OVERVIEW

The Weekend Rip: January 26, 2025

Source: Tenor.com

It was another positive week for stocks, as fears around inflation and Trump’s tariffs calmed down, and earnings season kicked off with mostly positive results. 📈

Let's recap and prep you for an action-packed week ahead. 📝

What Happened?

📆 On Monday, U.S. markets were closed for Martin Luther King Jr. Day.

👍 On Tuesday, stocks started off strong, with Trump’s tariffs beginning to look less severe than anticipated. Netflix jumped after its earnings beat, driven by paid memberships that exceeded expectations by a wide margin. Trump Coin craziness kicked off over the weekend but sank sharply as the regular trading week began.

🤖 On Wednesday, investors amped up their AI bets. Three top tech firms teamed up to create “Stargate” and invest $500 billion into AI infrastructure. AST Spacemobile sank following another private offering, and the Stocktwits community voted on their favorite space stock for 2025.

📊 On Thursday, the S&P 500 hit a new all-time high. Trump continued to hint that he will push the Federal Reserve to reduce U.S. interest rates. Meanwhile, popular retail stock Hims & Hers closed in on a fresh breakout, and “Daily Rip Live” hosts dove into the AI revolution and how they’re playing it.

🧺 On Friday, Morgan Stanley made the case for diversification. The bank diverged from its peers in offering alternatives to U.S. stocks, Melania Coin sank 80% in a week as ‘meme coin madness’ died down, and “The Weekend Rip’s” Ben and Emil broke down the applications of blockchain and smart contracts with Sui.

🤩 This week's Stocktwits Top 25 posted mixed performance relative to the indexes.

Here are the closing prices:

S&P 500 | 6,101 | +1.74% |

Nasdaq | 19,954 | +1.65% |

Russell 2000 | 2,308 | +1.40% |

Dow Jones | 44,424 | +2.15% |

Bullets From The Weekend 📰

🤝 An Oracle TikTok takeover is reportedly being negotiated. The Trump administration is negotiating a deal that would see Oracle take over TikTok alongside new U.S. investors. NPR’s reporting suggests that a deal is now shaping up where Oracle would take control of TikTok’s global operations while ByteDance retains a minority stake. However, it’s unclear whether lawmakers would support this type of solution, as the existing law requires ByteDance to divest fully. TechCrunch has more.

📺 Netflix asserts its pricing power as its streaming wars lead grows. With Netflix shares approaching their next major milestone, a $1,000 price tag, it appears investors have fully given in to the idea that the company is the future of TV. Despite the increased competition from behemoths like Amazon, Apple, and many other legacy media brands, Netflix has become a virtually uncancellable part of mainstream culture with a catalog so wide and deep that there’s something for everyone. To keep that content catalog growing (and boost its profits along the way), the streamer plans continued price hikes as long as we’re all willing to pay them. More from The Verge.

📱 Tinder uses TikTok influencers to court Gen Z. Tinder’s recent brand sentiment study showed that young people found dating apps more appealing after watching paid TikTok influencers share their experiences. The marketing strategy comes after reports that Gen Z and Millennials are moving away from swiping and instead seeking in-person alternatives to finding relationships. Match Group needs to find a solution, and fast, as it’s reported negative pay growth for eight consecutive quarters. Axios has more.

SPONSORED

Overseas talent with U.S. caliber resumes

Use Oceans to hire full-time finance talent and save over $100,000 a year.

✔ Deliver accurate forecasting and data-driven insights

✔ Build financial models to guide smarter decisions

✔ Help optimize profitability and cash flow

At Oceans, you get top-tier talent for just $36,000 a year.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

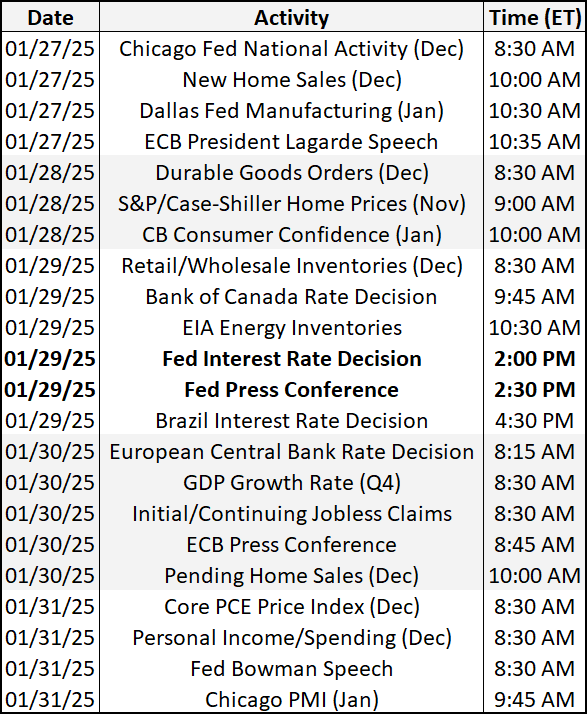

Economic Calendar

Source: TradingEconomics.com

It’s a busy week of economic data, with investors focused on Wednesday’s FOMC decision and commentary, as well as Friday’s inflation data. In addition to the above, check out this week's complete list of economic releases.

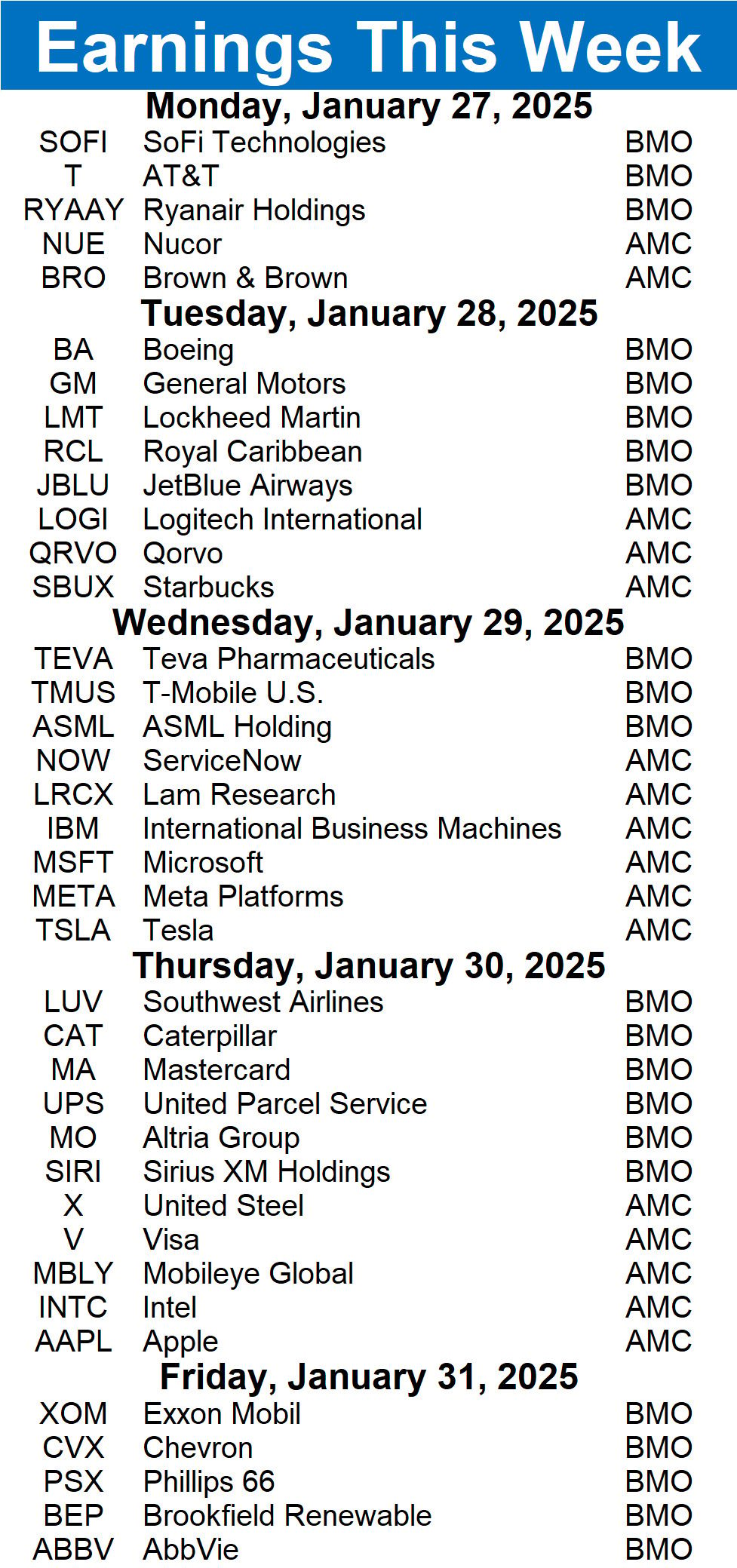

Earnings This Week

Most of the ‘Magnificent Seven’ stocks report this week as earnings season ramps up. Roughly 322 total companies are on deck.

Source: Stocktwits.com

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links That Don’t Suck 🌐

🧑🏫 Join a free 2-hour online workshop on 2/8 to learn investing strategies from IBD’s market experts*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋