NEWS

Trump Cyber Bullies Powell To Stop A Slowdown

Source: tenor

The market fell again on Monday, as investors lazily returned from a holiday weekend, and some international markets remained closed to celebrate Easter. Gold hit an all-time high, Bitcoin climbed, but U.S. indexes fell after President Trump continued his verbal attacks on Fed Chair Jerome Powell, egging him on to preemptively lower rates, even calling him a loser. ☹

It is the start of the first Mag 7 earnings week, with Tesla expected tomorrow and both Googles reporting Thursday. 👀

Today's issue covers Tesla’s make-or-break moment, Trump cyber bullying Powell, and more. 📰

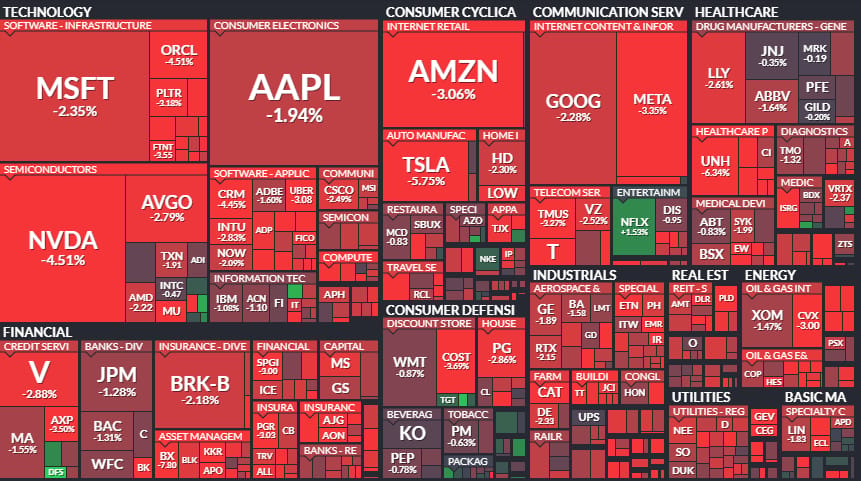

Here’s the S&P 500 heatmap. All 11 sectors closed red with consumer staples (-0.78%) leading and technology (-4.98%) lagging.

And here are the closing prices:

S&P 500 | 5,158 | -2.36% |

Nasdaq | 15,871 | -2.55% |

Russell 2000 | 1,840 | -2.14% |

Dow Jones | 38,170 | -2.48% |

EARNINGS

Tesla’s Red Alert Earnings Report 📦

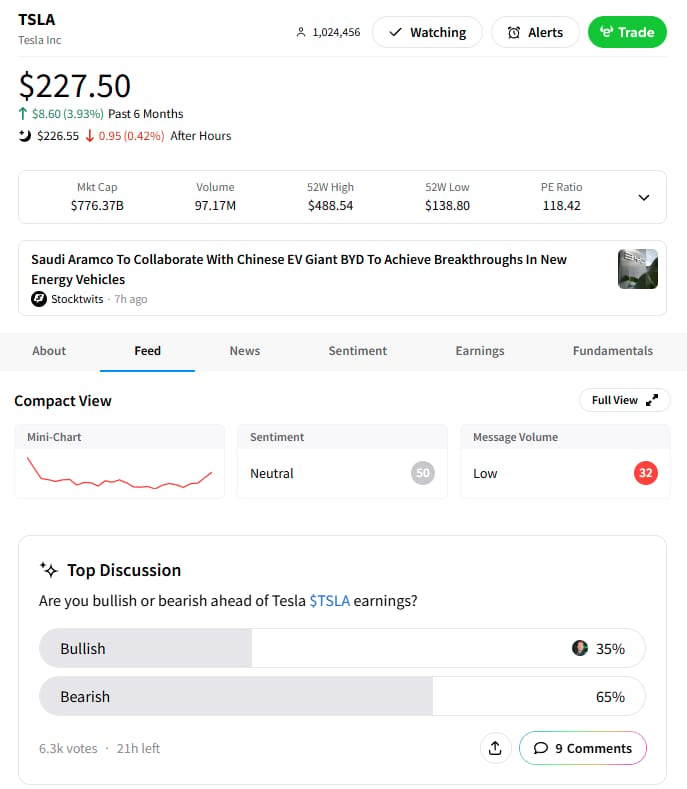

$Tesla fell 7% today. The EV firm is due to report on Tuesday, and more than one analyst calls it a make-or-break moment for the stock. Two analysts at Wedbush, including tech bull Dan Ives, wrote over the weekend that investors expect Chief Elon Musk to say he is reprising his role as full-time company leader. If he doesn’t stop his political work at DOGE, it’s a “code red situation.” 🚨

According to Ives, Tesla faces “potentially 15%-20% permanent demand destruction for future Tesla buyers due to the brand damage Musk has created with DOGE.”

Ives said Musk has become a starkly political figure, and the demand hit might become permanent if it does not reverse soon. Earlier this month, Tesla posted the worst quarter for deliveries in two years: a sharp 13% decline in first-quarter deliveries of 336,681 units. 👹

Tesla's shares have dropped 36% year-to-date, but Wedbush still has an outperform rating and a twelve-month price target of $315, believing the firm to be one of the "most disruptive" technology companies, with the chance to turn it around.

Analysts’ expectations compiled by Bloomberg expect Q1 earnings per share to decrease to $0.44 from $0.45 a year earlier, and revenue to increase marginally to $21.43 billion.

According to the firm’s investor relations Q&A submission site, shareholders hope to hear about self-driving cars, affordable model releases, and what tariffs mean for Tesla production. 📣

Stocktwits users in a weekend poll shifted to overwhelmingly bearish on the stock, though overall post sentiment is dead neutral. 🥸

SPONSORED

RIDE WITH INVESTOPEDIA’S "BEST BROKER FOR OPTIONS TRADING 2025"

We’ve got pre-set watchlists, curve analysis, and more tools to help you ride out tough markets.

Plus, pricing that fits the way you trade.

Find Stocks. Options. Futures. Crypto and more. All in one place.

Get serious about trading with order chains, backtesting, visualized analysis, and courses.

Discover how we’re blazing new trails in the world of finance.

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here. tastytrade, Inc., and Stocktwits are separate and unaffiliated companies that are not responsible for each other’s services, products, and policies.

STOCKS

Trump Keeps Bullying Powell, While The World Sells America 🫡

Over the weekend, Trump continued to call out Powell, saying the always late Fed head would have to lower rates or face the music. Advisors in the White House Cabinet have confirmed that Trump has asked about how he could remove Powell, and many talking heads are saying it would be a disaster for U.S. stability.

Though Trump won’t say what is causing the bearish market, he said the economy could slow unless “Mr. Too Late, major loser, lowers interest rates, NOW.”

“Sell American” has replaced the Buy American market, as investors are looking for any way to distance themselves from a market that, up until recently, outpaced the rest of the world. Gold hit a record high again, Bitcoin was on the way up, and the Dow is on track for its worst April since 1932, according to Barron’s.

Barclays analysts punctuated the Sell American trade, downgrading their dollar forecast as the world reserve hit a three-year low. 💵

Monex forex trader Helen Given told Bloomberg that any threat to removing Powell threatens the dollar's status as a global reserve currency.

“Trump’s musings on the potential for firing Fed Chair Powell do in the minds of the international community constitute a substantial threat to the independence of the US central bank and by extension the status of the dollar as a safe haven currency,” Given said.

In a Sunday note, TD Cowen Managing Director Jaret Seiberg wrote that the president does not have the power to remove Powell; that right is reserved for Congress alone. Seiberg said that if Trump wanted to, he would not stop.

“That said, we do not see legal questions stopping Trump if he is determined to act,” Seiberg said.

In a quick Stocktwits poll, nearly 2,300 retail respondents felt Powell deserved more time in the office. The market is waiting for the PCE inflation reading next week, and for Trump to relent or take it a step further.

STOCKS

Other Noteworthy Pops & Drops 📋

Gold ($XAU/USD +3%): Gold prices hit an all-time high of $3,404 per ounce, surging 29.67% year-to-date, driven by a weakening dollar and mounting trade policy uncertainties. The U.S. Dollar Index dropped to 98.30, marking its lowest point since March 2022.

Amazon ($AMZN -3%): Raymond James analyst Josh Beck downgraded Amazon stock to 'Outperform' from 'Strong Buy,' citing tariff-related supply chain and advertising headwinds. Beck trimmed the price target to $195 from $275. 30% of Amazon's gross merchandise value and 15% of its advertising business are tied to China.

Walgreens ($WBA -0.2%): The pharmacy company agreed to pay $300 million over six years to settle allegations of improperly dispensing opioid prescriptions, with an additional $50 million penalty possible under certain conditions.

Lucid Group ($LCID -3%): Baird raised its price target for EV maker Lucid to $3 from $2 following its product spotlight event, maintaining a 'Neutral' rating. The new target suggests a 26% upside from the company's closing price of $2.38 last Thursday.

Coca-Cola ($KO -0.3%): Analysts at JPMorgan highlighted Coca-Cola's resilience against Trump's tariffs Monday, crediting its diversified supply chain for shielding its financial performance.

Google ($GOOG / $GOOGL -2%): The DOJ began opening arguments in its antitrust trial against Google, advocating for restrictions to prevent the company from using AI to maintain its dominance in online search.

Reddit ($RDDT -2%): The social media platform Reddit faced a 28-minute partial operational outage on Monday, with thousands of users reporting errors globally.

Chipotle ($CMG -3%): Burrito firm Chipotle announced plans to expand into Mexico, targeting an early 2026 launch. Chief Business Development Officer Nate Lawton expressed confidence that Chipotle will appeal to Mexican consumers. 🌮

WHAT’S ON DECK

Tomorrow’s Top Things 📋

Economic data: IMF/World Economic Outlook (9 am), Fed Harker Speech (9:30 am), Richmond Fed Manufacturing (10 am), Fed Kashkari Speech (2 pm). 📊

Pre-Market Earnings: GE Aerospace ($GE), Verizon ($VZ), Lockheed Martin ($LMT), RTX ($RTX), Northrop Grumman ($NOC), 3M ($MMM), Haliburton ($HAL), Danaher ($DHR), Kimberly-Clark ($KMB), PulteGroup ($PHM). 🛏️

After-Hour Earnings: Tesla ($TSLA), Enphase Energy ($ENPH), Intuitive Surgical ($ISRG), Capital One Financial ($COF), Steel Dynamics ($STLD), Range Resources ($RRC), Chubb ($CB), Mind Technology ($MIND). 🎧

P.S. You can listen to all of these earnings calls and more straight from the Stocktwits app or website. You’ll find them on the calendar page and individual symbol pages once they’re set to begin! We’ll see you there. 👍

Links That Don’t Suck 🌐

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Get In Touch 📬

Follow our social channels for great, real-time content on Stocktwits and Twitter. And check out our YouTube channel for in-depth video content! 📲

Help us deliver the best content possible by completing this brief survey. 📝

Email me (Tom Bruni) your feedback; I’d love to hear from you. 📧

Want to sponsor this newsletter and reach hundreds of thousands of passionate investors and traders? Reach us here.

Terms & Conditions 📝

Securities Disclaimer: STOCKTWITS IS NOT A TAX ADVISOR, BROKER, FINANCIAL ADVISOR OR INVESTMENT ADVISOR. THE SERVICE IS NOT INTENDED TO PROVIDE TAX, LEGAL, FINANCIAL OR INVESTMENT ADVICE, AND NOTHING ON THE SERVICE SHOULD BE CONSTRUED AS AN OFFER TO SELL, A SOLICITATION OF AN OFFER TO BUY, OR A RECOMMENDATION FOR ANY SECURITY. Trading in such securities can result in immediate and substantial losses of the capital invested. You should only invest risk capital, and not capital required for other purposes. You alone are solely responsible for determining whether any investment, security or strategy, or any other product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. You should also consult an attorney or tax professional regarding your specific legal or tax situation. The Content is to be used for informational and entertainment purposes only and the Service does not provide investment advice for any individual. Stocktwits, its affiliates and partners specifically disclaim any and all liability or loss arising out of any action taken in reliance on Content, including but not limited to market value or other loss on the sale or purchase of any company, property, product, service, security, instrument, or any other matter. You understand that an investment in any security is subject to a number of risks, and that discussions of any security published on the Service will not contain a list or description of relevant risk factors. In addition, please note that some of the stocks about which Content is published on the Service have a low market capitalization and/or insufficient public float. Such stocks are subject to more risk than stocks of larger companies, including greater volatility, lower liquidity and less publicly available information. Read the full terms & conditions here. 🔍

Author Disclosure: The author of this newsletter does not hold positions in any of the securities or assets mentioned. 📋