The Weekend Rip

Happy Weekend!

Let's recap and prep you for the week ahead. 📝

◀ Markets opened the week higher on Monday despite fresh 30% tariff threats on EU and Mexican goods. Analysts predicted these new tariffs would result in either a pause or a limited impact. Meta unveiled plans for multi-gigawatt AI server farms—one nearly the size of Manhattan—sending nuclear and data center stocks flying. Bitcoin surged past $123K, while Coinbase cooled after a record run. The EU signaled openness to negotiation before the August 1 tariff deadline.

🌏 Markets dipped on Tuesday as inflation edged up to 2.7%, hinting at early tariff price climbs, but tech stocks surged on news that Nvidia can resume H20 GPU exports to China after receiving informal U.S. approval. The reversal could recover up to $15B in lost revenue. AMD also received clearance to ship chips, easing pressure on the sector. Big banks kicked off Q2 earnings season with strong trading revenue: JPMorgan beat estimates, while Citi hit a 17-year high on a $4B buyback and 25% profit growth. Wells Fargo missed and lowered guidance, and BlackRock fell despite beating EPS. Retail sentiment soured on small caps, with $IWM hitting its most bearish level since April. Meanwhile, Trump announced a trade deal with Indonesia, lowering tariffs to 19% from 32% and securing $15B in energy, $4.5B in agriculture, and 50 Boeing jets.

⚡ Markets closed higher on Wednesday, despite a morning tech slump, as a second wave of strong bank earnings lifted sentiment. Goldman Sachs posted a standout quarter, breaking trading revenue records on market volatility, while Morgan Stanley, PNC, and Bank of America also exceeded expectations. Johnson & Johnson boosted its 2025 guidance and slashed tariff cost projections. After the bell, United Airlines and Alcoa delivered solid reports, though UAL slipped post-market. The Fed’s Beige Book revealed modest growth and rising price pressure across all districts, with analysts warning that inflation may remain elevated into 2027. Crypto stocks climbed on fresh policy progress, while Bitmine spiked following a Peter Thiel stake disclosure.

🐂 Markets hit fresh highs Thursday as the S&P 500 crossed 6,300 and the Nasdaq closed at a record, powered by strong retail sales, falling jobless claims, and blockbuster earnings. TSMC posted a record quarterly profit on surging AI chip demand, while PepsiCo beat expectations. The House passed the GENIUS Stablecoin Bill, marking the first major U.S. crypto legislation. Netflix beat earnings but dipped post-market on margin concerns, and Uber announced a $300M robotaxi deal with Lucid and Nuro to deploy 20,000 autonomous EVs starting next year.

😢 Markets closed narrowly lower Friday despite fresh records earlier in the day, capping off a strong first week of earnings season. Invesco rose after proposing changes to its QQQ fund that could lower investor fees. Chevron’s acquisition of Hess fueled speculation about potential new additions to the S&P 500, and names like Robinhood, Carvana, and AppLovin climbed. Block was the ultimate winner. Trump signed the GENIUS Act, which boosts crypto policy clarity but triggers a selloff in public crypto stocks. Consumer sentiment reached a five-month high, while inflation expectations continued to decline. Fed commentary was split, with Waller hinting at rate cuts and Kugler urging patience.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,296 | +0.59% |

Nasdaq | 20,895 | +1.51% |

Russell 2000 | 2,240 | +0.23% |

Dow Jones | 44,342 | -0.07% |

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → https://event.tixologi.com/event/5863

#Stocktoberfest25

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

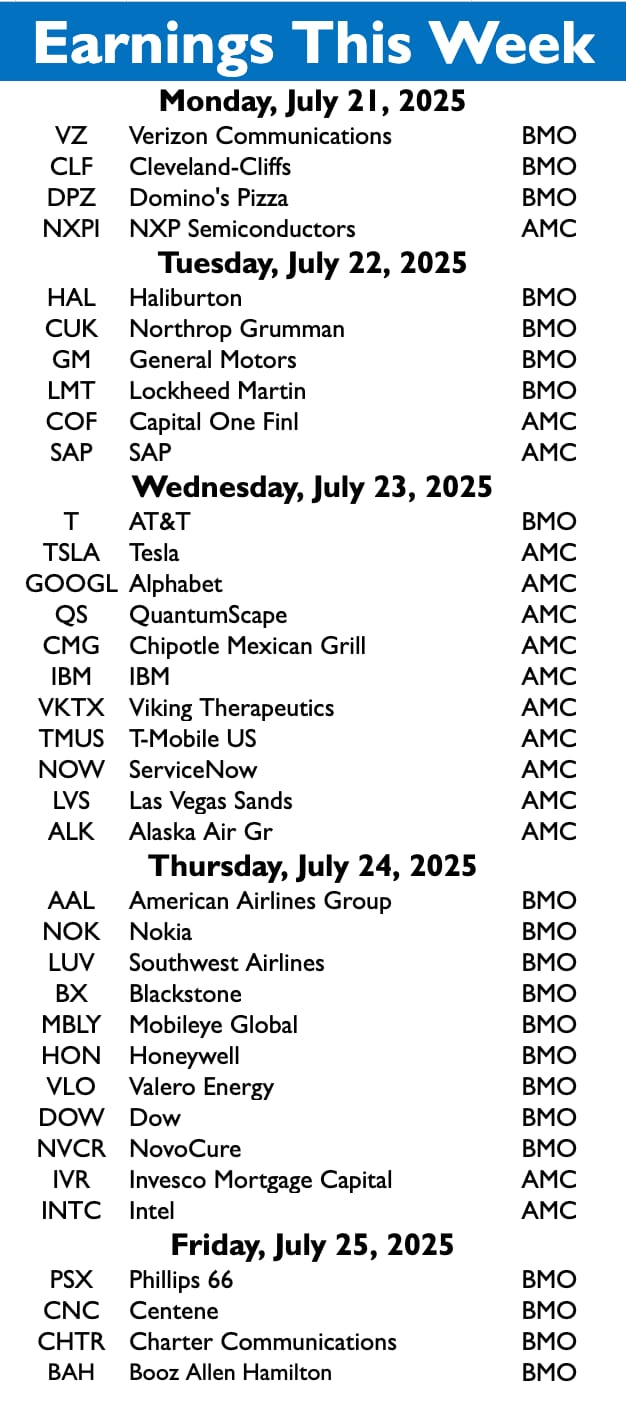

Earnings This Week

Earnings season is well underway, with over 486 stocks reporting this week. There are too many to fit into the chart, but here are some Stocktwits favorites:

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on Fed Speak.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

⚠ Tesla, Alphabet highlight earnings rush as market hovers near record highs: What to know this week

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋