NEWS

Thursday Took Us For Nearly $2T: Is It Over?

The market fell on Thursday and gave back a third of everything it gained the day before, after the bear market really started to show its teeth. A 20-24% average tariff rate across every nation is not good for business, even if it is better than something worse.

Bank earnings are tomorrow, and half of Stocktwits users think in this economy the result will be bearish. 👀

Today's issue covers de-dollarization, industries hurting despite the pause, and one sign that inflation was falling. 📰

Here’s the S&P 500 heatmap. 1 of 11 sectors closed green, with consumer staples (+0.04%) leading and technology (-9%) lagging.

Source: Finviz

And here are the closing prices:

S&P 500 | 5,268 | -3.46% |

Nasdaq | 16,387 | -4.31% |

Russell 2000 | 1,831 | -4.27% |

Dow Jones | 39,594 | -2.50% |

STOCKS

When Bonds Are A-Rockin’ Don’t Come A-Knockin’ 😉

If one thing has become clear, it’s that international investors are shifting money away from U.S. assets like Treasury bonds and toward stability-enhancing alternatives. Gold hit an all-time high despite low inflation and jobless claim numbers.

What’s going on? Well, longer-term treasuries are still selling off, and that shows fear that the pain is not over yet. The US 10-year treasury note yield fell after the tariff pause but was climbing back toward 4.5 at the time of writing.

Thankfully, the normal 10-year sale Wednesday was followed by a solid 30-year sale today, according to Rick Santelli, On-Air Editor at CNBC. The market was working just fine, it was just worried the U.S. was not as stable as hoped.

Where is capital going? Well, for one thing, the Euro: it climbed the most today as it has for years, according to MarketReader Chief Jens Nordvig:

According to the Wall Street Journal, traders also pushed gold futures to a new all-time high, the biggest move up in front-month contracts since 2020. Edward Harrison, Senior Editor at Bloomberg, wrote yesterday that the Trump administration's sudden knee-jerk moves on trade are undermining the country's position as a good, old, trustworthy place to keep your dollars safe.

He saw the spike in Swiss Francs, Euros, and Yen vs. the dollar as a sign that people wanted out. According to George Saravelos, head of FX strategy at Deutsche Bank, Trump singled China as the main target, but they are also best equipped to fight a financial war against the U.S.

Even the Stocktwits community seemed convinced that, in the face of a trade war, Chinese equities were in for more gain. Unfortunately, Fox Business Correspondent Charles Gasparino reported late Thursday that the Trump administration was testing the appetite to delist Chinese firms from U.S. exchanges. 🧧

IN PARTNERSHIP WITH STOCKTWITS

Expert Charts, Candor, & Conclusions: Join Us Monday, April 14th In NYC 🧑🏫

Fundstrat’s Mark Newton & Tom Lee will join Macro Risk Advisors’ John Kolovos for a session, “Navigating the Noise: Tools & Tactics in Turbulent Markets.” 🚨

Join the CMT Association for this must-attend event for financial professionals seeking cutting-edge insights into technical analysis, market strategy, and next-gen portfolio management. Taking place at the stunning Hudson Yards, this summit promises to deliver valuable knowledge from industry leaders and thought-provoking discussions.

Kick off the Summit with networking and refreshments, then dive into an afternoon filled with engaging sessions. Learn to develop a tactical playbook for volatile, uncertain, and erratic markets from a panel of seasoned experts, including Jay Woods, CMT; Frank Cappelleri, CMT, CFA; and Katie Stockton, CMT.

Wrap up the summit by connecting with peers during a relaxed cocktail hour. Don’t miss this unique opportunity to advance your technical analysis expertise and expand your professional network. Stocktwits’ own Tom Bruni and Kevin Travers will be in attendance, so we’ll see you there! 👋

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

COMPANY NEWS

Less Than A Ton Is Still A Lot 🫠

The U.S. might have limited tariffs from the nuclear option, but trade issues are still ripping through the economy.

$KMX Carmax shares fell the most on the SPX Thursday morning after the firm reported solid Q4 results but removed the timeframe for its forward guidance- Truist analysts said no one had an idea how tariffs would affect car prices. Bloomberg said it faced the biggest one-day drop since 2022.

It would have finished out in the worst spot, falling 17%, but a half hour before the close, RFK spoke about vaccines and autism on Fox News, and the lab research firm Charles River suddenly fell 26%. 💉

Anyway, car parts: 25% levies on parts are coming on May 3rd, which is bad news for car servicing and selling firms. Carmax reported earnings of $0.58/share, below Wall Street estimates, despite a year-over-year revenue increase of 6.7% to $6 billion.

The firm reported used vehicle sales rose, but it was not enough to compensate for trade troubles. According to Barron's, automakers like Audi, Volkswagen, and Jaguar have begun halting shipments to the U.S., which has affected firms like Carvana and AutoNation.

China Will Never See Dune 3 At This Rate

$WBD Warner Bros. gave back half of yesterday's 20% jump, one of the stocks leading QQQ lower. The Hollywood studio was falling alongside firms like Microchip Technology, which flew 27% on Wednesday and was falling back with the rest of the semiconductor firms.

Film producer stocks were falling Thursday after it became clear that movies are one thing the U.S. exports to China. The China Film Administration announced Thursday it would cut imports of American films. Disney also fell on the news.

According to Box Office Mojo, Dune: Part Two was the seventh-best-performing film worldwide last year, bringing in $282 million from the domestic box office and $48 million from China. 🪱

U.S. Steel Hit By Change Of Plans

In yet another upset in the $X saga, U.S. Steel shares fell after the troubled producer was hit while it was down. They fell further after the Trump Administration made it clear they did not want X to sell to Nippon Steel for $14B. Though investors were hopeful earlier in the week, Stocktwits users were not convinced. 😢

Tech Pulls Back After Historic Run

In general, the best day in history for the Semiconductor sector could only see a down day to follow. It seems obvious in hindsight, but hey, so did Trump telling us all to buy.

$NVDA Nvidia pulled back after adding $440B to its market cap, but the reality of the bear market set in. $TSLA Tesla led the Mag 7 in declines Thursday, a company that Chief Musk claims is the most vertically integrated in the U.S., but it relies heavily on imported parts for construction. Dan Ives told Bloomberg earlier this week it was a “fairytale” that Tesla could succeed without a pile of imported parts machined abroad.

$AAPL Apple had its best day since 1998 on Wednesday but gave back a third of its climb. The firm emergency airlifted 600 tons of iPhones from India to beat tariffs to the U.S. Let’s hope for Apple’s sake that they land soon. 🧑✈

STOCKS

Other Noteworthy Pops & Drops 📋

Delta ($DAL -9%): Airlines fell sharply after Delta said it would reduce capacity growth in Q2 amid slower demand from tariff wars. 41% of Stocktwits respondents said the stock is a sell because the economy is headed for a recession.

Rivian ($RIVN -3%): EV maker Rivian fell after multiple price target cuts. Goldman Sachs lowered its target to $12, noting tariffs would hurt automakers and suppliers.

Capri ($CPRI -9%): Italian luxury house Prada agreed to buy Versace from Capri Holdings on Thursday for $1.38B in debt and cash. Following the announcement, Capri fell more than 10% as investors worried about the timing of this large purchase.

CureVac ($CVAC -4%): The biotech company CureVac N.V. fell after its fourth-quarter revenue was below Wall Street estimates. Its revenue growth was primarily driven by a new license agreement with GSK with a €400 million upfront payment.

General Motors ($GM -3%): Multiple brokerages downgraded the automaker and cut their price targets due to auto tariff concerns. UBS downgraded General Motors to ‘Neutral’ from ‘Buy’ with a price target of $51, down from $64.

Polestar ($PSNY-4%): The EV maker declined despite news that its retail sales volume climbed 76% year-over-year to an estimated 12,304 units.

JPMorgan Chase ($JPM -3%): Bank earnings kick off on Friday, with four major lenders, JPMorgan, Morgan Stanley, Wells Fargo, and BlackRock, ready to report. Retail investors appear to be nervous ahead of the reports' release, led by fears of a slowing economy and declining net interest margin.

PRESENTED BY STOCKTWITS

Tariffs Paused. Markets Ripped. Portfolios Exploded. 🚨

Daily Rip Live hosts Shay Boloor and Katy Perry react to the market’s historic day. Shay outlines his market edge and how he’s adjusting his portfolio after the rally.

ECONOMY

At Least Inflation Fell Last Month 🧺

Macroeconomic numbers this morning showed one of the few good signs in the seven long days since liberation. 👍

In macro news, March CPI was lower than expected, at 2.4% YoY, and actually fell 0.1% MoM. That's the first time consumer inflation numbers have done that since June of last summer. Despite the great inflation numbers (they went down), the market did not really care.

In fact, Claudia Sahm, a Former Fed economist, told Yahoo Finance it could be the last good CPI number for a while. 😢

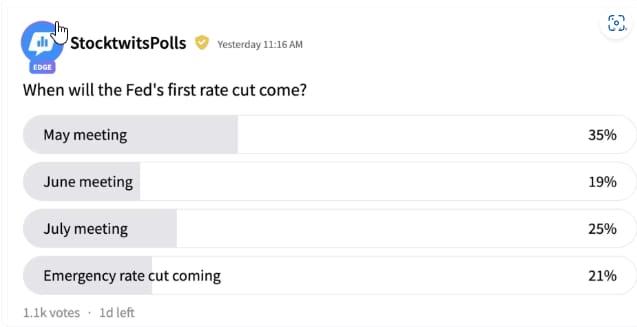

"The tariffs that have gone into effect, it's going to take time for it to show up in the data." She said. Stocktwits users think these numbers might be what the FOMC needs to make a monetary policy change in May.

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: European Central Bank President Speech (5:45 am), Producer Price Index (8:30 am), Michigan Consumer Sentiment (10 am), Fed Musalem Speech (10 am), Fed Williams Speech (11 am). 📊

Pre-Market Earnings: JPMorgan Chase ($JPM), Wells Fargo ($WFC), Morgan Stanley ($MS), BlackRock ($BLK), Bank of New York Mellon ($BK), Fastenal ($FAST). 🛏️

After-Hour Earnings: Children's Place ($PLCE). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

🧑🏫 Join IBD’s experts for a comprehensive workshop where you’ll learn the secrets of short selling*

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋