The Weekend Rip

Happy Weekend!

Despite early-week jitters over massive AI capital expenditure and a software rout triggered by "agentic" disruption, markets finished on a historic high with the Dow crossing 50,000. This volatility was defined by a massive "buy the dip" reversal in chips and crypto, offsetting a brutal week for traditional SaaS and Amazon's spending-induced sell-off. Is everything back to normal, or more different than ever?

Let's recap and prep you for the week ahead. 📝

Monday 🦫: Markets trended toward record highs as strong manufacturing data and a $12 billion critical minerals stockpile offset jitters from a government shutdown. While Nvidia slipped on rumors of frozen OpenAI investments, Palantir skyrocketed after-hours following a massive 70% revenue surge driven by U.S. commercial AI demand. Bloomberg also reported a potential $1.25 trillion merger between SpaceX and xAI, signaling a massive shift in the private equity landscape.

Tuesday 📉: The S&P 500 suffered its worst session in two weeks as software stocks plummeted 4.6% due to fears that open-source AI agents could disrupt traditional business models. While the Dow hit a record $49K earlier in the week, investor sentiment soured despite Trump signing a resolution to fund the government and end a brief shutdown. Earnings were a mixed bag, featuring a massive guidance-driven surge for Palantir while PayPal collapsed 18% following a leadership change and a reset of its financial targets.

Wednesday 📉: A massive software rout erased over $300 billion in market value as new AI agent tools from Anthropic and OpenAI sparked existential fears for traditional SaaS providers. Despite Alphabet smashing revenue estimates with its Gemini 3 rollout, tech stocks tanked as investors weighed the staggering $175 billion–$185 billion capital expenditure forecast for 2026. Meanwhile, macro jitters intensified following a weak ADP private payrolls report and a looming Department of Homeland Security funding deadline.

Thursday 📉: The market suffered a widespread sell-off as skyrocketing January layoffs and a "capex black hole" in Big Tech spooked investors, sending every sector but utilities into the red. Amazon plummeted 10% after-hours on a massive $200 billion AI spending forecast for 2026, while MicroStrategy tanked 17% due to heavy unrealized Bitcoin losses. Despite the carnage, Reddit and Roblox bucked the trend with significant post-earnings gains driven by strong revenue growth and user engagement.

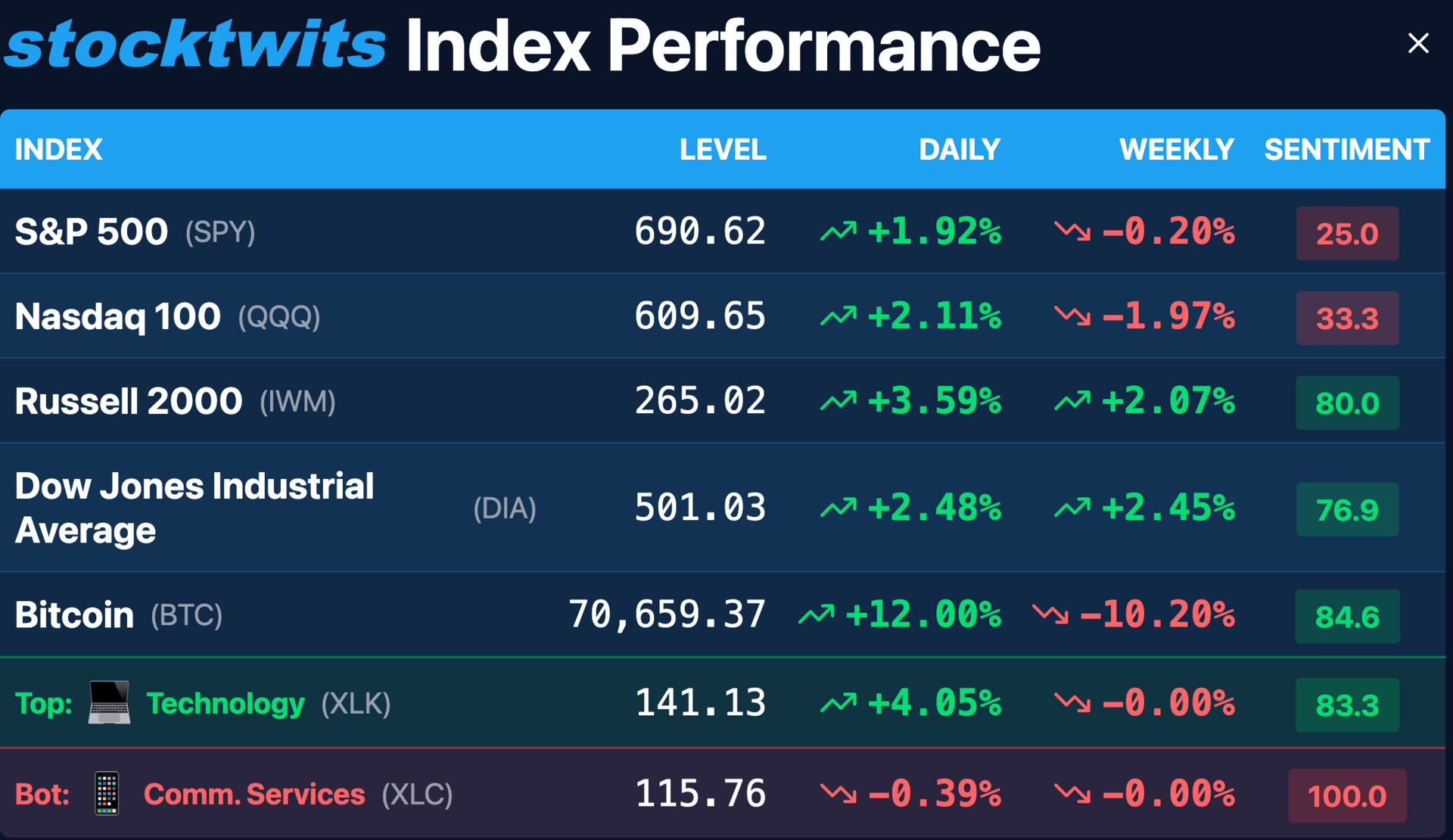

Friday 🚀: The Dow hit a record 50,000 points as tech sectors jumped 4%, fueled by a massive recovery in Bitcoin to the $70k level. Despite Amazon shares cratering 9% over a staggering $200 billion AI spending plan, chip leaders like Nvidia and AMD surged as investors rewarded the aggressive Capex cycle. Retail sentiment exploded as MicroStrategy and Robinhood posted double-digit gains, signaling a major "buy the dip" reversal across crypto and tech equities.

🤩 This week's Stocktwits Top 25 showed how momentum movers fared vs. the indexes.

Here are the closing prices:

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

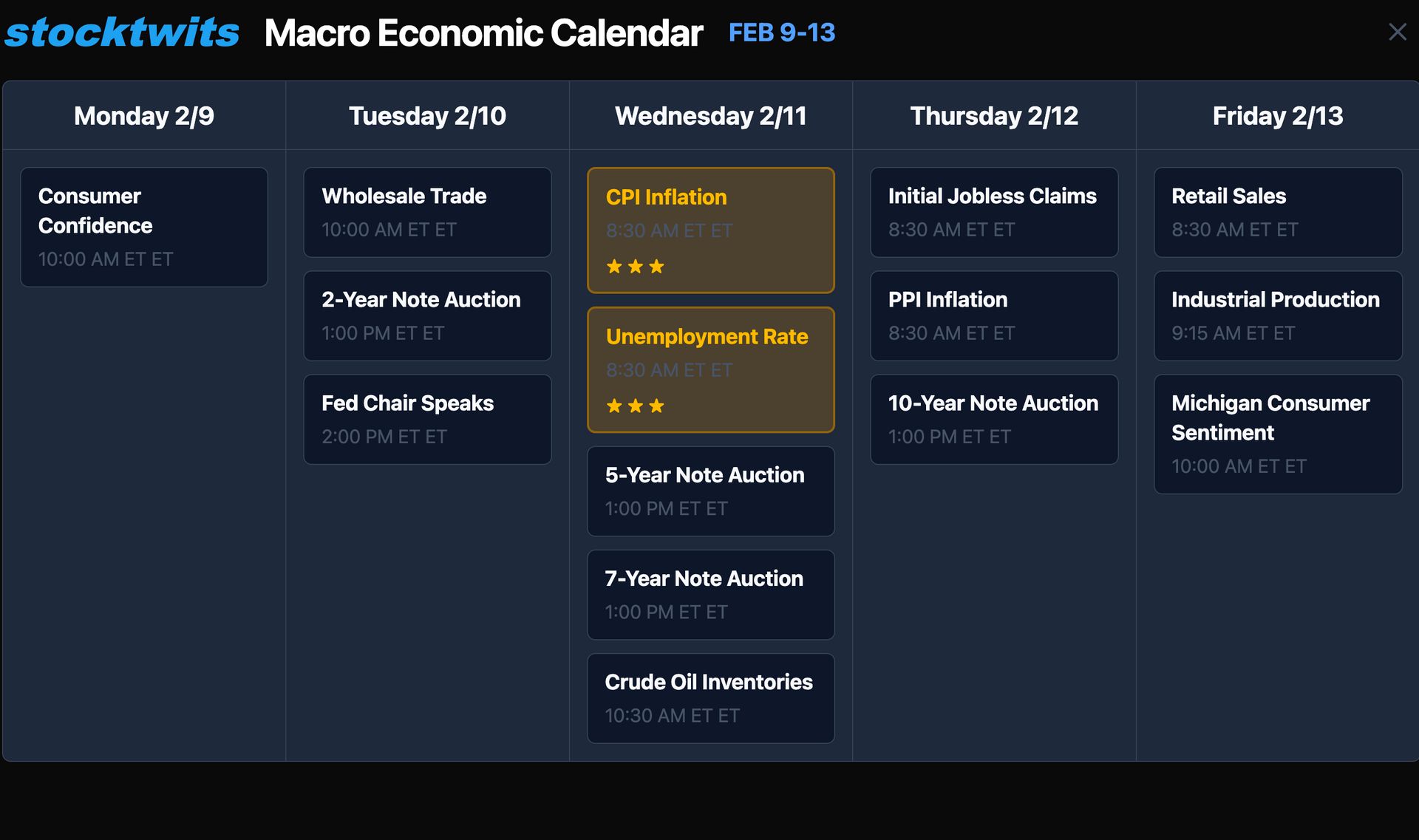

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋