Presented by

The Weekend Rip

Happy Weekend!

Markets swung hard all week, sliding below key averages early, rebounding on Nvidia’s monster earnings, then collapsing on jobs data and crypto liquidations before closing Friday green on chip‑sale rumors and mixed Fed signals. Tech volatility, Fed uncertainty, and Bitcoin’s crash defined the tape, while Buffett’s portfolio moves, Three Mile Island’s restart, and retail earnings kept headlines busy.

Let's recap and prep you for the week ahead. 📝

◀ Monday the market slipped with all major indexes closing below their 50‑day averages, a bearish signal ahead of fresh government data. Buffett’s 13F filing showed a big new Alphabet stake and a trimmed Apple position, while Peter Thiel’s fund dumped $100M of Nvidia, sending chip stocks lower. Fed officials stayed split on December cuts, Bitcoin slid toward $90k, and investors braced for Nvidia’s earnings report midweek.

🌏 Tuesday the market slid again, with the S&P 500 nearing its 100‑day average and semis dropping into correction territory ahead of Nvidia’s big report. Bitcoin briefly dipped under $90k before rebounding, while Microsoft and Amazon led the Mag 7 lower after a downgrade that questioned AI profitability. Constellation landed a $1B loan to restart part of Three Mile Island with Microsoft as a partner, ADP data showed job losses, and the House voted to release the Epstein files as Trump hosted Saudi Crown Prince bin Salman.

🐻 Wednesday the market finally broke its losing streak as Nvidia delivered its 10th straight earnings beat, with $57B in revenue and datacenter sales off the charts. CFO Colette Kress said Blackwell chips are sold out and forward visibility tops half a trillion dollars through 2026, sending the stock up more than $300B in post‑market trading. Meanwhile, FOMC minutes showed deep divisions on December cuts, jobs data is delayed until mid‑December, and Bitcoin kept sliding under $90K, rattling crypto stocks.

🥵 Thursday started green after Nvidia’s double beat, but the rally collapsed into the biggest one‑day tech drop since April, with the Dow off nearly 1,000 points and semis down 5%. September jobs data showed strong hirings but unemployment at a four‑year high, adding to confusion as Fed signals stayed mixed and crypto liquidations dragged equities l ower. After hours, Intuit, Webull, Gap, and Ross reported, Citigroup’s CFO stepped down, and Michele Steele was introduced as Stocktwits’ new Content Strategy Director.

🍏 Friday the market closed green after Nvidia’s earnings beat pulled stocks out of a morning nose‑dive, helped by rumors the Trump team may allow H200 chip sales to China. Fed signals stayed mixed with John Williams calling for a cut while others urged patience, pushing December odds up to 70 percent. Bitcoin kept sliding with $2B in liquidations and index risks for crypto firms, while earnings split the tape as BJ’s showed resilience, VinFast burned cash, and Manchester United leaned on sponsorships.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

SPONSORED

Meet Sidekick, AI for Active Investors

A new way to navigate the market. Meet your AI-powered market analyst and trading assistant.

Sidekick is AI designed for active investors. It can see your charts, find new trade ideas, access real-time market data, analyze and compare fundamentals and options flow, double-check your levels, help with strategy design, and much more.

Test drive with full access on any plan for 50¢ a day.

Love it? Stay for up to 68% off. Sidekick is included with every new active account.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

Earnings This Week

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

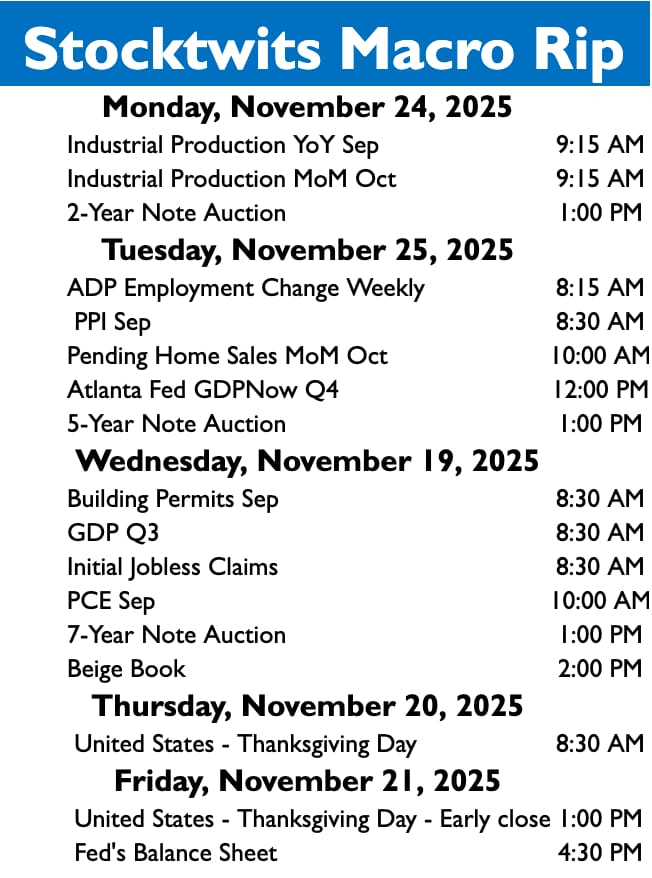

Economic Calendar

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋