NEWS

THREE DAY STREAK

Well, well, well, looks like the market climbed for a third day in a row. The indexes were retaking records we took for granted last summer. With tariff talk taking a time out, the market is watching one thing: big tech earnings. Alphabet joined Tesla in the winners’ club after it too beat very high expectations this afternoon.

Oh wait, Tesla missed bad, but the stock is up 14% this week as eyes looked toward the passive income self-driving future. Speaking of bad, existing home sales were at a three-year low in March, and closings haven’t been this bad since 2009.

Surely it won’t jynx tomorrow’s trading direction if we ask for four up days in a row. 👀

Today's issue covers Google, Google, and Intel, House sales suck, and a bunch more earnings. 📰

Here’s the S&P 500 heatmap. 10 of 11 sectors closed green, with tech (+3.73%) leading and consumer staples (-0.88%) lagging.

And here are the closing prices:

S&P 500 | 5,485 | +2.03% |

Nasdaq | 17,166 | +2.74% |

Russell 2000 | 1,958 | +2.00% |

Dow Jones | 40,093 | +1.23% |

EARNINGS

Google And Google (And Intel) 🤖

Alphabet reported Q1 EPS of $2.81 on revenue of $90.23B, both above estimates. The stocks were up about 2% in the lead-up to the results, and popped 5% after the firm showed its earnings climbed 40% above estimates.

Cloud revenue barely missed as a segment, coming in at $12.26B, while the market wanted ten million more. Still, the unit pulled in 28% more revenue this quarter than in Q1 2024. Chief Sundar Picahi said the firm’s Gemini 2.5 AI model powers summaries seen by 1.5B users every month.

“We’re pleased with our strong Q1 results, which reflect healthy growth and momentum across the business. Underpinning this is our unique full-stack approach to AI,” Picahi said. “Driven by YouTube and Google One, we surpassed 270 million paid subscriptions. And Cloud grew rapidly with significant demand for our solutions.”

CNBC reported earlier that YouTube is on track to become the world’s largest media company by revenue this year.

According to Yahoo Finance, analysts were looking for Q1 earnings of $2.01/share on revenue of $89B. For forward guidance, analysts expect $2.12 /share for Q2, and $8.08 for the full year 2025, with revenue at $89.45B for Q2, and $368.5B for the full year.

With nearly $360B in revenue tracked for the year at this rate, it’s clear why tech giants stand out from the rest of the stock crowd. Congrats to the 70% of you who called this one correctly in our poll:

Intel also reported today, but the firm said it lost $0.19 a share in the past quarter. Revenue beat at the U.S. chipmaker, but fell from last year’s Q1 to $11.67B. The firm’s guidance also fell below expectations, and after a 20k layoff announced this week, new CEO Lip Bu-Tan said he would change management a lot going forward. 👁

SPONSORED

RIDE WITH INVESTOPEDIA’S "BEST BROKER FOR OPTIONS TRADING 2025"

We’ve got pre-set watchlists, curve analysis, and more tools to help you ride out tough markets.

Plus, pricing that fits the way you trade.

Find Stocks. Options. Futures. Crypto and more. All in one place.

Get serious about trading with order chains, backtesting, visualized analysis, and courses.

Discover how we’re blazing new trails in the world of finance.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. tastytrade, Inc., and Stocktwits are separate and unaffiliated companies that are not responsible for each other’s services, products, and policies.

STOCKS

Selling A House? Get In Line, Buddy 🏚

Existing U.S. home sales fell the most in March as they have in three years. Bloomberg called it a sign that the American housing market is about as unaffordable as ever, and 7% mortgage rates are making it worse.

Contract closings fell 5.9% in March to an annualized rate of 4.02 million, the worst since 2009. ☠

Prices are only going up. The median sales price climbed 2.7% from a year ago to $403,700, a March record. Prices have risen every year since 2023.

Prices are climbing even with more houses on the market- there were about 1.3M previously owned homes, 20% more than a year ago. The National Association of Home Builders said policies are not helping- tariffs will add about $10,900 to the price tag of a new home.

Okay, But…

All eyes watched for Federal Reserve speakers today, hoping there might be mention of tariffs or interest rates.

New York Fed Governor Christopher Waller said he’d support rate cuts if tariffs hurt the jobs market, speaking with Bloomberg. Cleveland Fed President Beth Hammack told CNBC that the board could move on rates as early as June if it has a clear economic direction. 📆

President Trump started the week speaking out against Fed President Jerome Powell and interest rates, but has since softened, likely at the request of advisors. As the story evolved, it became clearer that the market would hate it if Trump took direct action to change the board and rates, and even removing Powell would not be enough. Or, ya know, legal.

Trump said that China talks were going well; they talked today, in fact, even though China said they are not on speaking terms. A bit of ‘He said Xi said.’ 🤼

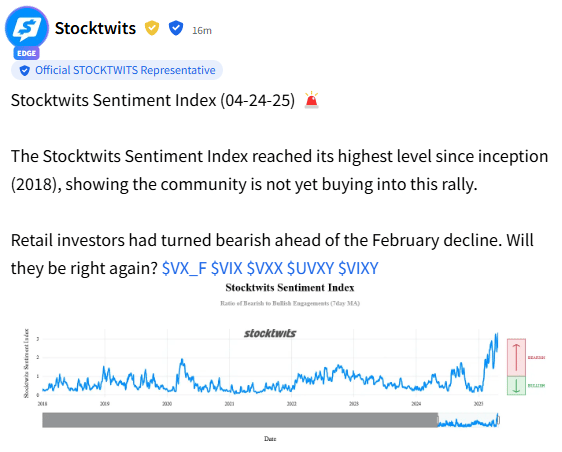

One thing is clear: sentiment is low, outlooks are dim after a crazy month, and Stocktwits retail data supports it: Check out the “Chart of the Day” below. 👇

CHART OF THE DAY

The Stocktwits Community Isn’t Buying This Rally 🤔

If you like this chart and commentary, you’ll love our “Chart Art” newsletter. We’ll deliver you the best trade ideas and analysis from the Stocktwits community every evening by 8 pm ET. Give today’s a read, it was a good one!

STOCKS

The Stocktwits News’ Team’s Top Hits 📰

Hasbro Inc. ($HAS +15%): The toy maker reported Q1 revenue of $887.1 million, up 17% YoY and over estimates. EPS came in at $1.04, beating the $0.67 forecast. Despite tariff headwinds, the company maintained its full-year outlook but warned of potential job cuts due to cost pressures.

ServiceNow Inc. ($NOW +15%): Reported an EPS and revenue beat. Subscription revenue grew 20% YoY to $3.03 billion, and the company raised full-year subscription revenue guidance to $12.64–$12.68 billion.

PepsiCo ($PEP -5%): Cut its 2025 earnings outlook, citing rising supply chain costs tied to global tariffs. Q1 revenue fell 1.8% YoY to $17.92 billion, beating the $17.77 billion estimate, while EPS narrowly missed at $1.48 versus $1.49 expected.

Comcast Corp ($CMCSA -4%): The media giant reported Q1 revenue of $29.89 billion, surpassing the $29.76 billion estimate, despite a marginal YoY decline. Adjusted EPS came in at $1.09, beating the $0.99 forecast. Shares fell, reflecting concerns over broadband subscriber losses.

American Airlines ($AAL +3%): Reported a Q1 revenue of $12.55 billion, slightly missing the $12.56 billion estimate, with an adjusted loss per share of $0.59, beating the expected $0.67 loss. The airline withdrew its full-year guidance, citing economic uncertainty, but expects Q2 EPS between $0.50 and $1.00.

Procter & Gamble ($PG -4%): Q3 results missed revenue expectations, with earnings per share of $1.54 beating by $0.01. Revenue declined 2% to $19.8 billion, below the $20.1 billion forecast. It lowered its full-year sales and EPS guidance, citing a $1-$1.5 billion annual impact from Trump’s tariffs.

Bristol Myers Squibb ($BMY +0.3%): Reported Q1 revenue of $11.2 billion, beating the $10.71 billion estimate, despite a 6% YoY decline. Adjusted EPS came in at $1.80, surpassing the forecast of $1.5. The company raised its full-year revenue guidance, reflecting strong growth in its portfolio.

VinFast Auto ($VFS +3%): EV firm VinFast reported a Q4 net loss that got worse this year by 81% to $1.26 billion, with revenues rising 70% YoY to $677.9 million. The performance fell short of the $859.08 million estimate, but the company aims to double vehicle deliveries in 2025.

PRESENTED BY STOCKTWITS

Daily Rip Live With THREE Special Guests 🤩

It was a jam-packed morning with your regular hosts, Shay Boloor and Katie Perry, joined by three special guests: Andrew McCormick (eToro), Daniel Newman (Futurum Group), and Olivier Roussy Newton (DeFi Technologies).

eToro says 75% of retail investors are buying or holding during this dip

Daniel Newman outlines how enterprise AI is breaking the stack

Discussing all things crypto and macro with Olivier Roussy Newton

Google vs. the DOJ, Geimini’s Rise, and the AI search wars

Plus, some FOMO around The Cashtag Awards next week in NYC

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: Russia Interest Rate Decision (6:30 am), Michigan Consumer Sentiment (10 am). 📊

Pre-Market Earnings: AbbVie ($ABBV), SLB ($SLB), Phillips 66 ($PSX), Flagstar Financial ($FLG), Colgate ($CL), Charter Communications ($CHTR), AutoNation ($AN). 🛏️

After-Hour Earnings: None — have a good weekend. 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋