Presented by

CLOSING BELL

The Year of The Horse and You

The market climbed with more gusto Wednesday despite an FOMC report from last month’s meeting that showed voting members came to the table without a big appetite for cuts.

Of course, in the vague way all Fed speech slithers out of Washington, the minutes also had plenty to support the idea that if inflation comes down, rates come down.

Either way, the news did little to stop the third day of S&P 500 gains. Mag 7 stocks rebounded, Amazon pulling further away from its record losing streak. Energy stocks were shining the brightest, or burning the brightest, after peace talks between Ukraine and Russia ended before anyone made peace, and U.S. - Iran relations did anything but cool. Iran closed the Strait of Hormuz for hours to practice naval exercises, a 20 million barrel a day artery that they can lever to cut supply.

At the same time, the U.S. withdrew forces from Syria, while naval and air forces deployed off Iran’s coast. A second aircraft carrier, the USS Gerald R. Ford, is heading there now.

DEAL NEWS

eBay Buying the eBay Gen Z Uses 🎽

eBay shares surged 7% after the company announced a $1.2 billion cash buy out of the fashion marketplace Depop from Etsy, paired with a significant Q4 earnings beat. The deal marks a major consolidation in the "recommerce" sector, as the e-commerce giant moves to capture a younger demographic.

The quarterly results outperformed analyst expectations with revenue reaching nearly $3 billion, a 15% year-over-year increase. Adjusted earnings per share landed at $1.41 vs. the $1.35 consensus, while Gross Merchandise Volume (GMV) grew 10% to $21.2 billion.

The acquisition is centered on a massive demographic shift, as 90% of Depop’s 7 million active buyers are under the age of 34. By bringing Depop's $1 billion in annual sales under its umbrella, eBay aims to scale its existing $10 billion fashion business and leverage its "Authenticity Guarantee" infrastructure for Gen Z shoppers.

The outlook turned bullish as the deal allows both companies to refocus, with Etsy shares also jumping 14% on plans to use the proceeds for a $750 million stock buyback. Etsy bought the brand for $1.68B in 2021. eBay issued strong Q1 guidance of $3.05 billion in revenue, signaling that the integration of Depop will serve as a primary catalyst for sustained growth in the circular fashion market through 2026.

SPONSORED BY XTRACKERS

Invest in the Architects of AI’s Future

The transformative impact of artificial intelligence is undeniable—and growing. For a deeper perspective on where AI is headed, read Artificial General Intelligence: AI’s Next Chapter.

Investors looking to stay ahead of this revolution should explore the Xtrackers Artificial Intelligence and Big Data ETF (XAIX), a diversified, pure-play strategy built to capture the companies shaping the very fabric of this AI-powered future.

XAIX doesn’t just follow trends, it proactively analyzes millions of newly approved patents, uncovering the firms that are pioneering AI innovation at its core, not merely riding its coattails.

Discover XAIX and invest with Xtrackers, a global leader in AI-focused ETF investing since 2019.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Xtrackers disclaimer linked at the bottom of the Newsletter.

AFTER THE BELL

Figma, Carvana, and Dash Make After-Hours Waves With Q4 Reports ✍

One stock is showing software does not need to fear AI. Figma shares rocketed 15% in after-hours trading Wednesday after the design software leader said if you can’t beat ‘em, join ‘em.

The Q4 results outperformed estimates, revenue hitting $303.8 million. Adjusted earnings per share reached $0.08.

Growth came from Figma Make, an AI tool that saw weekly active users surge 70% quarter-over-quarter. AI models from Anthropic and Google use a ton of computing, but the company maintained an 86% adjusted gross margin without breaking the bank to process design requests.

Management’s outlook showed the hope for sustainable AI monetization, guiding Q1 revenue to a range of $315 million–$317 million, well above the $292 million consensus. Starting in March, Figma will enforce new AI credit limits, positioning the company to hit $1.37 billion in total 2026 revenue.

Carvana reported a massive 58% year-over-year revenue explosion for Q4 2025, yet shares tumbled over 20% in after-hours trading. A miss on adjusted EBITDA and rising operational expenses hit the price by -15% after hours, despite a 43% climb in cars sold YoY to 596,641 in 2025. The catalyst for the sell-off was a squeeze in unit economics, as gross profit per unit fell by $255 to $3,076.

DoorDash delivered a "watershed" Q4 2025 featuring record-breaking order volumes, and the stock climbed 12% even as management warned of heavy investment spend for the year ahead. They are getting in on the AI capEx game: Management’s 2026 outlook includes several hundred million dollars in incremental spending to scale autonomous delivery and AI-native infrastructure.

MACRO NEWS

Federal Reserve Minutes Reveal "Hawkish Pivot" as Hike Talk Surfaces 🏛️

The Federal Reserve is signaling a stark departure from its recent easing cycle, with January meeting minutes that dropped Wednesday showing a growing internal divide over persistent inflation. While the central bank paused its string of cuts, some officials are now floating the possibility of returning to rate hikes if price stability remains elusive.

“The vast majority of participants judged that downside risks to employment had moderated recently while the risk of more persistent inflation remained,” the minutes said. “Several participants cautioned that easing policy further in the context of elevated inflation readings could be misinterpreted as implying diminished policymaker commitment to the 2% inflation objective.”

Benchmark rates were held steady at a 3.50%–3.75% range in a 10-2 vote, on Jan. 28th ending a streak of three consecutive quarter-point reductions. Several participants argued to put rate increases back on the table if inflation stays at 3%

While Fed Governors Christopher Waller and Stephen Miran dissented in favor of an immediate cut to support the labor market, the majority shifted focus to a "cyclical bottom" in hiring and a dip in the unemployment rate to 4.3%. This leaves the incoming Fed chair Kevin Warsh, a man known for calling for rate increases, in a difficult position. His nomination by Trump was done with the experes puropose of aiming for cuts.

MARKET NEWS

Forget the Fed chair—the best market predictor might actually be a stable. 🏇

Happy Chinese Lunar New Year, the Year of the Horse has officially begun. We are all thinking, what does this mean for markets? If you scroll Fintwitter as much as I do, you’ll know its a complicated question.

Ryan Detrick, CMT, said data shows the market seems to like animals that walk on all fours. Horse, Goat, Ox, Pig, and Dog show the strongest performing years in the 12-year cycle, often delivering double-digit gains. Two-legged signs like the Rooster and Monkey come up short.

Stephanie Guild, CFA, warns that the market may go wild. She said stock buybacks may be thinning, doubling over the last five years to $925 billion, but as companies shift cash toward capital investments, buyback demand could decline by 5% this year.

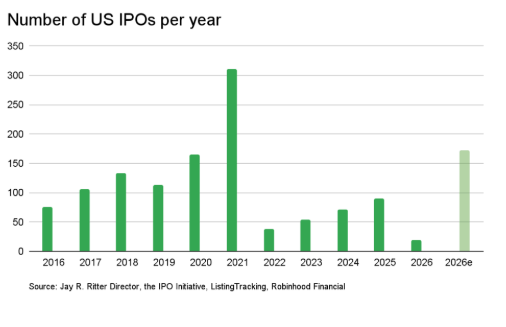

That if buybacks are low, IPOs may be the highest in a decade, save for 2021. We have already seen dozens of new listings and SPACs in 2026, with over 150 more rumored or planned.

And the year has already been wild: the S&P 500 has remained mostly resilient, but software stocks and the Magnificent Seven have taken a hit, with the Mag 7 Index slumping 7.2%. Software stocks are near “capitulation territory" after an eight-session losing streak wiped out 15% of their value. Analysts at Jefferies found that 42% of software stocks are trading near historical low valuations, with the sector trading below 20 times forward earnings for the first time ever.

Koyfin representation of a software ETF vs. QQQ, a Nasdaq 100 tracking ETF

But while AI giants are horsing around, the software subsector is still expected to post 14.1% earnings growth in 2026, still outpacing the 13.7% growth anticipated for the overall S&P 500. So does that mean they are a buy or not? Will the year of the horse follow the trend, or Buck it? 🐴

2026 Forecast

TRENDING STOCKS

Market Movers

$RXT ( ▼ 24.82% ) Rackspace Technology: Shares exploded to $1.47 after announcing a strategic partnership with Palantir to deploy AI Foundry and AIP platforms in sovereign data centers.

$IBRX ( ▼ 9.78% ) ImmunityBio, Inc.: Stock soared following conditional marketing authorization from the European Commission for ANKTIVA to treat bladder cancer in 33 countries.

$SHOP ( ▲ 1.27% ) Shopify Inc.: Rose 7.13% after a major analyst upgrade to Buy with a $150 price target, citing its dominance in the AI-integrated e-commerce space.

$MRNA ( ▼ 0.17% ) Moderna, Inc.: Advanced 6.28% as the company pivots toward its non-COVID pipeline, highlighting positive data for its upcoming RSV and seasonal flu vaccines.

$PANW ( ▼ 1.97% ) Palo Alto Networks: Shares tumbled 7.03% to $152.01 as disappointing full-year guidance overshadowed a quarterly beat, raising concerns about cooling enterprise software spending.

STOCKTWITS UPDATE

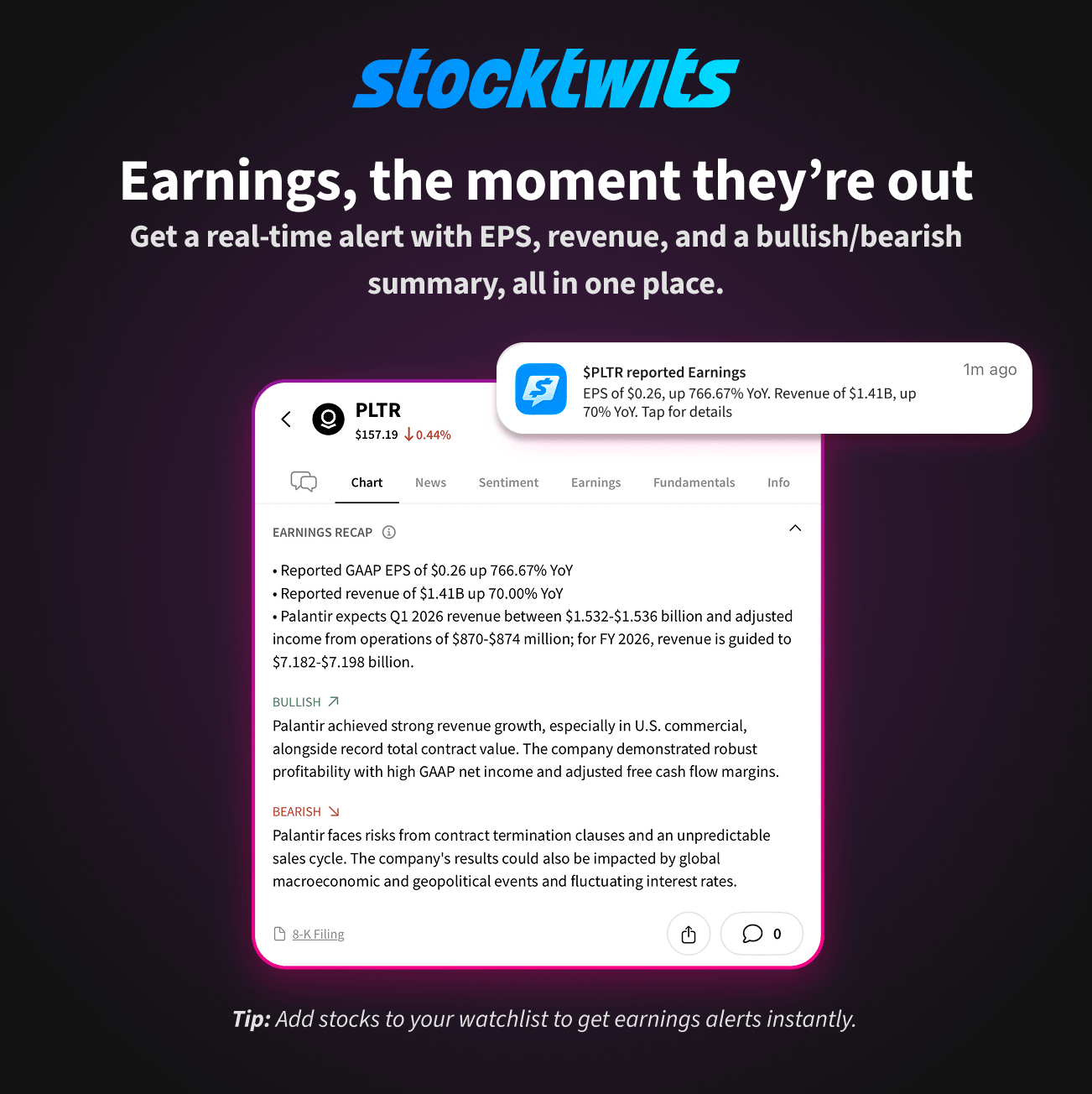

📢 New Feature: Earnings Summary Notifications

Earnings are the highest-stakes moments in trading, but if you aren’t staring at a terminal, you’re already behind. We’ve changed that.

Starting today, Stocktwits will notify you the second an AI-powered Earnings Summary is published for any stock on your watchlist. Whether you’re on the move or at your desk, we’ve got you covered:

App Users: Receive real-time push notifications.

Web Users: Get the breakdown delivered straight to your inbox

Each alert gives you the "Big Three" instantly: EPS, revenue, and forward guidance. From there, dive into our curated Bullish vs. Bearish takes and official SEC filings to see the full context without ever leaving the platform.

Don’t miss the next big move.

Links That Don’t Suck 🌐

📈 Join IBD Live and watch experts analyze the market in real time--and save $400 for a limited time*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

ST MEDIA

Top Stocktwits Stories 🗞

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Macro: Initial Jobless Claims, Philly Fed Mfg Index, 10-Year Note Auction, Existing Home Sales. 📊

Pre-Market Earnings: $BABA, $WMT, $ETSY, $W, $DE, $FUN, $YETI, $KLAR, $TECK, $ALIT, $SO, $UP, $SATS, $PWR, $EPAM, $FTI. ☀️

After-Market Earnings: $OPEN, $RIG, $DBX, $NEM, $CEG, $VAL, $AKAM, $LYV, $SFM, $RNG, $CENX, $CC, $PK, $CPRT, $TXRH, $ED. 🌙

P.S. You can listen to all of these earnings calls on Stocktwits.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The content is to be used for informational and entertainment purposes only and the service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which content is published on the service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋

Xtracker Disclaimer: All investments involve risk, including loss of principal. Information on the fund’s investment objectives, risk

factors, charges, and expenses can be found in the fund’s prospectus at Xtrackers.com. Read it carefully

before investing. For current holdings and more info Xtrackers Artificial Intelligence and Big Data ETF | XAIX. Distributed by ALPS Distributors, Inc.Companies involved in artificial intelligence and big data face intense competition, may have limited

product lines, markets, financial resources and personnel. Artificial intelligence and big data companies are also subject to risks of new technologies and are heavily dependent on patents and intellectual property rights and the products of these companies may face obsolescence due to rapid technological developments. Incorporation of ESG criteria in the fund’s investment strategy does not guarantee a return or protect against a loss, limits the types and number of investment opportunities available to the fund and, as a result, the fund may underperform other funds that do not have an ESG focus. This fund is non-diversified and can take larger positions in fewer issues, increasing its potential risk. An investment in this fund should be considered only as a supplement to a complete investment program for those investors willing to accept the risks associated with the fund. Please read the prospectus for

more information. Nasdaq Global Artificial Intelligence and Big Data Index is a registered trademark of Nasdaq, Inc, (which

with its affiliates is referred to as the “Corporations”) and is licensed for use by DBX Advisors LLC. The Fund has not been passed on by the Corporations as to their legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE FUND. Xtrackers ETFs ("ETFs") are managed by DBX Advisors LLC (the "Adviser") and distributed by ALPS Distributors, Inc. ("ALPS"). The Adviser is a subsidiary of DWS Group GmbH & Co. KGaA and is not affiliated with ALPS. © 2026 DWS Group GmbH & Co. KGaA. All rights reserved. 108985-1 (1/26) DBX007118 (1/27)