Presented by

The Weekend Rip

Happy Weekend!

Labor Day kicked off the week with a job market trend that turned out to be a bummer. Markets kicked off September with a hangover, rallied midweek on tech tailwinds, and stumbled into Friday on weak labor data and recession fears. Google’s antitrust win lifted Apple and revived tech sentiment, while Broadcom’s AI-fueled earnings helped push indexes to fresh highs. But Friday’s surprise job cut flipped the script: rate cut bets surged, mortgage rates plunged, and safe-haven assets like gold and bitcoin soared. 📉

Let's recap and prep you for the week ahead. 📝

◀ On Monday, the market remained closed for Labor Day.

🌏 Markets opened September with a hangover, pulling back after a summer rally as inflation fears, tariff uncertainty, and legal drama weighed on sentiment. A federal court ruled most Trump-era tariffs illegal, sending gold to $3,500/oz and Treasury yields higher. Another ruling let Google keep Chrome and some search exclusivity deals. Meme stocks like Opendoor and American Eagle surged despite the broader decline, and Kraft Heinz confirmed its split into two public companies, drawing Buffett’s regret.

⚡ Markets climbed Wednesday as Google’s antitrust win gave tech a jolt, preserving its $20B search deal with Apple. Apple jumped 3% on the news and teased new AI search tools for Siri, while earnings showed mixed consumer resilience: Macy’s beat and raised guidance, but Dollar Tree flagged tariff pressure, and Salesforce, C3.ai, and Figma all fell on weak software outlooks. American Eagle soared 34% after its Sydney Sweeney campaign drove a retail revival, and the Fed’s Beige Book showed flat spending, slowing wages, and tariff-driven price hikes across districts.

🐂 Markets climbed to fresh highs Thursday as Broadcom’s AI-fueled earnings and resilient consumer spending offset jitters ahead of Friday’s jobs report. ADP and jobless claims hinted at a slowing labor market, fueling rate cut bets, while Trump’s Fed shakeup and SCOTUS request to fire regulators stirred debate over central bank independence. Earnings season wrapped with mixed results: Broadcom beat and raised guidance, Docusign rallied on AI momentum, but Lululemon and Figma fell on weak domestic demand and investor unease over aggressive tech spending.

😢 Markets fell Friday as a weak jobs report rattled sentiment, showing just 22,000 payroll additions and the first monthly job cut since 2020. Rate cut odds surged to 100% for September, sending mortgage rates plunging and gold and bitcoin rallying, while banks and brokers sold off on recession fears. Robinhood and AppLovin climbed after being added to the S&P 500, while Broadcom’s strong earnings helped buoy tech despite looming semiconductor tariff threats.

🤩 This week's Stocktwits Top 25 showed outperformance vs. the indexes.

Here are the closing prices:

S&P 500 | 6,481 | +0.33% |

Nasdaq | 21,644 | +1.14% |

Russell 2000 | 2,391 | +1.04% |

Dow Jones | 45,392 | -0.32% |

SPONSORED

SonicStrategy’s $40 Million Catalyst for Alt-Season Mania

Wall Street is buzzing about digital asset treasury companies bridging DeFi & TradFi, and SonicStrategy (OTCQB: DBKSF) is emerging as a frontrunner, with shares up ~717% YTD.

This week, Sonic Labs, the foundation behind the Sonic blockchain, committed $40M via a convertible instrument funded in $S tokens. Priced at $4.50 per share, the deal signals a 344% valuation gap and paves the way for a Nasdaq uplisting. According to the Sept 2, 2025 announcement, the company expects formal closing of the investment and issuance of the convertible debenture to occur within five business days. This valuation by Sonic Labs suggests the company is undervalued by more than 4x its ~$1.00 market price.

Backed by Sonic Labs and fuelled by validator yield, SonicStrategy is the only public vehicle giving investors direct exposure to Sonic’s breakout, making it a standout play as alt-season accelerates.

Read full disclosure below. *3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

THE BRIEF

Need a concise summary of what's going on this week? Look no further. Here’s a rundown of this week’s earnings and economic data.

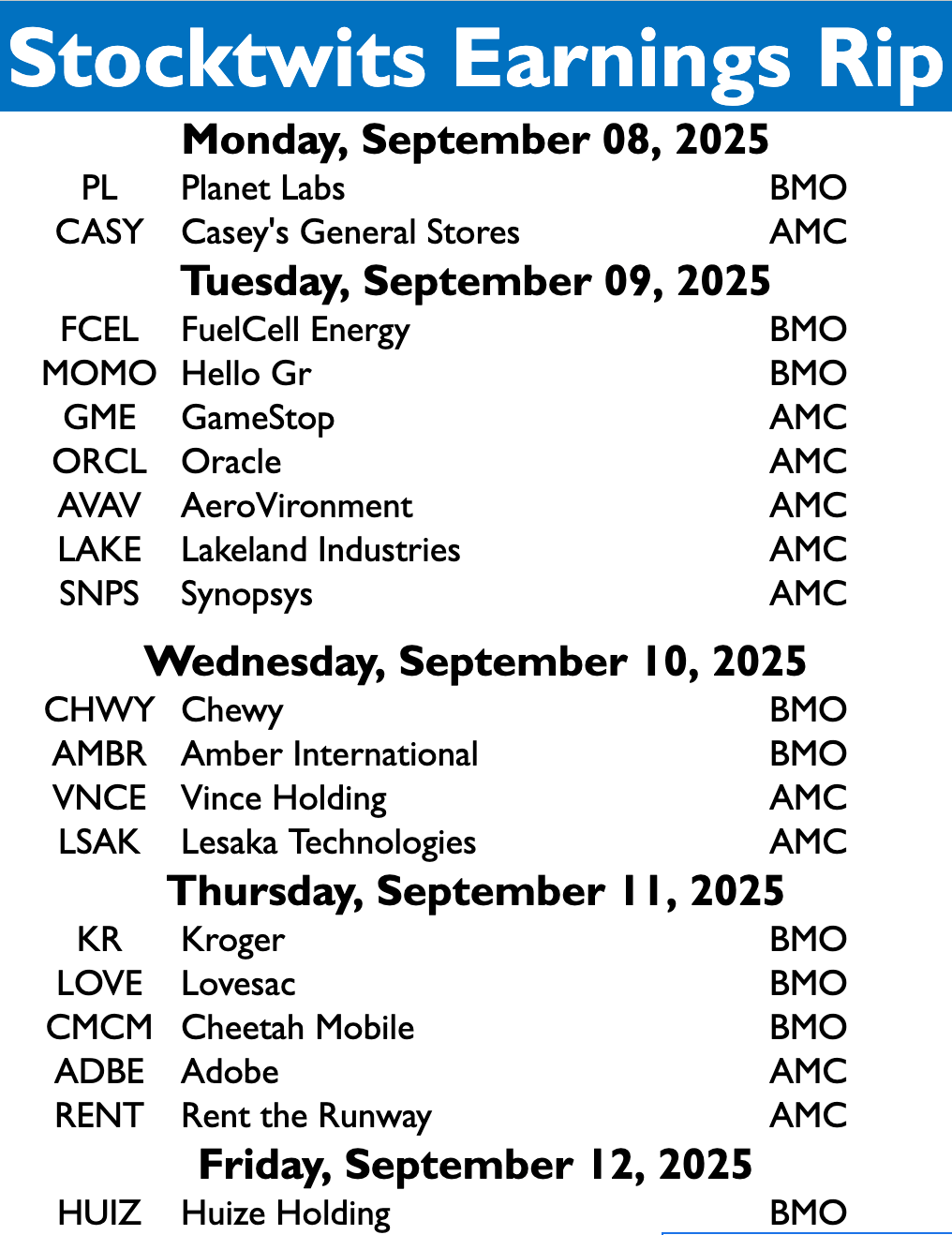

Earnings This Week

The Earnings season is somehow still going, with over 72 stocks reporting this week.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Economic Calendar

It’s a busy week of economic data, with investors focused on sentiment, bond auctions, and inflation readings.

In addition to the above, check out this week's complete list of economic releases.

IN PARTNERSHIP WITH MONEYSHOW

Join Stocktwits Editor-in-Chief Tom Bruni At The MoneyShow Virtual Expo🛢

Hey all, Tom Bruni here! For those looking for opportunities in the energy space, our friends at MoneyShow are hosting a free virtual expo featuring experts who will be sharing their latest picks and strategies.

I’ll outline the sectors, stocks, and strategies that retail is using for the rest of the year, as well as which energy stocks they’re paying most attention to. Join me for this free two-day event on September 8-9. I’ll see you there! 👍

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Groundhog Day on Wall Street: Chaos Resets and Stocks Go Up

The market feels like Groundhog Day. We wake up to huge headlines, panic, politics, tariffs, Fed chatter, AI hype, even a hotter jobs print, and by the close stocks shrug and grind higher. Ben and Emil break down why dips keep getting bought, why the VIX won’t wake up, what rising unemployment might mean for September cuts, and how narratives like tariffs, crypto, and AI are colliding with price action. Plus: SPY and QQQ on the week, Bitcoin’s bounce, sector winners and losers, and what to watch next week.

Links That Don’t Suck 🌐

🚘 South Korea says it has reached a deal with the U.S. for the release of workers in a Georgia plant

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋

Sponsorship Disclaimer:

Harbourfront Media Solutions Inc. (“We” or “Us”) are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice. Harbourfront Media Solutions Inc. made a payment of sten thousand dollars to Stocktwits to provide advertising services. This article is informational only and is solely for use by prospective investors in determining whether to seek additional information. This does not constitute an offer to sell or a solicitation of an offer to buy any securities. Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEDAR+ and SEC filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from SEDAR+ and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Forward Looking Statements

This article is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Spetz Inc. ( "SonicStrategy") in any jurisdiction. The information contained in this article contains forward-looking statements, which may include estimates, projections, and other statements that involve risks and uncertainties. These statements reflect SonicStrategy's current expectations regarding future events, performance, and operating results, but actual results may differ materially from those expressed or implied due to known and unknown risks, uncertainties, and other factors.

This article contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian securities laws, including the Securities Act (Ontario) as well as other provincial securities laws. Forward-looking statements include but are not limited to statements regarding Sonic Strategy's business Strategy, financial performance, growth opportunities, market outlook, future plans, and other matters. These statements are identified by terms such as "anticipates," "believes," "expects," "intends," "plans," "forecasts," "may," "will," "could," "would," and similar expressions. These forward-looking statements are based on management's current expectations and assumptions, including assumptions about general economic and market conditions, Sonic Strategy's ability to execute its Strategy, regulatory changes, and other factors that could affect SonicStrategy's performance. Although management believes these assumptions are reasonable, actual results could differ materially from those anticipated due to risks and uncertainties. Factors that may cause such differences include, but are not limited to, risks related to market volatility, regulatory developments, competitive pressures, technological change, and general economic conditions.

Forward-looking statements are subject to known and unknown risks, uncertainties, and other factors, which may cause actual results, performance, or achievements of SonicStrategy to differ materially from any future results, performance, or achievements expressed or implied by such forward-looking statements. Investors and potential investors are cautioned not to place undue reliance on forward looking information. For a detailed discussion of risk factors, please refer to SonicStrategy publicly filed documents available on SEDAR+ (www.sedarplus.ca).

This article does not constitute financial, legal, or tax advice, nor is it an offer or recommendation to buy or sell any securities. Investors should conduct their own due diligence and consult their own professional advisors before making any investment decisions regarding SonicStrategy. Past performance is not indicative of future results. This article contains confidential and proprietary information of SonicStrategy. While SonicStrategy strives to ensure that the information in this article is accurate and up to date, SonicStrategy makes no representation or warranty, express or implied, as to the accuracy, completeness, or adequacy of the information presented. SonicStrategy expressly disclaims any liability for any losses or damages resulting from the use or reliance on the information contained herein.

This article is not a prospectus or offering document and is not an offer to sell or a solicitation of an offer to buy securities in any jurisdiction. SonicStrategy's securities have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States without registration or an applicable exemption from registration. Any offer or sale of securities in Canada must be made in accordance with applicable Canadian securities laws, including the requirements of the Canadian Securities Administrators (CSA) and the regulations of the stock exchange on which SonicStrategy's securities are listed.