OVERVIEW

The Weekend Rip: November 03, 2024

Source: Tenor.com

Last week was volatile and ended in the red, though traders and investors are buckling up for another wild ride this week. In addition to 1,200+ companies reporting earnings, we’ve got the U.S. presidential election and Fed interest rate decision that will likely put markets on their toes. 😱

Let's recap and prep you for the week ahead. 📝

What Happened?

👆 On Monday, stocks rebounded to start the week as all eyes turned to ‘Magnificent Seven’ earnings. Ford’s forecast failed to impress, SoundHound bulls sounded the alarm, and retail set up for SoFi’s earnings results.

🤖 On Tuesday, big tech buoyed a mixed market. Reddit soared, SoFi slumped, PayPal slipped, Snap jumped, Alphabet bumped, and AMD tripped on earnings. Meanwhile, Bitcoin was the breakout of the day.

😵 On Wednesday, semiconductors were sent lower by shocking SMCI news. The semiconductor giant’s shares slipped after its auditor EY resigned and other big tech earnings failed to impress. The U.S. economy continued to hum along, even as the labor market showed additional signs of slowing.

😨 On Thursday, spooky season struck stocks after lackluster earnings. Apple and Amazon failed to impress Wall Street, but Intel bounced back after better-than-expected results. Fintech auto insurance stocks boomed on improving business fundamentals, and the “Trends With Friends” crew chatted about the future of crypto.

😬 On Friday, earnings failed to quell pre-election jitters. The Dow Jones Industrial Average finally dropped Intel and added Nvidia to keep up with the times. And one popular bull began calling out bearish signs for the market.

🤩 This week's Stocktwits Top 25 showed mixed performance vs. the indexes.

Here are the closing prices:

S&P 500 | 5,729 | -1.37% |

Nasdaq | 18,240 | -1.57% |

Russell 2000 | 2,210 | +0.05% |

Dow Jones | 42,052 | -0.15% |

Bullets From The Weekend 📰

🤏 Legal bets on the U.S. presidential election are still dwarfed by sports gambling and other wagers. Prediction market startup Kalshi says Americans have legally wagered more than $123 million on the presidential election, in the country’s first election where betting is legal and widespread. Still, it pales in comparison to people betting over $400 billion on sports since legalized in 2018 and $120 billion just in 2023. With Robinhood rolling out its prediction market last week, we’ll see how these numbers shake out post-election. Axios has more.

🥺 Startups and incumbents join hands in fighting AI regulation. Two of the biggest forces in the tech ecosystem, Microsoft and a16z partners, are pleading with the government to stop considering regulations that might affect “innovation” in the emerging artificial intelligence (AI) industry. “Our two companies might not agree on everything, but this is not about our differences,” is part of the group's joint statement. More from TechCrunch.

🍷 Producers are whining about too much wine. A global decline in wine consumption creates problems for vineyards; too many grapes and too much wine. Global wine consumption fell from 247 million hectoliters in 2017 to 221 in 2023, roughly 3.5 billion fewer bottles of wine. Younger generations’ lifestyle changes and inflation are the primary drivers, with the industry trying desperately to win customers back and limit supply. Axios has more.

STOCKTWITS CONTENT

Discover New Trade Ideas With “Chart Art” By Stocktwits

We launched “Chart Art” to curate the best analysis and trade ideas from the Stocktwits community. And so far, thousands of readers have enjoyed discovering new ideas and Stocktwits users to follow each day.

Like this idea shared by Stocktwits user @AskLou and featured in Chart Art ahead of the fintech stock’s 145% rally!

There is so much great content happening on Stocktwits, and it’s our job to help you find it. If you want to join thousands of other traders and investors receiving our “Chart Art” email every evening by 8 pm ET, click here.

And if you need another reason to join, you’ll receive a welcome email with a list of the top Stocktwits chartists to follow for real-time posts like this.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

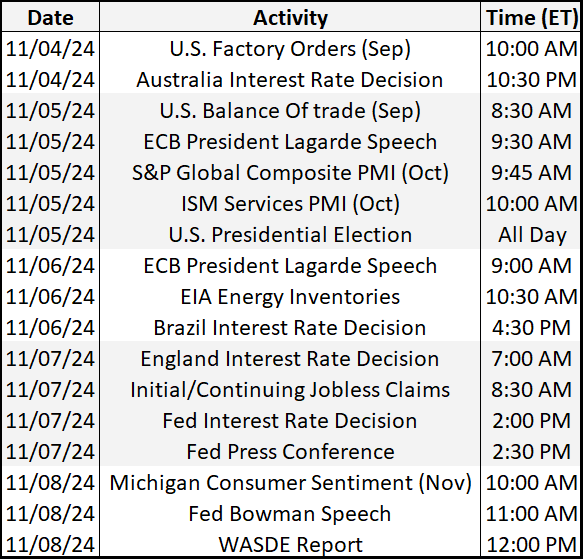

Economic Calendar

It’s a slower week of economic data, with investors on the U.S. presidential election and Fed interest rate decision. In addition to the above, check out this week's complete list of economic releases.

Earnings This Week

Earnings season is in full swing, with over 1,260 stocks reporting this week. 🤯

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week, and add your favorite stocks to your watchlist to be notified when the earnings call goes live on Stocktwits! 🚨

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here. 👍

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋