by the great news that layoffs are at a 2020 high, adding fuel to the "bad jobs = rate cuts" fire. Meanwhile, Mark Zuckerberg officially admitted the Metaverse is a failure, presumably while throwing his VR headset into the bin, as media giants engaged in a massive, costly battle to buy Warner Bros.'s IP library of superheroes and Scooby-Doo.

Friday 🥳: The market ended the week on a high note, fueled by the happy news that September's inflation was only slightly up, pretty much guaranteeing the Fed will cut rates next week. The biggest drama involved Netflix winning the bid for Warner Bros.'s studio and streaming assets for a whopping $72B, though the deal is now in jeopardy because a rival bidder's dad is Larry Ellison, who happens to be a long-time Trump supporter.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

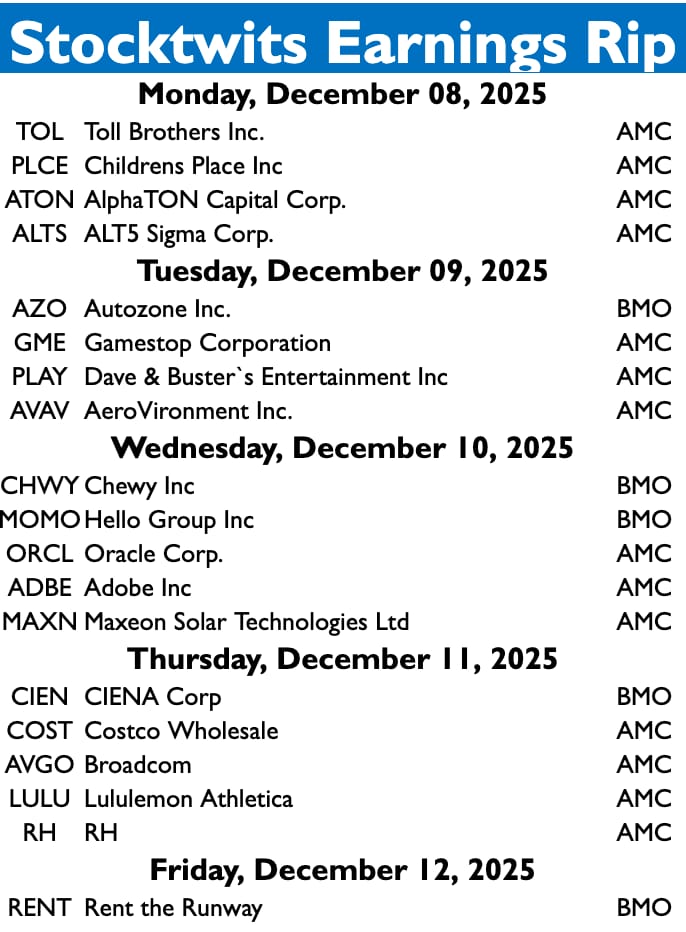

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on the FOMC decision on Wednesday.

In addition to the above, check out this week's complete list of economic releases.

IN PARTNERSHIP WITH

The Real AI Play? The Developers Who Own the Land and the Power

AI demand is overwhelming the electricity grid, and interconnection queues have become a multi-year choke point. Hyperscalers know it—which is why the real winners will be the developers who control both the land and the energy beneath it.

Meet New Era Energy & Digital (Nasdaq: NUAI). In one of the fastest-growing data-center corridors in the country, Permian-based NUAI is building powered land and powered shells with integrated natural-gas generation engineered for true speed-to-power.

Texas-born, raised, and based — $NUAI ( ▼ 1.18% ) is the power behind the next digital wave.

This advertisement is for informational purposes only. New Era Energy & Digital, Inc. accepts no responsibility for any actions or decisions made based on the information presented in this advertisement. Do Your Own Research (#DYOR).

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋