Presented by

CLOSING BELL

TikTok Deal: Signed, Sealed, In Transit

The market fell for a third consecutive day, held back by Enui, and lack of substantial news to drive a climb. Macro data released on Thursday morning was positive, showing the economy expanded at a 3.8% rate in Q2 after contracting in Q1. Initial jobless claims came in lower in the past week, but in times of rate cuts, that might mean less weight on the scale to cut.

Ken Griffen of Citidel Securities had some words of warning at an event in Miami on Thursday. He said the Trump Admin was ‘picking winners’ in buying stakes of companies, and when the government does that, “all of us lose.” He also said the worst of tariff inflation is not here yet. 👀

Today’s RIP: Costco beat earnings, CarMax missed, and car sales suck, TikTok order signed but China needs to approve, and more. 📰

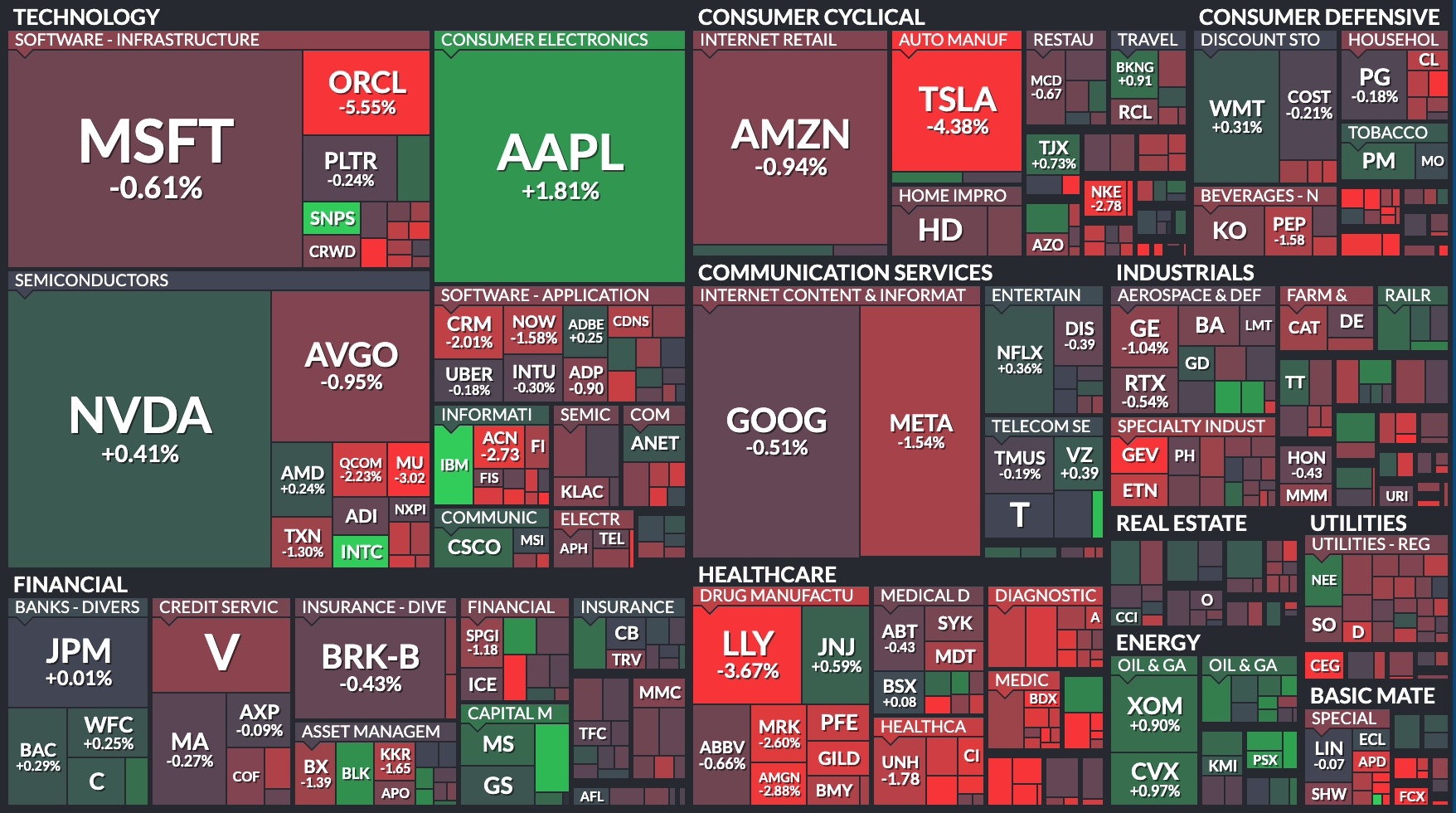

1 of 11 sectors closed green, with energy $XLE ( ▼ 0.09% ) leading and healthcare $XLV ( ▼ 0.42% ) lagging.

EARNINGS

Costco Beats With Growing Members, CarMax Misses As Car Market Slows 🛍 🚘

Costco $COST ( ▲ 1.26% ) reported EPS and revenue above estimates after the closing bell on Thursday. The big-box shopping club, known for its bulk items and affordable hot dogs, reported that same-store sales increased 6.4% in the past quarter. Revenue was $86.6B, with profit at $5.87 a share.

CFO Gary Millerchip said its average customer was getting younger, and younger buyers were snatching up membership fees. Costco raised its membership $5 last year. The higher ticket cost to ride the bulk-buying ride brought in $1.7B, up 14% from last year.

For the full year, Costco's net sales grew 8.1% to $269.9B. CostCo did not post updated 2026 guidance, and said it was still working out ways to keep costs low in the face of tariffs.

Strangely enough, the beat wasn’t a win for traders betting on a beat… on Polymarket. Polymarkets’ main stakes for the Costco results were based on adjusted earnings, though the firm does not report adjusted. The contract for ‘will Cosctco beat EPS estimates’ dropped from 80% to 1% today, when users found out.

Carmax $KMX ( ▲ 1.96% ) shares dropped Thursday, the lowest decliner on the S&P 500 after the in-person used car seller reported angsty consumers held back from buying cars in the past quarter.

The largest seller of used cars reported that sales declined in Q2, and Chief Bill Nash stated that buyers accelerated their demand in Q1, anticipating the worst from tariffs and inflation.

"The consumer has been distressed for a little while. I think there's some angst," Nash said. He also said customers with better credit are waiting on the “sidelines.”

Unlike $CVNA ( ▲ 0.02% ), CarMax operates a ton of retail spaces, 250 to be exact. Sales fell 5.4% from last year, and revenue fell nearly 6% from earlier in the year to $6.5B.

SPONSORED

$RR: Scaling Real-World AI Robotics Across the USA

Stocktwits community, check out $RR's progress in AI robotics! Public highlights:

- NVIDIA Connect partner

- 400+ robots deployed worldwide

- MSA with one of the largest retailers in the world

- Robots at the Kennedy Space Center & MLB Stadium

- Expanded into a new Las Vegas HQ with 400% more production capacity

- Inclusion in the Russell 2000 Index and the S&P Global BMI

$RR is deploying real world robotics solutions across the USA today. Don’t miss out!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

DEALS

TikTok Deal Approved By Trump In Oval Office Signing 🖊

President Trump greeted reporters in the Oval Office to sign an executive order approving the TikTok takeover deal on Thursday after the market closed.

The deal values the U.S. business at $14B dollars, according to VP Vance. China still needs to approve its end, but it would give the U.S. a 45% stake in TikTok, and ByteDance investors 35%, according to CNBC.

Oracle $ORCL ( ▲ 3.42% ) will provide cloud security and computing, and Trumpo said Chief Larry Ellison is taking a big role. The valuation is a bit low; TikTok’s U.S. arm previously fetched a $30-$35B price tag. If China approves, and Trump said President Xi has already given the thumbs up, it would be the better choice over a complete shutdown slated for Dec. 16.

It’s the second massive media deal to get close to home plate in the past months, and the second by an Ellison, after Skydance Media’s David Ellison agreed to take over Paramount $PSKY ( ▼ 1.61% ), the owner of CBS, MTV, and the Hollywood film studio. That deal closed Aug. 7th. Trump said the Murdochs, with succession recently organized under Rupert’s prized son, Malcom, in yet another media deal, may take part in the deal.

If that weren’t enough, Trump said yet another billionaire was vested in the TikTok deal, Michael Dell. Birds of a feather… 🦜

SPONSORED

Stocktoberfest 2025: Where Markets Meet the Coast

Stocktoberfest 2025 returns Oct 20–22 at the iconic Hotel del Coronado, bringing together retail investors, public company execs, and analysts for three days of real conversations, market insights, and beachside networking — all with a stein in hand. 🍺

✔️ Panels, workshops, and unfiltered discussions

✔️ Golf, sailing, yoga excursions

✔️ Sunset Biergarten showdowns and private dinners

Come for the markets. Stay for the sunsets and steins. 🌅🍻

🎟️ Tickets moving fast → Grab Yours Now

POPS & DROPS

Top Stocktwits News Stories 🗞

Oklo dropped 9% intraday after coolant test.

PepGen surged 121% intraday on DM1 trial data.

CoreWeave fell 5% intraday on $6.5B OpenAI deal.

World Liberty Financial listed on Robinhood.

IBM rose 5% intraday on HSBC quantum trial.

AtlasClear surged 23% intraday on $5M funding close.

Cipher fell 17% intraday on $3B Fluidstack deal.

IonQ fell 6% on AQ 64 breakthrough.

Predictive Oncology fell 19% intraday on reverse split news.

Evaxion surged 32% on a Merck vaccine deal.

Don’t miss a story! Follow @StocktwitsNews for a live feed in real time. ✍️

PRESENTED BY STOCKTWITS

September has been consistently brutal for crypto and the worst month on record for $BTC.X 📉

If you removed every September since 2010, Bitcoin’s total returns would be 112% higher 👀 Check out what Cryptotwits’ Jonathan_Morgan has to say:

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: PCE Price Index (8:30 AM), Michigan Consumer Expectations (10:00 AM), Atlanta Fed GDPNow Q3 (11:30 AM) 📊

Pre-Market Earnings: Inventiva ($IVA). 🛏️

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Help us deliver the best content possible by completing this brief survey. 📝

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋