The Weekend Rip

Happy Weekend!

It was a wild week that started with a call for peace in the Middle East after a massive bombing. Thankfully, the peace actually held after initial missile launches. Flash forward to the end of the week, and the market was hitting all-time highs, with hope that policymakers would find a market-friendly solution to trade and tax problems before the new earnings season starts in July. The sheer positivity in the face of such wild macro events could make a market junkie feel nuts. 📉

Let's recap and prep you for the week ahead. 📝

◀ On Monday, markets rallied as fears of all-out war faded following limited U.S. and Iranian military exchanges. The U.S. launched precision airstrikes on Iranian nuclear facilities over the weekend, and Iran responded with missile fire that was largely intercepted. With no further escalation by Monday’s close, crude oil tumbled and investors rotated back into risk-on assets, lifting the S&P 500 by its largest one-day gain in a month.

Tesla soared 8% as early feedback from its invite-only robotaxi pilot in Austin suggested the rollout went smoothly. Hims & Hers dropped 8% after Novo Nordisk ended their Wegovy partnership and accused Hims of selling unauthorized compounded versions of Wegovy.

🌏 On Tuesday, the market surged as a ceasefire between Israel and Iran showed tentative signs of holding. Oil futures dropped sharply on the de-escalation, while equities climbed across nearly every sector, pushing the S&P 500 within 1% of an all-time high. Carnival rose over 4% after posting record Q2 earnings and raising guidance, pointing to resilient consumer demand despite global uncertainty. In contrast, FedEx fell after hours as the shipper warned of weak Asia-to-America volumes and trimmed its 2026 outlook.

The robotaxi race intensified as Uber launched Waymo-powered autonomous rides in Atlanta, while analysts upgraded Lyft, calling it the top mid-cap idea for 2025. Meanwhile, Fed speakers struck a cautious tone—Raphael Bostic and Michael Barr both suggested one rate cut late this year, as the Fed balances stable employment with tariff-driven inflation risks.

⚡ On Wednesday, President Trump’s NATO remarks touted strikes on Iran as decisive, despite contrary Pentagon reports, while Fed Chair Jerome Powell reiterated caution on rates. Wall Street flinched after Socialist Zohran Mamdani secured the NYC Democratic nomination for Mayor, and it freaked out some talking heads, many of whom won’t be affected by NYC policies. 😏

General Mills slipped after weak forward guidance, while Tesla continued its European delivery slide, down 28% YoY, outpaced by rivals like SAIC and BYD. Semiconductors stayed hot: Nvidia hit another all-time high as analysts floated a $6T cap forecast.

🐂 On Thursday, the S&P 500 closed just shy of a new record as AI stocks carried the market higher, despite a Q1 GDP revision showing a contraction of 0.5%. Political chatter intensified around the search for Jerome Powell’s successor, with markets now pricing in a slim chance of a July cut as speculation of an early "shadow chair" pick builds. Powell’s term ends in 2026, but policy influence may shift sooner.

Nvidia extended its record-setting streak, while Micron rallied on the back of a Q3 beat and bullish revenue guidance that triggered a wave of analyst upgrades. BigBear AI surged again, continuing a breakout week fueled by biometric contract wins and DoD deals, pushing its market cap north of $1 trillion. Walgreens and McCormick also topped estimates.

😢 On Friday, the S&P 500 notched a fresh all-time high, closing at 6,173 despite mid-session turbulence triggered by a flare-up in U.S.–Canada trade tensions. Market momentum was driven by upbeat consumer sentiment data and optimism over potential Fed rate cuts, even as inflation ticked slightly above expectations.

Fed officials continued to send mixed messages—some hinting at a possible July cut, while Chair Powell warned tariffs could complicate that trajectory. With the Senate nearing a tax bill deal and the market shrugging off geopolitical and macro risks, the bulls ended the week firmly in charge.

Nike jumped after beating expectations despite a 12% sales decline and 86% drop in profit— guidance hinted at stabilization ahead.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing weekly prices:

S&P 500 | 6,173 | +3.44% |

Nasdaq | 18,519 | +4.25% |

Russell 2000 | 2,172 | +3.00% |

Dow Jones | 43,819 | +3.82% |

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → https://event.tixologi.com/event/5863

#Stocktoberfest25

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

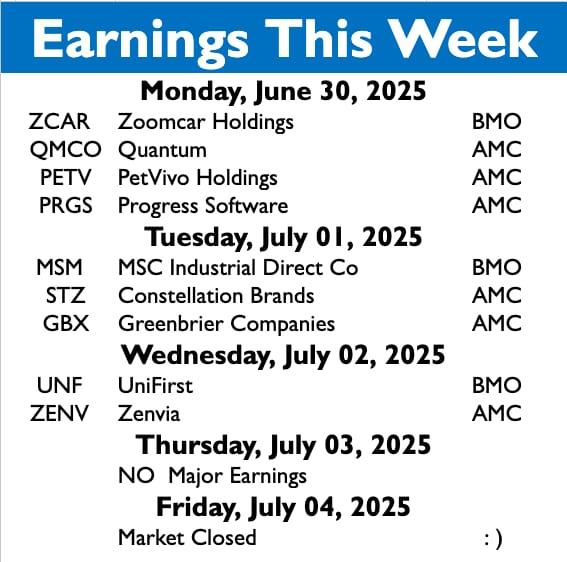

Earnings This Week

Earnings season is done, with just 22 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋