The Weekend Rip

Happy Weekend

The market transitioned from a "Santa Crawl" into a geopolitical explosion as the year-end precious metals frenzy and AI consolidation wave were eclipsed by a massive U.S. military strike in Venezuela. While the week started with silver volatility and Warren Buffett’s historic retirement, it ended with the capture of Nicolás Maduro and a U.S. vow to safeguard the world’s largest oil reserves.

Let's recap and prep you for the week ahead. 📝

Monday 🥈: The final week of 2025 kicked off with a massive hangover in the metals market as Silver pulled back 9% from its weekend high of $84, triggering a "margin requirement" frenzy and a $25K-per-contract hurdle for futures traders. Intel secured a $5 billion lifeline from Nvidia in a strategic equity deal, while SoftBank dropped $4 billion to acquire DigitalBridge and secure the physical data centers needed for its "Artificial Super Intelligence" roadmap. Tesla faced a 2% slide after a major South Korean supplier slashed a Cybertruck battery contract by 99%, proving that even Musk’s "origami-shaped" dreams aren't immune to end-of-year production reality.

Tuesday 🐌 : The market slowed to a "Santa Crawl" on Tuesday as major indexes dipped slightly on a fifth of average trading volume, even as the year-end rally remained barely in the green. Silver futures stole the show with an 11% jump — their biggest one-day gain since 2009 — while Meta and SoftBank fueled a year-end AI consolidation wave by dropping a combined $42 billion on agentic AI and OpenAI data centers. Meanwhile, Tesla shares slumped after production estimates revealed an 8% annual drop in car-making, proving that even a "retail trader era" can't hide the sting of falling delivery numbers and a cooling EV market.

Wednesday 📒: The market drifted through the final days of 2025 as precious metals like Silver and Platinum took the crown as the year’s top performers, leaving small-caps and the U.S. Dollar in the dust. The "Oracle of Omaha" officially passed the torch, with Warren Buffett retiring as Berkshire CEO after 60 years to leave Greg Abel in charge of a record $382 billion cash pile. While Wall Street prepped for an AI-led 2026, retail investors spent the low-volume session debating whether Buffett’s massive cash hoarding is a prudent safety net or a final, ominous warning for the new year.

🐂 On Thursday, the markets were closed for New Year’s Day.

Friday 🤖 : The first trading day of 2026 kicked off with an "AI Hope Economy" rally as ASML and Micron surged following a massive double upgrade from Aletheia Capital. Baidu soared on plans to spin off its $20 billion AI chip unit, while crypto treasury stocks finally caught a relief bid despite Tom Lee’s bold proposal to increase authorized shares by 100x. Meanwhile, Tesla officially lost its title as the world’s largest EV maker, and the UK’s FTSE 100 hit 10,000 for the first time in history.

Friday night, the United States staged a military operation in Venezuela, bombing multiple military targets to capture President Nicolas Maduro. The operation took just minutes, with hundreds of aircraft and Delta Force operatives on the ground. The bombing killed upwards of 40 people, according to reports from the NYT, as special forces shepherded Maduro and his wife to the U.S.S. Iwo Jima aircraft carrier waiting in the Gulf. Maduro was then moved to New York City on Saturday night ET, where he will stand trial for charges of narco-terrorism, among others brought up during the first Trump administration. The president, flanked by operation architect Secretary of State Marco Rubio, said Saturday the U.S. would safeguard control of Venezuela and its massive oil supply toward U.S.-friendly industry. Trump live tweeted the entire event and its aftermath, posting a picture of Maduro blindfolded in handcuffs. It is unclear who will lead the country in Maduro’s absence or how the oil markets will wake up on Monday, but it is a dramatic start to the new year and a major escalation of U.S. power over the Western Hemisphere.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

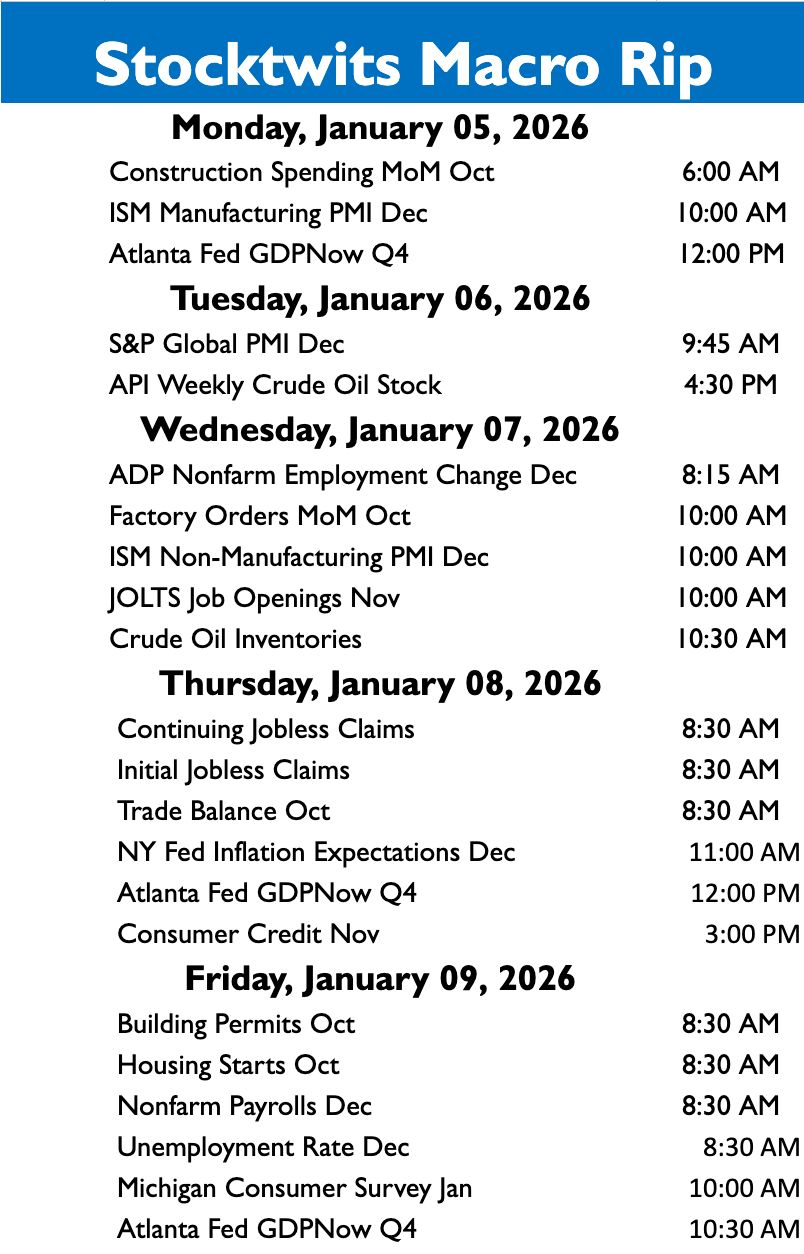

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

How Was The Daily Rip Today?

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋