Presented by

The Weekend Rip

Happy Weekend!

Markets surged to all-time highs last week as CPI came in cooler than expected, boosting the odds of a Fed rate cut. Tesla and Netflix disappointed on earnings, while IBM and AMD rallied on quantum breakthroughs. Quantum stocks soared on U.S. stake rumors.

Let's recap and prep you for the week ahead. 📝

📡 Monday Market Recap: Apple Soars, AWS Stumbles, and Crypto’s Web2 Reality

Markets climbed Monday as Apple hit a 2025 record high on strong iPhone 17 sales in China, outselling the iPhone 16 by 14% in its first 10 days. Trade tensions eased with U.S.–China talks continuing in Malaysia, while the government shutdown dragged on. Amazon’s AWS suffered a major outage, disrupting services from Robinhood to Reddit and Coinbase, exposing crypto’s reliance on centralized infrastructure. Despite the chaos, $AMZN, $HOOD, and $COIN all closed higher. Meanwhile, rare earths got a boost from a U.S.–Australia supply chain deal, and Adobe rallied on its new AI Foundry launch.

🐔 Tuesday Market Recap: Dow Hits Highs, Netflix Misses, GM Shines

Markets closed flat Tuesday, but the Dow hit a record high as strong earnings from 3M, GM, and Coca-Cola offset Netflix’s EPS miss. Netflix posted record revenue but took a $619M tax hit from Brazil, dragging EPS to $5.87. GM surged on raised guidance and record vehicle deliveries, while Beyond Meat squeezed higher on meme ETF inclusion before fading. Gold tanked; its worst drop since 2013—as Diwali paused Indian demand, and Anthropic-Google inked a multi-billion dollar AI compute deal after the bell.

📉 Wednesday Market Recap: Tesla Tanks, Meme Stocks Whip, IBM Slips

Markets fell Wednesday as tech sold off following Netflix’s miss and Tesla’s post-close earnings disappointment. Tesla posted $28B in revenue but saw adjusted EPS drop 31% to $0.50, with operating profit down 40% amid falling carbon credit sales and rising costs. Despite record deliveries and energy growth, investors balked at vague robotaxi promises and margin pressure. IBM beat estimates but sold off after a strong YTD run, while Beyond Meat spiked 1000% intraday on meme ETF inclusion before crashing 22%. Gold tried to recover, Bitcoin dipped below $110K, and the shutdown dragged into historic territory.

📈 Thursday Market Recap: Quantum Buzz, Intel Surprise, Tesla Rebounds

Markets rallied Thursday as trade talks resumed and CPI data loomed. Quantum stocks soared on rumors of U.S. stake buys, with IonQ, Rigetti, and D-Wave jumping after reports of federal funding discussions; though the White House denied equity negotiations. Intel beat expectations with $13.7B in revenue and doubled EPS to $0.02, despite a $2.3B loss in Foundry Services. Tesla clawed back losses post-earnings, while Ford hit $50B in quarterly revenue but warned of a $2B hit from an aluminum plant fire. Crude climbed on fresh Russian oil sanctions, and Trump finalized a summit with Xi for next week.

📊 Friday Market Recap: CPI Relief, Quantum Momentum, Coinbase Climbs

Markets hit all-time highs Friday after delayed CPI data showed 3.0% inflation in September; slightly below expectations; fueling near-certainty of a Fed rate cut next week. IBM and AMD rallied after Reuters revealed AMD chips are powering IBM’s quantum error-correction breakthroughs, sending chip stocks and the Nasdaq 100 soaring. Intel faded despite a profit beat, while Coinbase surged on news of a national bank charter filing and bullish Fed commentary on crypto master accounts. The shutdown continues, but traders cheered CPI relief, quantum optimism, and a pro-crypto regulatory shift.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,791 | +1.92% |

Nasdaq | 23,204 | +2.31% |

Russell 2000 | 2,513 | +2.50% |

Dow Jones | 47,207 | +2.20% |

SPONSORED

GraniteShares announced distribution rates for all GraniteShares YieldBOOST ETFs today, as listed in the table below.

*GraniteShares disclaimer located in the link

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

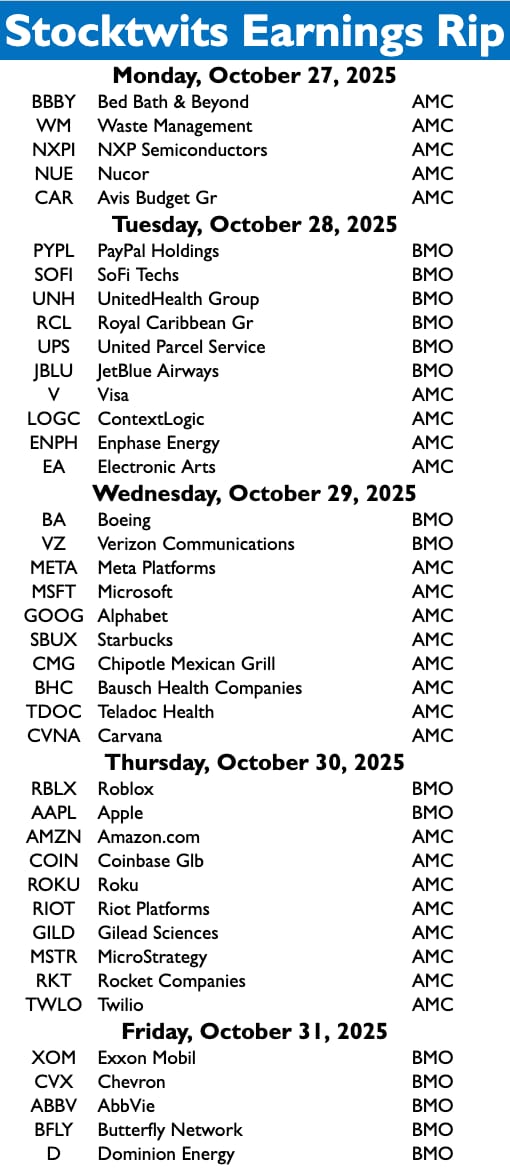

Earnings This Week

Earnings season is in full swing, with over 897

stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on the FOMC rate decision.

In addition to the above, check out this week's complete list of economic releases.

Links That Don’t Suck 🌐

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋